Housing funding deals double in value over a year

Financing requirements and new rules offer increased work for advisors and auditors.

The value of bonds, private placements and similar deals issued have nearly doubled in a year, analysis by Social Housing shows.

Our round-up of deals supported by advisors shows that £3.16bn were made between July 2016 and 2017, compared to £1.70bn in the same period a year earlier. The number of deals rose from 19 to 27 during that time. The analysis covers bonds, retail and retail charity bonds, plus private placements and loans provided by institutional investors rather than banks, including leaseback deals. It doesn’t include bank loans or deals made through bond aggregators.

There was a rise in the number and total value of all types of deal analysed. There was a notable rise in the value of bond issues, which doubled to £1.8bn – even though only one more deal was made in 2016/17 than during the previous year.

They included L&Q’s £500m bond, which is the biggest own-name bond in the sector. The total value of institutional loans also grew from £77m to £435m, but again, only one additional deal was made in the second year compared to the first. They included a £275m loan for Trafford Housing Trust, which included funding from Pension Insurance Corporation and BlackRock.

During the two-year period, bonds made up nearly 56 per cent of the £4.74bn raised. Private placements raised £1.19bn while institutional loans, including leasebacks, and retained bond sales made up almost all of the remaining sum.

Auditors

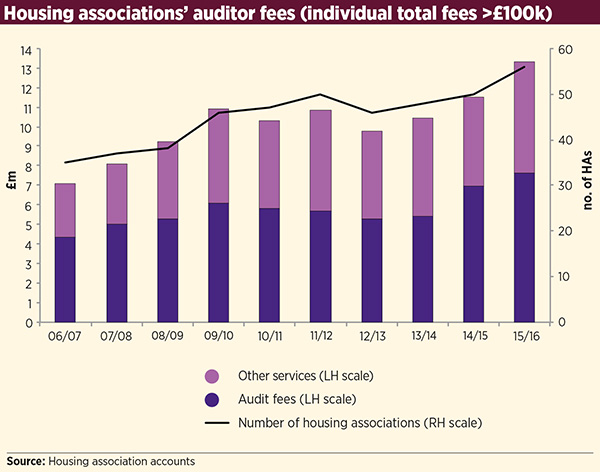

A total of £13.3m was paid to auditors by associations whose individual bills were £100,000 or more in 2015/16. This figure, which includes audit fees for accounts and fees for other work, is up from £11.5m in 2014/15. The figures for this part of the report come from the 2015/16 audited accounts of the associations.

The amount paid in audit fees by this group rose nine per cent in 2015/16 to £7.6m, but the amount paid for other work, which can include tax, pensions and restructuring advice, rose 27 per cent to £5.7m. The change in audit fees paid by individual associations varied, with four spending at least 50 per cent more on them in 2015/16 compared with 2014/15, and 11 spending less in 2015/16 than they did in 2014/15.

There were big variations in spend on other work from auditors, with 12 associations spending more than double the amount they spent in 2014/15 – including some with rises of more than 1,000 per cent. However, 20 associations spent less than they had in 2014/15. KPMG continued to be the most used audit firm among the ones that spend more than £100,000 on auditors. BDO and Grant Thornton swapped with PricewaterhouseCoopers, which dropped into fourth.

There were 50 associations with total fees of over £100,000 in 2014/15, and 56 a year later.

The number of housing associations spending more than £100,000 with auditors has been climbing since 2012/13, following a one-off dip the previous year. Similarly, the total amount spent has risen during that time, too. The amount spent on audit fees has been rising since 2012/13, but had particularly large increases in 2014/15 and 2015/16, which were the years when associations prepared for the introduction of FRS 102.

However, the spending on other work with auditors has been more volatile since 2009/10, with rises and falls on alternate years. Yet 2015/16 saw the highest spend on both audit fees and other services of the 10 years in our graph.

Jonathan Pryor, partner in assurance and business services at Smith & Williamson, said preparation for an implementation of the new accounting standard, FRS 102, may have had an impact on fees. ‘I’d expect it would have had an impact on audit fees in 2015/16 and on advisory fees in 2014/15, because that’s when associations were looking at what it demanded.’

An increase in mergers could also have had an effect, with some associations seeking tax advice. But he added: ‘I suspect there are lots of factors. One thing driving up audit fees are audit regulations, which have stepped up enormously.’ Additionally, some associations find they need extra work beyond the scope they described in their tender for audit services, which means they have to pay additional fees for it.

Lawyers

Addleshaw Goddard undertook the largest amount of work for funders in summer 2015 to 2017. Allen & Overy – leaders in 2014/15 – were just behind. There were two deals for which funders’ lawyers were not stated, and two which were retained bond deals, where the legal work would be done as part of the original issue. There was also one private placement where the investor was not named.

As in 2014/15, Trowers & Hamlins continued to work on the largest number of deals for housing associations in 2015 to 2017, followed by Devonshires. CMS, formed from the 2016 merger of leading law firms CMS Cameron McKenna, Nabarro and Olswang, made an appearance for the first time with two deals for Dolphin Living.

Valuers

Savills and JLL continued to work on the largest number of deals analysed in number and total value in summer 2015 to 2017. Other firms – DTZ, Cushman & Wakefield and Mazars – worked on one each, though there were 10 where the valuer was either not stated or it did not involve a valuer because the deals were unsecured.

Advisors

Centrus acted as funding advisor on eight deals – the largest number in our table. Rothschild advised on the largest total value of deals worth more than £1bn, all of which were for L&Q, although it was also arranger for Martlet Homes. However, the deals for which the name of the funding advisor was not given or for which there was no advisor, also totalled just over £1bn.

Rothschild also advised on the largest number and values of bonds, and David Tolson Partnership on the largest number of private placements. TradeRisks advised on the biggest value of placements and largest number of retained bond sales. Savills Financial Consultants advised on a blended £275m deal for Trafford Housing Trust, which was far greater than any of the other institutional loan or leaseback deals during the period.

46

Number of deals, July 2015 to 2017

Several deals had a different funding arranger to the advisor. In most cases, the arranger was a bank, but JCRA arranged MHS Homes’ £70m private placement on which Altair advised, and Peel Hunt arranged Dolphin Living’s retail charity bond with Hallcroft Finance as advisor.

Rent cut and EU membership referendum

There were notable movements in the number and value of deals made in the year after the July 2015 Budget (which announced the four-year rent cut), following the implementation of the rent cut on 1 April 2016 and after the referendum on membership of the European Union at the end of June 2016. When making these comparisons, we have just looked at the number and total value of private placements and bonds (including retail and charity bonds) because Social Housing’s pre-June 2015 data only included these types of deals.

The value and number of deals made fell dramatically in the year after the July 2015 Budget compared with the year before. There were 45 bonds and private placements from July 2014/15, compared with 13 a year later. The total value of these fell from more than £4bn in 2014/15 to £1.5bn in 2015/16.

The number of deals done in the year after the rent cut began fell from 31 to 17, whereas the value of the deals grew from £1.4bn to £2bn.

The difference in deal volumes was less marked in the year following the referendum on EU membership. The number of bonds and private placements rose from 12 to 19 in the year after the vote, and the total value of the deals rose from £1.4bn to £2bn. These figures do not include institutional loans (including leasebacks) and retained bond sales.

Jonathan Clarke, director at funding advisors Centrus, said the rise in institutional borrowing suggested growing confidence on the part of associations. He said: ‘Focusing only on institutional money leaves out the role of bank debt. A borrower who wants money but is less sure of the long-term plan will tend to focus on short-term bank debt. The return of institutional borrowing speaks of a greater level of confidence in the long-term shape of the business, so is positive in that sense.’

Mr Clarke added: ‘The one per cent rent cut was the bigger hit to housing association investment appetite specifically, but uncertainty over our future relationship with Europe is having more impact on economic confidence generally, and on the private sale market.’

Other unusual deals

The period from July 2015 to 2017 has seen many other deals which are not covered here because they were done by aggregators, real estate investment trusts (REITs) or were bank loans.

Government guarantees scheme, Affordable Housing Finance, stopped underwriting new deals in March 2016. Before that it amassed a portfolio of loans worth over £2.5bn to more than 60 associations, so 2015/17 was a busy period. The period saw the launch of the sector’s first REIT, Civitas, followed by Residential Secure Income (RESI) Triple Point and LXi REIT. There have been a number of other unusual deals, such as Places for People’s establishment of a fund management company, which it has seeded with private rented sector properties. It is seeking investment, which it expects to get from pension funds primarily.

BlackRock made its debut social housing loan to Trafford Housing Trust, followed by one to Wheatley. It already held over £1bn in social housing investments through the bond market.

Note: This report was updated on 17/8/17 to show that Trafford’s £275m blended deal included £125m of bank loans. This has moved the total institutional funding figure from £4.86m to £4.74bn.

The data in this report is based on deals reported by Social Housing over the last two years.

HAs’ funding advisors for bond issues/placements: Jul 2015-Jul 2017

| Advisor | Bond issues: number | Bond issues: value £m | Private placements: number | Private placements: value £m | Inst. loan: number | Inst. loan: value £m | Total value of fundings £m |

|---|---|---|---|---|---|---|---|

| Altair | 1 | 70 | 70 | ||||

| Capita | 2 | 85 | 85 | ||||

| Centrus | 4 | 750 | 3 | 258 | 1 | 40 | 1,048 |

| Chaco | 1 | 9 | 9 | ||||

| David Tolson Partnership | 4 | 125 | 2 | 35 | 160 | ||

| EC Harris | 1 | 80 | 80 | ||||

| Hallcroft Finance | 1 | 45 | 1 | 53 | 98 | ||

| JCRA | 1 | 250 | 2 | 90 | 340 | ||

| Murja | 2 | 45 | 45 | ||||

| Rothschild | 3 | 1,050 | 1,050 | ||||

| Savills Financial Consultants | 1 | 50 | 1 | 150 | 200 | ||

| TradeRisks | 4 | 240 | 3 | 310 | 550 | ||

| None given or N/A | 4 | 775 | 3 | 124.6 | 1 | 100 | 999.6 |

| Total | 18 | 3,160 | 21 | 1,187.6 | 7 | 387 | 4,735 |

Note: Bond issues include retail, retained and charity bonds. Source: Various, including housing associations and advisors

Range in size of deals July 2017

| Size £m | Bonds | Placements | Inst. loans |

|---|---|---|---|

| 301 to 500 | 3 | 0 | 0 |

| 101 to 300 | 5 | 2 | 1 |

| 81 to 100 | 1 | 3 | 1 |

| 61 to 80 | 1 | 3 | 0 |

| 51 to 60 | 2 | 1 | 1 |

| 41 to 50 | 5 | 2 | 0 |

| 21 to 40 | 1 | 6 | 1 |

| 11 to 20 | 0 | 2 | 2 |

| 5 to 10 | 0 | 2 | 1 |

| Total | 18 | 21 | 7 |

Funding advisors to housing associations: bonds, private placements and institutional loans, July 2015 to 2017

| Issued by | Date | Amount £m | Housing associations' funding advisor/arranger/bookrunner | Housing associations' legal advisor | Funders' valuation | Funders' legal advisor | Investor (if named) |

|---|---|---|---|---|---|---|---|

| MHS Homes | 05-2016 | £70m | Altair/JCRA | Trowers & Hamlins | Savills | Greenberg Traurig, Addleshaw Goddard | PIC |

| Port of Leith | 08-2016 | £35m | Capita/Lloyds* | Harper Macleod | JLL | Pinsent Masons | Canada Life |

| Stafford and Rural (pp) | 06-2016 | £50m | Capita/Santander | Anthony Collins | Savills | Addleshaw Goddard | M&G |

| Places for People (b) | 08-2016 | £400m | Centrus/RBS, HSBC, Barclays/BNY Mellon | Allen & Overy | n/a | Clifford Chance | - |

| Cottsway (pp) | 01-2016 | £80m | Centrus/Macquarie | Trowers & Hamlins | Savills | Clifford Chance | Macquarie |

| Orbit (rb) | 08-2016 | £50m | Centrus/-/Santander, HSBC | Trowers & Hamlins | Savills | Allen & Overy | - |

| Welsh Housing Partnership (pp) | 03-2017 | £93m | Centrus | Devonshires | Savills | Pinsent Masons | PIC |

| Cross Keys (rb) | 06-2016 | £50m | Centrus | Trowers & Hamlins | - | - | - |

| Greenfields (il) | 10-2016 | £40m | Centrus/Santander | Anthony Collins | JLL | Addleshaw Goddard | M&G |

| One Housing Group (pp) | 03-2017 | £85m | Centrus/Centrus | Trowers & Hamlins | Savills, JLL | Winckworth Sherwood | M&G |

| A2Dominion (b) | 11-2016 | £250m | Centrus**/Lloyds /Lloyds | Devonshires | n/a | Allen & Overy | - |

| Pennaf (il) | 07-2015 | £9m | Chaco/Chaco | Anthony Collins | Savills | Trowers & Hamlins | Aviva |

| Wythenshawe (pp) | 05-2017 | £90m | DTP/RBS/Santander, RBS | Devonshires | Savills | Addleshaw Goddard | M&G |

| South Liverpool Homes (il) | 07-2015 | £15m | DTP/DTP | Trowers & Hamlins | - | Winckworth Sherwood | M&G |

| South Lakes Housing (il) | 05-2017 | £20m | DTP/DTP/na | Trowers & Hamlins | Savills | Addleshaw Goddard | M&G |

| Staffordshire HA (pp) | 04-2017 | £5m | DTP/DTP/na | Trowers & Hamlins | - | Addleshaw Goddard | M&G |

| Valleys to Coast (pp) | 04-2017 | £10m | DTP/DTP/na | Trowers & Hamlins | Savills | Pinsent Masons | M&G |

| Sovini Group (pp) | 04-2017 | £20m | DTP/DTP/na | Weightmans | - | Addleshaw Goddard | M&G |

| Waterloo (pp) | 10-2015 | £80m | EC Harris/Santander | Devonshires | - | Addleshaw Goddard | - |

| Dolphin Living (cb) | 06-2017 | £45m | Hallcroft Finance/Peel Hunt/Peel Hunt | CMS | n/a | Allen & Overy | - |

| Dolphin Living (il) | 06-2016 | £53m | Hallcroft Finance | CMS | Savills | Addleshaw Goddard | Canada Life |

| PenArian (Pennaf Group) (b) | 06-2017 | £250m | JCRA/-/Lloyds, Barclays | Anthony Collins | Savills | Allen & Overy | - |

| Origin (pp) | 06-2017 | £30m | JCRA/-/na | Trowers & Hamlins | JLL | Greenberg Traurig, Devonshires | ****see key |

| Plymouth Community Homes (pp) | 06-2017 | £60m | JCRA/Barclays | Trowers & Hamlins | - | Pinsent Masons, Chapman & Cutler | - |

| Hanover Scotland (pp) | 10-2015 | £20m | Murja/Bank of Scotland | Harper Macleod | JLL | Pinsent Masons | - |

| Coastline Housing (pp) | 02-2017 | £25m | Murja/Santander | Trowers & Hamlins | Savills | Addleshaw Goddard | - |

| Wheatley (il) | 05-2017 | £100m | na | Pinsent Masons | JLL | Addleshaw Goddard | BlackRock |

| Places for People (rtb) | 01-2017 | £65m | na/BNY Mellon/Investec | Allen & Overy | n/a | Linklaters | - |

| Aldwyck (pp) | 04-2017 | £40m | na/NatWest Markets/- | Devonshires, Trowers & Hamlins | JLL | Addleshaw Goddard | PIC |

| Swan Housing (rb) | 07-2016 | £60m | na/-/Lloyds | Devonshires | Savills | Allen & Overy | - |

| Places for People (pp) | 02-2016 | £34.6m | na/BNY Mellon/Nomura | Allen & Overy | n/a | n/a | - |

| Metropolitan (b) | 09-2015 | £250m | None/RBS, Santander/RBS, Santander | Devonshires | JLL | Clifford Chance | - |

| L&Q (b) | 05-2016 | £300m | Rothschild/-/Goldman Sachs, HSBC, Santander | Clarke Willmott | JLL | Allen & Overy | - |

| L&Q (b) | 10-2015 | £250m | Rothschild/Barclays, Lloyds, RBS/Barclays, Lloyds, RBS | Devonshires | DTZ | Allen & Overy | - |

| L&Q (b) | 07-2017 | £500m | Rothschild/-/Barclays, HSBC, RBC | Devonshires, Trowers & Hamlins, Allen & Overy | Savills | Addleshaw & Goddard | - |

| Martlet Homes (Hyde) (b) | 04-2017 | £400m | na/Rothschild/Lloyds,Barclays | Devonshires | Savills | Allen & Overy | - |

| Trafford (il) | 02-2017 | £275m | Savills FC/-/- | Devonshires | Savills | Addleshaw & Goddard | ****see key |

| EMH (rb) | 12-2015 | £50m | Savills FC/-/Lloyds | Trowers & Hamlins | Cushman & Wakefield | Allen & Overy | - |

| Circle (pp) | 09-2015 | £150m | TradeRisks/TradeRisks | Devonshires | Savills | Allen & Overy | - |

| Bracknell Forest (pp) | 04-2016 | £35m | TradeRisks/TradeRisks | Trowers & Hamlins | Savills | Addleshaw & Goddard | - |

| Radian (rb) | 07-2015 | £57m | TradeRisks/TradeRisks | Devonshires | JLL | n/a | - |

| Peabody (pp) | 07-2016 | £125m | TradeRisks/TradeRisks | Trowers & Hamlins | Savills | Morgan Lewis | - |

| Herefordshire (rb) | 11-2016 | £35m | TradeRisks/TradeRisks | Trowers & Hamlins | Mazars | Allen & Overy | PIC |

| CoE Pensions Board (b) | 08-2015 | £100m | TradeRisks/TradeRisks | Trowers & Hamlins | Savills | Clifford Chance | - |

| Radian (rb) | 06-2016 | £48m | TradeRisks/TradeRisks | Devonshires | JLL | n/a | - |

| Network (pp) | 06-2017 | £50m | na/MUFG | Trowers & Hamlins | Savills | Addleshaw Goddard | BAE*** |

Notes: (rtb) retail bond, (pp) private placement, (cb) charity bond, (rb) retained bond sale, (il) institutional loan or leaseback, (b) bond; *Bank of Scotland arranged related loan; **JCRA/Peel H. ***BAE Systems Pension Funds Investment Management; ****Great-West Life & Annuity Insurance Company, Massachusetts Mutual Life Insurance Company. Source: Social Housing magazine funding advisors

Highest paying housing associations: audit and other fees above £100k, 2015/16

| Housing association | Auditor | Total fees | Change on year % | Audit | Change on year % | Other services | Change on year % |

|---|---|---|---|---|---|---|---|

| Sanctuary** | KPMG LLP (UK) | 1,200,000 | +50 | 600,000 | +0 | 600,000 | +200 |

| Hanover | KPMG LLP (UK) | 710,000 | +4 | 685,000 | +0 | 25,000 | N/A |

| Anchor Trust | KPMG LLP (UK) | 624,000 | +140 | 151,000 | +41 | 473,000 | +209 |

| Riverside | KPMG LLP (UK) | 458,000 | -51 | 162,000 | -1 | 296,000 | -61 |

| Thirteen | PricewaterhouseCoopers LLP | 416,000 | +256 | 106,000 | +41 | 310,000 | +638 |

| Hyde | PricewaterhouseCoopers LLP | 386,000 | +72 | 146,000 | +15 | 240,000 | +147 |

| L&Q | KPMG LLP (UK) | 385,000 | +173 | 149,000 | +15 | 236,000 | +2,045 |

| Peabody | KPMG LLP (UK) | 362,000 | -25 | 150,000 | +60 | 212,000 | -45 |

| Places for People | KPMG LLP (UK) | 349,000 | +37 | 319,000 | +28 | 30,000 | +500 |

| Network | PricewaterhouseCoopers LLP | 347,000 | +40 | 118,000 | +6 | 229,000 | +67 |

| Home | KPMG LLP (UK) | 335,000 | +5 | 79,000 | +1 | 256,000 | +7 |

| A2Dominion | BDO LLP | 300,000 | +0 | 300,000 | +50 | 0 | -100 |

| Circle Anglia | KPMG LLP (UK) | 300,000 | +50 | 300,000 | +50 | 0 | +0 |

| Metropolitan | BDO LLP | 294,000 | +54 | 175,000 | +14 | 119,000 | +222 |

| Gentoo | KPMG LLP (UK) | 277,000 | -8 | 146,000 | -18 | 131,000 | +8 |

| Genesis | KPMG LLP (UK) | 272,000 | +19 | 167,000 | +18 | 105,000 | +22 |

| Wheatley | PricewaterhouseCoopers LLP | 271,000 | +1 | 223,000 | +24 | 48,000 | -45 |

| Together | Grant Thornton UK LLP | 251,000 | +10 | 119,000 | -14 | 132,000 | +45 |

| Notting Hill | PricewaterhouseCoopers LLP | 243,900 | +104 | 129,800 | +9 | 114,100 | N/A |

| Affinity Sutton | KPMG LLP (UK) | 243,000 | +22 | 181,000 | +24 | 62,000 | +17 |

| Your | Grant Thornton UK LLP | 232,000 | +32 | 166,000 | +33 | 66,000 | +29 |

| Southern | PricewaterhouseCoopers LLP | 206,000 | +56 | 206,000 | +56 | 0 | +0 |

| East Thames | Grant Thornton UK LLP | 205,000 | +30 | 166,000 | +38 | 39,000 | +3 |

| Guinness | Nexia Smith & Williamson | 200,000 | -50 | 200,000 | -50 | 0 | +0 |

| Orbit | KPMG LLP (UK) | 193,000 | +8 | 90,000 | -29 | 103,000 | +98 |

| Sovereign | KPMG LLP (UK) | 191,000 | +29 | 122,000 | +0 | 69,000 | +165 |

| Thames Valley | BDO LLP | 190,000 | -2 | 54,000 | -2 | 136,000 | -2 |

| Derwent Living* | RSM UK Audit LLP | 181,000 | +36 | 91,000 | +15 | 90,000 | +67 |

| Industrial Dwellings | Nexia Smith & Williamson | 178,000 | +709 | 18,000 | +6 | 160,000 | +3,100 |

| Symphony | KPMG LLP (UK) | 174,000 | +5 | 108,000 | -1 | 66,000 | +16 |

| City West | KPMG LLP (UK) | 171,745 | +279 | 32,225 | +17 | 139,520 | +682 |

| East Midlands | KPMG LLP (UK) | 171,000 | +39 | 82,000 | +12 | 89,000 | +78 |

| Midland Heart | KPMG LLP (UK) | 157,000 | +14 | 107,000 | +27 | 50,000 | -7 |

| Viridian | RSM UK Audit LLP | 156,000 | +11 | 127,000 | +25 | 29,000 | -26 |

| Aster | PricewaterhouseCoopers LLP | 149,000 | -47 | 134,000 | -32 | 15,000 | -82 |

| Accord | Grant Thornton UK LLP | 144,000 | -30 | 118,000 | -27 | 26,000 | -41 |

| Catalyst | BDO LLP | 144,000 | -32 | 65,000 | +0 | 79,000 | -46 |

| Radian | Deloitte LLP | 139,000 | -11 | 110,000 | +9 | 29,000 | -47 |

| Torus | KPMG LLP (UK) | 139,000 | -10 | 48,000 | +7 | 91,000 | -17 |

| Moat | KPMG LLP (UK) | 130,000 | +16 | 83,000 | +1 | 47,000 | +57 |

| One | BDO LLP | 129,000 | -13 | 125,000 | +6 | 4,000 | -87 |

| Swan | Grant Thornton UK LLP | 127,000 | -12 | 83,000 | +5 | 44,000 | -32 |

| Family Mosaic | KPMG LLP (UK) | 126,000 | +0 | 89,000 | +1 | 37,000 | -3 |

| Luminus | RSM UK Audit LLP | 122,000 | +16 | 75,000 | +3 | 47,000 | +47 |

| Knowsley | Grant Thornton UK LLP | 120,000 | -7 | 30,000 | +3 | 90,000 | -10 |

| Trafford | BDO LLP | 120,000 | +50 | 36,000 | +57 | 84,000 | +47 |

| Asra | KPMG LLP (UK) | 118,000 | +28 | 96,000 | +85 | 22,000 | -45 |

| Aldwyck | Grant Thornton UK LLP | 115,000 | +34 | 49,000 | +4 | 66,000 | +69 |

| Bromford | Beever and Struthers | 114,000 | +8 | 55,000 | -2 | 59,000 | +18 |

| First Wessex | Nexia Smith & Williamson | 111,000 | +9 | 57,000 | +16 | 54,000 | +2 |

| Accent | Grant Thornton UK LLP | 108,000 | +10 | 57,000 | -5 | 51,000 | +34 |

| Rochdale Boroughwide | BDO LLP | 106,000 | -7 | 29,000 | +7 | 77,000 | -11 |

| Knightstone | Mazars LLP | 104,000 | +24 | 43,000 | +13 | 61,000 | +33 |

| Walsall | RSM UK Audit LLP | 103,000 | -29 | 97,000 | +49 | 6,000 | -93 |

| Longhurst | Beever and Struthers | 100,000 | +2 | 76,000 | +23 | 24,000 | -33 |

| Origin | BDO LLP | 100,000 | +69 | 86,000 | +91 | 14,000 | +0 |

| Total | 13,297,645 | +16 | 7,616,025 | +9 | 5,681,620 | +27.2 |

Notes: *EU IFRS; **accounts year-end December 2015

Highest paying housing associations: audit and other fees above £100k, 2015/16

| Auditor | Number of HA clients (fees over £100k): 15/16 | Number of HA clients (fees over £100k): 14/15 | Total fees | Change on year % | Audit | Change on year % | Other services | Change on year % |

|---|---|---|---|---|---|---|---|---|

| KPMG | 22 | 22 | 7,085,745 | +17 | 3,946,225 | +10 | 3,139,520 | +26 |

| BDO | 8 | 6 | 1,383,000 | +6 | 870,000 | +27 | 513,000 | -16 |

| Grant Thornton | 8 | 6 | 1,302,000 | +6 | 788,000 | +4 | 514,000 | +10 |

| PwC | 7 | 7 | 2,018,900 | +46 | 1,062,800 | +13 | 956,100 | +115 |

| RSM UK Audit | 4 | 4 | 562,000 | +7 | 390,000 | +22 | 172,000 | -16 |

| Nexia Smith & Williamson | 3 | 2 | 489,000 | -7 | 275,000 | -41 | 214,000 | +269 |

| Beever and Struthers | 2 | 2 | 214,000 | +5 | 131,000 | +11 | 83,000 | -3 |

| Mazars | 1 | 0 | 104,000 | +24 | 43,000 | +13 | 61,000 | +33 |

| Deloitte | 1 | 1 | 139,000 | -10.9 | 110,000 | +9 | 29,000 | -47 |

| Total | 56 | 50 | 13,297,645 | +16 | 7,616,025 | +9 | 5,681,620 | +27.2 |

Source: Housing associations' audited accounts, 2015/16

Pre/post-Budget referendum rent cut

| July Budget | Value of bonds and private placements £m | Number of bonds and private placements |

|---|---|---|

| 1 year before | 4,084.5 | 45 |

| 1 year after | 1,544.6 | 13 |

| Rent cut | ||

| 1 year before | 1,383.5 | 31 |

| 1 year after | 2008 | 17 |

| Referendum | ||

| 1 year before | 1,419.6 | 12 |

| 1 year after | 2083 | 19 |

RELATED