The new accounting direction is an opportunity to revisit policies

The 2022 accounting direction should not require radical changes to most associations’ accounts, but is a good opportunity to revisit accounting policies and presentation, writes Julia Poulter of Crowe UK and the Housing SORP Working Party

The Regulator of Social Housing has recently issued The Accounting Direction for Private Registered Providers of Social Housing 2022. The direction is effective for periods beginning on or after 1 January 2022 and supersedes the requirements of the 2019 direction. Early adoption of the 2022 direction is encouraged, therefore registered providers (RPs) may like to consider this for their forthcoming year-end accounts.

The changes are fairly minimal and focus on guidance supporting segmental reporting requirements and also remove any direction in relation to the Disposal Proceeds Fund, as the fund ceased to exist from April 2020.

Segmental reporting

Notes A and B require RPs to distinguish between turnover, cost of sales, operating expenditure and operating surplus for social housing and other activities, and provides a required format for these notes. This has not changed from the 2019 direction. As previously required, additional lines should be included within notes A and B to ensure consistency with the operating surplus and deficit line in the statement of comprehensive income.

The 2022 version has provided the following examples of possible additional lines in respect of Note A:

- The disclosure of profits or losses on the sale of property, plant and equipment

- Gift aid

- Revaluation of investment properties

The requirements for Note B are largely unchanged except for the addition of ‘lease costs’ as a separate line item in the breakdown of operating expenditure.

The 2022 direction also provides a read across to guidance for the financial viability accounts return, which can be used as a reference in respect of Note B.

Other matters clarified

The glossary of terms has been updated to provide additional guidance for the following:

- Care homes

- Low-cost homeownership

- Social housing lettings

- Units owned

- Units managed

There has been no change in the requirements for value-for-money reporting. In the consultation response, the regulator acknowledges that there will be some variability in the measures due to differences in accounting policy choices. RPs should follow standard metric calculations but are free to outline the differences in the text

of their reporting.

Going concern

Forecasts will need to be revisited and any sensitivities and stress-testing performed by management should reflect a range of challenges currently impacting the sector, such as:

- Planned fire and building safety spend

- Decarbonisation costs

- Rising development costs and the impact of labour/surplus challenges on the timing of completion and associated income

- Potential for additional costs not covered by service charges arising on new requirements of the shared ownership model (for 2021-26 affordable homes grant)

- Increases in future contributions to the Social Housing Pension Scheme

Loan covenants

Where changes to the financial results/position cause a breach in an RP’s banking covenant, it should seek to obtain a covenant waiver at the reporting date. Where a breach has not been remedied by the reporting date, RPs should follow the reporting and disclosure requirements of FRS 102 paragraph 11.47. It may even need to reclassify debt as due within one year.

RPs may already have carve-outs in place for additional fire safety costs, but may need to consider how decarbonisation works will impact EBITDA MRI ratios. As a result, RPs may need to approach lenders for additional carve-outs.

Capitalisation and depreciation

With new costs for fire/building safety and decarbonisation works starting to follow through, it is a good time for RPs to revisit key policies in relation to capitalisation and depreciation.

Plans for works may indicate a reduced economic life for some components. We are seeing this for items such as boilers (both in terms of reduced life expectancy but also planned replacement for decarbonisation purposes). In this case, RPs may need to separate out heating infrastructure and piping from the boiler itself if this is not already separated, as this element of the component may have a different useful economic life.

Impairment

For properties, as a starting point, RPs should review housing-specific indicators of impairment under paragraph 14.6 of the Housing Statement of Recommended Practice (SORP) against the association’s individual circumstances.

For investment properties carried at valuation, RPs should consider whether an external valuation is required at the reporting date, and assess the assumptions and caveats included in the report by valuers.

Development stock – completed and work in progress – should be carried at the lower of cost and net realisable value (NRV). When assessing NRV, RPs should look at up-to-date investment appraisals and consider total scheme costs (costs to date, plus costs to complete) against the estimated sales revenue, taking into account any increases to costs as a result of supply chain and labour shortage challenges.

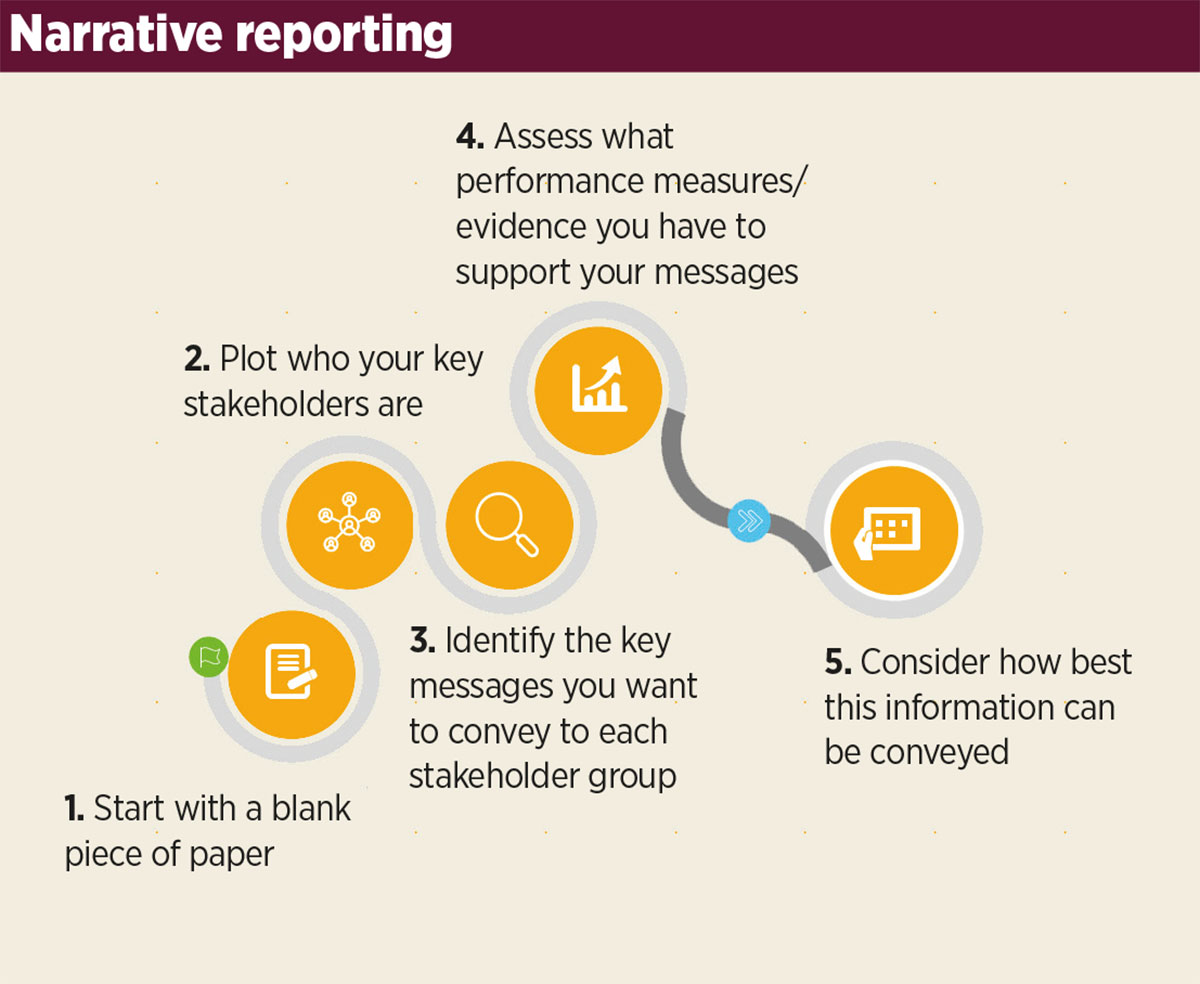

Narrative reporting

When RPs ask me about moving to ‘glossy’ accounts, my answer is that the focus shouldn’t simply be on how they look – you can’t improve narrative reporting by adding pretty pictures alone. I suggest the following simple steps:

- Start with a blank piece of paper – don’t re-hash what you already have

- Plot who your key stakeholders are – who is going to use the annual report and accounts, and what for?

- Identify the key messages you want to convey to each stakeholder group

- Assess what performance measures/evidence you have to support your messages

- Consider how best this information can be conveyed (use of infographics, charts, graphs, bullets, amplified text, quotes, case studies)

Julia Poulter, head of social housing, Crowe UK, and technical advisor, Housing SORP Working Party

Sign up for the Social Housing Finance Conference

The leading one-day event for senior finance and treasury professionals

Brought to you by Social Housing magazine, the Social Housing Finance Conference (11 May, etc. venues, St Paul’s, London) is recognised as the longest-standing, leading one-day event bringing together sector leaders and senior finance and treasury professionals from across the sector to discuss the strategic, operational and technical finance matters of most importance.

RELATED