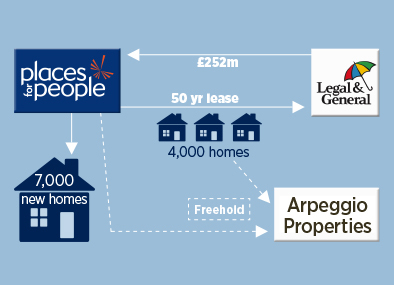

Places for People sells 4,000 homes with L&G leaseback deal

Places for People has raised £252m by selling a 50-year lease on 4,000 affordable properties to Legal and General.

The leaseback ‘income strip’ deal sees L&G purchase the lease on the properties, which are in turn let back to PfP Homes.

The majority are social housing assets, and all are existing and occupied.

The homes will then be passed on to an unnamed registered provider at the end of the lease.

PfP had 81,556 owned or managed units at 31 March 2013, of which 41,195 were general needs rental.

The deal provides PfP with £252m of capital, which it plans to invest in 7,000 new affordable, private rented and owner occupier homes in the next seven years.

Chris Jones, tax and treasury director at PfP, said the proceeds are being used to reduce short-term debt levels and increase corporate liquidity to support the delivery of new homes.

PfP retains a significant surplus over rents - Chris Jones, PfP

The deal follows an £100m bank refinancing by PfP, where it extended its £80m revolving credit facility with Lloyds Bank.

PfP had borrowings of £2.03bn at 31 March 2013 and gearing of 52 per cent. It now has 45 per cent of its borrowing portfolio unsecured, with a view to increase this to 60 per cent.

Borrowings had included £241m of debt repayable within one year, which Mr Jones said related in the main to existing revolving credit facilities that have now been renewed.

Under the leaseback deal, PfP retains management and resident facing responsibilities, including the rental risk, which will be subject to increases at the Consumer Prices Index (CPI) plus 1 per cent from 2015.

Income strip deals have in the past been linked to the Retail Prices Index (RPI) - which can potentially mean rent payment increases lagging behind lease payment rises due to the RPI/CPI differential.

The parties declined to comment on the inflation link in this case due to ‘commercial sensitivity’, however they said there is a ‘significant buffer’ in place, and that PfP ‘retains a significant surplus over rents including a margin for management and maintenance costs’.

Pete Gladwell, head of public sector partnerships at Legal & General Property, said L&G stewards over £35bn of capital, which it invests to generate long-term, secure income streams that are paid to pensioners in retirement.

‘This also motivates us to ensure these arrangements are sustainable in the long-term, with plenty of headroom between gross rents and fund rents to generate a surplus for the RP and allow for any future changes in rental growth.’

Under the model, at the end of 50 years L&G returns the homes to the ownership of the RP.

Mr Gladwell added that the arrangement removes ‘refinancing’ risk, as the structure is in effect fully amortising.

PfP’s new facility with Lloyds includes both secured and unsecured elements and does not carry any gearing or interest cover covenants.

Mr Jones said this type of facility has been central in providing the working capital for day-to-day operations while PfP continues to diversify its longer-term funding.

The group continues to do ‘a lot of work’ to bring new investors into the sector, he said, including from Japan, the US and Europe, and has a £650m European unsecured medium-term note programme.

Of the group’s debt at 31 March 2013, 79.6 per cent was fixed and hedged, with swaps on £30m of floating debt.

The accounts said a 0.25 per cent rise in interest rates would incur £0.9m in interest payable.

The group’s £380m turnover included 61 per cent social rented activity, 19 per cent market sale and 7 per cent private rent in 2012/13.

RELATED