Private equity has a place in property, but not in social housing

The social housing sector should look inwards before turning to private equity, argues Waqar Ahmed, group finance director at L&Q

We are living through history, and at times it can be difficult for even the most level-headed of us to think rationally and positively about the future. After years of uncertainty caused by Brexit, we had a couple of months of respite following the emphatic general election result, and then bang: coronavirus.

Whether the economic impact turns out to be as bad as the Great Depression remains to be seen, but the world has changed, and some things will never return to normal.

While none of us underestimate the impact on our near-term business planning, on our residents and supply chains, and on the wider economy, the fundamental fact that demand for our products will outstrip supply is not going to change. When the pandemic has passed, we will still be talking about the need for quality homes that people can afford, building safety, sustainable communities, infrastructure, decarbonisation, and other big things on our agenda.

Right now, investors are looking for opportunities, and there isn’t a much safer bet than social housing, as evidenced by recent activity in the debt capital markets and the continued lending support from the banking community.

So, is now the time for us to start thinking seriously about bringing private equity into our sector?

In any consideration of this, it is important to go back to basics and to look at what equity is and what motivates equity investors. At the most basic level, equity investors are motivated by two things: the fear of making a loss, and the hope of making a return.

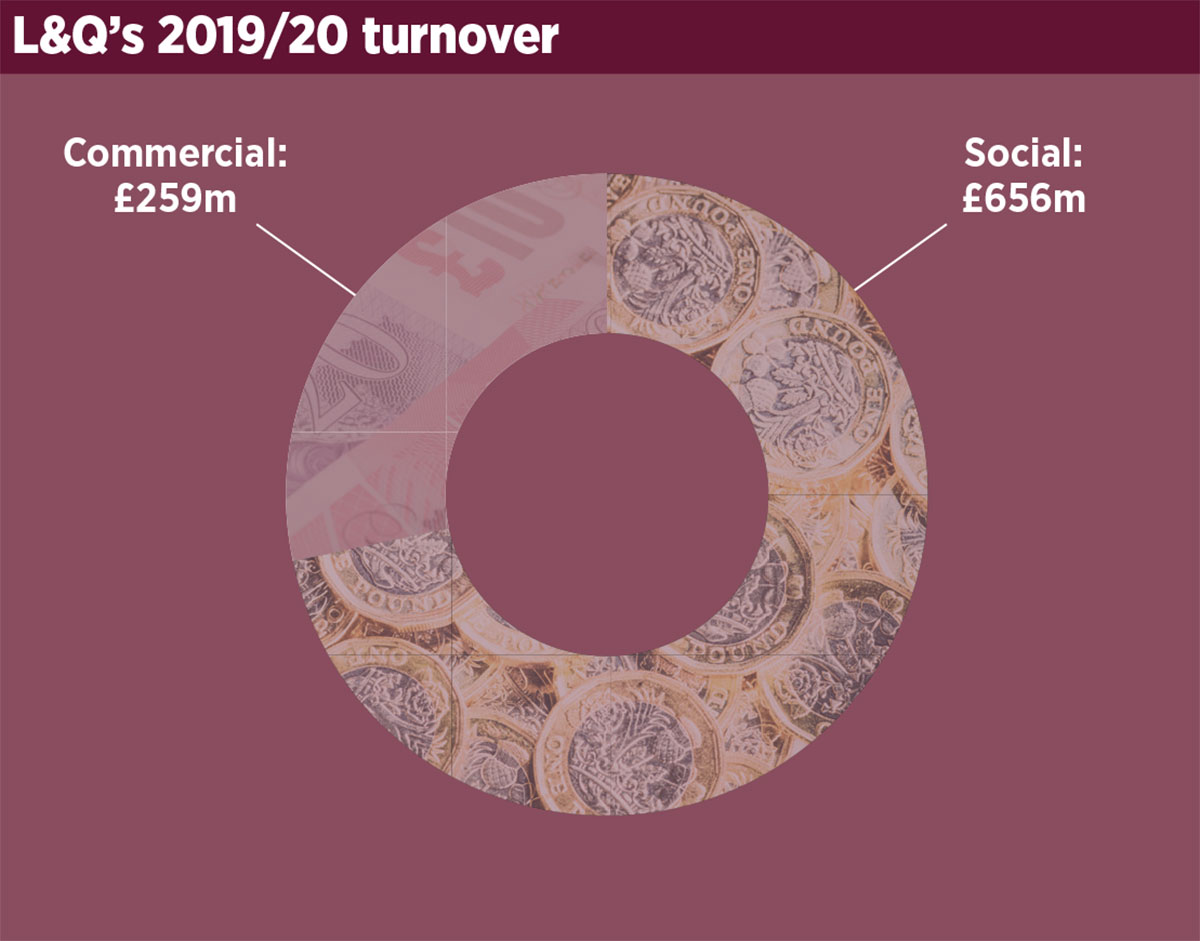

It is these two fundamental factors that underpin my caution about equity investment in social housing, and why L&Q has always said no to it. First, there is a disconnect between risk and reward on social housing. As reported by Social Housing magazine in January, I can see the potential for equity investment in the private rented sector and other commercial activity, but social housing is an inherently low-risk product.

Demand will always outstrip supply, rental income is essentially guaranteed through government support in the form of welfare benefits, the sector is independently and robustly regulated, and housing associations (HAs) such as L&Q have almost 60 years’ experience in delivering and managing social housing.

In short, social housing essentially is a low-risk, sub-market social business that has benefited from the long-term patient capital ploughed in through public subsidy by the government and HAs’ internally generated reserves accumulated through sub-market returns over the long term.

And yet equity investors seek initial yields in the region of three to four per cent, rising by inflation thereafter. This is broadly in line with what you can expect from the London Stock Exchange blended average over the past 10 years with all its shocks and volatility that constantly put the underlyingequity at risk as well as any hope for sustainable dividend income.

If an equity investor wants that higher rate of return, they should therefore be prepared to accept more risk and not look to acquire social assets at roughly half their market value. Will they be willing to share the burden if our management fees go up, or if new legislation imposes an unexpected cost on our business?

“How much of their profit is an equity investor willing to allocate for future social housing and community investment programmes?”

Will they come and talk to us about increasing pressure on health and safety costs, resident expectations, the decarbonisation agenda or taking on sales risk to generate much-needed cross-subsidy to provide the affordable homes in the first place?

HAs are of course not-for-profit, and every penny we make is reinvested in our social mission. How much of their profit is an equity investor willing to allocate for future social housing and community investment programmes?

Banks and bond markets continue to support the sector, and as ESG plays a more significant role in their investment plans, HAs will become an even more natural partner.

Another disconnect is the issue of time. HAs are cradle-to-the-grave providers. We source the land, build the homes and then manage them into perpetuity. We ride the waves and hold our assets for the long term, but will a private investor share that approach? What happens if the equity investor decides to cash in on their assets at the top of a market, or needs to boost liquidity by selling assets when the market turns bearish?

I believe the sector should look inwards before turning to private equity. Our balance sheets and risk tolerances may vary, but we share the same vision and values. Greater collaboration and partnerships will enable us to further our social impact even more.

Joint ventures and partnerships can be further bolstered with the likes of Homes England and the Greater London Authority, which also share our vision for building more quality, sustainable, affordable homes. Government grant flexibility and equity options would enable us to do even more.

As we look to the other side of coronavirus, there is also a requirement for the ratings agencies and valuers to play their part and understand that our sector is all about the long term and our unique ability to adapt to changing conditions.

Ratings agencies are often too risk averse. If they see an HA with a significant sales programme, it is viewed as a material credit negative. Greater emphasis needs to be placed on the fact that our business plans are flexible, and we can switch tenure if market conditions change.

While it is too early to speculate about the full extent of the ongoing crisis on our future financial performance, we have all planned for an inevitable material impact on trading performance and cash flows.

More uncertainty and tough decisions lie ahead, but we are confident in the strength of our finances, the talent of our people and the flexibility of our business to adapt to change.

Our sector has always proved to be resilient and comes through the toughest challenges, so why should now be any different? Do we really need private equity investment in social housing? For me, the answer for now remains no, unless of course every penny is reinvested in building more social homes.

Waqar Ahmed, group finance director, L&Q

RELATED