Call for clarity as safety guidance stalls sales

Housing associations are encountering problems with sales as a result of uncertainty about the government’s updated building safety regulations post-Grenfell. Robyn Wilson reports

Government and industry sources have confirmed that multiple outright sale, shared ownership sale and shared ownership staircasing transactions have been paused until mortgage valuers and lenders receive certain assurances that the buildings comply with the new guidance.

The assurances include particular technical detail about the building’s inner and outer wall structure and make-up, such as the types of materials used and how they have been fixed, as well as fire-stopping – information that some providers currently do not hold on their stock.

As Richard Petty, lead director at JLL’s living advisory, explains: “Lenders are instructing valuers in the absence of that technical information to put a nil value on the property, because if they don’t, there is a risk it will go through the credit approval process and a mortgage advance will be made against a property that the lender doesn’t want to lend against.”

The news adds to wider reports during September of individual homeowners seeing the value of their properties plummet because they do not meet safety regulations. One leaseholder on Hackney’s new Kings Crescent development saw their £685,000 flat deemed “worthless” by a surveyor because of this problem.

This latest development, however, is the first signal that the issue is having a wider impact on new builds in the social housing sector.

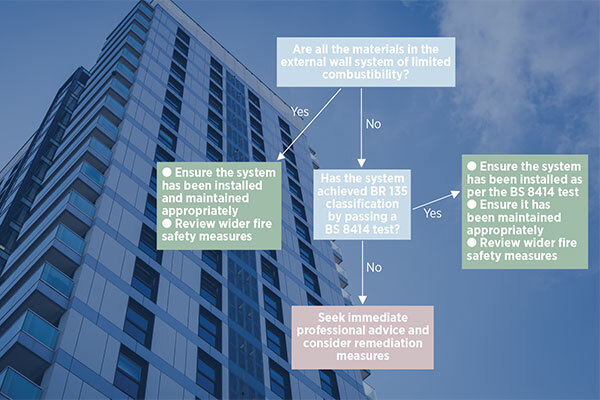

At the centre of the confusion lies Advice Note 14, the government’s building safety guidance on external wall systems that do not incorporate aluminium composite material (ACM), which, as one industry source explains, “has created a new burden” for building owners to be absolutely sure that there is no combustible material anywhere on buildings over 18 meters in height.

Another industry source adds that Advice Note 14 is “completely wrong”. They say: “If you read it and interpret it exactly as it’s written, it prohibits the use of any materials other than those that are of limited combustibility, and there is not a building that has ever been built that has all materials of limited combustibility. It goes too far.”

This is resulting in a multi-pronged problem for the sector, starting with the hold-up in sales until providers carry out the necessary technical investigations to satisfy lenders. But, in addition, there is ambiguity over how the industry should be interpreting this guidance and what this will eventually mean for the sector when it comes to remedial costs.

Helen Evans, chair of the G15, describes the problem as an “accumulating issue”, explaining that “it started slowly but the numbers are growing in the absence of a solution”.

She adds: “There has been extensive dialogue both between the G15 and [the Ministry of Housing, Communities and Local Government], who are co-ordinating an industry response, but if a solution is not found then it is potentially a really serious issue.”

In terms of numbers, there are currently sales hold-ups within the “low thousands”, across both private sector and G15 HA sales, says Ms Evans. Across the G15’s properties, 650 people are unable to access a mortgage.

It is understood that there are around 11,500 tall buildings nationally with external wall systems, which are therefore affected by Advice Note 14. The G15 has already estimated costs of between £1.8bn and £6.87bn over 10 years, based on 1,145 buildings over 18m with external wall systems, with work valued between £1.8m to £6m per block.

Mr Petty talks of one G15 member that has 24 outstanding new build sales because of this problem. He adds: “Given the rate of sales at the moment that’s not insignificant but it shouldn’t be enough to trouble an organisation of that scale.”

“Lenders are lending on flats in high-rise buildings, but obtaining the necessary paperwork to support that lending decision can add time”

Elsewhere, Social Housing understands that a scheme in the private sector, totalling hundreds of millions of pounds, has been halted because of this problem.

The news came as house builder Crest Nicholson reported an exceptional charge of £17m for 2019, relating to “latest government guidance notes in respect of combustible materials, fire risk and protection and regulatory compliance on completed developments”.

Responding to Social Housing, the Ministry of Housing, Communities and Local Government (MHCLG), the Royal Institution of Chartered Surveyors (RICS) and UK Finance (the latter of which represents mortgage lenders) all say the issue is one they are working on together to resolve. An MHCLG spokesperson adds that “resident safety remains our utmost priority”.

However, the MHCLG spokesperson says that while the government is working with the industry to understand the scale of the problem, it does not believe it is universal. They add: “Lenders are lending on flats in high-rise buildings, but obtaining the necessary paperwork to support that lending decision can add time.”

Both RICS and UK Finance say they hope “to be in a position to publish an update shortly”. A spokesperson for UK Finance adds: “Lenders will request mortgage valuations from an independent surveyor when deciding whether to lend. This will take into account a range of factors that affect value, including building safety and any associated remedial costs.

“As with any mortgage application, each lender will consider whether to lend on a case-by-case basis. UK Finance is working with RICS on guidance on this issue, which is due to be published shortly.”

“Often when we’ve been looking through [operating and maintenance manuals], you’ve got information about products that have gone into buildings but there’s no record of where they’ve gone in the building”

Technical investigations: what is the hold-up?

Availability of information about social housing stock is part of the challenge.

As Simon Latson, director of JLL’s residential building consultancy, explains: “Where the mortgage valuers are asking for information from the building owners, the building owners don’t necessarily have it and in our experience at the moment, where they do have it sometimes that building information is not correct.”

This includes health and safety files or operating and maintenance manuals that “are not necessarily what they should be and they don’t necessarily contain the information that might make this a bit easier”, Mr Latson adds.

George Stevenson, managing director at building information modelling (BIM) specialist ActivePlan, who is currently in “detailed conversation” with several providers about the use of BIM across their new build and existing housing stock, echoes this.

He makes a wider point about the lack of understanding among some providers of not just what products make up their buildings, but also of how those products interact with each other and how that changes the building’s risk profile.

“Often when we’ve been looking through [operating and maintenance manuals], you’ve got information about products that have gone into buildings but there’s no record of where they’ve gone in the building.”

This problem ties into wider concerns raised in the regulator’s Sector Risk Profile this year, which shows stock condition and the quality of data providers have on their stock rising up the risk agenda (see p14-15).

And as Mr Latson points out, there are a limited number of cladding specialists who are able to carry out these tests.

Remedial costs and interpretation

Once the technical reviews are complete, there is a second dilemma that providers must face: the cost of bringing the building up to standard. Ms Evans, who is also chief executive of Network Homes, explains that the technical reviews are “triggering enormous remediation costs” for some HAs.

One Network Homes scheme, for example, had 145 units that required remedial works costing up to £6m. These homes had no flammable cladding, however there were faults identified behind the non-flammable cladding that needed to be rectified.

Neal Ackcral, chief property officer at Hyde, says the association put aside a budget of £50m just for fire refurbishment, but that is expected to be deployed in full this financial year. While Hyde is yet to see Advice Note 14 impact new build, Mr Ackcral says it is a problem for existing shared owners.

“Advice Note 14 has caused us a lot of concern in that many shared owners, whether they’re looking to staircase or sell their house to someone else who requires a mortgage, have found it really difficult to get mortgages,” he says.

“We’re working with tenants and lenders very closely to give them confidence that the buildings are safe. We are quite advanced in our journey of replacing our cladding systems and putting fire protection in place but we understand that for lenders, until work is fully completed, they can be reluctant to give approval for the funding so this is still very much a live issue for our shared owners.”

“What’s safe and what’s not? There is still a lot of confusion about that”

Elsewhere, there is ambiguity around the interpretation of Advice Note 14 and what exactly it means to make a building safe. As one industry source puts it: “What’s safe and what’s not? There is still a lot of confusion about that.”

Commenting on the G15’s estimated range of costs of between £1.8bn and £6.87bn, Ms Evans says: “That’s an enormous range and part of the reason it’s so large is because of the variety of ways the guidance can be interpreted.”

Pegging that remedial work to an actual timetable also throws up questions for the sector. As Victoria Moffett, head of building and safety programmes at the National Housing Federation, notes: “This is a huge programme of work which could take many years to complete.”

Ms Evans makes a similar point, saying that the works would be more manageable if carried out over a longer period of time.

However, she adds: “If they’re taken over a shorter period, it will have a bigger impact on the things we can do. Housing associations only have so much money, and ultimately the money for this kind of remediation, if it’s being met by registered providers, is coming out of the same pot that would be used for supply.”

On this latter point, there is a general consensus among those spoken to for this article that the sector cannot shoulder this burden alone and that the government must help beyond the £400m fund made available for ACM removal.

As Ms Moffett says: “The government must take a strategic lead on a building safety programme, to make the best use of the resources and ensure the most urgent works are carried out first, as well as setting up a building safety fund to cover the cost of these urgent works.”

MHCLG did not respond to Social Housing about whether it will be making further funding available.

“In principle, it means that it’s slowing down sales and therefore slowing down the building-up of the necessary financial reserves or surpluses to deliver the cross-subsidy that other developments are resting on”

Impact on the sector

So, what else does this mean for the sector, which is semi-reliant on cross-subsidy to fund its future development?

“In principle, it means that it’s slowing down sales and therefore slowing down the building-up of the necessary financial reserves or surpluses to deliver the cross-subsidy that other developments are resting on,” says Mr Petty. But he is keen to stress that “we’ve got to be careful not to overdo the scale”.

Michal Skotny, housing development and regeneration director at Savills, adds that it could also impact a scheme’s viability.

“For most new properties below 18 metres in height, the key issues are reviewing materials specified to provide safety assurance and ensuring a high standard of build quality. Although this is having some impact on costs, the vast majority of projects remain viable.

“For high-rise properties exceeding 18 metres, the picture is a little different. As amended building regulations are more likely to apply to these types of buildings, the potential cost impact is greater. As a result, the viability of such projects is much less certain, although the extent of this issue remains unclear at present.”

He adds: “The implications of this are still being assessed in the main, but if scheme viability is impacted then mitigating measures being considered for sites already in ownership include requesting more grant funding, building fewer onsite affordable homes or renegotiating on Section 106 requirements.”

“As lenders, we will always be guided by the valuers, but this seems to be more of a problem for individuals”

Mr Skotny says that, for housing providers buying land, these higher building costs will be reflected in the price they and other developers are able to pay.

For the time being, sector funders also do not appear to be taking any direct action on the issue.

On this, Ms Evans says: “We have to provide a lot more information to lenders for tall buildings in terms of security, but we haven’t found them yet saying that they don’t want to accept it for security.”

One investor in the sector also plays down the significance of this at a corporate level. They say: “As lenders, we will always be guided by the valuers, but this seems to be more of a problem for individuals.

“If you’re a corporate lender it’s probably less of a problem because, if you’re confident that you will get the fire certification and if you’re funding a whole building, you are probably going to slightly discount that value based on the fact that you know that some money is going to be spent in order to make the building comply.”

RELATED