Optivo: we’re re-profiling our development plans to manage safety work costs

Housing associations face difficult decisions to maintain financial health amid ongoing uncertainty about building safety guidance and liability for remediation costs. That is why Optivo its re-profiling its development programme, writes chief executive Paul Hackett

Since the tragic fire at Grenfell Tower, the spotlight has rightly turned to building safety in the housing sector. And with serious fires in Clapton, Barking, Bolton and Sutton involving cladding, it’s clear there’s still much work to do to ensure lessons are learned.

With ongoing uncertainty about government guidance and liability for remediation costs, housing associations continue to face a number of important challenges.

At Optivo, we’re clear we won’t wait for greater certainty before acting. Resident safety is our top priority and we’re taking a number of major steps to make our buildings safer, which we’re funding through our operating business.

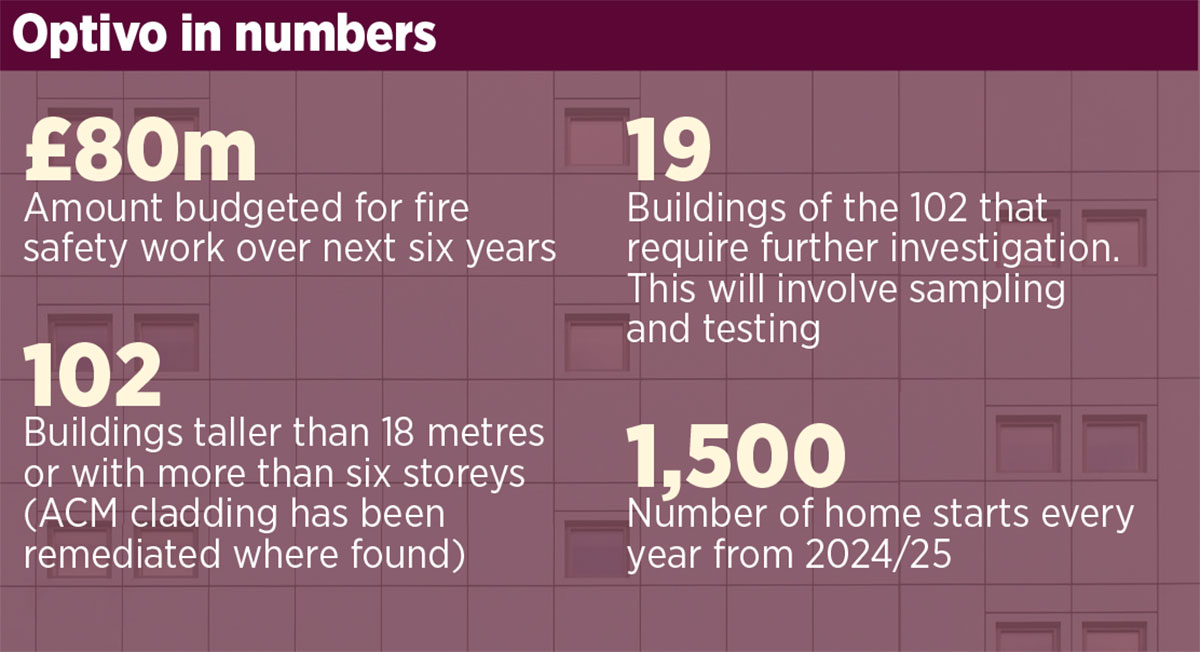

We have 102 blocks that are taller than 18 metres or that have six or more storeys, as well as 3,367 lower-rise blocks. It’s vitally important we keep residents in these buildings fully aware of any improvements we’re making to keep them safe and their homes compliant with regulations.

We’ve been proactive in working with residents to review our approach to fire safety. Our resident-led scrutiny panel has already carried out its own investigation into our fire safety communications. This project has made a valuable contribution to strengthening our approach, making a range of practical suggestions.

In addition, we’ve recently completed a small research project for the Ministry of Housing, Communities and Local Government. This has seen us working with residents in high-rise blocks to gauge understanding of fire safety procedures, to help inform improvements.

In the future, we’ll be redesigning our resident involvement approach to focus more on co-creation – residents and staff working together as partners to shape our services. Given the Hackitt Review recommendations about involving residents in fire safety decision-making, building safety will be an important area for co-creation in the coming years.

We’re also delivering an extensive building safety programme to make practical improvements to our properties. Like all landlords, we’re constantly updating this programme as more government advice emerges about different cladding and building types.

We’ve recruited additional in-house expertise to manage our inspection programme and ensure we stay on top of our fire safety actions.

All this vital activity comes at a cost and we’ve made room in our budget for extra spend. We’ve budgeted £80m for fire safety work costs over the next six years. For context, our surplus for 2018/19 was £61m (before fair value movements) and our reserves in March 2019 were £643m.

We’ve been cautious, and our estimate is sensitive to a wide range of factors including testing of our blocks, cost recovery, legislation and guidance. Key cost elements include:

- Remediating high-rise blocks with inappropriate cladding

- Implementing actions following fire risk assessments

- Implementing recommendations from the Hackitt Review and phase one of the Grenfell Inquiry

These extra fire safety costs will not put our financial covenants under pressure and they will not derail us.

We have financial flexibility, but we also still have difficult choices to make.

Mitigation is essential if we’re to responsibly maintain our financial health and our capacity to absorb any other future financial shocks should they emerge.

We remain committed to maximising our development programme but we’ll be reducing the acceleration rate to 1,300 starts over the next three years, rising to 1,500 every year from 2024/25. Our ambition since our merger in 2017 had been to reach 1,500 starts each year from 2020/21. Over the next decade the adjustment amounts to only a one per cent reduction in homes built compared with our previous financial plan.

But re-profiling will help us to manage our fire remediation commitments. At Optivo we recognise that we’re relatively fortunate in the scale of risks we face compared to our financial capacity to absorb them and keep growing.

While our operating business will cover fire safety costs, support of lenders and investors will continue to be essential as we look to raise the finance we need to meet our still ambitious growth targets.

But it’s not the same across the sector. Some associations have a much higher proportion of high-rise buildings in their stock and may face real financial difficulties unless government plays its part in contributing to remediation costs. For organisations that can find ways of funding the additional costs, it’s important to recognise the impact on other activities.

Given the scale of works required, building safety will remain an urgent matter for all social landlords for some years. We’re fortunate at Optivo that we’ve been able to make provisions for the significant additional costs.

As well as creating urgent priorities now, the range of building safety issues revealed by post-Grenfell work poses longer-term questions for the sector. Systemic issues about build quality have come to the fore as buildings have been inspected, panels tested and construction paperwork scrutinised.

For me, this strengthens the impetus for housing associations to have more direct control over development. Like many, Optivo has taken a strategic decision to reduce reliance on Section 106 sites and move to more land-led schemes.

We believe that by taking on the master developer role, we can build communities that are truly sustainable – socially, economically and environmentally. But it also gives us the direct control we need to monitor quality more closely, to scrutinise building components and receive direct assurance of regulatory compliance in the supply chain.

We’ll be launching our next strategic plan in April, which has all these major themes – building safety, land-led development, financial stability and co-creation – as priorities.

It’s hard not to feel that the sector faces a perfect storm of economic, environmental and regulatory challenges. But I am convinced that by confronting these issues head-on, and with prudent financial planning, we can continue to deliver our social purpose in powerful and innovative ways.

Paul Hackett, chief executive, Optivo

Sign up for Social Housing’s bloggers’ bulletin

Already have an account? Click here to manage your newsletters

RELATED