Community foundations: what, why and where next?

The pandemic has led housing associations to step up the work of their community foundations. Gavriel Hollander looks into the purpose and pecuniary practicalities of these charities within charities

There is a narrative deployed by critics of housing associations (HAs) that goes something like this: as landlords have become bigger and bigger, they have lost their social purpose and stopped helping the communities they were originally set up to serve.

The counter-narrative would say that HAs have merely strived to adapt to a subsidy-light funding environment by finding new ways to fulfil that same social purpose.

Whichever side of the argument one falls on, a consequence of the rise of ever larger landlords is the increasing presence of their socially conscious sidekicks: community foundations.

These foundations – or in some cases charitable trusts – come in a number of forms and have various financial, governance and organisational structures (see case studies).

Some are standalone subsidiaries with their own balance sheets, while others are glorified operational divisions within the governance orbit of their parent organisation. Some are funded mainly through their own fundraising activity, and others enjoy guaranteed revenue via their HA. What unites them is that, rather than concentrate on new building or maintenance, their work focuses on community initiatives.

But, given that HAs are non-profit organisations in any case, what accounts for this proliferation of new entities in recent years? And has the coronavirus pandemic changed either the scope of their work or the structure of their funding?

Andrew Cowan, head of social housing at Devonshires, says that the rise of foundations was concurrent with the belt-tightening of the coalition government around a decade ago: “In line with changed government priorities at the time, which were focused more on development outputs and less on resident engagement, combined with rent reduction, many registered providers, understandably, reduced spending on resident-focused activity.”

The timeline certainly tallies with this analysis. The L&Q Foundation, one of the biggest of its kind, was established a decade ago, at the same time as the launch of the austerity-driven Affordable Homes Programme.

“A few years back, the sector’s value for money was under intense political scrutiny,” says Jonathan Walters, deputy chief executive at the Regulator of Social Housing, recalling the cutting of subsidy and the replacement of social rent with affordable rent.

“I think some organisations were trying to differentiate what it is they do as a landlord and what it is they do as a charity, and making sure that their governance and financing structures were best placed to manage the range of different activities they were involved in.

“When associations were challenged about their cost base, there was always an argument back then that as not-for-profit organisations their strategic priorities were always wider than the core landlord function.”

According to Mr Walters, this range of other activities – which includes everything from employment support, to debt management advice for residents, to literacy programmes – was seen by some associations as better delivered via a separate ringfenced foundation that allowed them to populate respective boards with people with the right skills to deliver both landlord services and the aims of charitable foundations.

For those delivering these services, part of the attraction of having a foundation is organisational, in that it allows a number of programmes to be brought together under one roof.

“The benefit for us as an organisation is that we can hold all of those activities in one place, so we can really easily assess the impact of the work,” agrees Veronica Kirwan, director of community programmes at Peabody Community Fund, which the London landlord established in 2016.

“Historically, some of it did sit with neighbourhood teams and other areas of the business. I would like to think that pulling it all under one umbrella has improved the quality and driven some of the challenge around what are we really doing here and making sure that the breadth of services is equitable in all areas.”

More recently, the fashion for investment linked to environmental, social and governance (ESG) factors has made the work of these foundations more mainstream still. Just three years ago, L&Q agreed a £100m, five-year revolving credit facility with BNP Paribas which included a discounted margin if the landlord got 600 unemployed residents back into work.

Since then, the crossover of finance and social purpose has become increasingly common.

Banks including SMBC, NatWest, Lloyds and National Australia Bank have all signed sustainability-linked loans with HAs. Clarion alone has at least £300m of such loans from three lenders, while several HAs have now followed in its footsteps in issuing sustainability bonds.

These sustainability-linked products may have started as a minority sport, but the initial trickle is threatening to become a flood. L&Q finance director Waqar Ahmed describes these types of instruments as “the direction of travel in terms of future bank and bond finance”. He adds that the entirety of L&Q’s own £6bn loan book could one day be sustainability-linked, with any treasury gain as a result reallocated to the foundation’s programmes.

This shift in funding mechanisms means that the work of foundations will become far more central to what HAs do, given that a growing proportion of their funding is likely to be linked to outcomes.

COVID-19 has only served to strengthen the hand of these organisations within associations, as many increased their investment in community activities – such as digital connectivity – in response to the imposition of lockdown.

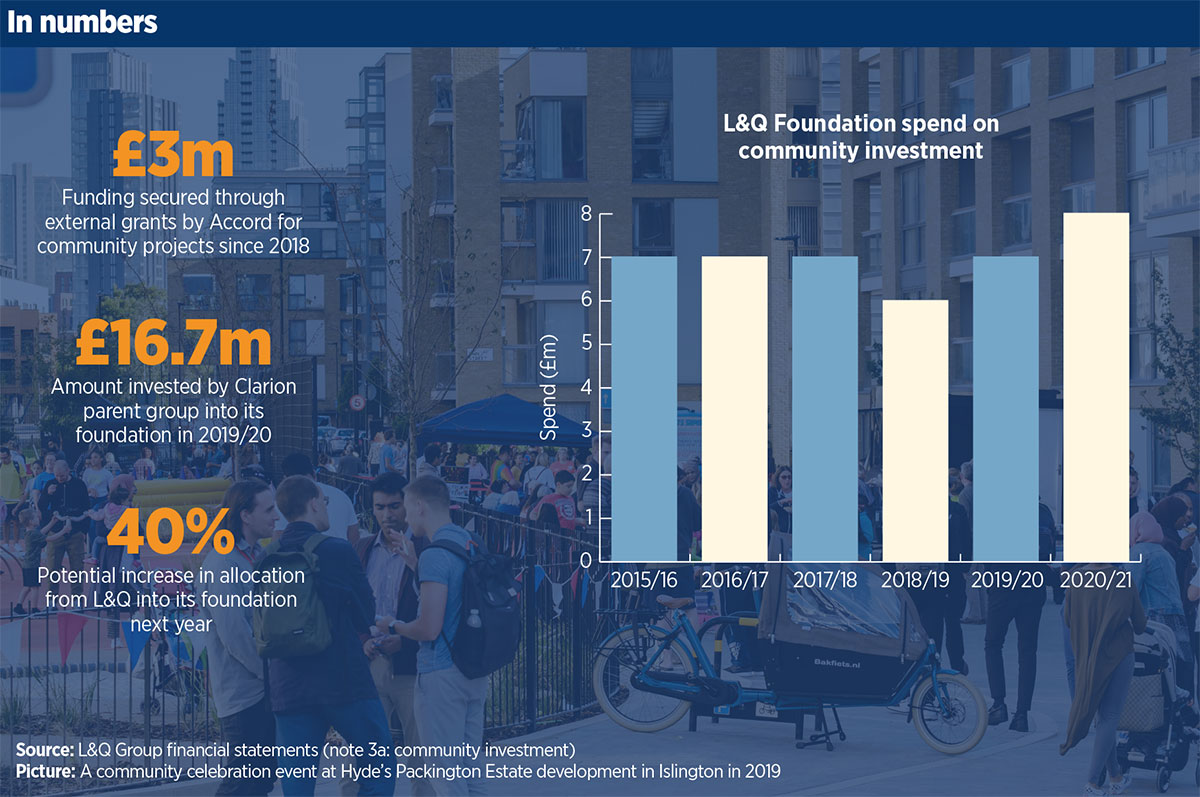

Clarion Futures, to take the largest of these foundations, invested £16.7m of its parent group’s money in 2019/20, up from £12.4m the previous year. Its work in response to the pandemic included setting up an emergency support fund to help some of the partner organisations it works with to deliver community programmes.

The Wheatley Foundation, which receives £1.5m in annual Gift Aid donations from Lowther Homes – the group’s mid-market homes and property management services subsidiary – alongside grants from other funding bodies, also upped its spending as a result of the crisis. Its Eat Well emergency food service, for example, received an additional £500,000 from Wheatley’s social landlords, while its emergency response fund was also expanded.

As the work of these foundations is placed increasingly at the centre of associations’ strategies, they are likely to grow in both number and size. But how they are structured and funded can be very different. Here we examine some of the different ways HAs have organised their foundations and how it allows them to carry out a variety of work.

The L&Q Foundation

Unlike many of its peers, the L&Q Foundation, which was set up in 2011, operates entirely within the L&Q group structure.

“[The structure] is far simpler than what you see elsewhere,” explains Waqar Ahmed. “What you see sometimes is people create a separate fund, which can be off balance sheet or on balance sheet, and then it has its separate board of local people who then manage and monitor the performance of the projects that sit within that fund.

“We made a decision on day one that this would be an officer-driven function. Nobody knows L&Q better than L&Q staff and nobody knows our residents better than our staff.”

The foundation therefore sits as a budget centre within the group, with the vast majority of funding coming internally. The group allocates around £10m a year to the foundation, according to Mr Ahmed, including its staff and running costs. But he says that figure “will start to increase” and could reach as high as £14m next year.

All the foundation’s programmes have to align with six strategic outcomes. These include teaching young residents new skills, improving residents’ financial situations to support independent living, and developing sustainable voluntary and community organisations.

L&Q will not rule out external funding for individual projects, but Matt Corbett, director of the L&Q Foundation, says that an advantage of using its own money is that it can stay true to its values.

“One of the challenges in (external) fundraising is you can find yourself working to outcomes that don’t really align with what your group’s trying to achieve,” he adds. “We are very clear what L&Q’s mission is, so we want to make sure we don’t drift away from that.”

The Hyde Foundation

In terms of structure, Hyde has taken a very different approach to L&Q when it comes to its community work. It operates a separate entity, the Hyde Foundation, which is funded through the Hyde Charitable Trust.

It operates as a standalone business and generates the majority of its revenue through external fundraising. In 2020/21 it allocated £1.4m to its grant-giving activity, compared with £400,000 the previous year – partly as a response to COVID-19. In addition, Hyde made a £5m donation to the trust to establish a rent relief fund to support customers in financial difficulty.

As Hyde Foundation head Kerry Starling explains, a big part of the reason the G15 landlord decided to operate a standalone business for its community work was that it allows it to access bigger pools of matched funding from the public and charitable sectors.

“One of the benefits of having the charitable trust is that it opens up the types of projects that we can apply for and to then be able to deliver them directly to our communities – that is a key factor. We do a lot of matched funding with our community partners as well as smaller community groups, so we can apply for funding on their behalf. It gives us greater flexibility to help manage the match-funding process,” she says.

Hyde recently launched its ESG framework, with the aim of attracting investors that will focus on its sustainability and social targets. Ms Starling believes that the framework can help not only bring in different sources of funding but also expand the scope of some of the projects the foundation works on.

She adds: “When we’re going to be talking to these big institutional investors, they’re going to want to hear a different language to what we’re used to communicating – it’s all going to be about what metrics will we deliver as part of the scheme, what will we contribute towards that? So we really see this as a big opportunity to open up lots of different avenues, both from a funding perspective but also just an impact perspective, and being able to get out some stronger messages about the impact of the work.

“There are lots of perceptions around community investment work as kind of all pink and fluffy. We’ve always had a bit of a battle generally to change that perception, and this is a really good way of being able to do that because we’re able to attach a strong narrative around the impact that we’re having on people’s lives, but also a really strong narrative around cashable values for the investment that’s made, and I think that takes the work in a whole new direction.”

GreenSquareAccord

Some HAs can still do all of the work of a community foundation without actually setting one up. In the case of 25,000-home GreenSquareAccord, which formed through a merger in April, it looked at establishing a trust but instead decided to keep the work in-house.

“As Accord, before merging with GreenSquare, we talked to a number of organisations who’ve got this trust approach to inform our view and we decided that the cons outweighed the pros,” explains Sara Woodall, managing director (north) at the new organisation.

Partly, those cons were around having either staff or funding “ringfenced” in a charitable trust set-up.

“There were also some potential issues around what we could apply for funding for if it was in a charitable trust,” Ms Woodall adds. “There were limits on where we could access funding and we felt it was much better that we accessed it through mainstream Accord rather than it being as part of a charitable trust.”

The absence of a standalone body hasn’t necessarily hampered legacy organisation Accord’s ability to invest in community projects. Since 2018, it has secured close to £3m in funding through external grants for a wide range of projects that fall into one of four ‘domains’: digital literacy; health and well-being; jobs and skills; and financial inclusion.

Ms Woodall says that many of its projects seek external funding as they are broader community projects – often where Accord is part of a wider consortium – rather than ones for Accord residents only.

“We wanted to gain external funding for many of these projects because whilst our direct customers can and do access them, they are more community initiatives so the direct beneficiaries are not always only our customers,” she says. “And so from my point of view, I can’t cross-subsidise community projects using tenant rent money, so that’s why we go out and get external funding.”

RELATED