Sharing lessons from the first housing association SONIA loan

In March, Riverside became the first housing association to complete a loan known to incorporate SONIA (Sterling Overnight Index Average) mechanics. Head of treasury Emma Turner, and Gary Grigor of Devonshires, the legal advisor on the transaction, talk through the process

Riverside completed the first loan in the sector known to incorporate SONIA (Sterling Overnight Index Average) mechanics in March, with support from Devonshires as legal advisor.

So what are the challenges and implications for housing associations adopting SONIA on future loan arrangements?

As all good treasurers know, cash is king. Knowing how much interest you will need to pay three or six months in advance is a comfort most entities (corporates as well as not-for-profits) have come to rely on.

In that context, LIBOR is easy: look at the screen rate, blend with the margin, add it to your cash flow forecast and pay the interest when it’s due.

The key downside to SONIA – and the thing that many borrowers fear – is that, by its nature, SONIA can only be applied retrospectively; you will therefore not know the final interest cost until the borrowing period has been completed. How can you manage the cash for your interest payments if you don’t know how high the cost is going to be?

There are practical steps we can take to ensure that the final interest bill doesn’t come as a surprise.

Firstly, SONIA does have a long history and tracks the Bank of England (BoE) base rate relatively steadily, so we do have indicators that we can utilise to make educated accruals from the outset.

Secondly, there are sources that publish SONIA rates daily (free of charge), so we can be calculating the compounded rate ourselves using the agreed formula and can adjust our initial accrual as required.

Therefore, we should have a good steer well ahead of the final settlement date of the likely payment and can plan cash accordingly.

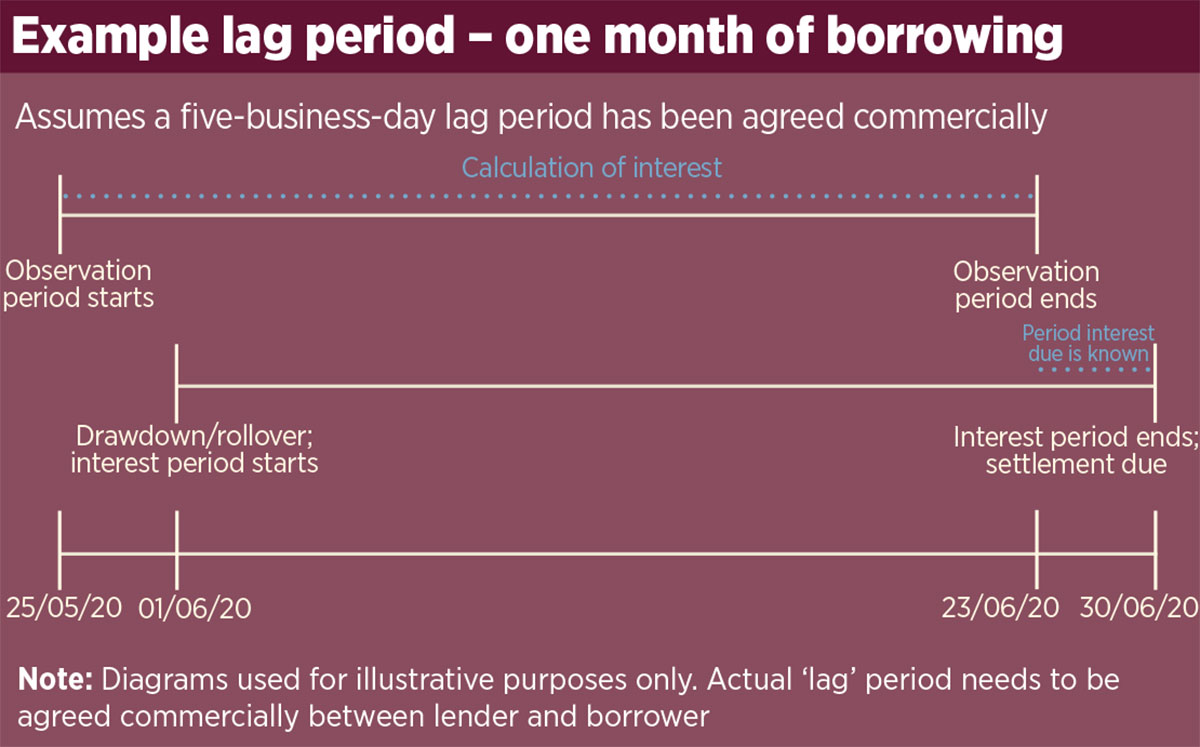

A key differentiation is the lag time or ‘observation period’, over which the actual interest payment is calculated (see diagram). It might first seem strange that borrowers won’t be paying interest over the actual interest period – but it has to be that way to allow the rate to be determined and paid at the end.

The overall interest paid following this methodology is still more likely to result in the borrowers paying a ‘truer’ cost of borrowing as compared to LIBOR.

For those borrowers where the thought of needing to compound a daily interest rate sounds terrifying (and understandably this is likely to be the majority of borrowers), the BoE has confirmed that it will publish a daily SONIA Compounded Index from July 2020.

We can expect this will become the ‘go-to’ reference rate in most new facility agreements, which will reduce the administrative burden for both lender and borrower.

For the time being, it seems inevitable that an additional credit adjustment spread needs to be factored into the interest calculation to bridge the gap if using SONIA as a reference rate, where an original loan offer was made based on using LIBOR.

A ‘reference rate adjustment’ is appropriate in these circumstances, but you would not expect this to be more than a handful of basis points based on the current LIBOR and SONIA differential.

For our deal, we recognised early in negotiations the need to apply an adjustment spread and constructively engaged with Lloyds to determine where we saw it.

The final adjustment comprises part of the new-world commercial negotiations and should therefore be agreed between the commercial parties during the process.

Given that the change over from LIBOR to SONIA should be interest-cost neutral, there should be no need to alter existing interest cover covenants; what worked previously on a LIBOR basis should still hold true following the transition to SONIA.

What may need some care is if the loan being transitioned has underlying standalone interest rate hedge arrangements.

It may prove important to transition the swaps at the same time to ensure that any hedge accounting treatment remains effective.

These could potentially be complex, so it is important to engage with your auditors early and talk through your transition plans.

Riverside hasn’t quite reached this stage yet, but has plans to tackle transitioning the wider borrowing portfolio from LIBOR to SONIA over the next 18 months.

Having a transition plan and understanding which facilities should be easier or harder to transition is crucial.

The facility Riverside entered into in March does not have any hedge arrangements attaching to it, so provides an opportunity to test the practicalities of utilising SONIA (eg how well accounting and treasury management systems cope).

For those housing associations with loan commitments linked to LIBOR that extend beyond 2021, we would suggest the time for talking is done – now is the time for action.

Focus groups and industry experts have all helped to shape the core principles and we were able to draw heavily from them.

It’s time to put the theory into practice and engage now with your key advisors and funding partners to ensure you are at the front of what will be a substantial queue.

We are already in negotiations with another lender to transition a second facility to SONIA this summer, with possibly a third following later in the year.

Ideally, we don’t want to take on any new variable debt now on a LIBOR basis, only to have to transition it next year or the year after.

However, there are a large number of lenders to the sector who are unable, even at this stage, to clearly articulate their plans to deal with the transition from LIBOR to SONIA.

We as a sector must encourage them to act, too – hoping it’s all going to be OK is not a strategy.

Working together we can make this transition as painless as possible, but we won’t be able to achieve that by leaving everything to the last minute.

Emma Turner, head of treasury, Riverside, and Gary Grigor, partner, Devonshires

RELATED