Sector assesses full impact of expelled Tri Fire engineer on loan securities

Registered providers, advisors and lenders are working together to assess the impacts of the expulsion of Tri Fire’s Adam Kiziak from the Institution of Fire Engineers, as some housing associations are understood to be seeing their loan securities affected. Michael Lloyd reports

Social Housing has spoken to a range of stakeholders to understand the impacts on the sector, following the expulsion of Tri Fire’s Adam Kiziak from the Institution of Fire Engineers (IFE) with immediate effect on 7 February.

The decision to expel Mr Kiziak came after the body confirmed in November that it had suspended his IFE membership and Engineering Council registration for breaches of the code of conduct.

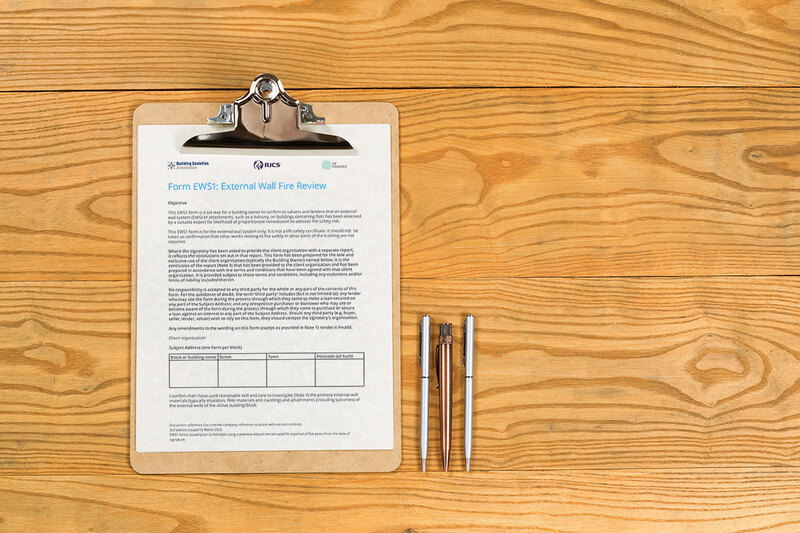

Tri Fire was one of the firms that carried out External Wall System 1 (EWS1) checks on buildings in the sector. The EWS1 process and form are intended to enable building owners to confirm to lenders or valuers that the external wall system has been assessed for safety by a suitable expert.

Housing associations may face a problem from this on two fronts. Some could have leaseholders encountering difficulties selling their homes that had EWS1 certificates signed by Tri Fire. Some could own properties that have EWS1 certificates signed by Tri Fire, which for some have also been charged as loan security.

A “significant” number of associations are seeing their loan securities affected, according to one lawyer, while another described the ramifications for the sector as “widespread”. Other advisors spoke of steps being taken to ascertain just how widespread the impact will be.

‘Widespread ramifications’

Marc Burns, director and co-head of affordable housing loan security valuation at JLL, said: “We haven’t got absolute numbers, but we’ve heard anecdotally that about 3,000 blocks have been signed off by Tri Fire in both the private and social sectors.”

“Now, of course, not all of those blocks will be used as security against loans. We’re very much in a holding pattern situation at the moment where we are information-gathering.

“So, we are reviewing our valuations, and we are speaking to borrowers to understand how many blocks were signed by Tri Fire, and we have been contacted by lenders conducting their own internal investigations into this. We are waiting for the outcome of those investigations from the lenders, and we’ll wait for their instructions on the next steps.

“Lenders are very much information-gathering and considering the next steps internally and affected RPs [registered providers] are speaking to their lenders on this matter as well.”

Mr Burns added that JLL will be due to revalue portfolios that may include blocks with Tri Fire EWS1 forms issued in the coming months.

Richard Petty, head of residential valuation at JLL, said he understands that Tri Fire has issued several hundred EWS1s in the sector.

“We have found over 500 [Tri Fire] forms so far in our own files for buildings valued over the last five years for charging purposes, but that is not to say we have identified every single one,” he said.

“I think it would be very helpful for the IFE to confirm how many EWS1s Tri Fire has issued and how many of those were not properly signed off or issued. We want to know how big the box of apples is, and we need to know how many are wrong.”

Charlotte Ingram, associate at Devonshires, said that the law firm is working with a “significant” number of housing association clients affected by the issue of Tri Fire-issued EWS1 forms for properties used for loan security.

“At the moment, it’s very much a case of working collaboratively with our clients and the lenders, who are still assessing the extent of the issue and how widespread it is [in terms of how many certificates Tri Fire has issued in respect of the number of properties],” she said.

Susie Rogers, security charging partner and head of portfolio transactions at Capsticks, said the “ramifications of the suspension of Adam Kiziak by the IFE have been widespread in the social housing sector”.

She added that several RPs, which are generally London-based, are “dealing with the fall-out”.

Ms Rogers said Capsticks is aware of several funders that are reluctant to lend against buildings with EWS1s provided by Tri Fire and this is causing problems for RPs and for residents living in those blocks.

“It is adversely impacting the buying and selling of those properties – but the repercussions are further reaching than that,” she said.

“At present, we are seeing an impact on new security charging of property portfolios because EWS1s from Tri Fire are unlikely to be accepted.

“This, in turn, might make it increasingly difficult to charge those properties at this point in time.”

Ruby Giblin, partner at Winckworth Sherwood, said that she was working on a tranche of a private placement for a recently completed deal, in which two per cent of the stock portfolio charged as loan securities were affected by Tri Fire EWS1 fire safety assessments.

She said that an EWS1 is required by the funders as a condition precedent, which is one of the conditions that must be satisfied before a loan can be made.

“Even though they are concrete buildings unlikely to have building safety issues, they have been given nil value, until new EWS1 certificates can be issued, but there are very few fire engineers qualified to issue them, so it could be a while,” Ms Giblin said.

“They could substitute new properties, but in this instance, there is no time.”

Investigating the full impact and working with lenders

Social Housing understands that lenders are working with housing associations to understand the degree of exposure. For some housing providers this will not be a big issue at all, whereas others may have pockets of properties that were assessed by Tri Fire.

Where landlords are affected, there will be a conversation with their lender to find a solution.

Mr Petty said that for affected loan securities, once lenders have identified how many buildings they have got in charge with how many different customers who have EWS1s given by Tri Fire, they have three options.

Lenders could wait for the existing EWS1 form to be replaced, as these are replaced every five years, and accept the current loan security, he said. No one would now accept a Tri Fire EWS1 form for new loan securities, he added.

Another option is funders declaring the security as nil until there is a replacement certificate.

“We have not seen anybody reach that decision yet, but it’s possible that they will,” Mr Petty said.

Mr Petty added that the third and “most extreme option” is to ask for a replacement security straight away because those existing buildings are no longer acceptable as security because of the EWS1s by Tri Fire.

He said replacement security, if it is available, is “probably going to be the quicker but more expensive solution” than obtaining a new certificate.

Mr Petty said that how quickly a landlord can replace an EWS1 will depend on the supply of fire engineers in the market and because there aren’t many, it could take weeks or months to get a new certificate.

“We haven’t seen any bank yet come down [publicly] on which of those three options it will take; there are clearly implications for security and for cost and for disruption in the market,” he said.

“But what we’re trying to do when we give an opinion of the value is to say what we think the portfolio of assets would sell for today, and the markets at large would not react well to an EWS1 given by Tri Fire.

“So, I think you probably would find it difficult to sell a building with a Tri Fire EWS1 at the moment, in which case, I think the most sensible option is probably giving a nil value to those buildings until you’ve got better and further information and get those certificates replaced by another provider as quickly as possible.”

Mr Petty said he believes “we will start to see some problems emerging in the coming weeks”, depending on how individual banks decide to deal with the matter.

“I think generally from our conversations with lenders and other stakeholders, there’s a general desire to be pragmatic here and to keep the market moving and to deal with each case on its merits, rather than start to panic or have a blanket response to anything,” he said.

Capsticks’ Ms Rogers said that for properties already in charge, RPs, valuers, funders and solicitors are working together to assess the impact and find a way forward.

“It is vital that RPs work closely with their investors and valuers before the portfolios come up for re-valuation, in case additional security is required because valuations are adversely affected,” she said.

“We work with several RPs who have cut ties with Tri Fire and who are working collaboratively with valuers and lenders to minimise the impact – including for residents.

“RPs are proactively seeking to get buildings re-certified as quickly as possible, but the scarcity of qualified fire safety engineers is impacting timescales, including where remediation works are required as those works specifications might need to be re-assessed.

“The situation is also putting an additional burden on valuers and, although the sector’s valuation firms are rising admirably to the challenge, RPs do need to be mindful of timescales.”

Ms Rogers said the situation is proving “challenging” for RPs, particularly if they are operating under threat of a remediation order under the Building Safety Act 2022.

Remediation orders under the act ensure that essential remediation work required to remedy relevant defects takes place without delay. Regulatory bodies and leaseholders can apply to the First-Tier Tribunal for a remediation order to compel a relevant landlord to remedy relevant defects by a specified time.

“In our experience, RPs are actively looking to remedy the position and are keen to support individual residents wherever they can, for example allowing shared owners to sub-let affected properties in certain circumstances,” Ms Rogers said.

Trade bodies

Victoria Moffett, head of building and fire safety programmes at the National Housing Federation (NHF), said that housing associations are working to identify where they need to review any work carried out by Adam Kiziak and Tri Fire.

She added that the NHF is “working closely” with its members to understand the full scale and impact of this evolving situation on them and their residents.

“Housing associations are doing all they can to minimise the impact of this issue on their residents and ensure any issues regarding EWS1 forms are resolved as quickly as possible,” Ms Moffett said. “We would urge any leaseholders affected to speak to their mortgage provider and their landlord.”

Fiona Fletcher-Smith, chair of the G15 and group chief executive at L&Q, said that Tri Fire is “one of the largest” building safety inspectors in the country, and has therefore provided services to “several members of the G15”.

“We’re very sorry for the impact that [Tri Fire’s] alleged actions [are] having on residents, in particular those who have had the sale of their homes interrupted,” she said.

“Our priority is putting measures in place as quickly as possible to reassure residents about the safety of their homes, and our members are focused on their individual plans to do this.”

A spokesperson from UK Finance, a trade body for the UK banking and financial services sector, said that it is engaging with the IFE and other industry bodies on the implications of Mr Kiziak’s expulsion for fire risk assessments and related EWS1 forms he has provided.

“Until there is clarity on next steps for the IFE and building owners as clients of the expelled fire engineer, mortgage lenders will make their own decision on whether they accept EWS1 forms completed by Mr Kiziak,” a spokesperson said.

“Anyone concerned about their property’s safety should speak to their building managing agent or building owner.”

In its latest statement online, the IFE said that it shares the concerns around the activities undertaken by Mr Kiziak, and that following a thorough investigation and in accordance with its disciplinary process, “he has rightly been expelled from the Institution of Fire Engineers (IFE) and his membership status has been revoked”.

“We have followed the appropriate processes throughout this case and have investigated all actionable complaints in a timely manner,” the IFE said in the statement.

“When complaints are made, we review these to consider the initial evidence and subsequently conduct a comprehensive investigation to arrive at just and proportionate findings. In this case, the findings resulted in Mr Kiziak’s suspension from the IFE and, ultimately, his expulsion.

“Throughout the formal disciplinary process, we have worked closely with relevant partners including the Ministry of Housing, Communities and Local Government, the Royal Institution of Chartered Surveyors [RICS], the Engineering Council, Institute of Fire Safety Managers and the National Housing Federation.

“An expulsion is the strongest sanction we are able to enforce on members who violate our code of conduct. Like many other professional bodies, we do not have powers of redress or access to further sanctions.

“We do, however, recognise that there are building owners and leaseholders looking for answers and solutions. We strongly urge Tri Fire to promptly engage in a dialogue to resolve any outstanding concerns.”

The IFE also pointed to its FAQs page on the investigation and its outcome.

Within this, the IFE said it is “not responsible for keeping and [does] not keep a register of all buildings inspected, or of any other work undertaken, by individual members of the IFE”.

“It is also important to note that Mr Kiziak’s expulsion does not automatically invalidate his historic assessments,” the professional body said online.

“Buildings that were inspected will name Mr Kiziak and/or Tri Fire. Owners or leaseholders who would like further reassurance should contact Tri Fire directly, or appoint another assessor for a second opinion.”

Social Housing asked the IFE and RICS about the reported shortage of fire engineers qualified to provide new EWS1s.

Gary Strong, head of professional practice, building at RICS, said: “Training interventions made by RICS to significantly increase the number of RICS members and other professional body members including IFE members who can carry out FRAEWs [fire risk appraisal of external walls] and EWS1 forms for low and medium-rise buildings up to 18 metres will ease the difficulties that building owners might find themselves in with having to seek professional advice.”

Mr Strong pointed to further information available on RICS’s website on EWS1 forms, as well as RICS’s list of course completers.

‘Crucial that social landlords prioritise building safety’

A spokesperson for the Regulator of Social Housing said: “We cannot comment on individual issues.

“However, it is crucial that social landlords prioritise building safety in order to ensure tenants are safe in their homes. If they have any concerns about EWS1 assessments, they should seek appropriate professional advice.

“If housing associations find any issues, they should alert these to all relevant stakeholders, including lenders.”

A spokesperson from the Ministry of Housing, Communities and Local Government said: “We are clear that all cladding and remediation works should be carried out to the highest safety and quality standards.

“Social landlords are responsible for making sure that fire safety reports for their buildings are fit for purpose. If a social landlord has successfully applied for government funding to remediate their building, the fire safety reports for that building will have undergone stringent audit.”

Matt Cowen, senior associate at Winckworth Sherwood, said that from a governance perspective the primary focus of affected RPs must be to “urgently” take steps to assure themselves of the safety of tenants living in any properties that may have been the subject of unreliable fire assessments or surveys by Tri Fire.

“If the RP owns a large number of affected units that will take time to reassess in full, it may be that, in the short term, the RP considers undertaking a desktop review of the existing Tri Fire assessments/surveys by qualified professionals to pick up any major flaws which might bring into question tenant safety,” he said.

“Furthermore, clear and proactive communication and engagement with affected parties, especially tenants who may not be able to secure a mortgage or sell their property, is essential, noting in particular the requirements of the Transparency, Influence and Accountability Standard.”

Housing associations

Social Housing contacted 20 of the largest housing associations in England by stock (excluding care providers) based on our Accounts Digest for 2023-24.

Out of a total of eight responses, four responded to reveal that they have used Tri Fire and to discuss the possible impact on leaseholders and the mitigation they are putting in place. None reported an impact on loan securities.

Three landlords said they were unaffected by Tri Fire assessments, while one said it will review the findings of the IFE’s investigation.

Notting Hill Genesis (NHG) said that Tri Fire was one of the fire engineers it worked with to secure EWS1 forms for its buildings.

Following the suspension of Mr Kiziak, the landlord decided to stop working with Tri Fire, and has started the process of obtaining new EWS1 forms for all buildings affected, prioritising those where ongoing sales may be impacted.

NHG said there has been no impact on its loan securities and instead its key concern is the effect on leaseholders.

“Our key concern is the effect this has had on leaseholders who are in the process of selling their homes, but [we] have also focused on reassuring everyone living in these homes that the need to replace their EWS1 form does not reflect upon the safety of their building,” a spokesperson from NHG said.

“We have reiterated that we have a thorough system of checks, investigations and safeguards carried out by surveyors and building safety experts to ensure the safety of our residents and buildings.

“We are aware of ongoing sales that are impacted, and we are working with affected leaseholders to expedite their case as best we can, given the high demand in the sector. There has been no impact on our loan securities and our funders are aware of the approach we have taken. Our priority at this time is providing new EWS1 forms as quickly as we can.”

Clarion Housing Group cited the impact of Tri Fire assessments on leaseholders.

“We recognise this situation will be concerning for some homeowners and we are working at pace to provide support and clarity to those affected,” a spokesperson said.

“We are already undertaking a fire risk appraisal of external walls (FRAEW) programme, which supersedes EWS1 certificates,” the spokesperson said.

An FRAEW can satisfy legal obligations under the Fire Safety Act 2021. This act requires landlords to consider the risk of external fire spread in their buildings.

It also replaced previous building safety advice that could be used for issuing EWS1s that was withdrawn in January 2022 to ensure it could no longer be used to justify disproportionate risk assessments of external wall systems.

“And while there are some buildings remaining where an EWS1 certificate from Tri Fire is the only assessment that we presently have, we are looking at available reassessment options as a matter of urgency,” the spokesperson from Clarion said.

“In the meantime, we can provide landlord certificates to those affected in buildings over 11 metres confirming that no remediation costs will be passed on for any relevant remedial works, as well as letters of comfort to reassure lenders.”

L&Q said it is working with an independent panel of fire engineers to review any building inspections conducted by Tri Fire at its buildings.

“Where the panel is not satisfied with their report, we will instruct a new inspection of the building as soon as possible,” the 105,000-home landlord said in a statement online.

“We will be writing to residents in affected buildings to let you know what will happen and when.”

The landlord said it is “very sorry” to hear that some residents are now struggling to secure a mortgage, as some lenders are rejecting EWS1 forms issued by Tri Fire.

L&Q said that if a resident or its potential buyer have been affected by a lender raising concerns with a Tri Fire certificate, they should email the landlord’s fire safety engagement team as soon as possible.

The landlord added that it will work with residents and their mortgage lenders to support them through this process.

Peabody said it stopped working with Tri Fire last year.

The 108,000-home landlord said in a statement online: “Some lenders are now rejecting EWS1 forms issued by them. This is making it difficult for some residents across England to remortgage or move house.

“Like many other housing associations, we’re recommissioning certificates, where appropriate, using different fire engineers. We’re working on a risk and height-based approach to double-check our tall buildings first.

“We’re also here to support anyone who is involved in a transaction to sell or remortgage and needs urgent clarity. We’ll continue to support residents through this situation, working with you and your lenders to find a solution.

“We want to assure you that we’re talking to sector organisations to try and help in resolving this complicated issue which is affecting residents across the country.”

Meanwhile, Sarah Stevenson, director of building safety and compliance at Stonewater, said: “We will review the findings of the IFE’s investigation into the complaints once it has concluded.”

Tri Fire and Adam Kiziak have been approached for comment.

Recent long reads from Social Housing

Waqar Ahmed’s parting request to the banking sector? ‘Take some more risk’

As he looks to step away from the financial helm of L&Q, 27 years after joining the group, Waqar Ahmed speaks to Sarah Williams about massive growth, major restructuring, Westminster’s “most stupid decision” and why the sector’s lenders must (finally) take on more risk

‘It was really the credit crunch that was our making’: Piers Williamson on two decades at THFC

After 22 years at the helm of sector bond aggregator The Housing Finance Corporation, Piers Williamson sits down with Sarah Williams to talk through two decades of turnaround, transactions and traversing market turbulence

‘It’s not something we would ordinarily do’: why the RSH made a payment to a failing provider

At the start of 2023, the English regulator exercised a power it had not used for more than two decades: it gave direct financial assistance to a struggling housing association by providing liquidity support. Sarah Williams reports

Devolution and housing in England – where are we now?

As the Labour government firms up plans for its next set of devolution deals, Social Housing looks at what settlements to date have meant for housing, and what is needed to do more. Robyn Wilson reports

Under the radar? Why housing providers need to talk about fraud

Data on the volume, types and cost of fraud to the social housing sector is hard to come by. Keith Cooper hears from providers and experts about why that matters – and what we do know about recent trends in fraudulent activity

Captive insurance: why more than 15 housing associations are exploring the approach

Michael Lloyd investigates what captive insurance entails and whether it could provide an answer to the sector’s challenges in this area, as Social Housing learns that at least 15 associations are exploring the approach

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED