When three become one: how Bromford navigated its mergers

Negotiations with lenders were key to overcoming challenges in the merger process, explain Lee Gibson and Imran Mubeen of Bromford

Picture: Getty

Bromford, Merlin and Severn Vale had been looking at potential merger partners for some time as a way of delivering efficiencies and to increase investment in homes and customers. So, by the time we announced the Merlin partnership in December 2017, we had already invested considerable time and energy into creating a robust business case, setting out the associated expenditure, benefits and synergies.

We were acutely aware of the challenges involved in bringing another housing association into our organisation. Chief among them was the negotiations with all the existing lenders. It is important for us to work with funders who understand our growth ambitions and partner with us to deliver joint solutions to complex problems.

Over a six-month period we engaged in dialogue with our existing lenders about merging the two organisations and what it would take to restructure our existing debt facilities to allow the merger to happen.

Ultimately, the smoothest option was to bring Merlin into our group structure as a subsidiary of Bromford Housing Group to sit alongside Bromford Housing Association, rather than the two registered providers being amalgamated into one.

This allowed us to establish a paradigm where lenders were comfortable with the new structure and their respective credit and balance sheet exposure levels, while allowing us to optimise and retain the positive embedded value we had established across the legacy loan books.

In March 2018, we initiated talks to merge with Severn Vale Housing. As we developed a business case, we entered into a similar dialogue with Severn Vale’s funders and agreed to formalise an arrangement where it could be absorbed into the Merlin subsidiary.

Concluding negotiations with our existing lender base was the most challenging financial aspect of the merger process and it was essential for us to design a group structure and future funding regime to serve the requirements of the new group. Our mantra was simple: ultimately, we are running one treasury function and solving one funding equation for the group.

“Concluding negotiations with our existing lender base was the most challenging financial aspect of the process”

We therefore wanted to have the ability to leverage security from wherever it exists to generate new funding that can be delivered to wherever it is required across the group. The timing of our debut bond issue, just in advance of the merger with Merlin, ensured that this objective could successfully be met through our capital markets issuing structure.

In terms of our legacy bank debt, as common funder to all three legacy organisations, Lloyds was particularly proactive in assessing our merger and restructuring £200m of legacy debt into new market-leading revolving credit facilities to meet our new liquidity requirements.

Every lender stayed on board and there was no change to our covenants or pricing.

It is also vital to have a clear management structure and constituents of the board in place at the start of any merger. We finalised our senior management team and board structure early on, which meant we had a clear vision about our purpose and goals for the future and we were able to communicate this to our stakeholders and investors on our debut public bond roadshows.

Merlin continues to legally exist as a subsidiary of Bromford Housing Group, but we operate as one business, with one co-terminus board and management team.

By operating as one organisation we were able to tap into the efficiencies identified in both business cases; by having not only a single management team, but also combined teams for each business function. We’ve already started this process and we’re reinvesting some of these savings into expanding our neighbourhood coaching approach to a further 12,500 households.

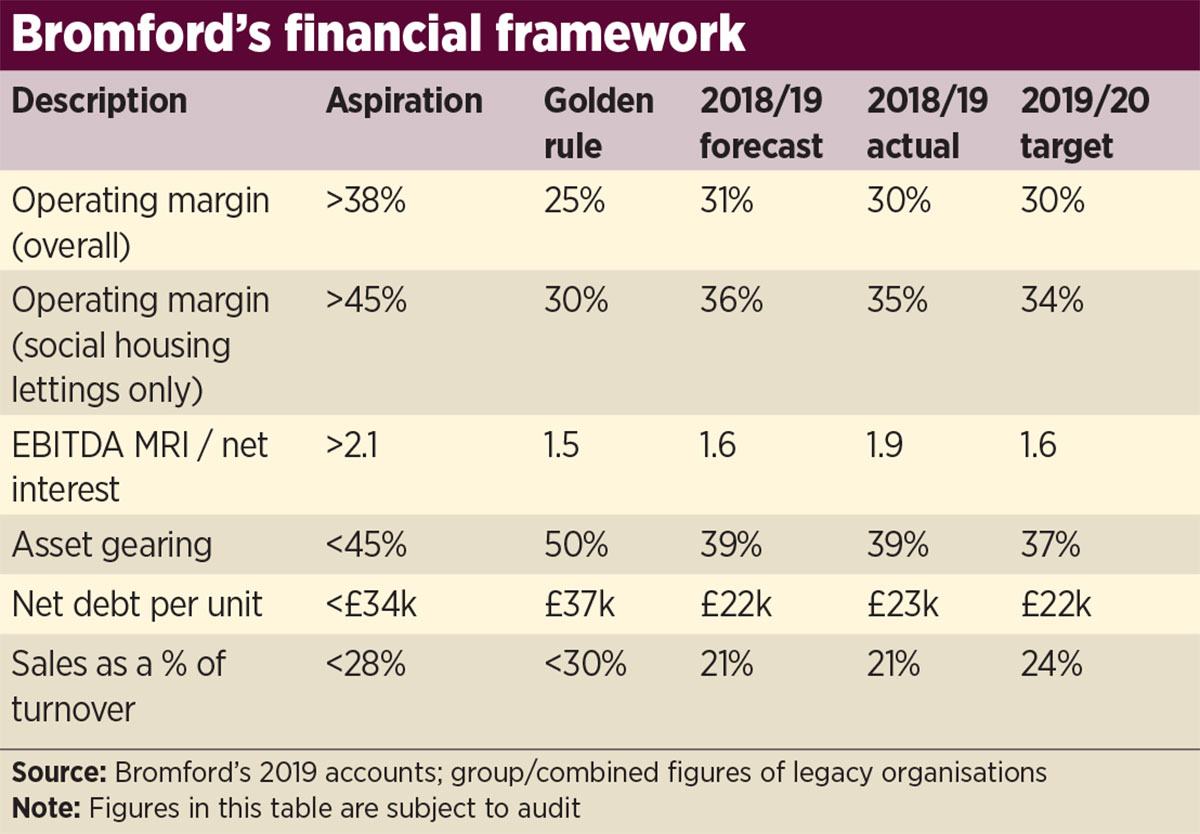

We have launched a new financial framework to sit alongside our recently launched five-year business strategy. The framework establishes golden rules and sets out our ambitions for creating value, which we can then reinvest to deliver our strategic goals and provides us with robust financial foundations.

In 2018, we purposefully established a dual credit rating platform. We continue to be proactive in sharing information with agencies and we now run our own shadow credit rating analysis on our business plan.

Given our development ambitions and increased scale, we were on a credit journey that aligned closely with a Moody’s A2 rating and this is a message we communicated to the investor community in April 2018. We were regraded by Moody’s to A2 in its latest review and we continue to benefit from our Standard & Poor’s A+ rating.

The mergers have allowed us to operate across a larger geographical area and increase our development programme from 10,000 homes over 10 years to 14,000 over the same period. We have a strong pipeline of developments for the years ahead, but to be able to develop this number we need additional funding in both the short term and the medium term.

Last year we secured a £300m public bond at a sector-leading 30-year rate of 3.125 per cent. This new funding was planned pre-merger to secure funding for our existing development programme. But our growing new homes plan led us to return to the market with our inaugural £100m private placement in the North American market, bringing in two new investors to UK social housing.

Our new banking and capital market facilities have generated a diverse funder and investor base that positions us well and we seek to bring in a further £750m to £1bn over the next 10 years.

We will continue to pursue traditional bank funding, Homes England grant funding, and publicly listed bonds on the London Stock Exchange – as well as private placements in the UK and overseas.

Maintaining strong liquidity means we can deliver our development programme and provide low-cost housing to those who can’t afford to access market housing, as well as investing in our relationships with existing customers.

Lee Gibson, executive director of finance, and Imran Mubeen, head of treasury, Bromford

RELATED