Is the build-to-rent market still attractive for RPs?

Supported by registered providers, build-to-rent has expanded rapidly. Robyn Wilson reports on the business case for it

In 2012, Thames Valley Housing (now Metropolitan Thames Valley Housing, MTVH) launched Fizzy Living: one of the first professional build-to-rent brands to enter the UK market.

With plans to create a portfolio of more than 1,000 new build apartments across London and the South East, the subsidiary promised to “revolutionise” renting and offer good-quality and much-needed homes for young professionals.

A decade on, and with government backing via financial initiatives including the Private Rented Sector [PRS] Guarantee Scheme, the UK build-to-rent market (or professional PRS) has been transformed into a thriving, multibillion-pound industry.

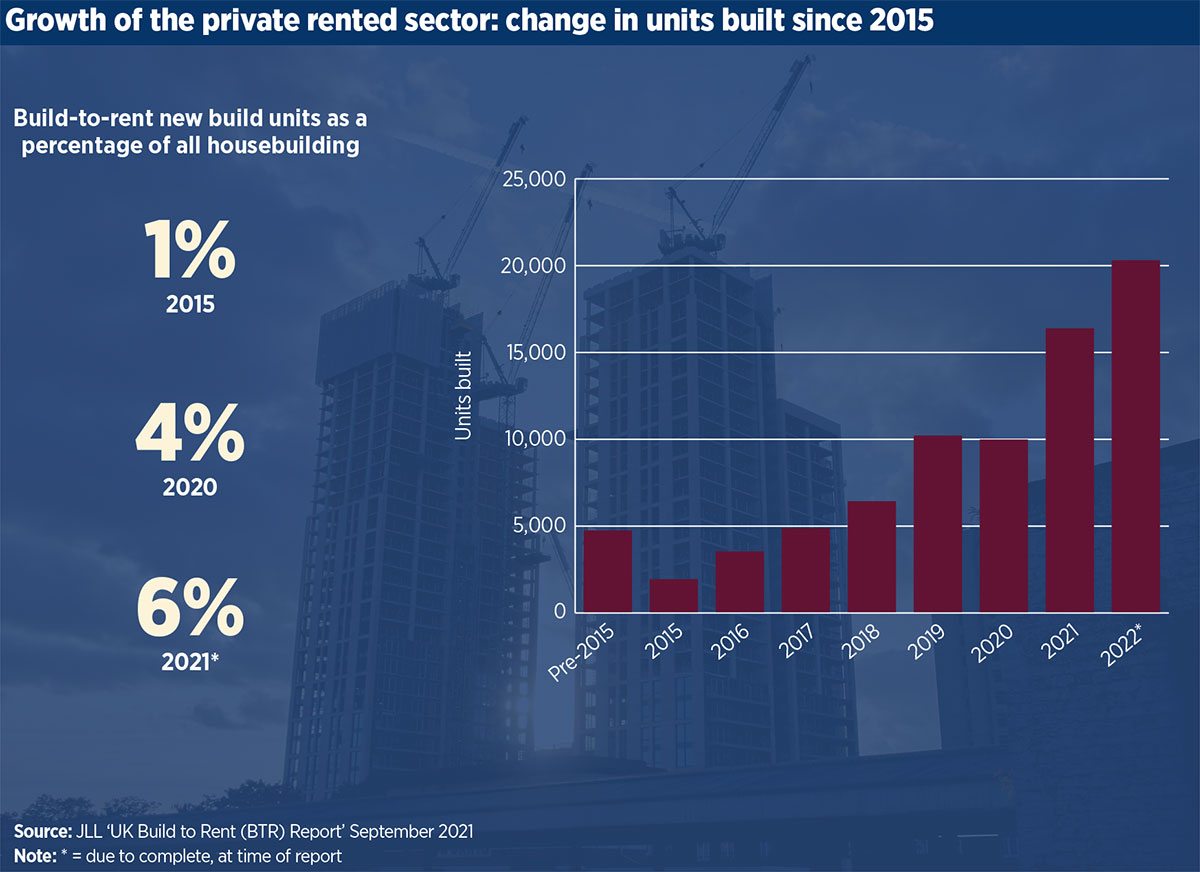

Described by JLL as the “fastest-growing sector in UK real estate”, research by the property group shows supply has increased by over 50 per cent per year since 2015. Heavyweight institutional investors and overseas build-to-rent brands such as US-based Greystar are now important participants in the market, and for some social housing providers, build-to-rent profits are a crucial part of their affordable housing cross-subsidy.

Still, the build-to-rent landscape – and, critically, housing associations’ (HAs) relationship with the sector – continues to shift. In December, MTVH sold its minority stake in Fizzy Living to Greystar in a £400m deal, while a number of HAs spoken to for this article revealed they are assessing their relationship with build-to-rent.

It begs the question, does build-to-rent remain an attractive proposition for HAs? Or is it simply too capital intensive and outside their core purpose?

Early movers into build-to-rent

“At the time [of Fizzy’s launch], there simply wasn’t a professional build-to-rent sector in the UK,” says Geeta Nanda, chief executive of MTVH. “It was something that existed in the US, Germany and elsewhere. However, in this country, institutional investors weren’t willing to build or grow something which didn’t exist.

“We realised that housing associations had the management experience and operative capabilities which would be key in making build-to-rent a success. For example, we already had key-worker housing schemes, in partnership with hospital trusts, and we already had well-developed shared ownership schemes.”

Launched soon after the financial crash, Fizzy also offered a much-needed alternative to open market sale, Ms Nanda explains. “People weren’t developing housing for market sale. However, there was still huge demand for housing and there was interest in housing from investors. So there seemed to be a real opportunity to develop build-to-rent.”

This was echoed by L&Q, which also made an early entrance into the market with L&Q PRS Co. As Waqar Ahmed, the group’s finance director, explains: “We launched our PRS vehicle around the time of the financial crisis, when there was some degree of uncertainty around the level of sales exposure that we wanted and there was a degree of uncertainty around the mortgage market. So we decided to put an alternative product out there, which was essentially market rent.”

As HAs’ portfolios grew over the years, the private sector started to enter the market. Andrew Saunderson, head of UK residential capital markets at CBRE, says: “Over time, I think what we’ve seen emerge is that the main players now in the market are generally the pension funds, so the likes of Legal & General, M&G and PIC, together with some of the property companies, such as the Graingers and the Long Harbours of this world. And that’s primarily due to cheaper cost of capital.”

“As investors continue to see this diversification element residential investment delivers, there’s still a real weight of capital targeting the sector”

While the expansion of the sector has been significant, there remains plenty of room for growth.

Chris Jeffs, a fund manager at M&G Real Estate, which runs a £1bn build-to-rent fund, says although the sector is growing at 50 per cent per year, build-to-rent only accounts for six per cent of total housing completions in the UK. He describes this as “still a very low proportion of overall completions”.

“If you look at the US model and how that’s evolved into a much more significant part of the market, I think there’s a real opportunity for built-to-rent to take more and more of the market share of total housing completions over the next few years,” he says.

“As investors continue to see this diversification element that residential investment delivers against some potentially more structural headwinds in some other commercial property sectors, there’s still a real weight of capital targeting the sector.”

This market maturity was a key driver behind MTVH’s exit, says Ms Nanda. “We felt that the sector had been established and developed and we are proud to have been pioneers in achieving that.

“By exiting when we did, we were giving opportunity to further grow the portfolio. The fact that investors wanted to purchase an entire portfolio was a real sign that the sector had matured significantly.

“Importantly, we also wanted to focus on our existing stock, maintaining and improving it, so the time was right.”

Vehicle for delivery

Whether HAs still view the sector as an attractive proposition depends on the organisation and, in some instances, the way in which they have set up their vehicles to deliver market rent.

Places for People is an example in that respect. It set up a fund and asset manager in 2017 – PfP Capital – which sits off balance sheet and enables the group to expand into build-to-rent in ways other social housing providers perhaps cannot.

“The advantage we have over some other [registered providers (RPs)] is that they have [these assets] on balance sheet,” says Alex Notay, placemaking and investment director at PfP Capital. “By setting up a fully autonomous FCA-regulated fund, [we were] able to take 1,379 units from the group into that core portfolio, [which were] individually assessed and checked with our investors.

“We were then able to give an immediate capital receipt to the group to reinvest in social value. It’s the epitome of a virtuous circle. Whereas for a lot of other RPs, if they have to do it all on balance sheet, it’s just a different risk profile,” she says.

For that reason, Places for People and PfP Capital have “huge growth plans for PRS”, says Scott Black, group executive director of development at Places for People.

“PRS will be a really key part of everything that we do moving forward,” he says.

“It will help us in our aim to smooth out the vagaries of the market, the ups and downs, to derisk our business and to create sustainable communities that will survive in perpetuity.”

Places for People has big plans to develop its programme, with a target to deliver 3,500 homes over the next three years and 5,000 homes in the next five years.

Of those 5,000 homes, the group wants 1,000 to be in the PRS. Mr Black says these will be offered to PfP Capital first, subject to the homes meeting the fund’s investment criteria.

Ms Notay says PfP Capital has £750m in assets under management across three funds – a PRS fund, a mid-market rent fund and an urban transformation partnership fund – which it is hoping to grow to £1bn by the end of this financial year, and £3bn in the next five years.

Others in the market are weighing up how best to make use of the hugely valuable build-to-rent assets they have built up over the years.

L&Q PRS Co, which has around 2,700 PRS homes worth about £1.2bn, is looking at ways to release equity from the portfolio to create more capacity for the group to develop more homes.

Expanding on this, Mr Ahmed explains the group had to scale back its growth ambitions to reinvest in its existing stock for upgrades, including building safety improvements.

“We had to restate our ambition of delivering 10,000 homes a year to 3,000. Currently we’re delivering around 4,500 to 5,000 homes a year, but that will start tapering down to around 3,000 homes,” he says.

“We don’t want to do that, we want to build more than 3,000 homes. But we have to operate within our financial parameters [so] that we know we will preserve at least that single-A space with the main ratings agencies.

“The only way we can increase development output is through creating more capacity.”

“It’s very valuable and we’re quite proud of that, but we are a housing association and it’s not our core function”

One way to create that additional capacity is via L&Q PRS Co, he says. “We own 100 per cent of L&Q PRS Co, there are no other investors. There is a third-party debt in there from the government guarantee scheme, which is administered by [ARA] Venn, but we own the shares.

“I suppose the question for us is, do we do a joint venture, do we dispose of 50 per cent of equity, do we dispose of larger chunks, or do we keep it?”

L&Q says it does not have a deadline for a decision, but it is “continuously reviewing [its] options”.

Notting Hill Genesis is also reviewing the next steps for Folio London, its market rent brand, which has around £1bn of assets, says Lizzie Stevens, director of Folio London.

“We’ve got about 3,500 units, which have grown year on year. We are actually at a bit of a stage where we’re just reviewing what we’re doing with it. It’s very valuable and we’re quite proud of that, but we are a housing association and it’s not our core function.

“We’re looking at whether we continue to grow it or scale it back a little bit and then grow it again – a sort of churn strategy. Nothing has been agreed on any of that at the minute, it’s just some of the thinking.”

She rules out a sale of the portfolio, saying “selling it is not on the cards” and adds that the group is interested in “a couple of developments”. This could mean it might dispose of certain underperforming assets or “assets which could be better placed elsewhere”.

A capital-intensive venture

In contrast, one Northern-based HA, which preferred to remain anonymous, says it has pulled back from the sector significantly. Build-to-rent had formed part of the organisation’s growth strategy, with it setting a target of delivering around a third build-to-rent, a third affordable and a third outright sale units across its schemes. However, it says its build-to-rent delivery today “is very, very low”.

It says that with greater levels of grant now available and having explored a number of delivery options on a large build-to-rent development but failing to “make it stack up”, it has turned its attention back to affordable products such as social and affordable rent and shared ownership.

“PRS was right up our street a few years ago when we had a different view on the world, but about three years ago, we took a very clear view that affordable was going to be the way forward for us,” the organisation told Social Housing.

“PRS was right up our street a few years ago when we had a different view on the world, but about three years ago, we took a very clear view that affordable was going to be the way forward for us”

Greg Campbell, a partner at Campbell Tickell, the consultancy, suggests there is a degree of reticence from some in the sector to take risks on commercial activities, including build-to-rent.

“We have a WhatsApp group with around 200 housing CEOs from the UK and Ireland, and there was a debate recently about whether people should be looking at opportunities that are outside core business as ways of generating income at a time when money generally is under pressure.

“Their pretty strong conclusion was to stay away from it unless you’re certain you can generate profit, and that even extended to organisations that run their own maintenance services.”

For Plumlife Homes and Cube Homes, the commercial arms of Great Places, build-to-rent is too capital intensive. Instead, the businesses favour market sale. Chris Heath, managing director of Cube Homes, describes market sale as a “much better use of the available capital”, adding that “it gives a better return”.

“On development [for sale], you get return on capital employed from anything from 20 per cent to 30 per cent, whereas your return on capital employed, if there is no external debt, in respect to rental property would just be your letting margin, which might be four or five per cent.”

However, Caroline Millington, director of private sector management at Plumlife Homes, says the group is interested in doing more build-to-rent management contracts.

“We [carried out] a management contract for quite a big institutional investor for 196 apartments as a built-to-rent model. They employed us to manage them.

“As an institutional investor, they wanted the yields without necessarily wanting to do the day-to-day management, so that’s where we’ve stepped in, and we’re having continuing conversations with that client about future projects as well,” she says.

Mr Heath injects a final word of caution around build-to-rent.

“There are challenges ahead, as construction cost continues to grow, inflationary pressure continues and new building regulations [and Energy Performance Certificate] changes come through,” he warns.

“If costs increase, but your rental levels don’t increase correspondingly, you may get to a point where it might be very difficult to build an asset that will actually generate the return you need.”

Food for thought, perhaps, for those involved in build-to-rent. Although, there was a recognition by everyone spoken to for this article that elements of build-to-rent are crucial to creating balanced communities and will continue to form – even if in small numbers – part of their housing delivery.

RELATED