Asking the right questions about an increase in V2-rated associations

Number of V2 HAs set to increase by half.

Fiona MacGregor was appointed the Regulator of Social Housing’s (RSH) Chief Executive on 1 October 2018.

RSH was previously part ...READ MORE

“Follow to the letter your itinerary/ This badge of shame you’ll show until you die/ It warns you’re a dangerous man,” sings the police inspector Javert to Jean Valjean in Les Misérables, as the latter begins his parole after 19 years’ imprisonment.

While we would not claim that our regulatory gradings have quite the same enduring personal significance – and Housing Regulation: The Musical is hopefully still a long way off – recent Twitter exchanges at the National Housing Federation conference suggest that there is healthy debate as to whether a V1 (or V2) is a badge of shame (or pride).

Let’s be clear at the outset. V1 and V2 are both compliant grades, and a wide range of organisations could fall into each category.

It’s important to note that each grade is supported by a strapline, stating that a provider meets the requirements of the Governance and Financial Viability Standard, and has the financial capacity to manage either a wide range of adverse scenarios (V1) or a reasonable range of adverse scenarios (V2).

The judgement is not just based on current financial metrics, but takes into account a provider’s future plans and the operating environment. It is a broader judgement than a credit rating, which focuses on the likelihood of default.

Judgement journey

In reaching our judgements, we assess both the financial capacity and the quantum of downside risk that a provider can withstand.

We do this as part of our in-depth assessment work, where we consider the quality and results of stress testing, and also in the annual ‘stability check’ where we focus on the information we receive in annual accounts and financial forecasts, including some flexing and peer comparison. Either can result in a change to our published financial viability grade.

For some time we have been signalling the changing risk profile of the sector. In particular, we have been looking at risks arising from diversification into more market-exposed activities and the ability of providers to cope with downside economic and policy risks.

At the sector level, while there is more certainty on rents than a few months ago, there are still significant uncertainties over housing markets, the future cost of debt and the level of inflation, to name but three.

The volume of debt required for refinancing and new expansion is growing. For some individual providers, sales are becoming more important than debt for funding development programmes, creating a higher level of procyclicality.

Other providers have high gearing or low margins, and so are less able to manage changes in the cost or availability of debt.

All of these can reduce risk capacity and, in some cases, mean that the levels of financial performance which we once considered sufficient to withstand a wide range of adverse scenarios may now be considered sufficient to cope with a reasonable range.

Grading realignment

In this year’s stability check, we have particularly focused on the consistency with which we take account of these emerging risks, the capacity of providers’ business models to accommodate them and the pace of change in the mix of business activities.

This has resulted in a number of adjustments to gradings. In some cases we have also amended gradings to reflect poorer actual or forecast performance, or changes in the range of activities proposed.

“Our viability grades are not a comment on the strategy being pursued.”

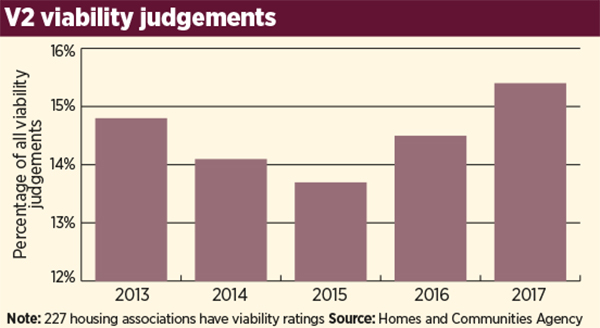

By the end of the calendar year, we expect the number of providers with a V2 grade to increase by around 50 per cent compared to the beginning of the year.

Through our regular contact with lenders, ratings agencies and other financial sector stakeholders, we are confident that this is consistent with their view and does not adversely affect pricing or availability.

Lenders view our viability gradings as a useful addition to, not a substitute for, their own credit work, and providers with a V2 grade continue to be able to raise bank and capital markets debt.

The right questions

Much of the debate focuses on questions such as whether a provider should aim for a particular grade, or executives be incentivised to ‘achieve V1 status’ – maybe by toning down development in the next year’s business plan or building in extra contingency.

Or perhaps an organisation should aspire to a V2, giving due credit to how far the balance sheet is being stretched in pursuit of valuable social benefits.

I don’t think these are the right questions to be asking.

We intend our viability grades to be as objective and consistent a reflection of the amount of financial and risk capacity in the business as possible – not a comment on the strategy being pursued. We do not consider one as ‘better’ than another, not least because there are many ways a provider could end up in either category.

There are providers graded V2 which are stock transfers not yet at peak debt; providers with high gearing and low interest cover – with or without development programmes; providers with strong metrics undertaking complicated mergers, restructuring and refinancing; providers with proportionately large market sale or regeneration programmes; and providers that are managing a weak financial profile.

There are V1-graded providers undertaking similarly large development and market programmes that are more constrained by land or labour availability than financing, and there are those that grow steadily or not at all.

Strategic view

More useful questions to ask would be whether the board has a clear strategic view of where it wants to take the business, and whether the organisation has the capability to manage the risk associated with the strategy. We will have concerns in situations where the board’s risk appetite is not matched by its capacity to manage the downside risks, and we would reflect this in our governance grade.

The issue with the viability judgement is not the ‘correctness’ or desirability of the business strategy, but how much capacity to absorb downside financial risk it leaves the organisation with.

We expect all providers to undertake robust planning, risk management and stress testing for the benefit of their businesses and tenants – not for ours. It is better to ensure financial risk is well managed and strategic objectives effectively delivered than to be “singing a song of angry men” about a number on a badge.

Fiona MacGregor is executive director of regulation, Homes and Communities Agency

Hear from the social hosing regulator at the Social Housing Annual Conference on 9 November 2017.

RELATED