MMC: where are we now on banks, lending and security?

Recent developments could finally propel modern methods of construction (MMC) into the funding mainstream, writes Ruby Giblin of Winckworth Sherwood

Modern methods of construction (MMC) are back on the agenda. The UK construction industry is under increased pressure from the government to up output, and house builders are being urged to adopt new, greener, more sustainable methods of construction to play to the environmental, social and governance (ESG) narrative.

MMC has had to negotiate various hurdles of post-completion funding, as a result of lenders’ concerns about homes’ durability and saleability. But with the National House Building Council (NHBC) introducing a potentially game-changing warranty scheme in July, where are we now on bank lending and security?

Back in 2019, Winckworth Sherwood held a round table for real estate lenders. The panel included retail banks, new banking market entrants from Japan, Australia and Europe, capital market funders, insurers and trustees. They were asked what was holding back the funding of MMC developments.

Funders at that time were cautious, considering a number of issues from warranties and assurance schemes, building insurance, the number of units to accept for charging, how long the MMC units would last, and whether any element of aftercare was required – a particular concern for registered providers (RPs).

Lending criteria quickly followed and, after conditions precedents were agreed by funders, we waited for RPs to come knocking.

One capital market entity with long-term debt asked for drafting to be added to the documentation so that if at any stage over the 30‑year term MMC charging was required, basic definitions would be prepared. One of the largest retail banks in the sector said that it is absolutely an area it wants to develop out and support.

Fast forward a year – and the funders are still waiting. Not a single funder from the same cross-section has completed or even been asked to charge substantial numbers of MMC units.

Building Better, the MMC arm of the National Housing Federation, records just five RPs having used MMC products. These have been bankrolled largely through loans for working capital borrowed against the business, and limited government grant from Homes England or the Ministry of Housing, Communities and Local Government (MHCLG), and with development finance from the same large retail banks that later require compliance with the ‘checklist’ when refinancing.

Other RPs, such as Swan, have turned to joint ventures with RPs, councils and house builders and, where councils are involved, the Public Works Loan Board.

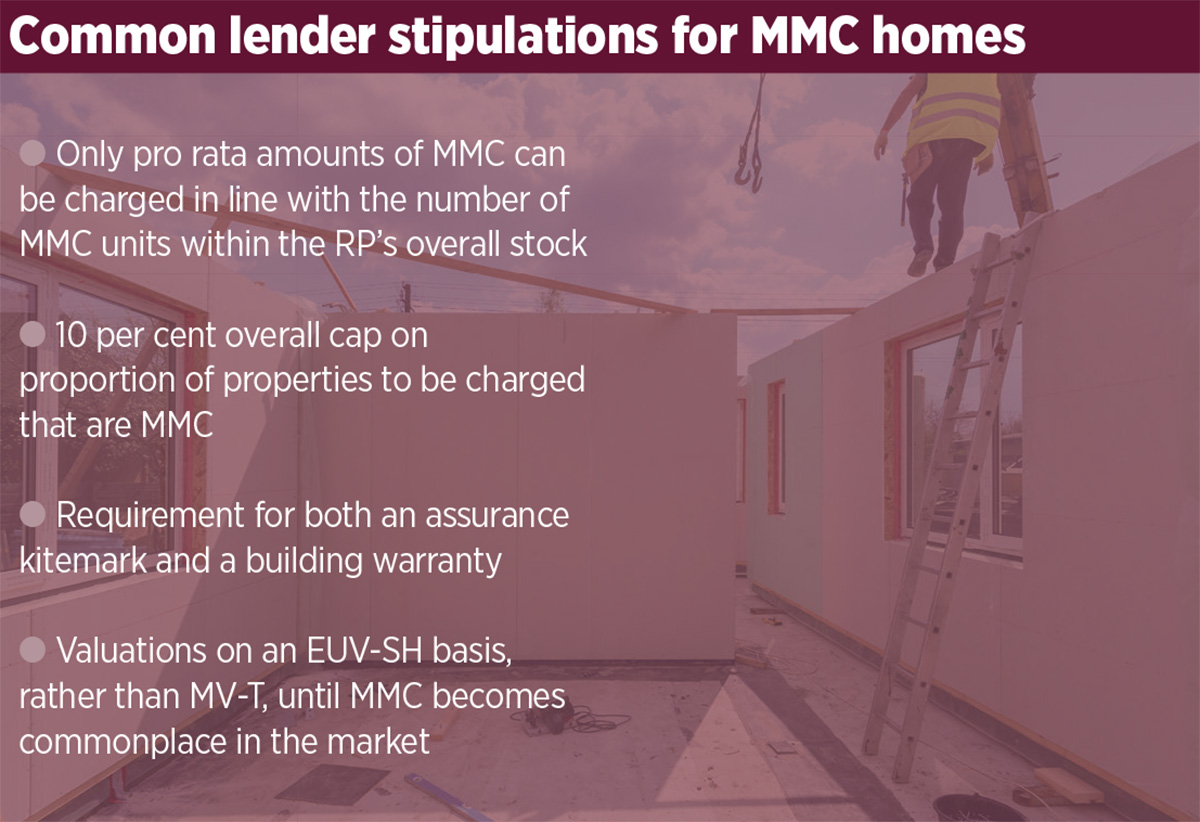

MMC properties that do not require refinancing are therefore being built. When they do require refinancing, RPs will be faced with the more unusual conditions that apply only to MMC properties and that many of the funders stipulate. One of these is that only pro rata amounts of MMC can be charged in line with the number of units owned by the RP.

For example, if the RP owns a total of 2,000 units and 200 of those were built using MMC, the funder would accept 10 per cent of the portfolio of properties to be charged that were MMC.

There is, in most cases, a 10 per cent overall cap, which funders say ensures saleability on default. Some also stipulate that initially, until MMC is commonplace in the market, they will lend only on an existing use basis – EUV-SH – and not on a market basis (MV-T).

Another condition is the requirement for an assurance kitemark and a building warranty, such as BOPAS and NHBC Buildmark.

NHBC has just launched a new product, NHBC Accepts, that potentially combines both of these and that could kick-start funding. It goes beyond the existing Buildmark programme, following the product and processes right back to the factory floor.

Funders may find that this provides the requisite data, stringent technical review, and equivalent standards with traditionally built properties, with the NHBC Accepts kitemark as evidence of a high-quality product and confidence in the sector. It may assist funders to reconsider any suggested aftercare requirements.

The extreme timetable the pandemic has imposed on developers to build housing for homeless people and key workers, and future housing required by local councils to keep people off the streets (bolstered by £105m government grant) is being met partly by MMC manufacturers.

The lockdown has also accelerated the green revolution that demanded new sustainable methods of construction to play to the ESG narrative.

There is also the argument that social distancing is more easily practised in a factory than on construction sites.

New legislation, such as the Environment Bill, the Future Homes Standard and the Building Safety/Fire Safety Bill all promise a green utopia.

Add to that the UK’s target to be carbon neutral by 2050 and the cost to refit a standard terraced house to the required energy efficient standards – £40,000 by some estimations – and it becomes apparent that MMC using sustainable and quality materials will represent savings to both RPs’ pockets and the planet.

Investors, too, are looking to invest ethically, as seen in the rise of green, social and sustainable bonds.

Although there is no hard and fast definition of what such investments must look like, MMC will fit into that agenda.

Where money leads, RPs will follow.

L&Q has, for example, vowed to build all its properties using some form of MMC by 2025. Others are investing their own cash, including Places for People, which has put £100m into MMC.

For funders, there still remain many questions, but, step by step, MMC is making its inevitable journey into the mainstream.

Ruby Giblin, partner, Winckworth Sherwood

RELATED