April brings big changes to the rent regime. Here’s how to prepare

April will herald some significant changes in the rent regime for registered housing providers in England. Abigail Davies of Savills outlines how housing associations should prepare

For most providers, April means the end of the four-year, one per cent annual rent cut. A new Rent Standard will also be introduced by the Regulator of Social Housing.

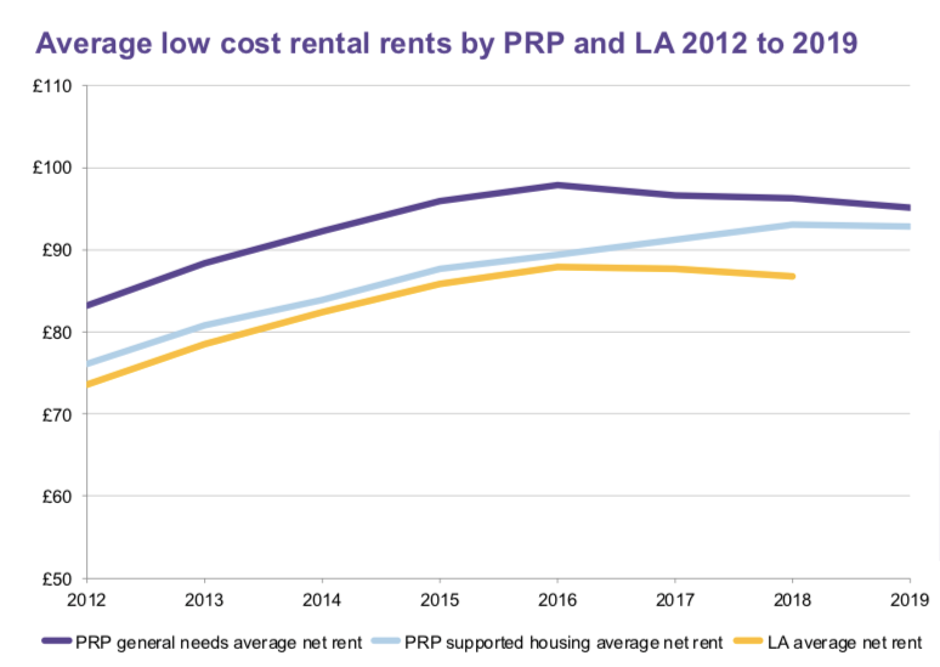

A five-year rent settlement at up to Consumer Price Index (CPI) plus one per cent from April 2020 was confirmed by Theresa May’s government, but there remains uncertainty about the longevity of this arrangement as we near the end of the one per cent annual rent cut (see chart).

Faced with the need for new development, tightening opportunities to generate cross-subsidy from market development, and investment requirements relating to building safety and the 2050 zero-carbon target, business-planning discussions are not easy at present. Questions reverberating around the sector include: will the five-year rent settlement hold? Is there a chance to strengthen it? And what about affordability?

So, what are some of the approaches being explored by housing providers as they consider their approach to rents and affordability?

Living rents

Some landlords in Wales, where rent regulation allows for more flexibility, have implemented Living Rents, as developed by the Joseph Rowntree Foundation, the National Housing Federation and Savills. In doing this, Welsh housing providers aim to take closer account of incomes and likely living costs among working households.

The Greater London Authority’s London Living Rent product has gained traction in the capital, within the regulatory ambit of affordable rent. Most recently, housing providers and developers in the West Midlands are now getting to grips with the new policy from the West Midlands Combined Authority that stipulates affordable homes to rent or buy cannot cost more than 35 per cent of earnings each month. Elsewhere, housing providers continue to enquire about potential rent flexibilities relating to both delivering affordability of rent and recognising affordability of occupation. For example, where rents could take account of lower utility bills arising from investment in high energy efficiency standards.

New Rent Standard

For now, though, the principal focus among housing providers is on the new Rent Standard and associated policy statement.

It is not as simple as “you can put your rents up by CPI plus one per cent now”. Some of the rules are slightly different than they were before, requiring policy and system change.

The transition from the requirements of the Welfare Reform and Work Act 2016 needs careful management. For local authorities, it is the first time this standard and the requirement to report against it have applied.

And the regulator has been clear that it has its eye on landlords’ compliance.

In terms of its expectations in this regard, in the most recent Sector Risk Profile in 2019, the regulator said: “It is important that all providers have a comprehensive understanding of the rent rules and these are applied correctly across the organisation… rent compliance will be a continued area of scrutiny for the regulator.”

The regulator is concerned about providers accidentally overcharging tenants, or overstating capacity in the business plan, as well as expecting to see appropriate controls in line with the Governance and Financial Viability Standard.

Rent ready

The key new Rent Standard and policy statement rules include:

- Local authorities must now adhere to the Rent Standard, including submission of rents data and communication on any non-compliance

- Requirement to calculate rents using the ‘2020 limit’ (the average weekly rent payable in the last year of the rent reduction) to manage the transition from the Welfare Reform and Work Act 2016

- Affordable rent increases restricted to CPI plus one per cent when a property is re-let to an existing tenant at the end of a fixed-term tenancy

- Greater clarity on when revaluation for rent-setting is appropriate

- A new definition of intermediate rent – properties that providers consider to be intermediate rent may be caught by the Rent Standard if they do not meet the definition.

In recent years executives and boards have tightened their oversight of matters that may previously have been considered ‘operational’. Our work supporting clients has given us insight into the sort of questions boards and executive teams may want to consider when looking beyond simple approval of the annual rent increase:

- Does our rent policy reflect the new Rent Standard?

- Is our policy approach accurate for different rent types, and consistent across comparable properties/rent types?

- What programme of work is under way to improve processes and information, and get rents in line with where they could/should be?

- Do we understand the implications of the policy and programmes on our business?

- How has the policy been implemented across the organisation?

- What assurance have we seen that our systems are able to implement the policy?

- What checks of our compliance with our rent policy, the Rent Standard and the government’s policy statement are in place?

Only from a solid base can registered providers begin to determine the rental policies that will allow them to deliver their chosen strategic aims.

Abigail Davies, associate director, Savills Affordable Housing Consultancy

RELATED