L&Q: it’s time for ‘creative solutions’ to fill the funding void

With cross-subsidy in question, Waqar Ahmed tells Luke Cross why L&Q is exploring other ways to help fill a funding void

L&Q is primed to explore “creative solutions” to help fill a funding void created by increased investment in existing homes and its commitment to new build ambitions.

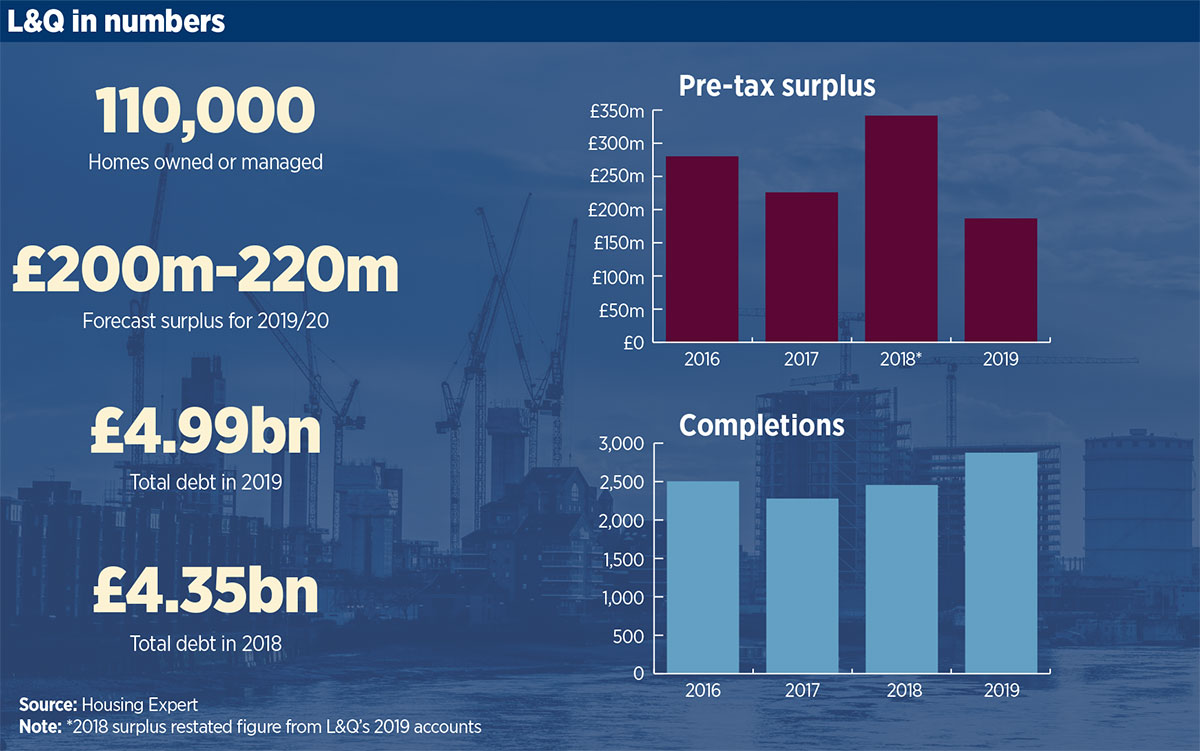

A decision to “eat into surpluses” and improve the quality of its properties is making the 110,000-home association with the sector’s biggest balance sheet think differently about potential equity funding and stock rationalisation.

Between now and March, L&Q’s finance team is set to take ideas to the group’s board to help the organisation meet all its social objectives, including ways to continue on a trajectory towards 100,000 new build homes.

While L&Q’s forecast surplus for 2019/20 remains at a healthy £200m-£220m, it is £50m below budget following a “conscious” decision to invest in health and safety – resulting in an annual increase of £70m to its maintenance budget – along with pressure on its sales activity, where its 25 per cent margins have fallen below its hurdle rate of 15 per cent. It has paused new scheme approvals and is “re-appraising existing commitments”.

“You’ve got to look at the need to improve build quality, to tackle social stigma by improving void standards and investing in communities, and the need to recognise the market is not as buoyant as it was a few years ago”

In addition to cladding removal costs – having identified 15 blocks with aluminium composite material (ACM) cladding that needed to be removed – L&Q is now spending £7m a year on waking watches alone. ‘Intrusive’ surveys are being carried out in 150 buildings.

Waqar Ahmed, group finance director, tells Social Housing that the uncertain operating conditions combined with meeting higher standards across L&Q’s homes means a conversation is needed with government about how much grant should support health and safety programmes and the grant rate per unit for sub-market rented homes, “recognising that cross-subsidy is not a given any more”.

“You can’t isolate this as just looking at fire safety – you’ve got to look at the need to improve build quality, to tackle social stigma by improving void standards and investing in communities, and the need to recognise the market is not as buoyant as it was a few years ago.”

He adds: “[It] will require L&Q to think differently around the balance sheet and funding opportunities and initiatives, and it will require a more flexible conversation with government around their role in terms of equity and grant.”

But it will also require a conversation with the housing industry about partnerships, building better-quality components and joint ventures with other housing associations, as L&Q looks for ways to invest while meeting its capacity-risk model.

He adds: “If we can’t use our balance sheet, we would talk to others about using their balance sheets – hence other strategies around asset management, looking at off-balance-sheet structures [and whether there is] a role for equity. All of those are coming into play.”

Mr Ahmed says that if the government is serious about its supply ambitions, it needs to provide direct grant funding.

“We want to talk about genuine joint ventures with the Greater London Authority and Homes England – so shared equity”

“We want to have a much wider conversation than just grant per unit; we want to talk about genuine joint ventures with the Greater London Authority and Homes England – so shared equity.”

The group finance director says the commitment to get to 10,000 new build completions per year – and 100,000 homes over a decade – still stands, by working as an enabler through L&Q Estates, joint ventures with house builders, and L&Q’s in-house construction arm. Sixty per cent of the London pipeline will be social housing, along with 50 per cent outside the capital.

But with current grant levels insufficient to subsidise social housing, there is a need to generate the income somewhere else.

He adds: “Concerns ratings agencies have about the sales market, combined with the slowdown we are seeing in London and the South East, will mean we are not able to significantly increase private sales – so where does that cross-subsidy come from?”

One potential route is to follow the likes of Clarion into a large-scale stock rationalisation programme that would return L&Q about £1bn that it could reinvest in existing and new homes.

L&Q now has a footprint beyond London and the South East through its acquisitions of Trafford Housing Trust and Gallagher Estates, and could review areas where it does not have critical mass, and where it “may be better for [other social landlords] to manage those assets”.

Mr Ahmed says: “We’re at the beginning of the conversation. But it helps other housing associations use their balance sheet to grow, creates capacity for L&Q to invest in growth – it might be a model we explore as well.”

Subject to the parameters of core and non-core, Mr Ahmed says he “wouldn’t be surprised” if at least five per cent of L&Q’s homes, or 5,000 properties, were used to generate an estimated £1bn of income. It would mean retaining its stronghold in areas such as Lewisham, Newham, Greenwich, Waltham Forest and Trafford, but disposing of clusters of 200 properties in areas that do not feature in its long-term development plans.

“We don’t see any value in redistributing social housing surpluses out of sector and outside of communities”

He adds: “We would only sell to not-for-profit social housing providers. We would only sell to like-minded organisations who want to preserve housing in perpetuity. We don’t see any value in redistributing social housing surpluses out of sector and outside of communities.”

Despite embracing new ways of working, there will continue to be a financial impact for L&Q over the next two to three years.

While it was forecasting EBITDA interest cover around 300 per cent, this now sits at around 175 per cent, forming one of six metrics the finance team uses to assess the group’s position.

“In a post-stress test scenario, if our view is that we’re not in a single A, we would have to adjust the financial plan – that will mean reducing development, but that won’t mean reducing health and safety, or reducing our obligations to improve customer service and the quality of homes.”

Click to view larger image

Despite looking to alternatives such as equity partnerships, banks and the bond market continue to dominate the £6bn treasury strategy.

To date, L&Q’s funders and investors – who are used to seeing L&Q outperform its forecasts – have been asking about the direction of travel for the group’s 100,000-home pipeline in a more uncertain environment, how much sales risk the group is prepared to take and what L&Q’s situation means for the wider sector.

While there is a pause on new developments, Mr Ahmed says the group still has access to 100,000 plots, half of which is within L&Q and the rest of which is in L&Q Estates – formerly Gallagher Estates. However, it has slowed the plan to climb from 5,000 to 10,000 completions a year.

He also says there is flexibility in the programme to change tenure mix, the rate of construction and the regional spread – with half the pipeline outside London.

It is also split between apartments and houses, with flats in London typically within six-storey buildings and above, with some high rise “but the majority at medium height”.

“It’s a relatively de-risked programme and [investors] take a lot of comfort from that,” he adds.

“In two years’ time, L&Q will be back to restoring a higher level of surpluses”

Mr Ahmed also maintains that, despite commentary on the London market being over-exposed, the city is still growing while suffering from a chronic shortage of housing supply – meaning that any slowdown “can’t be permanent”.

Surpluses are not expected to fall further, but instead stabilise before increasing again.

As the group moves into the next year’s plan, it will have provided for exposure to health and safety, and taken a “more prudent view” on the sales market.

“We see it as a short-term issue – in two years’ time, L&Q will be back to restoring a higher level of surpluses generating more capacity for growth and pushing back up the development pipeline.”

This will be bolstered by the return to a Consumer Price Index plus one per cent rent regime in 2020 and the investment made in existing homes, despite net expenditure in maintenance remaining higher than before.

That means Mr Ahmed has his sights on a return to a 50 per cent social housing letting margin in three years’ time.

“We’ve made conscious decisions to invest more in the quality of homes, the safety of residents and the digital agenda – and we’re eating into our surpluses to do that”

While it continues to seek efficiencies and deliver an operational transformation, it will be growing its workforce rather than streamlining it – and there are no changes at the top either.

Mr Ahmed also rejects any comparison to a plc-style approach to what some have described as “profit warnings” over the past year.

“When a plc makes a profit warning it is essentially saying to investors, ‘You may not get your expected yields and dividends from this organisation.’ L&Q doesn’t make profits – we make surpluses. And we reinvest every single penny of those back into our business.”

He adds that part of the surplus fall is down to the housing market and “outside the control of any one individual”.

“We’ve made conscious decisions to invest more in the quality of homes, the safety of residents and the digital agenda – and we’re eating into our surpluses to do that.

“We can make that decision because we are a long-term investor, a social business and we make surpluses for a purpose – we are a not-for-profit. We don’t have the same objectives [as a house builder], we do not build short-term assets – we are a housing association, not a house builder.”

RELATED