Sustainable finance: how have expectations changed?

There is still no ’right way’ in how organisations choose to disclose ESG-related information, but doing nothing is unlikely to be a justifiable option, writes Chris Evans at Newbridge Advisors

While socially responsible investing can be traced back to the Methodist movement hundreds of years ago, the concept of Environmental, Social and Governance (ESG) is still relatively new in comparison. It came to prominence as a set of criteria incorporated in financial evaluations for signatories to the United Nations Principles for Responsible Investment in 2006.

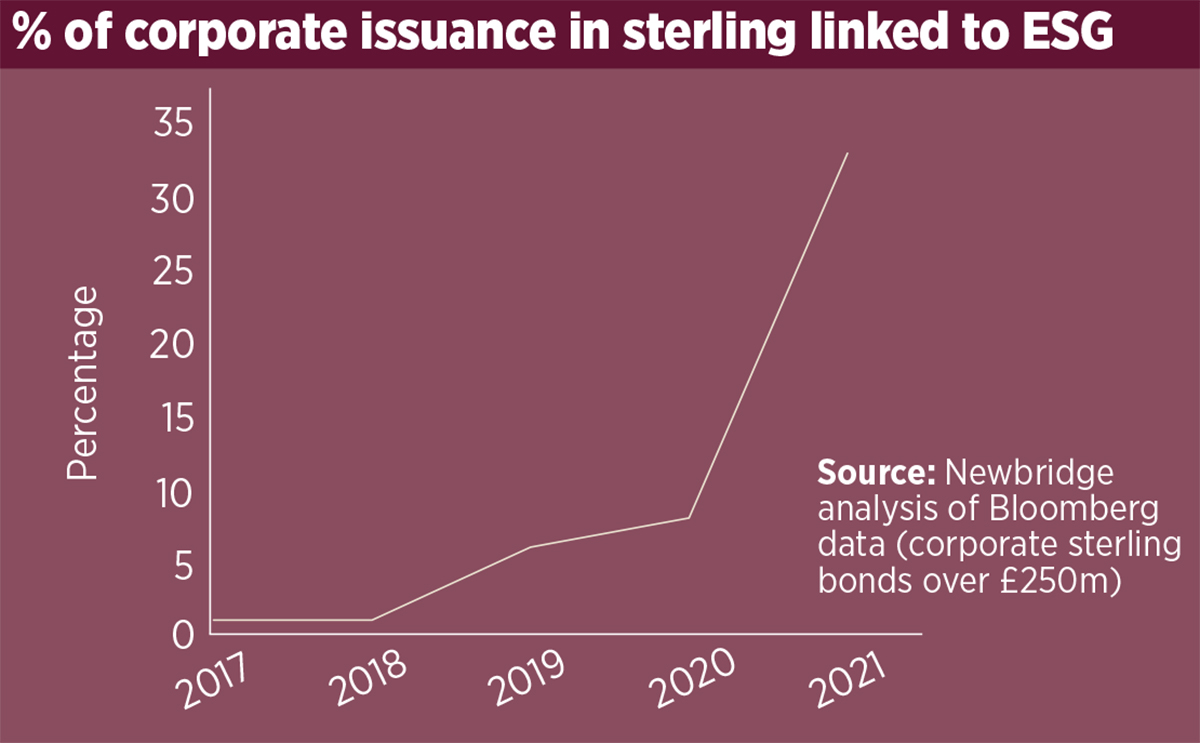

ESG has penetrated investment criteria in the housing sector and sustainability is set for a prominent role, bringing further opportunities for associations already securing competitive funding in the bank and bond markets. There will be some upfront work for associations, including an understanding of the obligations that come with sustainable and green finance, but these requirements are likely to become commonplace across the debt market before too long.

From what was just a general point of discussion five years ago, often interpreted as a box-ticking exercise, stakeholders are now demanding better disclosure of ESG-related information.

The shift in sentiment is noticeable within the investor community, and that is regardless of where they are based (the UK, Europe and the US). Sharing your ESG strategy is not a ‘nice to have’ any more, it is a necessity. Then there is also the need to balance the ESG messaging. This is perhaps more challenging than first thought.

“Where we see an information bottleneck is how associations articulate their environmental performance”

The sector is naturally very good at articulating its social impact and, following useful input from the regulator, is well positioned with its governance disclosures. However, where we see an information bottleneck is how associations articulate their environmental performance. This is largely attributed to a lack of operational resource, as well as financial, to understand the association’s impact.

In aligning funding to ESG, the market – both banking and capital – breaks down the opportunities into two broad categories: (1) company-wide key performance indicators (KPIs); and (2) use of proceeds.

First, and more affiliated to the banking sector due to the nature of the underlying facility, we have seen a company-wide KPI used. To name a few lenders to the sector, the likes of BNP, NatWest and SMBC have all structured facilities offering a pricing benefit should the bilaterally agreed KPI be adhered to. Examples of KPIs agreed between the housing association and the bank include continuous improvement of the gender pay gap, targeted energy efficiency of new homes and greenhouse gas emission reductions.

The capital markets tend to follow a more prescriptive route when considering ESG, by tracking the use of proceeds, eg where the money raised is being put to use. Here the borrower declares in advance the eligible ESG-related projects the money will be allocated to, although there is an emergence of adopting the KPI route with precedent now seen in the broader corporate market. This information is disclosed in a framework, aligned to market standards and accompanied by a second-party opinion (SPO).

Once funding has been raised in the capital markets, the borrower is required to report on progress made against its listed ESG projects within the financing framework – this is referred to as an impact report. The other obligation is an allocation report – this keeps investors updated on when proceeds have been assigned to ESG projects. With respect to ongoing reporting obligations of an ESG-linked banking facility, this can be agreed bilaterally, although a similar transition to that seen in the capital markets seems inevitable.

An SPO is the external sense check of what is disclosed in the framework. Given the need to align disclosure to industry standards, this one-off verification gives investors comfort that the framework has followed guidelines. There are a number of SPO providers (Standard & Poor’s, Sustainalytics, Vigeo Eiris) and, although this may change, investors have not specified a preference to a particular organisation.

“There is an opportunity for housing associations to make a greater impact in the markets than ever”

The opinion accompanies the framework and requires an update only should material changes happen to the framework.

There is still no right way in how you choose to disclose ESG-related information, but doing nothing is unlikely to be a justifiable option. With ratings agencies now incorporating ESG within their credit assessment and lenders showing a pricing advantage to those willing to link debt facilities to ESG metrics, away from what could be defined as a moral obligation, there is now a commercial reason to improve your awareness of ESG.

As a minimum, we would encourage associations to improve their disclosure, either within the annual report or a separate ESG report. The UK sector standard approach for ESG reporting provides a valuable guide on the type of measurements to track.

Should you want to go further, you can establish a financing framework, adhering to industry standards, although it is currently only an ESG-linked product in the capital markets that requires this level of detail to be published.

A final crucial element in this brave new world is how you communicate effectively and tell your story well.

There is best practice that can be followed for investor presentations, including a credible and well-constructed ESG story. But there is also an opportunity for a more strategic approach to financial communications, which isn’t only transaction-led, or limited to the investor presentations.

There are different levels of appetite for information depending on the investor you’re dealing with. But having a clear, consistent and compelling narrative is not just good practice. It will support your treasury strategy, align with your wider corporate strategy and keep your messaging on point.

We see communications as fundamental to ESG and sustainable finance, and are working with partners like communications consultancy Social Invest to provide specialist support to providers.

As all eyes turn to ESG and sustainability in the financial sector, there is an opportunity for housing associations to make a greater impact in the markets than ever. The work finance teams do today around ESG and sustainability will drive value, and bear fruit, tomorrow.

Chris Evans, director, Newbridge Advisors

RELATED