What is carbon offsetting – and should housing providers do it?

Registered providers could both buy and sell carbon credits, writes Chris Evans of Newbridge Advisors

Environmental, social and governance (ESG) has rapidly emerged from being a specialist, almost niche, subject matter to becoming one of the most relevant and discussed topics, in not only the social housing sector but the broader corporate market, too.

Alongside its global necessity, the rapid rise of ESG is driven by the effective lack of boundaries around its remit; it touches customers, employees, physical assets and financing partners, with each sharing differing, sometimes conflicting, views on best practice.

Much has been discussed on the environmental part of ESG, mainly as to how organisations can promote and disclose their retrofitting and decarbonisation commitments better. There is already a question of whether the current focus of Energy Performance Certificate Band C by 2030 is enough.

With net zero strategies beginning to take shape, this article explores the concept of carbon offsetting and whether housing associations could, or should, become more active in this space – both as a buyer and a seller.

Voluntary product

Carbon offsetting is a voluntary product driven by businesses and their customers seeking to contribute to achieving a low-carbon future. Every activity, business or individual has a carbon footprint, and carbon offsetting is used to compensate for the emissions generated by funding an equivalent amount of emissions savings elsewhere.

In simple terms, offsetting one tonne of carbon means there will be one less tonne of carbon dioxide in the atmosphere.

It is a tool used fairly frequently by corporate entities, notably in the energy and airline industry, and aligns with those who actively seek to track and measure their own carbon footprint.

By investing in an eligible project, an organisation is able to quantify and disclose against the amount of emissions saved, with the argument that the organisation is unrestricted as to where the offset takes place – the atmosphere has no boundaries, so why should the underlying initiative? An organisation buying the offset can therefore really seek to understand the project that best suits its motive. While the eligible projects can cover a broad spectrum of initiatives, they tend to follow two broad themes:

- Carbon avoidance – prevent future carbon emissions by supporting the transition to green energy. This could be supporting initiatives focused on fossil fuel replacement

or preventing deforestation. - Carbon removal – actively removing carbon emissions from the atmosphere. This could be tree restoration to sequester carbon or direct air capture technologies.

Eligible projects also carry by-products that are worthy of consideration by the underlying buyer. Key determinations will be:

- Does it have a positive outcome for a community?

- Does it support the broader economy in that area?

- Which United Nations Sustainable Development Goal(s) does it align with?

- Is it consistent with our overall group strategy?

So, how does one go about purchasing a carbon offset project?

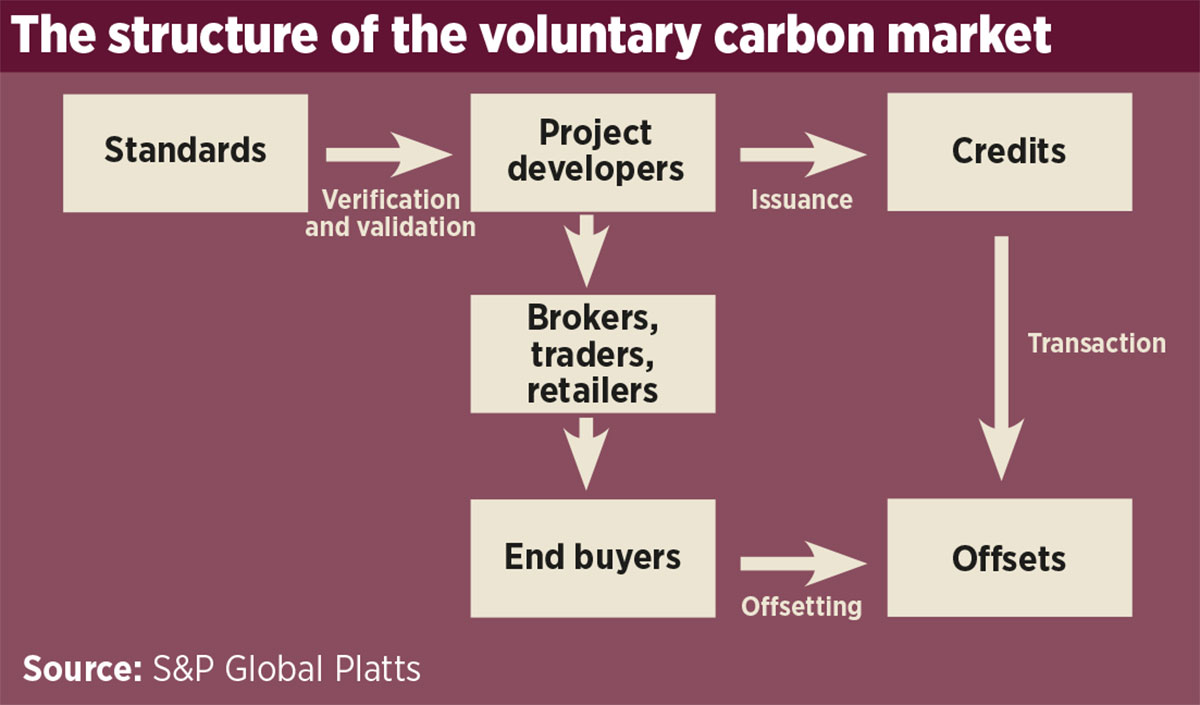

Typically, buying an eligible project is executed through a broker, exchange or intermediary whose role is to bring buyers and suppliers together – creating pools of liquidity in specific niches. However, given that the market is voluntary, options are vast when deciding a route to market and it can be daunting when navigating through the various exchanges to determine which offer best practice and, importantly, most scrutiny of the seller.

Diligence required

Readers should note that the voluntary market is unregulated and requires expertise to ensure appropriate diligence has taken place. Most exchanges undertake their own due diligence, in some form, in order to accredit a project. The better ones have established a set of transparent standards to ensure the eligible projects are not only real, but also measurable and permanent – and we would always encourage potential buyers to progress a purchase through these routes. In terms of the underlying project, given that it is a carbon saving, the projects are quoted on a per-tonne basis and the quantity purchased is a multiplier of one.

But what about certifying an eligible project? As a not-for-profit organisation, can an association design a project that provides not only a positive impact but that can quantifiably contribute towards climate security and sustainable development? We believe it is possible, and in doing so, a project seller can monetise the impact through issuance of a carbon credit or, more broadly, simplify certified project impacts for sustainability commitment or brand value.

It is also worth highlighting that certifying a project for listing on an exchange will have associated fees dependent on project type, size, complexity etc.

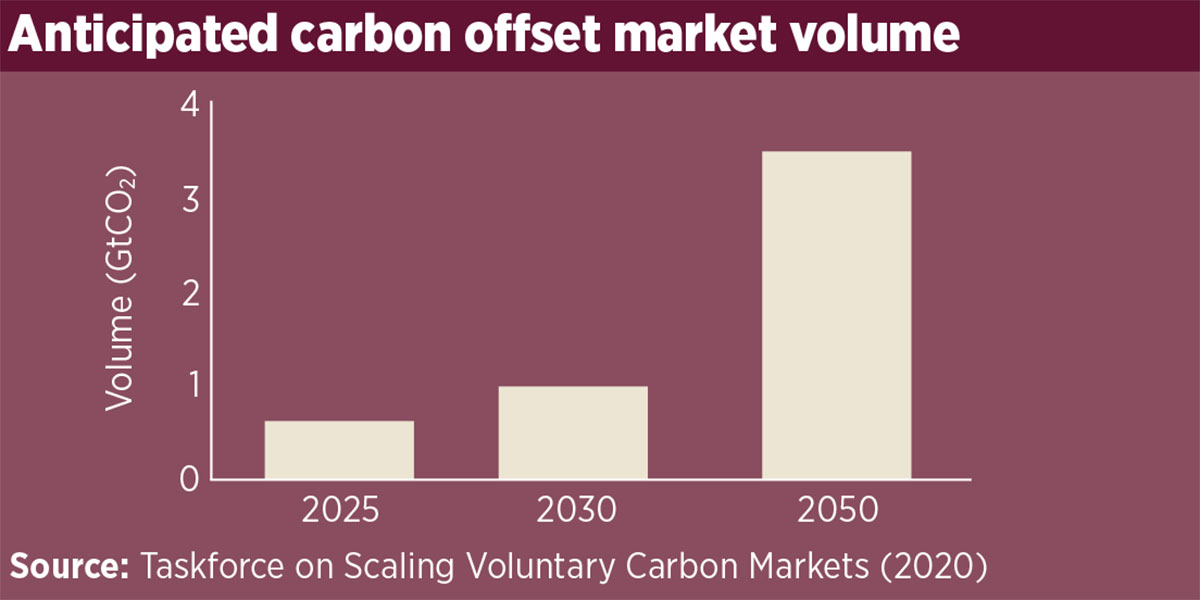

In summary, the carbon offsetting market is expected to soar in the coming decades as demand grows among companies seeking to actively track and reduce their emissions as part of strategies to reach net zero by 2050 or sooner.

A survey conducted by the Taskforce on Scaling Voluntary Carbon Markets in 2020 demonstrated a projected step change in both volume and price in the path to 2050, reaching an expected market volume of 3.6Gt of C02 by 2050 (see graph above).

The UN’s Climate Change Conference in Glasgow, in November 2021, highlighted the role of the voluntary carbon market and its purpose in unlocking finance for nature and future innovation. The event provided an important endorsement for more corporate climate action and, as organisations begin to understand what is required to achieve net zero, we expect the carbon offsetting market to provide a meaningful contribution.

Chris Evans, director, Newbridge Advisors

RELATED