Margin for error: how RPs should approach relationships with REITs

RPs should treat REITs like other property owners

The Social Housing magazine online archive is a fascinating place to lose 20 minutes or so.

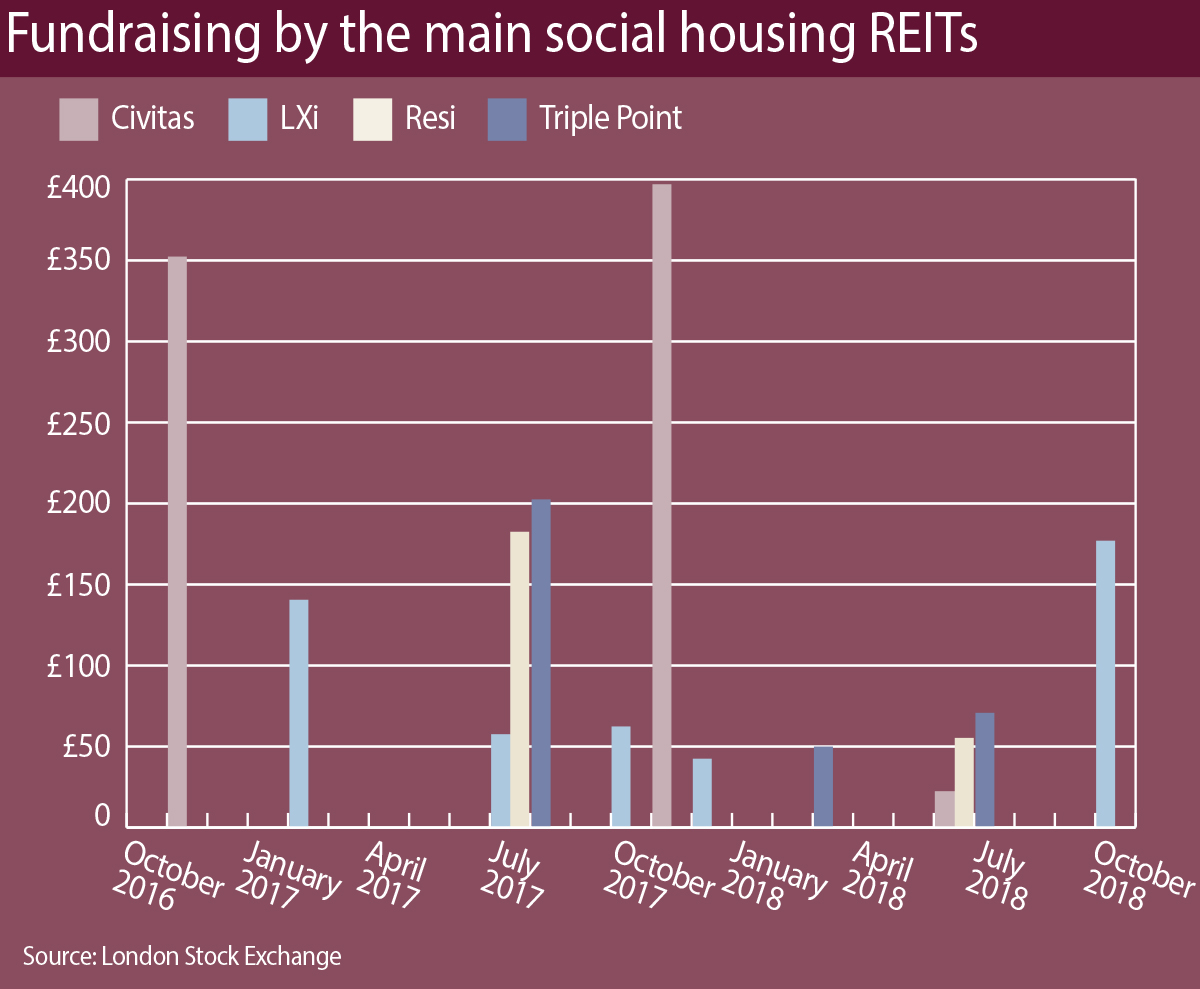

Some statistics for the time-killing connoisseur: since the beginning of the archive, there have been 65 articles mentioning real estate investment trusts (REITs) – not including this one. Eleven of them are from 2012 or earlier, when the government undertook a consultation on whether the REIT rules could be made more supportive of social housing (conclusion: perhaps). And 53 have appeared since November 2016, an average of 2.2 per issue, which is a higher hit rate than ‘Orr’ (2.1).

So why the sudden excitement?

A clue can be found in the 2012 consultation. This noted that the median return on equity expected by institutional investors from social housing was six per cent, with some anticipating up to 15 per cent – levels which are pretty much impossible to achieve from social housing.

However, since mid-2015, yields from UK real estate have fallen on average to less than 5.5 per cent. Reduce that slightly for lower perceived risk and the five per cent target return of the active social housing REITs – and other social housing investment funds – becomes appealing.

This shift in the market, and the higher rents potentially available from some types of social housing, has created a market niche. Civitas, Resi and Triple Point’s launches focused attention on REITs, mainly due to the associated public reporting requirements, though several private investment funds began to place property with registered providers in 2015.

Ownership debate

Perhaps another reason the entry of the REITs and other funds has attracted attention is that the social housing sector owns most of its property – lease financing of assets is not widespread.

However, engaging with a REIT is no different to engaging with any other property owner or fund.

Most of these relationships are leases, though other arrangements such as management contracts or licences are also possible.

Whatever the structure being considered, we expect registered providers to understand the responsibilities and risks involved; assess whether they have the ability and capacity to mitigate them effectively before committing; and then actively manage them. Any transaction will involve transfers

of risk and reward.

Striking a balance

Achieving an appropriate balance between these – and managing the risk – is key to making lease and other structures work.

From our perspective, situations where the provider does not own the asset are more difficult to resolve, so it is of concern that we have seen structures where most of the risk sits with the RP but the reward is insufficient to cover the downside.

Many of the lease structures we have seen involve full repairing and insuring leases on very long terms with indexed payments (Consumer Price Index or CPI plus) and no break clauses.

In specialised supported housing, properties often also have a contract or nominations agreement with a care provider, and a lease payment related to the housing benefit and rent agreed with local authorities.

Both of these are agreed for shorter periods than the lease, creating potential revenue uncertainty in the future. The lack of break clauses in the lease means that this uncertainty is open-ended.

We would expect providers to have robust mitigation plans in place for the possibility of rental income not being received for a period, or falling relative to the lease payment.

Leases and rents

In some cases we have seen leases where the lease payment is very close to, or exceeds, the rent receivable. This leaves no margin for error in estimating inflation, void rates and repair costs, and raises questions about the level of understanding providers had before committing to the lease. This margin for error is further reduced if the property is void or unsuitable for letting when it is taken on; if inflation rates exceed any increase in rents; or revenue collection is weak. We have come across examples of corners being cut in maintenance in order to meet lease payments. This can never be acceptable behaviour from a registered provider.

These risks are not inherently unusual or unmanageable. Good negotiation at the outset can mitigate onerous consequences later. Careful management mitigates void and revenue collection risk. Having a cash buffer available mitigates cash flow risks. Exit strategies (and costings) can be developed.

However, these mitigations may be difficult to put in place in smaller or less diversified organisations – it would be unwise to take on proportionately large obligations with uncertain ability to meet them, however appealing the quick growth might be.

The specific lease structures which have emerged with the rise of the REITs and other funds over the past two years are still relatively untested, and we are only just beginning to understand how they perform under stress. Given the vulnerable tenant group involved and the expectations registered provider status entails, winding up or walking away because the financing is too onerous is unlikely to be a suitable response in the court of public opinion.

Our position

To be clear, the regulator does not approve or disapprove of particular structures or financing approaches.

Leasing and managing property on behalf of others – REITs, private equity funds, other RPs – can be a legitimate activity for an RP.

Leasing clearly offers an opportunity for RPs with limited existing balance sheets to expand.

However, no RP is obliged to enter into leases or other structures, and we would expect the boards of organisations to take responsible decisions based on close study of the documents when presented with opportunities.

It is too early to say whether REITs and other property funds will become an established part of the social housing landscape.

Or whether, similar to rent securitisation, large-scale voluntary transfer gap funding or 25 years at five basis points over Libor, they will become a feature of a particular set of market circumstances for the future social housing browser to discover in the archives.

Will Perry

Assistant director, Regulator of Social Housing

Hear from Will Perry at the Social Housing Annual Conference’s ‘New entrants and equity stream’. Click here for details

RELATED