The editor’s rundown: how do you insure a problem like… insurance?

New analysis suggests that barriers to the market are in danger of making insurance a risk in its own right. Social Housing editor Sarah Williams rounds up the key finance and regulatory stories from the past month

Keeping sight of an accurate and up-to-date study of the risks to their business goes with the territory of financial leadership. Meeting regulatory requirements aside, simply being able to sleep at night would be a stretch for a finance director without the knowledge that, should these materialise, their organisation can call upon not only a healthy list of available mitigations but also a robust insurance policy.

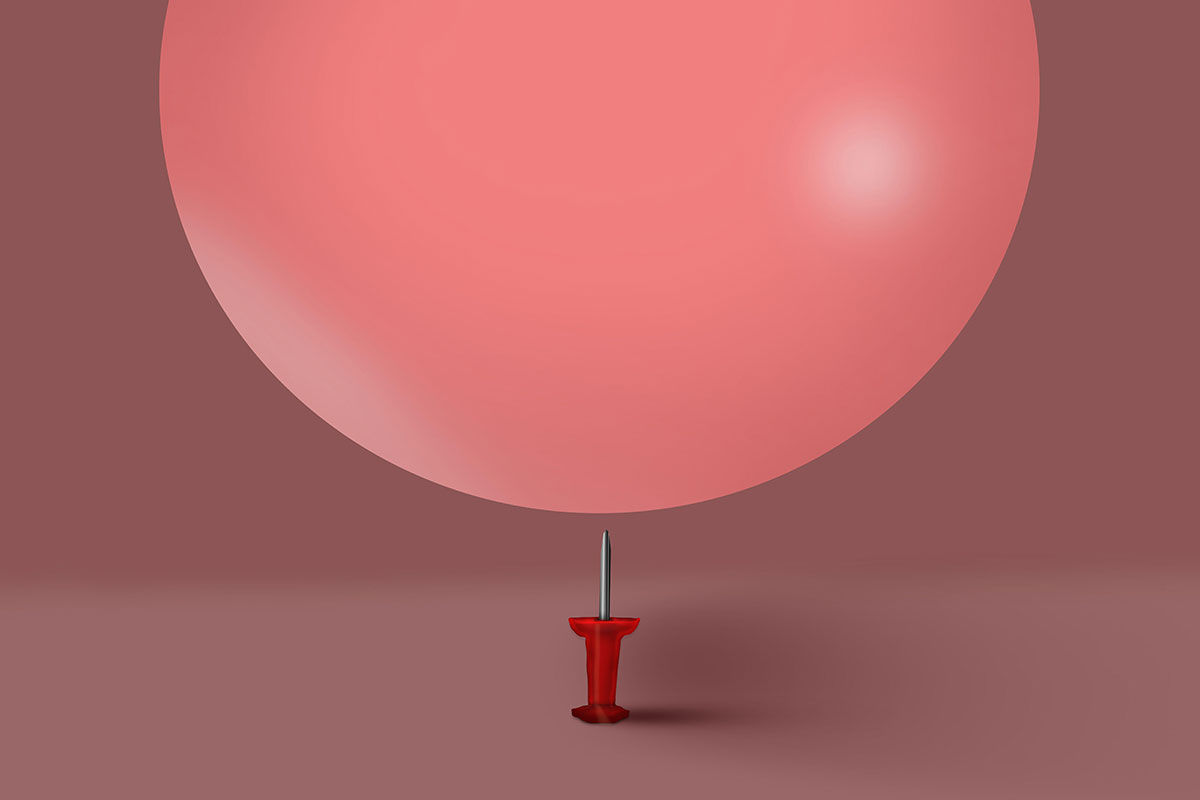

But what if a potential inability to source adequate and affordable cover is itself becoming a risk?

Our in-depth feature this month explores how ballooning premiums and increased demands on housing providers are causing a ‘crisis point’. Read the full report here.

Temporary accommodation challenge grows

Elsewhere, our special report takes a deep dive into the scale and urgency of the challenge within temporary accommodation. Looking across a range of data points from government and local government over four years, Social Housing analysis has found that the number of households in temporary accommodation in England rose nearly a third over the period.

Complaints and stock quality

The figure is one of a number of alarming statistics that emerged during the month. That included news from the Housing Ombudsman that the number of severe maladministration findings has skyrocketed 323 per cent in the last year, as complaints spiked off the back of wider media attention on conditions.

Speaking at a recent conference, ombudsman Richard Blakeway criticised the “very striking” complacency around missed appointments for repairs.

The latest Statistical Data Returns (SDR) publication by the Regulator of Social Housing also showed that the number of homes failing the Decent Homes Standard in England rose by 130 per cent in 2023.

The large increase, the RSH suggested, was a result of the focus on stock quality in the SDR survey, as well as recent regulatory work “leading providers to assess data quality and reporting”.

Having a handle on the number of homes requiring investment is an essential start, but it doesn’t make finding the funds to pay for the works themselves any easier.

New valuation approach

To that end, with the high costs of decarbonisation works in mind, some of the sector’s major valuers are calling on funders to enable housing providers to realise more value during the loan securitisation process through a lotting approach.

Intended to better reflect the way stock actually trades, a “considerable body of evidence” has been built up, according to JLL’s Richard Petty. However, funding lawyers are as yet unconvinced. Michael Lloyd explores the proposals – and the reaction – here.

Policy change

Meanwhile, providers in Wales now have more stretching targets, still, to focus on. Local housing authorities and registered social landlords regulated by the Welsh government now have until 2034 to comply with a new standard focused on quality, affordable warmth and decarbonisation. In the words of climate change minister Julie James, the new Welsh Housing Quality Standard 2023 is both “bold and achievable”.

Those might not have been the words that immediately sprang to mind on 12 October at organisations involved in the funding and delivery of shared ownership homes, as a somewhat unheralded (although by no means unprecedented) intervention by government on rent levels emerged.

Designed to bring the tenure into line with other affordable housing products, the rule change sees the upper limit for rises now pegged to the Consumer Prices Index, as opposed to the Retail Prices Index.

Outlining the decision, housing minister Rachel Maclean said: “We recognise the financial pressures people are facing and we must do all we can to protect shared owners from higher costs.”

That sentiment is to be welcomed, but another sudden policy change further dilutes certainty in the operating environment and will do little to support efforts to deliver long-term supply.

To hear how the latest policy and economic conditions are impacting business plans and financial resilience, and to contribute to the discussion, join me and a host of sector experts at the Social Housing Annual Conference on 30 November.

Co-located with Inside Housing’s Development and Regeneration Summit, the event is your chance to explore pathways to maintaining financial resilience and how to continue developing new homes. I look forward to seeing you there.

Sarah Williams, editor, Social Housing

- Insurance in social housing: how ballooning premiums and increased demands are causing a ‘crisis point’

- Special report: data shows major four-year rise in temporary accommodation levels

- Valuers urge funders to adopt ‘lotting’ approach, while lawyers call for more assurance

- DLUHC intervenes on shared ownership rents to ‘protect’ residents

- Fitch downgrades two providers’ ratings and gives negative outlook to G15 landlord

- Broaden skill sets and embed the tenant voice, governance experts advise

- M&G still has ‘plenty of appetite’ for shared ownership despite slow growth, says senior executive

- London landlord in merger talks with Places for People

- Starmer promises 1.5 million new homes

- Wheatley sees surplus rise despite economic volatility

-

Number of homes failing the Decent Homes Standard rises by 130%

-

Sector grows by almost 34,000 social homes, boosted by for-profit growth

-

North East provider breaches Rent Standard while two landlords are downgraded to V2

-

Welsh providers must comply with new housing quality standard by 2034

-

London landlord being investigated over possible non-compliance

-

Housing Ombudsman criticises ‘very striking’ complacency around missed repairs appointments

-

RSH reveals details of approach for new landlord inspection regime

-

Scottish regulator orders landlords to submit information on RAAC

-

Housing Ombudsman gets ‘extra tools’ to act on service failures

Sign up to Social Housing’s newsletters

New to Social Housing? Click here to register and sign up to our selection of newsletters

News bulletin: Social Housing’s weekly newsletter delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Comment newsletter: Our fortnightly selection of specialist opinion, guidance, and political and economic commentary, from a unique range of leading experts.

Data analysis newsletter: A twice-monthly round-up of Social Housing’s leading data analysis, keeping you up to speed on key trends and pointing you to all the data you need on financial and operating performance in the sector and beyond.

Already have an account? Click here to manage your newsletters.

RELATED