Boost in share of top HAs’ pre-tax surplus from sales

Profits from sales form 42% of 150 English HAs’ total surplus

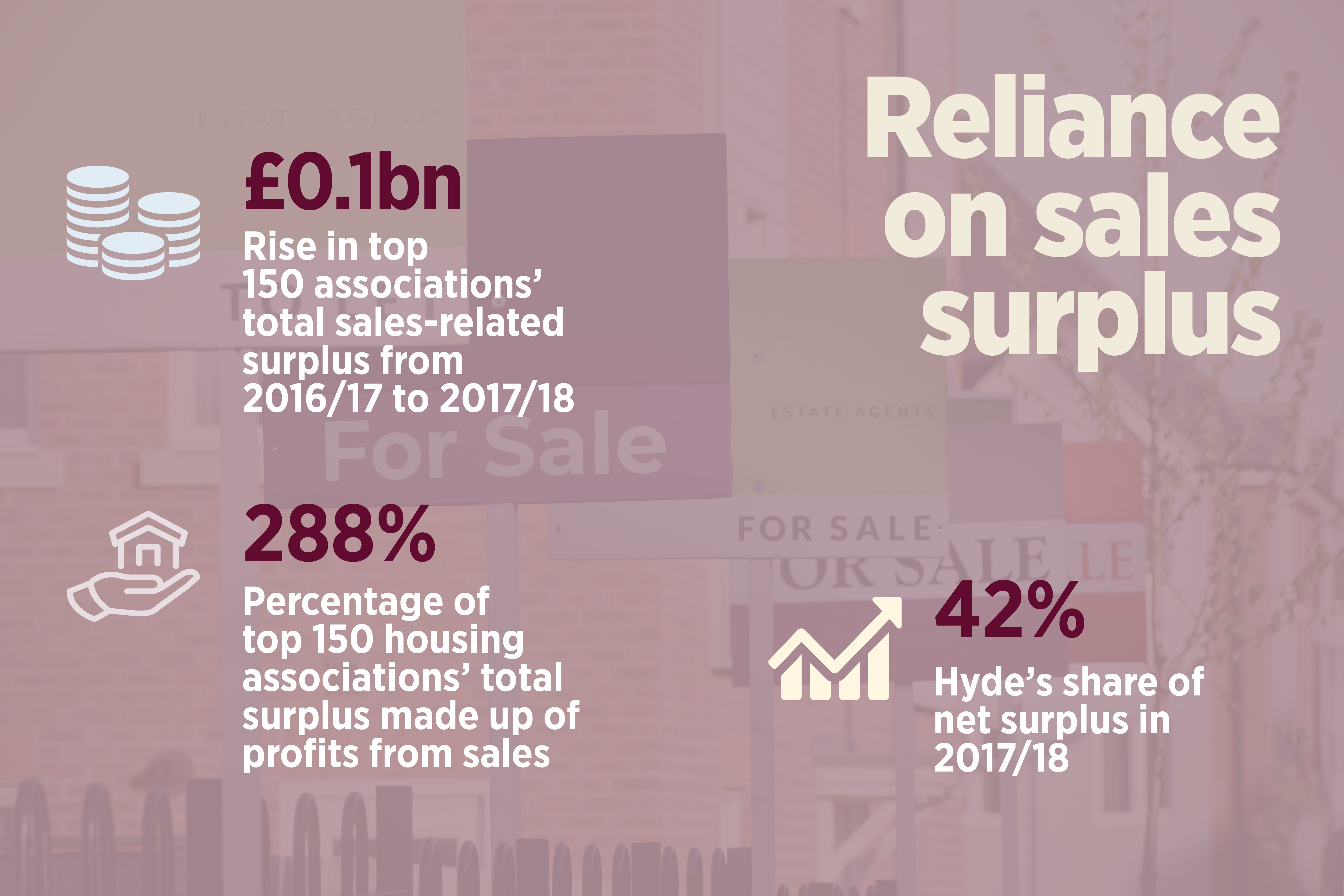

The share of pre-tax surplus from sales for England’s top housing associations saw a boost during 2017/18.

Figures show that profits from sales formed 42 per cent of housing associations’ total surplus, bouncing back from last year’s dip when sales-related profits made up 34 per cent of net surplus.

The figure was 42 per cent in 2015/16, although that report covered a slightly different cohort of associations.

Social Housing analysed profits from sales in the 2018 accounts of the 150 associations with the largest turnovers across the country and found that total sales-related surplus was £1.46bn, up from £1.36bn.

Sales surpluses are made up from first tranche shared ownership sales, sales of fixed assets such as the Right to Buy and Right to Acquire, and non-social housing sales of properties built for open market sale.

Out of the 150 housing associations, 24 had no development activity and made their sales income from fixed assets only with a surplus of £35.2m.

The remaining 126 housing associations saw £342m come from first tranche sales and £258m come from non-social housing development. However, the bulk of their sales surplus came from fixed assets at £825.6m. This resulted in fixed asset sales making up an increased share of total surplus for this group at 25 per cent, up from 19 per cent the prior year.

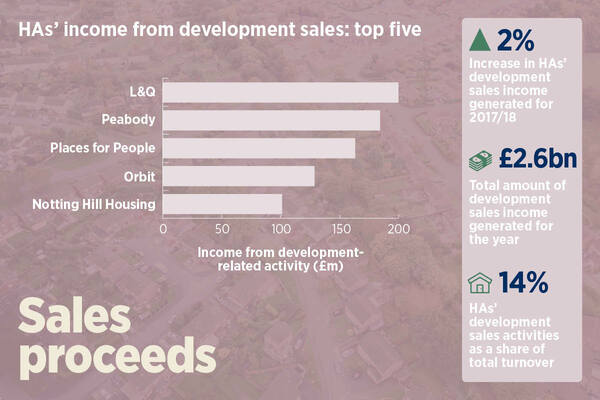

This report covers the top 150 associations by turnover and also includes surplus from sales of fixed assets, whereas Social Housing’s March 2019 report on sales income looked at associations with combined first tranche and open market sales income above and below £4m. It did not include income from fixed asset sales because this is not stated by all associations in their accounts.

Individual associations

Hyde Housing came top of the list with the largest share of net surplus at 288 per cent, but this was due to its sales-related surplus (£80.9m) being larger than its total pre-tax surplus (£28.1m).

The group said that this was because its “pre-tax profit deducts its entire interest cost and the break costs of its loan restructuring, while sales profit didn’t”. Its overall operating profit, before interest and break costs, was £161m.

There were 10 other registered providers (RPs) that had a larger sales-related surplus than total pre-tax surplus. They included Genesis, Aspire and The ExtraCare Charitable Trust.

Genesis had a sales-related surplus of £50.3m, compared with £22.4m. The group said the £22.4m was stated after adding the surplus on sales of properties (£42.8m) and deducting net interest costs and other financing and fair value charges (£59.4m) to the operating surplus of £39m.

Aspire reported a sales-related surplus of £4.7m, compared with £3.8m, while The ExtraCare Charitable Trust had a sales-related surplus of £12.3m, compared with a total surplus of £10.2m.

On this, Chris Skelton, executive director for corporate resources at the trust, said: “As a charity, some of the services we offer to our residents do not break even, and while we aim to make each service self-sufficient we do need to direct our income-generating, including fundraising, efforts towards supporting them.

“These services include care, dementia support, preventative health and well-being advice. As a charity we are committed to cover this shortfall and to continue to provide these services to all residents, regardless of circumstance.”

Largest 150 registered providers: reliance on sales surpluses 2017/18

| Sales surpluses (£m) First tranche surplus | Sales surpluses (£m) Non-social housing surplus | Sales surpluses (£m) Fixed assets surplus | Sales surpluses (£m) Total sales related | Total pre-tax surplus (£m) | Share of net surplus (%) First tranche | Share of net surplus (%) Non-SH devt. related | Share of net surplus (%) Fixed assets sales | Share of net surplus (%) 17/18 total | Share of net surplus (%) 16/17 total | |

| Hyde Housing Association | 13.7 | 1 | 66.2 | 80.9 | 28.1 | 49 | 3 | 236 | 288 | 124 |

| Genesis Housing Association | -0.6 | 8.1 | 42.8 | 50.3 | 22.4 | -3 | 36 | 191 | 225 | 166 |

| Aspire Housing (Staffordshire) | 1.5 | 0 | 3.2 | 4.7 | 3.8 | 40 | 0 | 83 | 124 | 32 |

| The ExtraCare Charitable Trust | 4.4 | 6.5 | 1.4 | 12.3 | 10.2 | 43 | 64 | 14 | 121 | 139 |

| Poplar Harca | 2.1 | 0 | 39.1 | 41.2 | 42.9 | 5 | 0 | 91 | 96 | 63 |

| Gentoo Group | 0 | 5.6 | 0.9 | 6.5 | 7.7 | 0 | 73 | 12 | 84 | 34 |

| The Wrekin Housing Trust | 0.9 | 0 | 9.9 | 10.8 | 13.5 | 7 | 0 | 74 | 80 | 65 |

| Catalyst Housing | 7.8 | 17.6 | 17.7 | 43 | 54.6 | 14 | 32 | 32 | 79 | 60 |

| Wandle Housing Association | 7.8 | 0 | 7.2 | 14.9 | 19 | 41 | 0 | 38 | 79 | 61 |

| Stockport Homes | 1.1 | 0 | 0 | 1.1 | 1.4 | 77 | 0 | 1 | 78 | 18 |

| Trafford Housing Trust | -0.1 | 2.1 | 3.6 | 5.6 | 8.1 | -1 | 26 | 44 | 69 | 68 |

| Hastoe Housing Association | 1.1 | 0.2 | 3.8 | 5.1 | 7.4 | 15 | 3 | 51 | 69 | 55 |

| Network Homes | 1.8 | 17.5 | 10.8 | 30.1 | 44.6 | 4 | 39 | 24 | 68 | 62 |

| Paradigm Housing Group | 5.8 | 5.1 | 6.4 | 17.3 | 25.6 | 23 | 20 | 25 | 67 | 54 |

| One Housing Group | 13 | 6.6 | 13.8 | 33.5 | 52.1 | 25 | 13 | 27 | 64 | 61 |

| Broadacres Housing Association | 0.8 | 1.6 | 1.4 | 3.8 | 6 | 14 | 26 | 23 | 63 | 40 |

| Housing Solutions | 2.6 | 0 | 1.5 | 4.1 | 6.7 | 39 | 0 | 22 | 61 | 108 |

| Orbit Group | 17 | 9.4 | 24.9 | 51.3 | 85.4 | 20 | 11 | 29 | 60 | 66 |

| CHP | 2.7 | 2.1 | 0.6 | 5.5 | 9.1 | 30 | 23 | 7 | 60 | 137 |

| Thames Valley Housing Association | 10.9 | 0 | 9.2 | 20.1 | 33.8 | 32 | 0 | 27 | 59 | 16 |

| Notting Hill Housing Trust | 11.5 | 20 | 25.9 | 57.4 | 96.9 | 12 | 21 | 27 | 59 | 60 |

| Peabody | 22.6 | 35.5 | 42.2 | 100.3 | 175.3 | 13 | 20 | 24 | 57 | 56 |

| BPHA | 11.8 | 0 | 11.2 | 23 | 41.7 | 28 | 0 | 27 | 55 | 65 |

| Stonewater | 5.1 | 0 | 15.6 | 20.7 | 39 | 13 | 0 | 40 | 53 | 47 |

| Cross Keys Homes | 5.8 | 0 | 1.4 | 7.2 | 14.8 | 39 | 0 | 9 | 49 | 17 |

| One Vision Housing | 0.7 | 0 | 1.8 | 2.5 | 5.2 | 13 | 0 | 34 | 48 | 19 |

| Newlon Housing Trust | 1.2 | 0 | 7.5 | 8.7 | 18.4 | 6 | 0 | 41 | 47 | 25 |

| PA Housing | 6.1 | 1.3 | 8.3 | 15.7 | 33.5 | 18 | 4 | 25 | 47 | 46 |

| Town & Country Housing Group | 1.9 | -0.1 | 6.5 | 8.3 | 17.8 | 11 | -1 | 37 | 47 | 31 |

| Metropolitan Housing Trust | 9.6 | 1.7 | 18.5 | 29.8 | 65.4 | 15 | 3 | 28 | 46 | 40 |

| Hanover Housing Association | 0.5 | 9.3 | 0.7 | 10.4 | 22.9 | 2 | 41 | 3 | 46 | 4 |

| Octavia Housing | 1.6 | 1.5 | 1.9 | 5 | 11.5 | 14 | 13 | 17 | 44 | 25 |

| Southern Housing Group | 4.9 | 2.1 | 11.1 | 18.1 | 41.3 | 12 | 5 | 27 | 44 | 40 |

| Soha Housing | 2.6 | 0.5 | 1.6 | 4.7 | 10.6 | 24 | 5 | 15 | 44 | 38 |

| Plus Dane Housing Group | 1.1 | 0 | 1 | 2.1 | 4.9 | 22 | 0 | 21 | 43 | 8 |

| Estuary Housing Association | 0.5 | 0 | 1.7 | 2.2 | 5.4 | 9 | 0 | 32 | 42 | 15 |

| Curo Group (Albion) | 1.9 | 4.7 | 3.4 | 10 | 24.1 | 8 | 20 | 14 | 42 | 28 |

| GreenSquare Group | 1.4 | 0.8 | 3.1 | 5.3 | 12.9 | 11 | 6 | 24 | 41 | 43 |

| Aster Group | 5.6 | 0.1 | 14.6 | 20.3 | 49.6 | 11 | 0 | 29 | 41 | 14 |

| Shepherds Bush Housing Association | 0.1 | 0 | 3.5 | 3.6 | 9 | 1 | 0 | 40 | 41 | 27 |

| Advance Housing and Support | -0.1 | 0 | 1.2 | 1.1 | 2.6 | -3 | 0 | 44 | 40 | 5 |

| Moat | 5.1 | -0.1 | 20.1 | 25.2 | 64.6 | 8 | 0 | 31 | 39 | 45 |

| LiveWest Homes | 4.4 | 5.4 | 7.3 | 17.1 | 44.7 | 10 | 12 | 16 | 38 | 34 |

| Radian Group | 5.5 | 2.5 | 5.5 | 13.5 | 35.5 | 16 | 7 | 16 | 38 | 21 |

| Nottingham Community HA | 0.7 | 0 | 3 | 3.7 | 9.6 | 7 | 0 | 31 | 38 | 44 |

| Grand Union Housing Group | 3.6 | 0 | 2.4 | 6 | 16 | 23 | 0 | 15 | 37 | 8 |

| Swan Housing Association | 0.4 | 4.6 | 0.8 | 5.8 | 15.6 | 3 | 29 | 5 | 37 | 54 |

| Clarion Housing Group | 16.5 | 12.5 | 26.9 | 55.9 | 157.5 | 10 | 8 | 17 | 35 | 38 |

| Vivid Housing | 9.4 | 5 | 8.4 | 22.9 | 66.7 | 14 | 8 | 13 | 34 | 35 |

| Hightown Housing Association | 3.1 | 0 | 2.5 | 5.6 | 16.7 | 18 | 0 | 15 | 33 | 32 |

| One Manchester | 0 | 0 | 3.3 | 3.3 | 10 | 0 | 0 | 33 | 33 | 13 |

| Riverside | 0.3 | 4.1 | 15.4 | 19.8 | 60.1 | 0 | 7 | 26 | 33 | 42 |

| Housing Plus Group | 0.8 | 0.9 | 1.6 | 3.2 | 9.7 | 8 | 9 | 16 | 33 | 30 |

| Yarlington Housing Group | 1 | 0 | 3.8 | 4.8 | 14.8 | 7 | 0 | 26 | 33 | 29 |

| Connexus Housing | 0.5 | 0 | 2.8 | 3.4 | 10.3 | 5 | 0 | 27 | 33 | 20 |

| Knowsley Housing Trust | 0.1 | 0 | 3.2 | 3.3 | 10.2 | 1 | 0 | 32 | 32 | 41 |

| Bromford Housing Group | 4.2 | 0 | 11.4 | 15.6 | 49.2 | 9 | 0 | 23 | 32 | 23 |

| Walsall Housing Group | 2 | 0 | 8.8 | 10.8 | 34.4 | 6 | 0 | 25 | 31 | 30 |

| Merlin Housing Society | 1.4 | 0 | 3.2 | 4.6 | 15.1 | 9 | 0 | 21 | 31 | 15 |

| L&Q | 27 | 28 | 54 | 109 | 354 | 8 | 8 | 15 | 31 | 52 |

| Hexagon Housing Association | 0.3 | 0 | 1.7 | 1.9 | 6.3 | 4 | 0 | 26 | 31 | 31 |

| Great Places Housing Group | 0.8 | 0.5 | 2.3 | 3.6 | 11.8 | 7 | 5 | 19 | 31 | 43 |

| Ocean Housing Group | 0.4 | 0 | 0.8 | 1.2 | 3.9 | 11 | 0 | 19 | 30 | 31 |

| EMH Group | 1.2 | 0 | 3.4 | 4.6 | 15.5 | 8 | 0 | 22 | 29 | 23 |

| Sovereign Housing Association | 6.9 | 4.2 | 18.4 | 29.4 | 103.9 | 7 | 4 | 18 | 28 | 23 |

| Home Group | 3.2 | 3.8 | 7.6 | 14.6 | 51.8 | 6 | 7 | 15 | 28 | 22 |

| Saffron Housing Trust | 0.1 | 0 | 1.3 | 1.4 | 4.9 | 1 | 0 | 27 | 28 | 50 |

| The Community Housing Group | 0.3 | 0 | 0.3 | 0.6 | 2.2 | 13 | 0 | 15 | 28 | 14 |

| Halton Housing Trust | 0 | 0 | 1.7 | 1.7 | 6.5 | 0 | 0 | 26 | 26 | 14 |

| Waterloo Housing Group | 1.7 | 1 | 7.5 | 10.3 | 39.5 | 4 | 3 | 19 | 26 | 11 |

| Origin Housing | 0.5 | -0.1 | 3.6 | 4 | 15.3 | 4 | -1 | 23 | 26 | 28 |

| Silva (Bracknell Forest Homes) | 1.7 | 0 | 0.3 | 2 | 8 | 22 | 0 | 4 | 25 | 32 |

| Greenfields Community HA | 2.2 | 0 | 0.9 | 3.1 | 12.7 | 18 | 0 | 7 | 25 | 7 |

| Aldwyck Housing Group | 0.8 | 0.5 | 3.6 | 4.9 | 20.1 | 4 | 2 | 18 | 24 | 127 |

| A2Dominion Group | 5.2 | 3.7 | 13.4 | 22.3 | 92.5 | 6 | 4 | 14 | 24 | 46 |

| Liverpool Mutual Homes | 0.3 | 0 | 1.7 | 1.9 | 8.3 | 3 | 0 | 20 | 24 | 5 |

| Longhurst Group | 2.9 | 2 | 1.3 | 6.3 | 27 | 11 | 8 | 5 | 23 | 25 |

| Magna Housing Group | 0 | 0 | 3.3 | 3.3 | 14.3 | 0 | 0 | 23 | 23 | 37 |

| South Yorkshire Housing Association | 0.2 | 0 | 0.6 | 0.8 | 3.4 | 5 | 0 | 17 | 23 | 19 |

| North Hertfordshire Homes | 1.5 | 0 | 1.3 | 2.8 | 12 | 12 | 0 | 11 | 23 | 5 |

| Havebury Housing Partnership | 0.6 | 0 | 1 | 1.5 | 6.8 | 8 | 0 | 14 | 23 | 17 |

| Stafford and Rural Homes | 0.6 | 0 | 1.2 | 1.8 | 7.9 | 7 | 0 | 15 | 23 | 8 |

| Golding Homes | 1.7 | 0.1 | 0.5 | 2.4 | 10.8 | 16 | 1 | 5 | 22 | 1 |

| Sanctuary Housing Association ** | 3.5 | 2.2 | 9.6 | 15.3 | 70.8 | 5 | 3 | 14 | 22 | 16 |

| Selwood Housing Society | 1.4 | 0 | 0.7 | 2.1 | 10.1 | 14 | 0 | 7 | 21 | 8 |

| West Kent Housing Association + | 1.1 | 0 | 1.3 | 2.3 | 11.7 | 9 | 0 | 11 | 20 | 12 |

| The Guinness Partnership | 0.5 | 4.5 | 5.8 | 10.8 | 54.2 | 1 | 8 | 11 | 20 | 36 |

| Castles & Coasts Housing Association | 0.2 | 0.1 | 0.9 | 1.2 | 6.2 | 3 | 2 | 14 | 19 | 14 |

| Beyond Housing (Coast & Country Housing) | 0.3 | 0.1 | 0.8 | 1.2 | 6.8 | 5 | 1 | 12 | 18 | 3 |

| Rooftop Housing Group | 0.2 | 0 | 1 | 1.2 | 7.4 | 3 | 0 | 13 | 16 | 8 |

| Mosscare St Vincent’s Housing Group | 0 | 0 | 1 | 1 | 6.6 | 0 | 0 | 16 | 16 | 2 |

| Raven Housing Trust | 2.1 | 0 | 1.8 | 3.9 | 25.2 | 8 | 0 | 7 | 16 | 26 |

| Acis Group | 0.2 | 0.5 | 0.2 | 0.9 | 5.9 | 3 | 8 | 4 | 16 | 24 |

| Karbon Homes | 0.4 | 0.3 | 2.8 | 3.5 | 22.6 | 2 | 1 | 12 | 15 | 9 |

| Midland Heart | 1 | 0.2 | 6 | 7.3 | 47.9 | 2 | 0 | 13 | 15 | 9 |

| Vale of Aylesbury Housing | 0.3 | 0 | 1.3 | 1.6 | 10.6 | 3 | 0 | 12 | 15 | 5 |

| Regenda | 0.5 | 0 | 1.1 | 1.6 | 12 | 4 | 0 | 9 | 13 | 2 |

| Futures Housing Group | 0.2 | 0.3 | 0.8 | 1.4 | 10.3 | 2 | 3 | 8 | 13 | 18 |

| Westward Housing Group | 0.4 | 0 | 0.8 | 1.3 | 9.7 | 4 | 0 | 9 | 13 | 15 |

| Bernicia Group | 0.2 | 0 | 1.4 | 1.5 | 12.1 | 1 | 0 | 11 | 13 | 4 |

| Fortis Living | 3.3 | 0 | 1 | 4.3 | 34.4 | 10 | 0 | 3 | 12 | 10 |

| Weaver Vale Housing Trust | 0 | 0 | 0.6 | 0.6 | 5.4 | 1 | 0 | 11 | 11 | 10 |

| Accent Group | 0.6 | 0 | 1.3 | 1.8 | 16.3 | 3 | 0 | 8 | 11 | 14 |

| Torus62 | 0.6 | 0 | 3.5 | 4.1 | 36.1 | 2 | 0 | 10 | 11 | 8 |

| Thirteen Group | 1.2 | 0 | 2 | 3.1 | 27.7 | 4 | 0 | 7 | 11 | 3 |

| Accord Housing Association | 0.2 | 0 | 1 | 1.1 | 10.8 | 2 | 0 | 9 | 11 | 12 |

| Flagship Housing Group | 0.8 | 0 | 3 | 3.8 | 37 | 2 | 0 | 8 | 10 | 8 |

| Orwell Housing Association | 0.2 | 0 | 0.3 | 0.5 | 5.2 | 3 | 0 | 6 | 9 | 4 |

| Saxon Weald Homes | 0.2 | 0 | 0.2 | 0.4 | 5.2 | 3 | 0 | 5 | 8 | 23 |

| Housing & Care 21 | 0.2 | 0 | 1.2 | 1.4 | 21.5 | 1 | 0 | 6 | 7 | 10 |

| ForViva Group | 0.1 | 0 | 0.6 | 0.6 | 10.1 | 1 | 0 | 6 | 6 | 15 |

| MHS Homes | 0.7 | 0 | 0.2 | 0.9 | 15.7 | 4 | 0 | 1 | 6 | 12 |

| Places for People Group | 1/2 | * | 4.7 | 5.9 | 130.2 | 1 | 0 | 4 | 5 | 6 |

| Onward Homes | 0.1 | 0.1 | 0.8 | 1.1 | 27.8 | 0 | 0 | 3 | 4 | -1 |

| Watford Community Housing Trust | 0.3 | 0 | -0.1 | 0.2 | 6.7 | 4 | 0 | -2 | 3 | -2 |

| Wakefield and District Housing | -0.3 | 0 | 1 | 0.8 | 30.9 | -1 | 0 | 3 | 2 | -3 |

| NSAH (Alliance Homes) | -0.1 | 0 | 0.2 | 0.1 | 7.1 | -2 | 0 | 3 | 1 | 3 |

| Jigsaw (Adactus Housing Group) | 0 | 0 | 0 | 0 | 18.1 | 0 | 0 | 0 | 0 | 4 |

| Plymouth Community Homes | 0 | 1.3 | -1.3 | 0 | -35.4 | 0 | -4 | 4 | 0.1 | -23.6 |

| Progress Housing Group | 0.2 | 0 | -0.4 | -0.2 | 8.2 | 3 | 0 | -5 | -2 | 2 |

| WM Housing Group | 0.3 | 0.8 | 2 | 3.1 | -52.2 | -1 | -2 | -4 | -6 | -8 |

| The Abbeyfield Society | 0 | 0.6 | 0.1 | 0.7 | -6.5 | 0 | -9 | -1 | -10 | -3 |

| Wythenshawe Community Housing Group | 0.7 | 0 | 3.5 | 4.1 | -10 | -7 | 0 | -35 | -41 | 20 |

| Optivo Homes | 8.8 | 4.9 | 24 | 37.7 | -51 | -17 | -10 | -47 | -74 | 46 |

| Your Housing Group | 0.3 | 0.2 | 22.9 | 23.3 | -15.8 | -2 | -1 | -145 | -148 | 12 |

| Together Housing Group | 0.4 | 2.3 | 7.1 | 9.7 | -3.2 | -11 | -70 | -219 | -301 | 12 |

| Total 126 dev. for sale activity | 342 | 258 | 825.6 | 1,425.9 | 3,275.7 | 10 | 8 | 25 | 44 | 35 |

| Total 24 no dev. for sale activity | 0.0 | 0.0 | 35.2 | 35.2 | 219.0 | 0 | 0 | 16 | 16 | 17 |

| Total top 150 by revenue | 342 | 258 | 860.8 | 1,461.1 | 3,494.8 | 10 | 7 | 25 | 42 | 34 |

| Source: Housing association audited accounts for year ended March 2018, + = year end 31 December 2017, * = figure not supplied, ** = EU IFRS | ||||||||||

The remaining seven had an overall deficit. They are: Plymouth Community Homes, WM Housing Group, The Abbeyfield Society, Wythenshawe Community Housing Group, Optivo Homes, Your Housing Group and Together Housing Group.

Most of them made a pre-tax loss because of break costs incurred during refinancing.

WM Housing Group had the largest deficit of £52.2m, compared with a £15m surplus the year before. In its company accounts, the group said it had been impacted by loan breakage costs incurred as part of a refinancing project that was undertaken in the previous year. Refinancing costs totalled £67.9m.

A sizeable pre-tax deficit of £51m was also recorded by Optivo. The group said in its accounts that its surplus before tax and impact of derivative movements was £90m but the change in hedging relationships following the refinancing of a loan portfolio and subsequent write-off of £164m of hedge reserves meant it reported a deficit before tax of £51m.

Plymouth Community Homes’ pre-tax loss was down to a £38.4m cost of cancelling an interest rate hedge, otherwise it would have made a £3m surplus.

The remaining RPs had smaller deficits. Your Housing Group’s was £15.8m, while Wythenshawe Community Housing Group’s was £10m – both caused by loan break costs. Otherwise both would have made a pre-tax profit. The Abbeyfield Society and Together Housing had the smallest deficits at £6.5m and £3.2m respectively, caused by impairments on properties in need of renovation or replacement.

Poplar Harca’s sales-related surplus of £41.2m made up 96 per cent of its total surplus. The bulk of this came from fixed asset sales, which correlates with the group’s property disposal strategy, which was laid out in its 2018 accounts. Within this, the RP said it would be using the proceeds to buy new affordable homes.

Large increases in the sales-related share of net surplus could be seen in Gentoo, Stockport Homes and Hanover Housing.

Gentoo’s sales-related surplus of £6.5m made up 84 per cent of its total surplus, up from 34 per cent last year. Stockport Homes’ £1.1m sales-related surplus accounted for 78 per cent of its total surplus, compared with 18 per cent. Hanover Housing’s £10.4m made up 46 per cent, compared with four per cent last year.

Out of those three RPs, both Gentoo and Hanover made the bulk of their sales-related surplus through non-social housing development, with £5.6m and £9.3m respectively.

In its accounts, Gentoo highlighted the changing funding environment that RPs must now operate within and said it will continue with its programme of new supply across tenures, including a 200-unit build-for-sale programme as well as 125 affordable homes for its rent programme and a pilot shared ownership programme, for which funding for 15 units has been secured through Homes England.

Hanover said that its development arm, Hanover Housing Developments, has made progress at its “significant development” at Woodside Square in Muswell Hill, north London. The RP said that this was part of a profit-sharing agreement, which reduced the overall development exposure and risk for Hanover.

RPs most reliant on first tranche sales

Stockport Homes was the RP most reliant on first tranche sales by quite a margin. It made £1m here, accounting for 77 per cent of its overall surplus, compared with Hyde, which was the next RP on the list with a £14m sales surplus (accounting for 49 per cent of its total surplus).

Hyde’s share of net surplus in relation to first tranche sales increased from last year, when it accounted for 16 per cent of the total.

The group acknowledged the boost in first tranche sales in its accounts, while noting that turnover from rents was also slowly increasing despite the roll-out of Universal Credit.

Six of the RPs that were most reliant on first tranche sales saw a reduction in the tenure’s percentage as a share of total surplus.

They are: The ExtraCare Charitable Trust, Housing Solutions, Chelmer Housing Partnership (CHP), BPHA, Paradigm Housing, and PA Housing. Of these, CHP and Housing Solutions saw the largest decreases. CHP’s first tranche sales surplus dropped from making up 94 per cent of its total surplus to 30 per cent in 2018. Housing Solutions decreased from 82 per cent to 39 per cent.

In terms of value, the RP in this list that made the largest surplus was Orbit with £17m. The smallest came from Stockport Homes and Plus Dane Housing, which both had a surplus of £1m.

Hyde had the second-largest surplus here with £14m, with One Housing in third (£13m). Overall, One Housing had a sales surplus of £33.5m, which also included £13.8m in fixed asset sales and £6.6m in non-social housing development.

RPs most reliant on first tranche surplus

| Top 20 | First tranche (£m) | Share of net surplus 2017/18 (%) | Share of net surplus 2016/17 (%) |

| Stockport Homes | 1 | 77 | 18 |

| Hyde | 14 | 49 | 16 |

| The ExtraCare Charitable Trust | 4 | 43 | 45 |

| Wandle | 8 | 41 | 12 |

| Aspire (Staffordshire) | 2 | 40 | 6 |

| Cross Keys Homes | 6 | 39 | 22 |

| Housing Solutions | 3 | 39 | 82 |

| Thames Valley HA | 11 | 32 | 7 |

CHP | 3 | 30 | 94 |

BPHA | 12 | 28 | 36 |

One Housing Group | 13 | 25 | 9 |

Soha Housing | 3 | 24 | 21 |

Paradigm | 6 | 23 | 30 |

Grand Union | 4 | 23 | 6 |

Plus Dane | 1 | 22 | 4 |

Silva (Bracknell Forest Homes) | 2 | 22 | 18 |

Orbit | 17 | 20 | 19 |

Hightown | 3 | 18 | 13 |

PA Housing | 6 | 18 | 30 |

Greenfields Community HA | 2 | 18 | 8 |

RPs most reliant on non-social development sales

Gentoo is the organisation most reliant on non-social development sales. Its non-social development sales surplus share as a percentage increased from 53 per cent to 73 per cent.

Broadacres and Octavia made a non-social development sales surplus of £2m each and were the only two RPs in this list that had previously made no surplus from non-social sales in 2016/17 (Broadacres made a deficit in 2017). This tenure, however, now accounts for 26 per cent of Broadacres’ total surplus and 13 per cent of Octavia’s.

Five RPs saw a reduction in non-social development sales as a percentage of total surplus. They are: The ExtraCare Charitable Trust, Swan Housing, One Housing Group, Orbit and The Guinness Partnership.

Swan saw the biggest decrease here. This tenure made up 29 per cent of its total surplus, compared with last year when it made up 60 per cent.

In company accounts about decreases in its operating surplus and turnover, the group said: “The variance year-on-year is attributable to a decrease in private residential homes sales which is anticipated due to the mix of affordable and private homes in our development plan.”

Peabody had the largest surplus in this group, making £36m. Housing Plus Group had the smallest with £1m.

Notting Hill Housing made the second-largest surplus here with £20m, making up 21 per cent of its total surplus. Its other sales-related surplus included £11.5m from first tranche sales and £25.9m from fixed assets.

RPs most reliant on non-SH devt. surplus

| Top 20 | Non-SH devt. (£m) | Share of net surplus 2017/18 (%) | Share of net surplus 2016/17 (%) |

Gentoo | 6 | 73 | 53 |

| The ExtraCare Charitable Trust | 7 | 64 | 83 |

| Hanover | 9 | 41 | 3 |

| Network Homes | 18 | 39 | 29 |

| Genesis | 8 | 36 | 16 |

| Catalyst | 18 | 32 | 26 |

| Swan | 5 | 29 | 60 |

| Trafford Housing Trust | 2 | 26 | 12 |

| Broadacres | 2 | 26 | -165 |

| CHP | 2 | 23 | 14 |

| Notting Hill Housing | 20 | 21 | 15 |

| Peabody | 36 | 20 | 17 |

| Paradigm | 5 | 20 | 4 |

| Curo Group (Albion) | 5 | 20 | 5 |

| Octavia Housing | 2 | 13 | 0 |

| One Housing Group | 7 | 13 | 31 |

| LiveWest Homes | 5 | 12 | 9 |

| Orbit | 9 | 11 | 12 |

| Housing Plus Group | 1 | 9 | 3 |

| The Guinness Partnership | 5 | 8 | 24 |

RPs most reliant on fixed assets

Hyde and Genesis top the table of the RPs most reliant on fixed asset sales surplus but, again, this would have been driven by their total surplus being lower than their sales surplus.

Incommunities had a fixed asset sales surplus of £5m, with a share as a percentage of total surplus of 132 per cent, which was up from negative figures last year.

Poplar Harca was in the top five, which is unsurprising given its property disposal strategy.

Aspire increased its fixed asset sales-related surplus share from 25 per cent to 83 per cent, with £3m. This added to its £1.5m made from first tranche sales. The group made nothing from non-social housing development sales.

Only two RPs decreased their fixed asset sales surplus as a percentage of total surplus. They are Trafford Housing Trust from 57 per cent to 44 per cent, and Wandle Housing Association from 49 per cent to 38 per cent.

Hyde had the largest fixed asset sales surplus in this group with £66m. It was followed by Genesis with £43m.

Future

The Homes and Communities Agency’s (now the Regulator of Social Housing) global accounts survey said in 2018 that more than one-third of the net surplus reported was attributable to sales.

This includes both the development of properties for sale and the sale of properties previously held for rent. Development of properties for sale is concentrated in a small number of providers.

Sales performance was “robust” throughout the year, despite “the tightening of conditions” in the market, although it still said exposure to the housing market remained a key risk.

It added that the profit from the sale of housing properties to existing tenants, either through the Right to Buy/Right to Acquire or through the sale of subsequent tranches of low-cost homeownership properties had increased in the year. In total, these categories of sales accounted for a profit of £0.5bn, 54 per cent of the total profit from fixed asset sales in the year (2017: £0.4bn).

RPs most reliant on asset sales surplus

| Top 20 | Asset sales surplus (£m) | Share of net surplus 2017/18 (%) | Share of net surplus 2016/17 (%) |

| Hyde | 66 | 236 | 104 |

| Genesis | 43 | 191 | 147 |

| Incommunities | 5 | 132 | -38 |

| Poplar Harca | 39 | 91 | 54 |

| Aspire (Staffordshire) | 3 | 83 | 25 |

| The Wrekin Housing Trust | 10 | 74 | 59 |

| Hastoe | 4 | 51 | 42 |

| New Charter | 3 | 48 | 8 |

| Framework | 0.1 | 46 | 0 |

| Trafford Housing Trust | 4 | 44 | 57 |

| Advance | 1 | 44 | 8 |

| Newlon | 8 | 41 | 18 |

| Stonewater | 16 | 40 | 35 |

| Shepherds Bush HA | 4 | 40 | 27 |

| Salix Homes | 3 | 38 | 19 |

| Bolton at Home | 4 | 38 | 49 |

| Wandle | 7 | 38 | 49 |

| Town & Country | 7 | 37 | 17 |

| One Vision Housing | 2 | 34 | 10 |

| One Manchester | 3 | 33 | 13 |

RELATED