Working the PRS market

What are some of the investment models available to HAs today as they build their PRS portfolios? Robyn Wilson reports

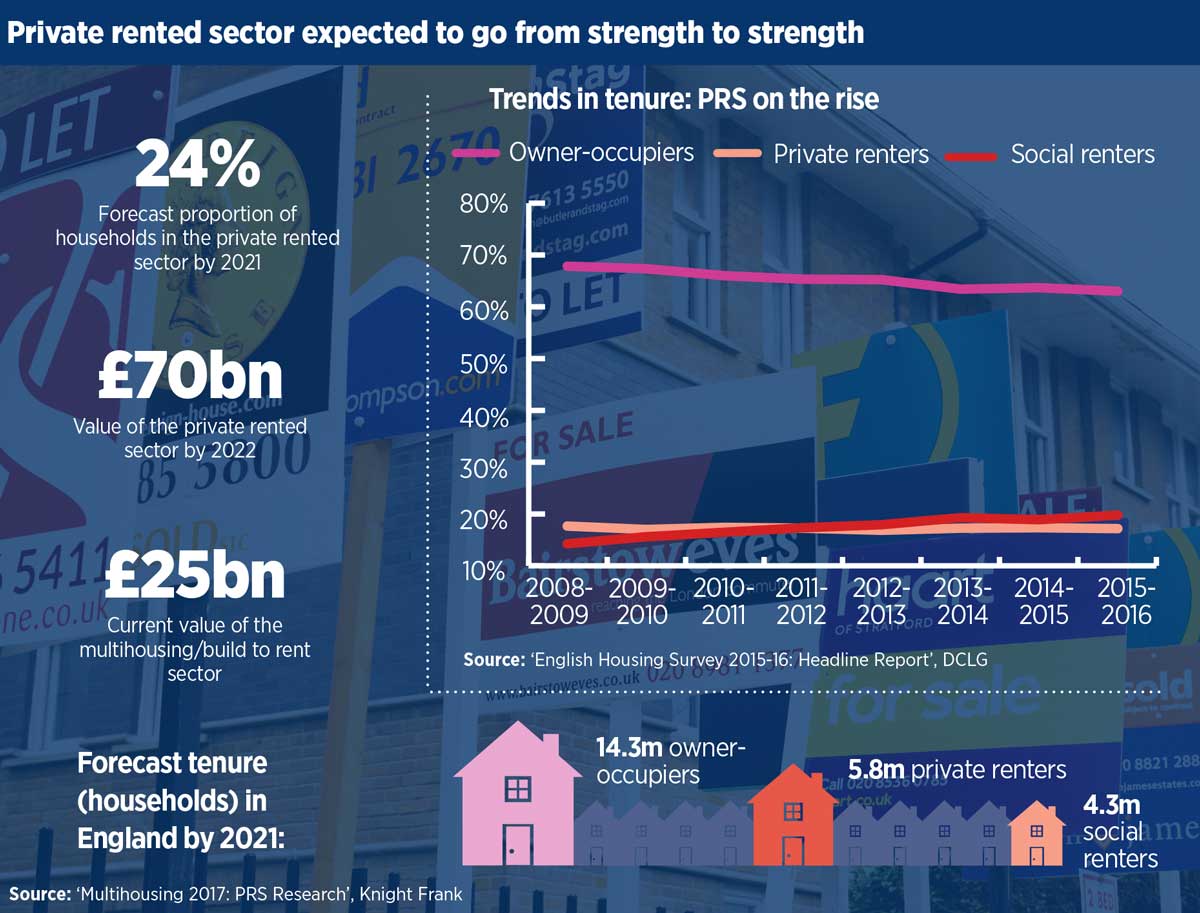

Appetite for the private rented sector (PRS) and professionalised build to rent (BTR) is growing among housing associations.

Investors told last year’s Social Housing Finance Conference that a non-recourse, off-balance sheet approach is “more appropriate” to reflect risk, with some pointing out that they would like to see loans in a more “commercial format”.

So what are some of the funding and investment models available to housing associations today as they build their PRS portfolios? And what operational and structural considerations do they need to bear in mind that will enable them to deliver successful commercial products, without putting their core social housing business model at risk?

Funding options

One of the most talked about delivery models came from Thames Valley Housing’s (TVH) Fizzy Living creation.

Set up in 2012, Fizzy was launched by TVH with a seed capital investment of £30m for the building and letting of PRS assets. This demonstrated to the market its capabilities in operating within the sector, with a view to drawing in a funding partner down the line. Two years later Fizzy attracted major equity funding from investor Silver Arrow, owned by the Abu Dhabi Investment Authority (ADIA).

ADIA has committed £400m to Fizzy, which is used by the PRS brand to fund the development aspect of its schemes. Fizzy has become a joint venture vehicle, with ADIA taking the majority stake.

Under the model, once a scheme is built and let Fizzy brings in a longer-term debt funding partner, with an agreed repayment structure at a fixed rate, which then releases ADIA’s development finance.

“So we more or less recycle the development finance,” says Rita Akushie, group finance director at TVH.

“Every time a scheme stabilises we bring in longer-term funding, which means we can do a lot more and that we’re not locking up the £400m.”

To make the distinction between TVH and the Fizzy brand clear, Thames Valley partnered ADIA through a limited liability partnership, creating Fizzy Enterprises LLP. ADIA’s investment entity Silver Arrow then took a majority 54 per cent stake in the partnership, with TVH holding the remaining 46 per cent.

Such a model allows TVH to benefit from Fizzy’s profits without the commercial activity leaking into the social business – something that Adam Challis, UK head of residential research at JLL, says is a very attractive option for other housing associations.

“Fizzy is a really good example of the sort of model that still has huge relevance for this sector,” he says.

“You’ve got a capable management platform, exposure to future development opportunities – or at least the ability to identify those opportunities – and then an investor partner that can provide some sophistication and, of course, some quite important extra capital that allows the platform to scale.”

Others in the sector have opted to seed-fund their own limited subsidiary companies.

L&Q is one of the more advanced in the market, albeit it only launched its private rented sector subsidiary in 2015. The association wants L&Q PRS Co to grow to 25,000 units over 10 years as part of its 100,000-home target. It transferred £250m of assets into the subsidiary company as a starting point.

“We more or less recycle the development finance.” Rita Akushie, TVH

By March last year, L&Q PRS Co had 1,239 units after a £56m acquisition of 221 units and another 209 units in management through an operating lease arrangement. It had £7.6m of cash at hand, and £283m of debt – including more than £107m to its parent.

The company reported a 68 per cent operating margin, rising to 74 per cent when excluding the impact of operating lease costs, with a gross rental yield of 5.5 per cent and net yield of 4.2 per cent.

L&Q PRS Co directly borrowed the first 10-year, £175m tranche of UK government-guaranteed PRS bond funding fixed at 2.78 per cent. It was secured against 728 properties and issued by PRS Finance – a funding aggregator and subsidiary of Venn Partners.

In the current financial year, L&Q was planning to increase its investment portfolio by £180m with the purchase of 438 properties across five schemes, and a committed pipeline of 1,109 units was forecast to be purchased from 2018 onwards.

On a smaller scale, Hyde also has its own subsidiary, called Hyde PRS Company, which started trading in 2015 and acquired 54 units in London last year, according to its latest accounts. Its parent entity, Hyde Housing Association, has provided a £50m revolving facility to its PRS subsidiary. There was £12.5m of inter-company loans when it started trading.

In March 2018, Clarion Housing Group said it has committed to add 3,000 homes to its build-to-rent portfolio over the next five years and is now looking at investment options, including equity. The homes will be built in what Clarion describes as “growth areas”, in London, the South East, the West Midlands and Greater Manchester.

Fund managers

Places for People has taken a different approach by setting up specialist equity funds through PfP Capital. The launch of a £250m PRS fund in 2017 – seeded by properties from the wider PfP group – was followed last month by the announcement of a new BTR fund (see p3).

The PRS fund offered a five per cent net rental yield from day one and was seeded with 1,379 fully let PRS properties from across 50 different sites in the UK. The capital is then recycled to speed up the delivery of new homes and its other social projects.

Further use of specialist housing funds is proving an attractive option for the wider sector, as they firstly allow large and mid-tier associations to gain access to outside capital to build new stock, rather than borrowing themselves through more traditional routes such as the bond markets.

For funds interested in PRS stock, they also enable housing associations to de-risk existing schemes by forward selling a number of PRS units on larger sites – much in the same way a house builder or developer does.

Alan Collett, chair of Hearthstone Group, who is also deputy chair of Hyde, says: “If you look at PRS funds such as those with M&G or Legal & General you’ll see that they are primarily buying from house builders who are de-risking a part of a larger scheme, and I think registered providers can follow that model very successfully.”

Hearthstone Investment Management (a joint venture between Hearthstone Investments plc and the senior management team) launched a closed-ended institutional PRS fund in December 2017 to invest in PRS schemes in regional cities and major regional towns, primarily in the suburbs where it sees there is sustainable rental demand rather than in London.

So far it has received £100m of investment from five UK local authority pension funds and expects to eventually raise this to £200m by the end of 2018.

“To make the model really work you’ve got to be big.” Adam Challis, JLL

The fund recently made its first investment of £24m and purchased a portfolio of six newly built low-rise apartment buildings in Manchester, Birmingham and Nottingham, in line with its strategy of focusing on low-rise apartment buildings and clusters of new build houses.

Associations have to ensure their needs are aligned with the investor they are getting involved with according to Andrew Screen, managing director of Traderisks and formerly of CBRE, who has a long track record in real estate and PRS/BTR in particular.

Mr Screen stresses the importance of understanding the type of private equity investor they are engaging with – including whether it is the cheaper and longer-term money provided by limited partner equity investors such as pension funds, or whether it is the more expensive money found in a general partner such as venture capital or hedge funds. “Registered providers need to be clear of the types of equity coming into the market,” he says.

“Another thing to consider is whether that income stream is being guaranteed by registered providers or not,” he says, adding that a lack of such a guarantee requires a higher return or risk level.

He adds that if RPs want the cheapest form of money then they would go and borrow themselves on balance sheet. “If they want to engage [private equity] they will want to look at the cheap forms of that. The good thing is that there’s a lot of that big, cheap money coming into the market so it doesn’t always mean that they are going to get a bad deal.”

The REIT way

One entry point for new investment is the growing number of real estate investment trusts (REITs), which could also prove beneficial to housing associations eager to grow their PRS portfolios.

In July 2017, Traderisks’ subsidiary ReSI Capital Management launched its Residential Secure Income plc fund (ReSI), which has an investment capacity of around £350m, to invest in residential properties and developments including BTR, retirement for rent, affordable, shared ownership and key worker housing.

ReSI can also co-invest. That means an association could invest a piece of land through a land lease of around 250 years and ReSI would then input the necessary capital into the vehicle to cover the scheme’s construction costs.

Mr Screen says this is an attractive model that would entitle the housing association to a portion of the project’s future rental income and allow it to keep its land rather than selling it off in a for-sale deal.

The association’s income would be determined by the value of the land they invested into the vehicle. So if the PRS/BTR scheme had a projected gross development value of, say, £100m and £30m of that was the land value, then the housing association would be entitled to 30 per cent of the scheme’s future rental income.

Mr Screen says: “This mechanism leaves the land sitting in the public sector/housing association in terms of freehold ownership, but brings in private equity or capital to be able to build out those units. Otherwise the associations would have to fund this on their balance sheet.”

Operational challenge

Finding the right investment model is one hurdle for associations to overcome. In addition, there are a number of operational and structural considerations that they also need to bear in mind if they are to satisfy the investment sector.

“From an operational perspective, there are broadly three core components that housing associations need to consider in more detail before entering PRS and they are around: systems, processes and reporting; staff; and compliance,” says Dominic Martin, UK director of operations at US BTR developer Atlas Residential.

“From a block management and resident engagement perspective, housing associations of course have experience in all three. Yet for each item, for PRS, these spheres are expanded.”

Mr Martin, who was also a member of the government’s PRS task force, says many of the larger private sector and PRS operators have sophisticated software in place for accounting and investor reporting, as well as for resident management and engagement, such as the US platform Yardi, and giving reassurance on these aspects will be important for any institutional investor.

Investors will also want to know what processes associations have in place to handle problems like late rent payments, complaints handling, leasing, and repairs and maintenance – all of which are crucial to tenant retention and, therefore, the scheme’s returns.

On staff, the association has to ensure it has consumer-facing employees that will not only market and convert applicant enquiries, but also help retain the residents, Mr Martin adds.

“Housing associations need to provide comfort around how they hire and train their staff, as well being proactive in responding to resident maintenance and repair requests,” he says.

A further vital element is around compliance, which includes building and marketing activities and, increasingly, data protection. The new data protection policy (GDPR), for instance, comes into force at the end of May.

Mr Martin says this policy is very onerous on how consumer data is now held, and questions whether housing associations are on top of both new and existing policies, some of which they haven’t had to consider before.

Track record

Demonstrating to the market that associations have the ability to develop and manage these assets successfully is an overriding theme among those active in the PRS/BTR sector.

As TVH’s Ms Akushie says: “Build to rent or PRS is more long term, and your management model and the extent to which you can manage efficiently makes all the difference to your yield.

“We demonstrated that we had a good model that was efficient and could retain tenants, and that was enough to attract an investor because it’s not so much about being able to develop a block, but it’s also about demonstrating that you can keep those properties occupied at a reasonable level all year round.”

Consolidation could be a necessary step for many associations here, says JLL’s Mr Challis.

“To make the model really work you’ve got to be big and you have to create the economies of scale,” he adds.

A larger organisation is also better able to spread its risk and split its management functions if it is to go down a subsidiary route.

Only by weighing up all of these factors will housing associations be able to assess the business risks attached to engaging with the private sector for PRS, without damaging their reputation and the social philosophy that underpins their parent group.

- Hear more on PRS/BTR at the Social Housing Finance Conference

RELATED