Housing associations’ income from sales flatlines

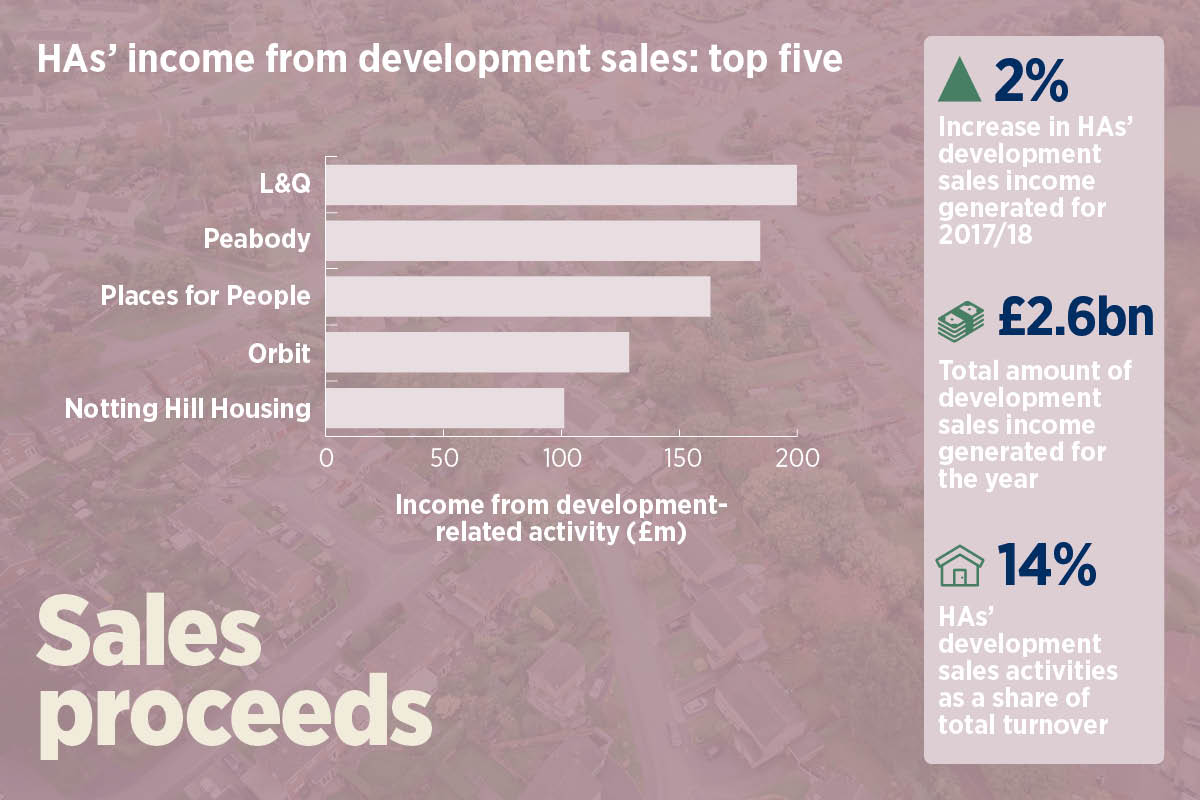

Analysis by Social Housing has found that there has been a two per cent increase in housing associations’ build-for-sale income in 2017/18

Development sales-related income flatlined for housing associations over 2017/18 – a trend driven largely by a drop-off in revenue from properties developed for sale.

Social Housing analysed income from first tranche shared ownership and homes built for sale from the 2018 accounts of 175 housing associations (HAs). It showed that there was only a two per cent increase in the total amount of development sales income generated for the year – to £2.6bn.

At the same time, development sales activities as a share of total turnover remained the same as the previous three years, at 14 per cent.

The data split the organisations into two categories: HAs with development sales income above £4m (78) and HAs with development sales income below £4m (97).

Within the lower-income band, it found a significant 63 per cent decline in income from properties developed for sale to £11.9m.

This group also saw a decrease – albeit considerably smaller – in first tranche sales income of four per cent to £135.2m. Development activities as a share of total turnover dropped by one percentage point to three per cent.

In contrast, the HAs with a development income above £4m saw a seven per cent increase in first tranche sales to £1.1bn, but for-sale income saw no change. Their total development income was up – by three per cent – to £2.5bn.

Development sales activities as a share of total turnover for this group remained flat at 17 per cent. Although clearly this still accounts for a significant amount of their income – a trend that began in recent years as housing providers look to offset a decrease in grant.

The data also tracked HA first tranche and for-sale surpluses and margins over the same period. The most notable change here was within the lower-income band, which had a £6.8m deficit from for-sale development.

Overall, however, this group made a £32.2m surplus due to its first tranche sales income, which stood at £39m, with a 29 per cent margin.

The upper-income HAs made a surplus of £257.1m for non-social housing development and £301.4m in first tranche sales.

First tranche margins dropped slightly compared with last year to 27 per cent, while non-social housing margins increased by eight percentage points to 19 per cent.

Individual HAs: total development income over £4m

More than half of the 10 associations with the largest development-related income were London based, which is unsurprising given that house prices are typically higher in this region.

L&Q sat at the top of this list with the largest overall development income of £200m – although this was down seven per cent on last year. This drop looks to have been driven by a 16 per cent decrease in first tranche sales to £80m.

The group’s non-social housing development income, meanwhile, was up slightly to £120m, while its development activities as a share of total turnover were considerably down to 19 per cent, from 28 per cent the year before.

Peabody, in comparison, saw its development activities take up a larger proportion of its total turnover compared with last year, increasing to 30 per cent from 24 per cent.

This was after it saw a 46 per cent increase in its non-social housing income (£135.1m) and a 14 per cent rise in first tranche income (£49.3m).

Out of this top 30 group, 82 per cent had more than 50 per cent of their stock in one particular region. They included L&Q, Peabody and Notting Hill Housing in London. The remaining 18 per cent were classed as having a ‘mixed’ stock geographically and included Places for People, Orbit and Clarion.

Summary of first tranche and non-social housing development sales-related income, 2017/18

| First tranche sales | Non-social housing development | Total development sales income | Development activities as a share of total turnover | |||||

|---|---|---|---|---|---|---|---|---|

| Income, £m | Change on year | Income, £m | Change on year | Income, £m | Change on year | 2017/18 | 2016/17 | |

| 78 housing associations above £4m | 1,117.9 | 7% | 1,364.6 | 0% | 2,482.5 | 3% | 17% | 17% |

| 97 housing associations below £4m | 135.2 | -4% | 11.9 | -63% | 147.1 | -15% | 3% | 4% |

| Total 139 | 1,253.1 | 6% | 1,376.4 | -1% | 2,629.6 | 2% | 14% | 14% |

Summary of first tranche and non-social housing development sales-related surplus, 2017/18

| First tranche sales | Non-social housing sales | Total development sales income | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Surplus, £m | 2017/18 margin | 2016/17 margin | Surplus, £m | 2017/18 margin | 2016/17 margin | Surplus, £m | 2017/18 margin | 2016/17 margin | |

| 78 housing associations above £4m | 306.5 | 27% | 33% | 257.1 | 19% | 11% | 563.6 | 23% | 25% |

| 97 housing associations below £4m | 39.0 | 29% | 26% | -7.0 | -59% | 4% | 32.0 | 22% | 24% |

| Total | 345.5 | 28% | 32% | 250.1 | 18% | 25% | 595.6 | 23% | 25% |

Surpluses: income over £4m

The HA with the largest surplus was Peabody, with £58m and a sizeable margin of 32 per cent. L&Q followed closely behind with a £55m surplus.

The next HA on the list, Notting Hill, had a notably smaller surplus of £32m, the bulk of which was made up from non-social housing development (£20m).

Similarly to income, London-based HAs dominated the top 10 list for surpluses. Catalyst, One Housing and Network Homes all appeared here. Within the top 10, Catalyst saw the largest drop in margin. It saw a decrease to 30 per cent from 57 per cent for its overall total development income margin and a drop in its non-social housing margin to 29 per cent from 63 per cent.

Top 30 first tranche margins

BPHA in Bedford topped the list of HAs with the largest first tranche margin, at 55 per cent. This was on an income of £21.4m and a surplus of £11.8m. This was also an increase on last year, when the group had a margin of 50 per cent.

Housing Solutions and Octavia Housing came second and third with respective margins of 52 per cent and 51 per cent.

Out of the top 10 in this list, Wandle in London and Worcester-based Sanctuary saw the largest increases in margin. Wandle had a margin of 48 per cent, up from 15 per cent, while Sanctuary’s rose from 23 per cent to 42 per cent.

Margin on HAs’ first tranche income: top 30 (2017/18)

| First tranche 2017/18 | First tranche 2016/17 | |||||

|---|---|---|---|---|---|---|

| Registered provider | Income, £m | Surplus, £m | 2017/18 margin | Income, £m | Surplus, £m | 2016/17 margin |

BPHA | 21.4 | 11.8 | 55% | 20.8 | 10.3 | 50% |

Housing Solutions | 5.0 | 2.6 | 52% | 8.3 | 4.2 | 50% |

Octavia Housing | 3.1 | 1.6 | 51% | 3.0 | 1.4 | 48% |

Wandle | 16.3 | 7.8 | 48% | 8.8 | 1.3 | 15% |

Broadacres | 1.7 | 0.8 | 47% | 2.7 | 1.1 | 43% |

Peabody | 49.3 | 22.6 | 46% | 43.3 | 20.2 | 47% |

Equity Housing Group | 4.4 | 2.0 | 46% | 4.1 | 1.4 | 35% |

A2Dominion | 11.7 | 5.2 | 44% | 15.6 | 6.1 | 39% |

Curo | 4.5 | 1.9 | 42% | 3.2 | 1.2 | 37% |

Sanctuary | 8.4 | 3.5 | 42% | 16.6 | 3.9 | 23% |

Greenfields | 5.5 | 2.2 | 41% | 1.5 | 0.6 | 43% |

Notting Hill Housing | 28.5 | 11.5 | 40% | 69.4 | 32.7 | 47% |

Optivo | 21.8 | 8.8 | 40% | 34.1 | 17.6 | 52% |

PA Housing | 15.2 | 6.1 | 40% | 17.6 | 8.1 | 46% |

Golding Homes | 4.3 | 1.7 | 40% | 1.6 | 0.4 | 22% |

Silva (Bracknell Forest Homes) | 4.5 | 1.7 | 38% | 4.8 | 2.0 | 41% |

Soha Housing | 6.9 | 2.6 | 37% | 7.3 | 3.0 | 42% |

WM Housing Group | 0.7 | 0.3 | 37% | 2.2 | 0.8 | 35% |

One Housing Group | 35.8 | 13.0 | 36% | 18.0 | 7.8 | 43% |

Cross Keys Homes | 16.0 | 5.8 | 36% | 10.5 | 2.6 | 25% |

Chelmer Housing Partnership | 7.5 | 2.7 | 36% | 10.1 | 3.5 | 35% |

Hastoe | 3.0 | 1.1 | 36% | 2.1 | 0.7 | 33% |

Town & Country Housing | 5.3 | 1.9 | 36% | 6.5 | 2.3 | 35% |

Vivid | 26.7 | 9.4 | 35% | 27.3 | 8.9 | 33% |

L&Q | 80.0 | 27.0 | 34% | 95.0 | 33.0 | 35% |

Selwood Housing Society | 4.3 | 1.4 | 33% | 1.6 | 0.3 | 20% |

Grand Union Housing Group | 10.9 | 3.6 | 33% | 10.3 | 3.6 | 35% |

Catalyst | 23.6 | 7.8 | 33% | 7.3 | 2.4 | 33% |

Paradigm | 18.1 | 5.8 | 32% | 23.9 | 10.0 | 42% |

Fortis Living | 10.3 | 3.3 | 32% | 7.7 | 2.0 | 26% |

Top 30 non-social margins

Soha Housing had by far the largest margin for properties developed for sale of the top 10 in this list, at 63 per cent, although this was on an income of £800,000, with a surplus of £500,000.

The housing association had maintained the same margin as last year, when it had an income of £1.1m and a surplus of £700,000.

The remaining nine HAs in the top 10 list here had a margin between 30 and 38 per cent.

Network Homes was the HA with the largest non-social housing development income – at £49.9m – within the top 10 margin list. It had a margin of 35 per cent.

Home Group had the smallest margin out of the full top 30 list, with 18 per cent. This was down on last year when it had a margin of 33 per cent.

Margin on HAs’ non-social housing development activity: top 30 (2017/18)

| Non-social housing development sales, 2017/18 | Non-social housing development sales, 2016/17 | |||||

|---|---|---|---|---|---|---|

| Registered provider | Income, £m | Surplus, £m | Margin, 2017/18 | Income, £m | Surplus, £m | Margin, 2016/17 |

Soha Housing | 0.8 | 0.5 | 63% | 1.1 | 0.7 | 63% |

PA Housing | 3.6 | 1.3 | 38% | 1.2 | 0.5 | 43% |

Optivo | 13.0 | 4.9 | 38% | 10.5 | 3.2 | 31% |

Network Homes | 49.9 | 17.5 | 35% | 39.2 | 18.0 | 26% |

Paradigm | 14.5 | 5.1 | 35% | 22.1 | 1.2 | 5% |

Plymouth Community Homes | 4.4 | 1.5 | 35% | 1.9 | 0.2 | 11% |

Hanover | 30.4 | 9.3 | 31% | 10.2 | 0.4 | 3% |

The ExtraCare Charitable Trust | 21.7 | 6.5 | 30% | 17.9 | 6.0 | 34% |

Southern | 7.1 | 2.1 | 30% | 18.2 | 6.2 | 34% |

Clarion | 42.3 | 12.5 | 30% | 24.4 | 7.4 | 30% |

Catalyst | 60.4 | 17.6 | 29% | 29.0 | 18.4 | 63% |

Notting Hill Housing | 72.6 | 20.0 | 28% | 72.0 | 21.0 | 29% |

Sanctuary | 8.3 | 2.2 | 27% | 7.5 | 2.7 | 36% |

Together | 8.6 | 2.3 | 26% | 6.0 | 1.0 | 17% |

Peabody | 135.1 | 35.5 | 26% | 92.3 | 30.7 | 33% |

Sovereign | 16.1 | 4.2 | 26% | 9.1 | 1.4 | 16% |

Two Rivers Housing | 2.0 | 0.5 | 25% | 0.0 | 0.0 | 0% |

Great Places | 2.2 | 0.5 | 24% | 6.1 | 1.4 | 24% |

The Guinness Partnership | 19.0 | 4.5 | 24% | 87.5 | 22.7 | 26% |

L&Q | 120.0 | 28.0 | 23% | 119.0 | 30.0 | 25% |

Hastoe | 1.1 | 0.2 | 23% | 2.0 | 0.4 | 17% |

One Housing | 30.0 | 6.6 | 22% | 96.7 | 26.8 | 28% |

Swan | 21.0 | 4.6 | 22% | 32.9 | 4.9 | 15% |

Curo | 22.8 | 4.7 | 21% | 23.6 | 0.8 | 3% |

Waterloo | 5.1 | 1.0 | 20% | 0.7 | 0.0 | 7% |

Octavia | 7.5 | 1.5 | 20% | 0.0 | 0.0 | 0% |

WM Housing | 4.1 | 0.8 | 20% | 3.4 | 0.8 | 23% |

Vivid | 26.1 | 5.0 | 19% | 9.6 | 0.2 | 3% |

LiveWest | 28.5 | 5.4 | 19% | 20.5 | 4.6 | 23% |

Home Group | 20.6 | 3.8 | 18% | 8.5 | 2.8 | 33% |

Unsold stock

Greater reliance on profits from shared ownership or open market sale properties puts housing associations at increased risk from property market downturns.

The Regulator of Social Housing’s quarterly survey, covering October to December 2018, reported rises of 18 per cent in the number of shared ownership and open market sale homes unsold in that period. It said this reflected growth in the number of these homes being built. But it also said the number of homes unsold for more than six months fell.

Forecast returns to the regulator show that HAs plan to increase development of for-sale properties of both types. The report said that in the next 18 months HAs plan to complete 30,000 shared ownership units and 13,100 market sale properties, compared with 19,300 shared ownership units and 6,700 market sale properties developed in the past 18 months.

HAs’ first tranche and non-social housing development activities: income above £4m, 2017/18

| Total turnover | First tranche sales | Non-social housing development sales | Total development-related activity | Development activities, share of total turnover | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Registered provider | Income, £m | Change on year | Income, £m | Change on year | Income, £m | Change on year | Income,£m | Change on year | 2017/18 | 2016/17 |

L&Q | 1,026 | 36% | 80.0 | -16% | 120.0 | 1% | 200.0 | -7% | 19% | 28% |

Peabody | 609 | 9% | 49.3 | 14% | 135.1 | 46% | 184.4 | 36% | 30% | 24% |

Places for People | 754 | -5% | 5.8 | 8% | 157.5 | -33% | 163.3 | -32% | 22% | 30% |

Orbit | 357 | 7% | 73.2 | 35% | 55.6 | 10% | 128.8 | 23% | 36% | 31% |

Notting Hill Housing | 371 | -10% | 28.5 | -59% | 72.6 | 1% | 101.1 | -29% | 27% | 34% |

Clarion | 829 | 4% | 54.9 | 6% | 42.3 | 73% | 97.2 | 27% | 12% | 10% |

Catalyst | 214 | 26% | 23.6 | 222% | 60.4 | 108% | 83.9 | 131% | 39% | 21% |

Hyde | 340 | 8% | 49.4 | 44% | 25.9 | 23% | 75.3 | 36% | 22% | 18% |

One Housing Group | 216 | -16% | 35.8 | 98% | 30.0 | -69% | 65.8 | -43% | 30% | 45% |

Metropolitan | 288 | 8% | 42.2 | 21% | 16.5 | 487% | 58.7 | 56% | 20% | 14% |

Genesis | 325 | 23% | 9.8 | 56% | 48.8 | 1,009% | 58.6 | 448% | 18% | 4% |

Network | 234 | -3% | 8.2 | -74% | 49.9 | 27% | 58.1 | -18% | 25% | 29% |

Advance Housing and support | 34 | 3% | 4.1 | 31% | 0.0 | 0% | 4.1 | -31% | 12% | 9% |

A2Dominion | 301 | -19% | 11.7 | -25% | 45.9 | -60% | 57.6 | -56% | 19% | 35% |

Sovereign | 378 | 2% | 38.2 | -9% | 16.1 | 78% | 54.3 | 6% | 14% | 14% |

Vivid | 228 | 8% | 26.7 | -2% | 26.1 | 171% | 52.8 | 43% | 23% | 18% |

LiveWest | 231 | 5% | 22.8 | 0% | 28.5 | 39% | 51.3 | 19% | 22% | 20% |

Riverside | 346 | -6% | 7.4 | 91% | 36.7 | -5% | 44.0 | 4% | 13% | 11% |

Gentoo | 182 | -6% | 0.0 | 0% | 39.0 | 10% | 39.0 | 10% | 21% | 18% |

Aster | 205 | 7% | 36.3 | 75% | 0.9 | -77% | 37.3 | 50% | 18% | 13% |

Thames Valley | 126 | 16% | 37.2 | 78% | 0.0 | 0% | 37.2 | 78% | 29% | 19% |

The ExtraCare Charitable Trust | 94 | 10% | 14.8 | 16% | 21.7 | 21% | 36.5 | 19% | 39% | 36% |

Home Group | 365 | 3% | 14.5 | 60% | 20.6 | 143% | 35.0 | 101% | 10% | 5% |

Southern | 200 | 0% | 27.8 | 47% | 7.1 | -61% | 34.9 | -6% | 17% | 19% |

Optivo | 317 | -8% | 21.8 | -36% | 13.0 | 23% | 34.8 | -22% | 11% | 13% |

Radian | 162 | 18% | 19.0 | 77% | 15.1 | 0% | 34.1 | 218% | 21% | 8% |

Paradigm | 124 | -9% | 18.1 | -24% | 14.5 | -34% | 32.6 | -29% | 26% | 34% |

Hanover | 142 | 17% | 1.6 | 382% | 30.4 | 197% | 32.0 | 203% | 23% | 9% |

Longhurst | 146 | 31% | 13.5 | 43% | 18.3 | 419.46% | 31.8 | 146.02% | 22% | 12% |

Anchor | 389 | 4% | 0.0 | 0% | 30.8 | 0% | 30.8 | 0% | 8% | 8% |

Curo | 99 | 1% | 4.5 | 41% | 22.8 | -3% | 27.4 | 2% | 28% | 27% |

Chelmer Housing Partnership | 77 | 23% | 7.5 | -25% | 18.4 | 426% | 25.9 | 91% | 34% | 22% |

Moat | 124 | 3% | 25.1 | 8% | 0.0 | -100% | 25.1 | 8% | 20% | 19% |

Swan | 91 | -10% | 1.7 | 197% | 21.0 | -36% | 22.7 | -32% | 25% | 33% |

Bromford | 174 | 4% | 22.3 | 41% | 0.0 | 0% | 22.3 | 41% | 13% | 9% |

The Guinness Partnership | 374 | -13% | 3.3 | -61% | 19.0 | -78% | 22.3 | -77% | 6% | 22% |

BPHA | 117 | -4% | 21.4 | 3% | 0.0 | 0% | 21.4 | 3% | 18% | 17% |

Stonewater | 187 | 4% | 20.6 | 37% | 0.0 | 0% | 20.6 | 37% | 11% | 8% |

PA Housing | 165 | 1% | 15.2 | -13% | 3.6 | 195% | 18.8 | 0% | 11% | 12% |

Waterloo Housing | 142 | 5% | 12.8 | 1% | 5.1 | 598% | 17.9 | 33% | 13% | 10% |

Sanctuary* | 708 | 6% | 8.4 | -49% | 8.3 | 11% | 16.7 | -31% | 2% | 4% |

Wandle | 66 | 16% | 16.3 | 85% | 0.0 | 0% | 16.3 | 85% | 25% | 15% |

Cross Keys Homes | 72 | 11% | 16.0 | 52% | 0.0 | 0% | 16.0 | 52% | 22% | 16% |

Trafford Housing Trust | 64 | 19% | 1.5 | 14% | 13.7 | 266% | 15.1 | 201% | 24% | 9% |

GreenSquare Group | 84 | -2% | 4.8 | 9% | 9.5 | -11% | 14.3 | -5% | 17% | 18% |

Broadacres | 48 | 2% | 1.7 | -36% | 12.3 | 14% | 14.0 | 4% | 29% | 29% |

Grand Union | 74 | 5% | 10.9 | 6% | 0.0 | 0% | 10.9 | 6% | 15% | 15% |

Octavia | 66 | 48% | 3.1 | 6% | 7.5 | 0% | 10.6 | 258% | 16% | 7% |

Hightown | 69 | 11% | 10.5 | 12% | 0.0 | 0% | 10.5 | 12% | 15% | 15% |

Fortis Living | 101 | 6% | 10.3 | 33% | 0.0 | 0% | 10.3 | 33% | 10% | 8% |

Aldwyck Housing Group | 79 | -15% | 4.0 | -68% | 6.1 | -44% | 10.2 | -57% | 13% | 25% |

Together | 184 | -10% | 1.2 | -50% | 8.6 | 43% | 9.8 | 16% | 5% | 4% |

Great Places | 101 | -8% | 7.6 | -42% | 2.2 | -64% | 9.8 | -49% | 10% | 18% |

Raven Housing Trust | 50 | 6% | 8.7 | 33% | 0.0 | 0% | 8.7 | 33% | 17% | 14% |

Soha Housing | 45 | 0% | 6.9 | -5% | 0.8 | -25% | 7.7 | -8% | 17% | 18% |

Midland Heart | 193 | -6% | 6.0 | -3% | 1.7 | 0% | 7.7 | 26% | 4% | 3% |

Housing Plus Group | 66 | 6% | 2.6 | 58% | 4.8 | 348% | 7.4 | 172% | 11% | 4% |

WHG | 106 | 7% | 6.9 | 177% | 0.0 | 0% | 6.9 | 177% | 7% | 3% |

Golding Homes | 46 | 11% | 4.3 | 165% | 1.7 | 213% | 6.0 | 177% | 13% | 5% |

Nottingham Community HA | 75 | 4% | 6.0 | 25% | 0.0 | 0% | 6.0 | 25% | 8% | 7% |

Coastline Housing | 30 | 14% | 6.0 | 146% | 0.0 | 0% | 6.0 | 146% | 20% | 9% |

Plymouth Community Homes | 69 | 4% | 1.5 | 45% | 4.4 | 134% | 5.8 | 102% | 8% | 4% |

Wakefield and District | 155 | -2% | 5.7 | -13% | 0.0 | 0% | 5.7 | -13% | 4% | 4% |

Greenfields | 47 | 10% | 5.5 | 278% | 0.0 | 0% | 5.5 | 278% | 12% | 3% |

Torus | 112 | 3% | 5.5 | 69% | 0.0 | 0% | 5.5 | 69% | 5% | 3% |

Town & Country Housing | 60 | -10% | 5.3 | -19% | 0.0 | -100% | 5.3 | -51% | 9% | 17% |

Housing Solutions | 43 | -6% | 5.0 | -40% | 0.0 | 0% | 5.0 | -40% | 11% | 18% |

WM Housing | 149 | -1% | 0.7 | -67% | 4.1 | 20% | 4.8 | -14% | 3% | 4% |

Stockport Homes | 46 | 12% | 4.6 | 129% | 0.0 | 0% | 4.6 | 129% | 10% | 5% |

North Hertfordshire Homes | 78 | 10% | 4.6 | 61% | 0.0 | 0% | 4.6 | 61% | 6% | 4% |

Futures Housing Group | 50 | 8% | 1.5 | 142% | 3.1 | 415% | 4.6 | 278% | 9% | 3% |

Flagship Homes | 134 | 12% | 4.0 | 74% | 0.6 | 0% | 4.6 | 100% | 3% | 2% |

Silva (Bracknell Forest Homes) | 43 | 1% | 4.5 | -5% | 0.0 | 0% | 4.5 | -5% | 11% | 11% |

Cambridge Housing Society | 31 | -1% | 1.7 | 100% | 2.8 | -36% | 4.5 | -14% | 15% | 17% |

Equity Housing Group | 25 | 2% | 4.4 | 8% | 0.0 | 0% | 4.4 | 8% | 18% | 17% |

Selwood Housing Group | 39 | 7% | 4.3 | 170% | 0.0 | 0% | 4.3 | 170% | 11% | 4% |

Hastoe | 34 | 1% | 3.0 | 42% | 1.1 | -47% | 4.1 | -1% | 12% | 12% |

Two Rivers Housing | 25 | 17% | 2.0 | 356% | 2.0 | 0% | 4.0 | 826% | 16% | 2% |

Total | 14,550 | 4% | 1,117.9 | 7% | 1,364.6 | 0% | 2,482.5 | 3% | 17% | 17% |

Source: housing association audited accounts for year ended March 2018; Notes: * EU IFRS, 0 either no income in 2017 or sales income was not stated

The regulator said that more than half of unsold stock was held by relatively few providers, mainly working in London and the South East, which are currently well-funded and which the regulator continues to monitor.

Social Housing’s feature on sales risk found that associations and house builders reported slowdowns in sales in London and the South, but performance in the regions has been better. The market for properties valued at more than £600,000 has been hit by uncertainty around Brexit, falls in sales of buy-to-let properties following a stamp duty rise, and a decline in interest from foreign buyers, according Charlie Campbell, an investment analyst following house builders for Liberum Capital.

A number of associations said they would change open market sale homes to rent in the event of a property market downturn. Tom Shaw, operations director at Hyde, said that the HA had been able to do this with limited grant by, for example, selling in bulk to an institutional build-to-rent investor. “We have been able to make a margin on the sale, while reducing our sales risk exposure completely,” he says.

HAs’ housing development-related surpluses, 2017/18

| First tranche sales | Non-social housing sales | Total development income | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Registered provider | Surplus, £m | 2017/18 margin | 2016/17 margin | Surplus, £m | 2017/18 margin | 2016/17 margin | Surplus, £m | 2017/18 margin | 2016/17 margin |

Peabody | 23 | 46% | 47% | 35.5 | 26% | 33% | 58 | 32% | 38% |

L&Q | 27 | 34% | 35% | 28.0 | 23% | 25% | 55 | 28% | 29% |

Notting Hill Housing | 12 | 40% | 47% | 20.0 | 28% | 29% | 32 | 31% | 38% |

Clarion | 17 | 30% | 43% | 12.5 | 30% | 30% | 29 | 30% | 39% |

Catalyst | 8 | 33% | 33% | 17.6 | 29% | 63% | 25 | 30% | 57% |

One Housing | 13 | 36% | 43% | 6.6 | 22% | 28% | 20 | 30% | 30% |

Network Homes | 2 | 22% | 39% | 17.5 | 35% | 46% | 19 | 33% | 43% |

Hyde | 14 | 28% | 28% | 1.0 | 4% | 13% | 15 | 20% | 22% |

Vivid | 9 | 35% | 33% | 5.0 | 19% | 3% | 14 | 27% | 25% |

Optivo | 9 | 40% | 52% | 4.9 | 38% | 31% | 14 | 39% | 47% |

BPHA | 12 | 55% | 50% | 0.0 | 0% | 0% | 12 | 55% | 50% |

Metropolitan | 10 | 23% | 32% | 1.7 | 10% | 11% | 11 | 19% | 30% |

Orbit | 2 | 2% | 22% | 9.4 | 17% | 16% | 11 | 9% | 19% |

Sovereign | 7 | 18% | 17% | 4.2 | 26% | 16% | 11 | 20% | 17% |

The ExtraCare Charitable Trust | 4 | 30% | 26% | 6.5 | 30% | 34% | 11 | 30% | 30% |

Paradigm | 6 | 32% | 42% | 5.1 | 35% | 5% | 11 | 33% | 24% |

Thames Valley | 11 | 29% | 35% | 0.0 | 0% | 0% | 11 | 29% | 35% |

LiveWest | 4 | 19% | 24% | 5.4 | 19% | 23% | 10 | 19% | 23% |

Hanover | 0 | 29% | -30% | 9.3 | 31% | 3% | 10 | 31% | 2% |

A2Dominion | 5 | 44% | 39% | 3.7 | 8% | 17% | 9 | 15% | 19% |

Radian | 6 | 29% | 21% | 2.5 | 17% | 0% | 8 | 23% | 21% |

Wandle | 8 | 48% | 15% | 0.0 | 0% | 0% | 8 | 48% | 15% |

Genesis | -1 | -6% | 8% | 8.1 | 17% | 66% | 8 | 13% | 32% |

PA Housing | 6 | 40% | 46% | 1.3 | 38% | 43% | 7 | 40% | 46% |

Home Group | 3 | 22% | 46% | 3.8 | 18% | 33% | 7 | 20% | 40% |

Southern | 5 | 18% | 36% | 2.1 | 30% | 34% | 7 | 20% | 35% |

Curo | 2 | 42% | 37% | 4.7 | 21% | 3% | 7 | 24% | 8% |

Cross Keys Homes | 6 | 36% | 25% | 0.0 | 0% | 0% | 6 | 36% | 25% |

Aster | 6 | 15% | 8% | 0.1 | 15% | 24% | 6 | 15% | 10% |

Sanctuary* | 4 | 42% | 23% | 2.2 | 27% | 36% | 6 | 34% | 27% |

Gentoo | 0 | 0% | 0% | 5.6 | 14% | 13% | 6 | 14% | 13% |

Stonewater | 5 | 25% | 22% | 0.0 | 0% | 0% | 5 | 25% | 22% |

The Guinness Partnership | 1 | 15% | 24% | 4.5 | 24% | 26% | 5 | 22% | 26% |

Swan | 0 | 25% | 15% | 4.6 | 22% | 15% | 5 | 22% | 15% |

Longhurst | 3 | 22% | 30% | 2.0 | 11% | 17% | 5 | 16% | 26% |

Chelmer Housing Partnership | 3 | 36% | 35% | 2.1 | 12% | 15% | 5 | 19% | 30% |

Riverside | 0 | 4% | 12% | 4.1 | 11% | 17% | 4 | 10% | 17% |

Bromford | 4 | 19% | 21% | 0.0 | 0% | 0% | 4 | 19% | 21% |

Grand Union Housing Group | 4 | 33% | 35% | 0.0 | 0% | 0% | 4 | 33% | 35% |

Fortis Living | 3 | 32% | 26% | 0.0 | 0% | 0% | 3 | 32% | 26% |

Octavia | 2 | 51% | 48% | 1.5 | 20% | 0% | 3 | 29% | 48% |

Hightown | 3 | 29% | 22% | 0.0 | 0% | 0% | 3 | 29% | 22% |

Soha Housing | 3 | 37% | 42% | 0.5 | 63% | 63% | 3 | 40% | 44% |

Waterloo Housing Group | 2 | 14% | 16% | 1.0 | 20% | 7% | 3 | 16% | 16% |

Together Housing | 0 | 29% | 34% | 2.3 | 26% | 17% | 3 | 27% | 22% |

Housing Solutions | 3 | 52% | 50% | 0.0 | 0% | 0% | 3 | 52% | 50% |

Broadacres | 1 | 47% | 43% | 1.6 | 13% | 0% | 2 | 17% | 8% |

Greenfields | 2 | 41% | 43% | 0.0 | 0% | 0% | 2 | 41% | 43% |

GreenSquare Group | 1 | 30% | 18% | 0.8 | 9% | 5% | 2 | 16% | 9% |

Raven Housing Trust | 2 | 24% | 32% | 0.0 | 0% | 0% | 2 | 24% | 32% |

WHG | 2 | 30% | 32% | 0.0 | 0% | 0% | 2 | 30% | 32% |

Trafford Housing Trust | 0 | -7% | -2% | 2.1 | 16% | 21% | 2 | 13% | 15% |

Equity Housing Group | 2 | 46% | 35% | 0.0 | 0% | 0% | 2 | 46% | 35% |

Golding Homes | 2 | 40% | 22% | 0.1 | 9% | 86% | 2 | 31% | 38% |

Town & Country Housing | 2 | 36% | 35% | -0.1 | -538% | 36% | 2 | 33% | 35% |

Silva (Bracknell Forest Homes) | 2 | 38% | 41% | 0.0 | 0% | 0% | 2 | 38% | 41% |

Housing Plus Group | 1 | 29% | 21% | 0.9 | 18% | 19% | 2 | 22% | 20% |

Plymouth Community Homes | 0 | 3% | 13% | 1.5 | 35% | 11% | 2 | 26% | 11% |

North Hertfordshire Homes | 1 | 32% | 22% | 0.0 | 0.0 | 0.0 | 1 | 32% | 22% |

Selwood Housing Group | 1 | 33% | 20% | 0.0 | 0% | 0% | 1 | 33% | 20% |

Hastoe | 1 | 36% | 33% | 0.2 | 23% | 17% | 1 | 33% | 25% |

Great Places | 1 | 10% | 10% | 0.5 | 24% | 24% | 1 | 14% | 14% |

Aldwyck Housing Group | 1 | 21% | 38% | 0.5 | 8% | 25% | 1 | 13% | 32% |

Midland Heart | 1 | 18% | 12% | 0.2 | 13% | 0% | 1 | 17% | 12% |

Places for People** | 1 | 21% | 22% | 0.0 | 0% | 0% | 1 | 1% | 0% |

Stockport Homes | 1 | 24% | 30% | 0.0 | 0% | 0% | 1 | 24% | 30% |

WM Housing | 0 | 37% | 35% | 0.8 | 20% | 23% | 1 | 23% | 28% |

Coastline Housing | 1 | 17% | 26% | 0.0 | 0% | 0% | 1 | 17% | 26% |

Flagship | 1 | 21% | 29% | 0.0 | 0% | 0% | 1 | 18% | 29% |

Two Rivers Housing | 0 | 13% | 61% | 0.5 | 25% | 0% | 1 | 19% | 61% |

Nottingham Community HA | 1 | 12% | 9% | 0.0 | 0% | 0% | 1 | 12% | 9% |

Torus | 1 | 10% | 10% | 0.0 | 0% | 0% | 1 | 10% | 10% |

Futures Housing Group | 0 | 17% | 29% | 0.3 | 10% | 18% | 1 | 12% | 23% |

Cambridge Housing Society | 0 | 12% | 26% | 0.1 | 3% | 12% | 0 | 7% | 15% |

Anchor** | 0 | 0% | 0% | 0.0 | 0% | 0% | 0 | 0% | 0% |

Moat | 5 | 20% | 31% | -0.1 | 0% | -2,250% | 5 | 20% | 31% |

Advance Housing and Support | 0 | -2% | -1% | 0.0 | 0% | 0% | 0 | -2% | -1% |

Wakefield and District | 0 | -4% | -3% | 0.0 | 0% | 0% | 0 | -4% | -3% |

Total | 306.5 | 27% | 33% | 257.1 | 19% | 11% | 563.6 | 23% | 25% |

Source: HA audited accounts for year ended March 2018, Notes: * EU IFRS, 0 means either no income in 2017 or sales income or surplus was not stated, ** gave income but not profit on non-social housing sales

House builders and housing association development directors agreed that the extension of Help to Buy to 2023 had provided some certainty.

But Jeanne Harrison, vice president – senior analyst for the sub-sovereign group at Moody’s Investors Service, warns that if public finances were hit by a no-deal Brexit, then the amount of support available through grants and housing benefit could decline. Housing associations could also slow build rates if the market declines.

Ratings agency Standard & Poor’s (S&P) added that a sharp rise in the supply of rented housing could lead to a drop in rents.

“We see a lot of housing associations switching [tenure] and even though demand is there, you could argue that rent levels or house prices will come down because the supply would increase quite substantially”

Karin Erlander, director of international public finance at S&P Global Ratings, says: “We see a lot of housing associations switching [tenure] and even though demand is there, you could argue that rent levels or house prices will come down because the supply would increase quite substantially.”

The RSH also wrote to associations to say that it expected to be informed if risks from Brexit could cause them to breach regulatory standards.

It warned that a sudden housing market downturn would have the “greatest financial impact” on providers after the Bank of England said prices could drop by between 14 and 33 per cent.

Fiona MacGregor, chief executive of the RSH, wrote: “Falling house and land values would reduce profitability and potentially crystallise impairments, while lower transaction volumes would increase working capital requirements and decrease cashflow.

“Valuations for security purposes could also be adversely affected, though these are more closely tied to ongoing rent levels than the market.”

RELATED