How the sector is tackling damp and mould

Following high-profile cases of damp and mould, Michael Lloyd asks landlords how they are budgeting to tackle the issue in their business plans

When details around the death of Awaab Ishak emerged in November, it sparked a heightened focus on the issue of damp and mould in homes.

The two-year-old died in a Rochdale Boroughwide Housing (RBH) flat due to prolonged exposure to mould. The case has attracted widespread media attention and regulatory intervention.

The housing secretary, the Housing Ombudsman and the Regulator of Social Housing (RSH) have all written to providers to warn them about the importance of tackling damp and mould.

As a result, social housing providers are busy making changes to their strategies and diverting more funding to repairs and maintenance.

Many of these strategies have been developed or improved over the past few years, with some making fresh updates now, others accelerating their implementation and almost everyone increasing their focus on damp and mould.

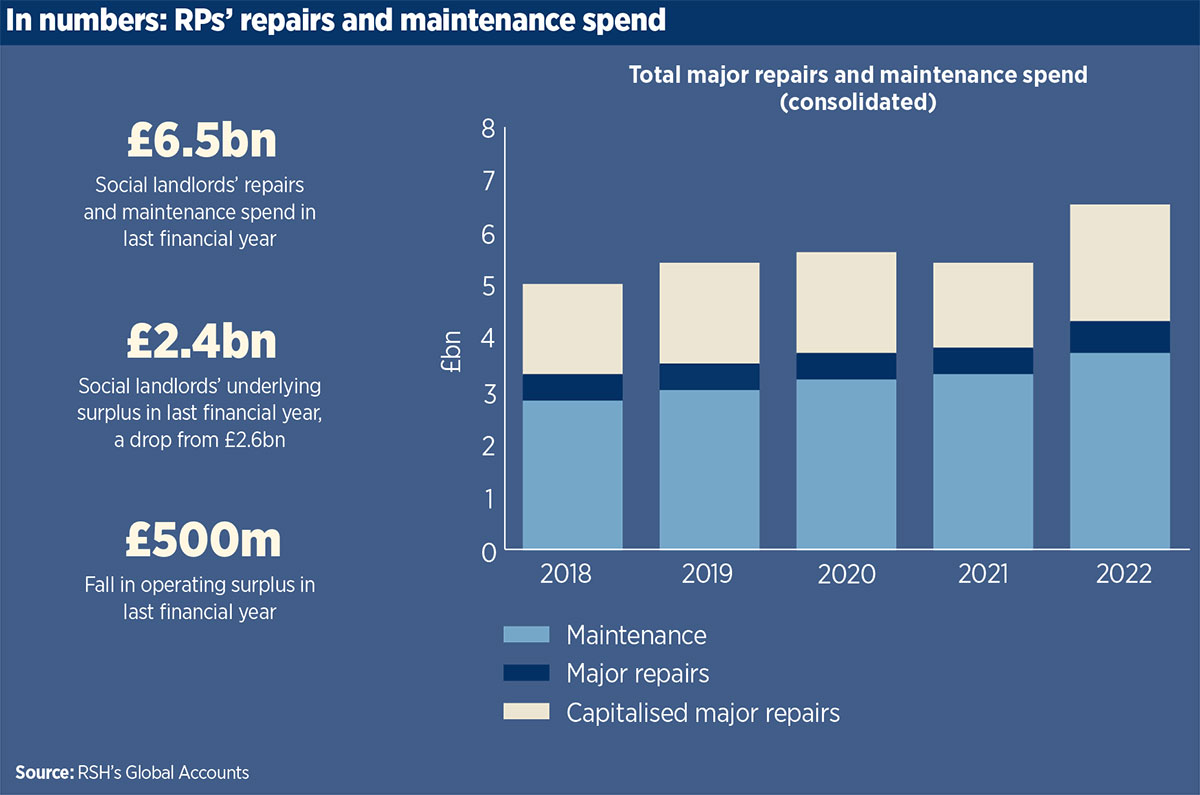

More broadly, the RSH’s latest Global Accounts show that social landlords in England spent a record £6.5bn on repairs and maintenance in the last financial year as they caught up with delayed work.

This represented a 20 per cent year-on-year rise, after a drop in spend during the pandemic.

The trend looks set to continue during the current financial year and future years as providers reveal plans to increase their funding allocations for their existing stock.

Funding figures

Neal Ackcral, chair of the G15’s Asset Directors Group and chief operating officer at The Hyde Group, says that the G15 collectively spends around £900m per annum on stock investment programmes.

He says that within this, 48,000-home Hyde is increasing its Decent Homes budget year-on-year with plans to spend an extra £10m this current year.

“I’d say for any social landlord at the moment, damp and mould is a key issue,” says Mr Ackcral. “I think quite rightly the media coverage on it has increased expectations.”

In the South West of England, another large landlord is increasing its spend on its existing stock. LiveWest, which operates 39,000 homes, forecasts to invest around £85m in this current financial year, which equates to around £2,297 per home. Then, in 2023-24, this will rise to an investment of £103m, representing £2,743 per home.

Russell Baldwinson, executive director of development at LiveWest, says that the budgetary increase includes extra investment in fire and building safety work and increasing the energy efficiency of its homes, and takes into account inflationary increases on material and contractor spend.

“Customer safety is our number one priority,” says Mr Baldwinson. “So, I would say the disrepair in our customers’ homes is a very high priority, of which damp and mould is a part.”

He says over the next five years (from 2023-24 onwards), the landlord will be investing around £550m in its current homes, with the caveat that future years are still estimates and will be firmed up nearer the time.

Meanwhile, Aster Group, which manages over 36,000 homes, has committed to investing £570m in improvements for its existing stock between now and 2030, and to better inform this, launched a £2.8m stock investment survey in March last year.

Emma O’Shea, chief operating officer at Aster, says: “The intelligence we receive from the survey is vital to ensuring our investment is channelled into the right areas and can deliver the best possible results for our customers.”

On damp and mould specifically, she says: “We’ve already taken several proactive steps to address this issue in the past few years, which are making a real impact. We’ve rolled out specialist training to surveyors on diagnosing damp and mould in properties, and focused on solutions to prevent condensation and mould from reoccurring.”

Ashling Fox, chief customer officer at Bromford, says that, subject to board approval, the 44,000-home landlord will increase its existing stock budget from £42m during this financial year to £44m next year.

Ms Fox says: “In part, that will be down to damp and mould, but there is an inflationary impact within those numbers.”

She adds: “You would hope that if that goes to plan, you would start to see the spike of damp and mould cases reduce once we’ve worked through our properties and disposed of those where we don’t feel we can permanently eradicate damp and mould issues.”

Balancing act

Some housing associations (HAs) have been forced to cut back spending on other areas, or expect to do so.

Paul Richards, group director of customer and communities at Orbit, says that the group will increase its investment in its existing stock by 25 per cent from 2022-23 to 2023-24 and maintain this going forward.

This comes after Orbit has recently revised its ambition to build 6,500 units in a five-year period to 6,000 units, a figure which will “remain under review”.

Mr Richards says: “Clearly, if we’re investing more into our existing stock, then obviously the money has to come from somewhere.

“We will retain a development programme, but we may have to scale it back somewhat, in order to continue to fund appropriately.

We have a strategic plan and these are changes that we’re making on a constant basis.”

He adds: “As an organisation, our number one priority is keeping customers safe. We talk about it at every meeting. We talk about it in every finance plan that we put forward.”

Paul Fiddaman, chief executive of Karbon Homes, says spending on existing stock has got to come first and development should be lower down the agenda. He says Karbon’s funding on existing stock will rise from an average of around £15m per annum over the past couple of years to £41m a year by 2026.

He adds that £1.5m will be spent on damp and mould over the next four or five years to treat all of the properties Karbon identifies as problematic.

Mr Fiddaman says: “Only when you’re satisfied that you’ve got a business plan that contains full provision for maintaining the quality of your existing [homes], should you then start worrying about how much capacity you have to do other stuff. So development in that sense becomes much lower-order priority in business-planning terms than the quality of existing homes, and I think that’s right.”

At 11,000-home CHP, chief executive Paul Edwards says it will likely cut back on net zero spending to prioritise damp and mould in the short term. CHP is increasing its spend on damp and mould improvements and mitigation costs from the circa £400,000 it was forecasting to around £750,000 by the end of the year, he says.

Mr Edwards says: “Within an overall £23.5m [of spending on repairs and maintenance], it’s likely that reluctantly, we’ll spend a little bit less of a balance on our overall net zero carbon journey to ensure that we do have the right amount of spend on damp and mould improvements in the short term.”

“I’d say for any social landlord at the moment, damp and mould is a key issue. The media coverage on it has increased expectations”

However, other social landlords describe how their spending will not impact other areas of their business.

Rose Bean, director of assets and sustainability at Abri, says that the 35,000-home group’s total stock investment over the next five years will be £220m and it has not reduced expenditure elsewhere to manage this.

However, she adds that the HA considers inflation as part of its financial planning and has to manage a “constant balancing act”.

Ms Bean says: “This is part of our planned investment programmes. But obviously, with the rent cap, there are increasing pressures on every organisation to balance kind of long-term investment and any potential changes with Decent Homes that could be coming down the line. So, it is a constant balancing act at this stage. Having that assurance that your investment in stock is going to mitigate damp and mould in a proactive way is really, really critical.”

Increasing existing stock funding leads to a fall in margins that providers need to manage.

This was shown in the RSH’s Global Accounts for 2021-22, which revealed that the ‘underlying surplus’ (excluding movements in fair value) dropped slightly from £2.6bn to £2.4bn, which was mainly attributable to a £500m fall in operating surplus.

This in turn was predominantly because of a £400m decrease in the operating surplus from social housing lettings that the RSH said was “largely attributable to increased repairs and maintenance costs”.

Jesse Meek, executive director of asset strategy and sustainability at Settle, says pressure on operating margins means discussions with the board about choices and priorities.

He says he is not a proponent of cutting back development programmes if it can be avoided, because it can be a really important way of solving housing quality issues over the long term.

Mr Meek says: “This is about a long-term housing quality challenge and about thinking what active asset management strategies can help us mitigate some of the impacts.”

It may be a constant balancing act, but all providers recognise the importance of damp and mould and investing in their existing stock.

They are prioritising this area, with some even adding it to their compliance checklist alongside the likes of gas, water, fire, electrics and legionella.

Orbit’s Mr Richards says: “We are now making damp, mould and condensation have the same level of focus and reporting. So, we’re giving it that level of priority.”

Changing strategy

The UK’s largest housing association, Clarion, has been improving its damp and mould mitigation over the past couple of years.

Rob Lane, chief property officer at Clarion, says that the 125,000-home landlord’s damp and mould approach started as one of its lessons learned as a result of ITV’s investigation into its Eastfields Estate.

He says that the organisation is hiring an additional 100 staff members, is also giving staff training on damp and mould and will roll out nationally the property MOT programme it started in north London last year.

Mr Lane says the coroner’s report into Awaab Ishak has been a catalyst for Clarion accelerating its plans.

He says: “The coroner’s inquiry just prompted us to accelerate our plans by increasing our staff and training around this and spending more money on it right now. It’s a watershed moment for the sector.”

Some HAs and local authorities have been setting up specific teams to tackle damp and mould.

RBH has set up a taskforce that is currently “assessing and booking works”, according to interim chief executive Yvonne Arrowsmith. RBH is launching a new stock condition survey and is currently reviewing its anticipated spend on its homes, which will be informed by the survey.

“Having that assurance that your investment in stock is going to mitigate damp and mould in a proactive way is really, really critical”

Ms Arrowsmith says: “Damp and mould is our number one priority. I have made it clear that ensuring our homes are safe, secure and comfortable is our overriding aim.”

Prior to the RBH case, Settle had set up a damp and mould team to understand cases reported to it and improve the speed of inspections and repairs.

Mr Meek says that the team was established to meet increasing demand during the winter. However, following the RBH press coverage, the demand increased further than was expected so Settle has allocated more resources to the team.

He says: “The tragic events of Awaab Ishak’s death has brought us all into a really sharp focus, particularly on the importance of quality in our homes.”

HAs are being proactive in detecting and tackling damp and mould. Several have been training their staff to ensure that they understand it, and that anyone who visits a tenant’s home can carry out a visual inspection.

Abri’s Ms Bean says: “It’s making it everyone’s responsibility. It is important that every colleague has that responsibility to pick up immediate issues and make sure that they take action through the business.”

Technology can also be used to better detect and prevent mould. Data generated from customer reports, sensors and stock condition surveys can show HAs where to target their efforts.

Orbit is fitting an increasing number of sensors into properties to remotely monitor the level of moisture in a home and is using data to map incidents of damp and mould against a range of metrics, such as house types. This is to find the potential for damp and mould and proactively contact customers.

“We’re using both a combination of technology, but also data, to try and more proactively manage damp and mould rather than waiting for it to be a problem and then responding,” says Orbit’s Mr Richards.

Similarly, CHP is using an artificial intelligence reporting system to scan all of its data, including customer feedback, queries coming into its call centres, repair orders and surveys for keywords like damp, mould and condensation.

Mr Edwards says: “Technology has helped us properly scan all the information we’ve got as an organisation, and make sure we’re picking up all those cases.”

Clearly social housing providers are having to take widespread action to tackle damp and mould issues, but face a constant balancing act in where they make investment.

Next year’s Global Accounts may well show another record year for repairs and maintenance spend.

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED