Rent rises under the new standard – how should landlords address affordability?

Following new research showing how quickly the gap between general needs and market rents may close up, Abigail Davies of Savills reflects on the challenges housing providers face on affordability and compliance

Newham Council in east London has recently begun reforming its housing allocations policy in a way that other housing providers should be watching with interest.

Earlier this month, Newham – seeking to respond to economic changes and links between overcrowding and COVID-19 – announced a consultation on revising its allocations policy to remove the prioritisation previously given to those in employment.

The latest Savills research, published this week at the Social Housing Finance Conference, shows how considerations around affordability and rents will become increasingly important for housing providers in England. This is because of three key factors:

- The new Rent Standard introduced in April that permits housing providers to increase rents by Consumer Price Index (CPI) plus one per cent, for the first time since 2015/16

- The narrowing gap in many places between general needs and market rents

- General needs rents increasingly contributing to households hitting the benefits cap

These issues present housing providers with challenges around compliance and the delivery of their strategic aims. Newham Council wants to ensure it is prioritising those in greatest housing need, but housing a higher proportion of people potentially on low incomes could soon present other challenges associated with the benefit cap. It’s tough to grasp the rents nettle and avoid being stung.

So, what does our latest research on rents and affordability show? And what are the key considerations for housing providers as a result?

Narrowing gap to market rents

First, housing providers are implementing the new Rent Standard against an incredibly challenging backdrop. Times were already tough when I wrote in February on planning for the changes – and since then we have had the COVID-19 pandemic.

Our recent Savills Housing Sector Survey 2020 found that 54 per cent of housing associations plan to increase rents by CPI plus one per cent in the coming 12 months. This is to ensure the necessary financial capacity to fund the construction of new homes, and investment in building safety and decarbonisation measures in existing properties.

“It’s tough to grasp the rents nettle and avoid being stung”

Yet, over the period of the mandatory reductions in regulated rents, there are some areas where market rents fell faster than general needs rents. And in many parts of the country, market rents have grown by less than CPI plus one per cent over the past five years.

We have modelled regulated rents growing at CPI plus one per cent and market rents growing in line with Gross Value Added (as a proxy for wage growth) to understand how long it might be before the average general needs rent overtakes the average market rent. Our analysis shows that, out of the 343 English local authorities, this will happen in three council areas by 2025, increasing to 23 by 2030, and 181 by 2040.

Rent rises of CPI plus one per cent therefore may not be sustainable for long across many parts of the country. The gap between average regulated rents and market rents is already narrow in areas like Fylde, Kingston upon Hull and Gateshead. More unexpectedly, the gap will also close quickly in East Hertfordshire and Broxbourne because current general needs rents are higher here than in surrounding areas.

Turnover of social housing stock is higher in the districts where market rents and general needs rents are the most similar. So, voids may increase as the gap reduces, unless landlords act to moderate rent increases in areas of greater rent competition.

Second, following the pandemic, there has been a surge in the number of households in receipt of benefits. This has been accompanied by a significant increase in households hitting the benefits cap, with a 93 per cent increase in such households to 150,000 from February to May.

This probably reflects changes in circumstances for part-time, low-wage Universal Credit claimants, as well as private sector rents increasing to align with new Local Housing Allowance rates.

For social housing, 14 per cent of tenants on housing benefit at May 2020 both have children and are either not in employment or are receiving passported benefits and are therefore likely to be subject to the benefit cap.

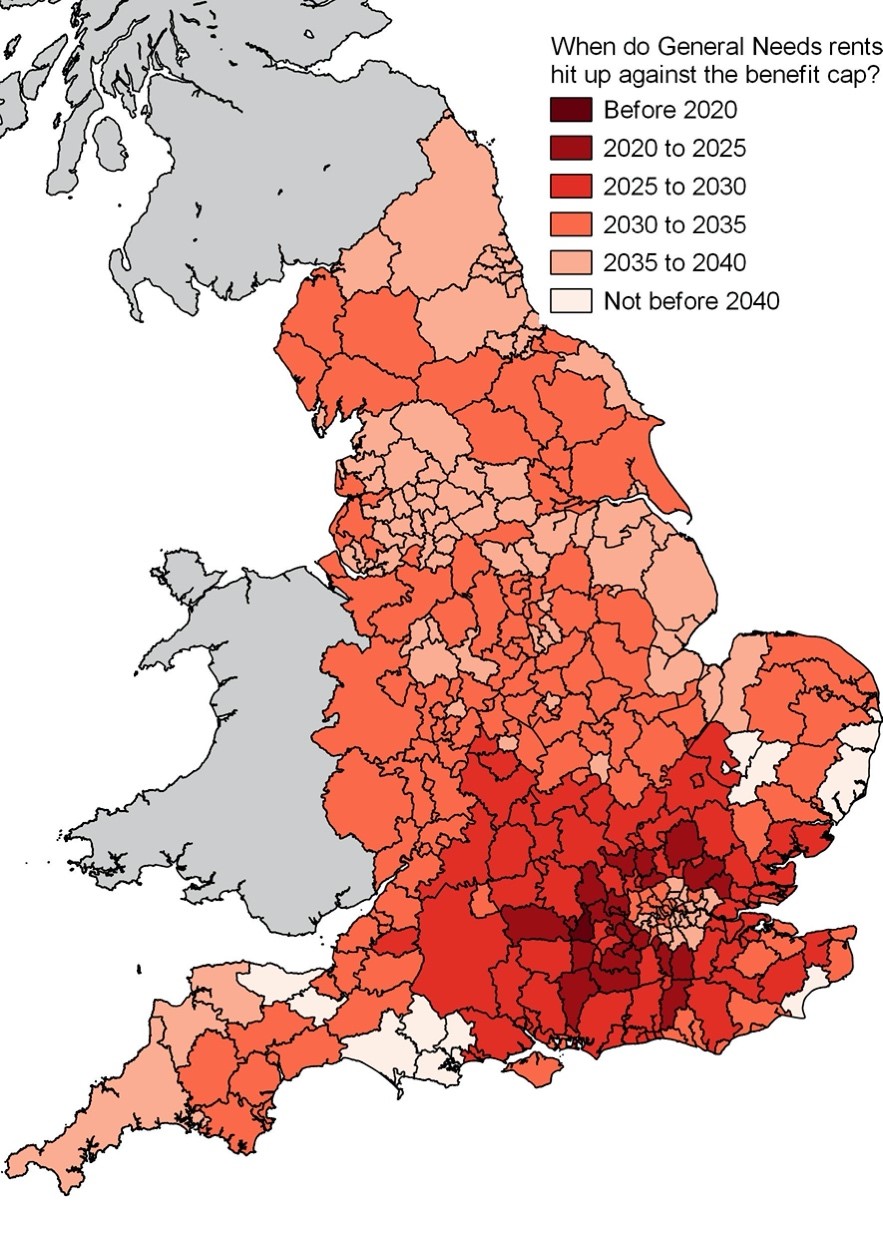

We have modelled how long it takes for general needs rents, increasing at the maximum rate of CPI plus one per cent, to cause households to hit up against the benefit cap in each local authority area. This assumes the benefit cap remains at current levels, as it has since 2016.

“Increasing general needs rents will therefore start to have an influence on housing providers’ financial and operational strategies”

The map shows that the greatest strain will be in the areas surrounding London. For many local authorities here, general needs rents will be pushing part-time low-earners and unemployed households against the benefit cap within five years. Until 2030, pressure remains concentrated in the South. After 2030, general needs rents start to take these households above the benefit cap across the rest of the country.

Increasing general needs rents will therefore start to have an influence on housing providers’ financial and operational strategies, especially in the Home Counties. Providers will want to ensure tenants are in work, and with enough income and hours, to avoid hitting up against the benefit cap.

As I mentioned in my February blog, the Regulator of Social Housing has made it clear that it is focusing on compliance with the new Rent Standard, following an increase in cases in this area. Our research highlights the extent to which rents and affordability are complex issues that are increasing in strategic importance.

Housing providers will want to ensure that they set, increase, and communicate rents in a way that meets their strategic aims and complies with regulatory requirements.

Abigail Davies, director, Savills Affordable Housing Consultancy

RELATED