Special report: level of affordable lettings drops for third year in a row

Affordable rent lettings reduce by 1.49 per cent, but decrease is less than in previous two years. Chloe Stothart and Robyn Wilson report

The level of affordable rent lettings by housing associations in England has dropped for a third consecutive year. At the same time, the average affordable rent rates across the country in 2018/19 saw marginal change on the prior year, with swings of between one and two per cent up or down across most regions.

One exception was in the South East where average rent rates decreased by more than four per cent to £150.99 per week. In contrast, this region last year saw a near-eight per cent increase in affordable rents. The other exception was in the North West, where affordable rent was static at £102.73.

Social Housing’s analysis – which is based on figures from the Regulator of Social Housing’s 2019 Statistical Data Return (SDR) – has shown that the number of affordable rent lettings reduced by 1.49 per cent to 41,709, from 42,338.

This marks the third year in a row that affordable rent levels have dropped in England – albeit the reduction was smaller than in the prior two years, when levels dropped by more than five per cent respectively.

Both affordable and social rents have been subject to the four-year, one per cent annual rent cut, which ended in April 2020.

Affordable rent was introduced by the coalition government in 2010 to enable providers to charge up to 80 per cent of market rents. The idea behind the policy was that housing associations could use the additional income generated by the higher rent rates to offset the impact of lower government capital subsidy, which was slashed to £4.5bn from £8.4bn during the previous review.

Affordable rent became central to the government’s Affordable Homes Programme 2011/15 – with hopes that the policy would help to meet an affordable homes delivery target of 150,000 – while social rent was scaled back as a tenure. Some development programmes also relied on conversion of social rent to affordable rent to be financially viable.

Subsequent grant programmes placed greater emphasis on shared ownership and social rent, which may have contributed to the three-year decline in the number of affordable rent lettings.

Conversion to affordable rent from social rent fell by its largest ever amount, dropping nearly 52 per cent in 2018/19 to 4,673 units compared with falls of around a quarter for the preceding two years.

A total of 38 associations that converted homes from social to affordable rent in 2018 did not make any conversions in 2019. A further 48 cut the number of conversions by half, while 23 organisations made more conversions in 2019 than in the year before, but only 13 of these increased conversions by more than 10 per cent.

Total general needs lettings, including affordable rent, went down to 168,840, having bucked the trend by rising in 2018. The number of affordable rent lettings also fell, by 1.49 per cent, but remained steady as a portion of general needs lettings at 24.7 per cent.

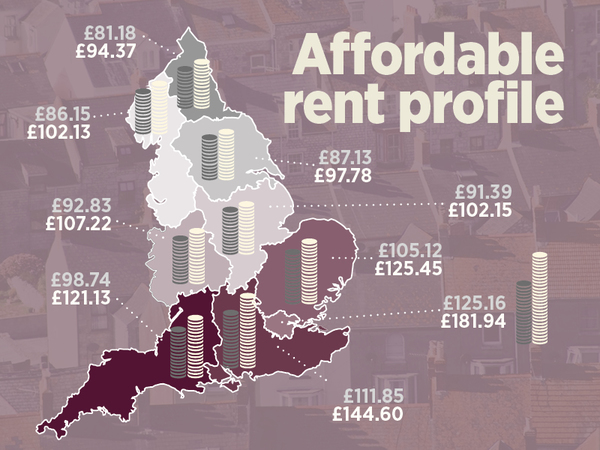

There was a marked difference between the North and the South in average affordable rent levels. The North East had the lowest average affordable rents overall at £95.93 per week; this compared with an average £77.88 weekly rent for its general needs stock.

Average weekly affordable rent levels remained highest in London, unsurprisingly, at £184.40 per week. The percentage difference between affordable and general needs rents was also highest in the capital at nearly 53 per cent.

A number of London associations have highlighted the unaffordability of affordable rent in the capital. In 2018/19, Peabody announced that it had begun converting its affordable rent homes to London Living Rent, which is roughly two-thirds of market rent. The gap between the average affordable rent in London and the next most expensive region, the South East, was 22 per cent compared to a 12 per cent gap in general needs rents between the areas. The gap between general needs and affordable rents was smallest in the East Midlands at nearly 19 per cent.

Summary of affordable rent lettings

| Affordable rent lettings | ||||||

|---|---|---|---|---|---|---|

| Affordable rent lettings | Change on year | Conversions to affordable rent | Other general needs lettings | Total general needs lettings made in year | Affordable rent as a % of total general needs lettings | |

2011/12 | 6,024 | n/a | 4,533 | 175,853 | 181,877 | 3.3% |

2012/13 | 29,793 | 394.57 | 23,877 | 148,581 | 178,374 | 16.7% |

2013/14 | 38,647 | 29.72 | 25,930 | 154,898 | 193,545 | 20.0% |

2014/15 | 45,668 | 18.17 | 21,306 | 151,736 | 197,404 | 23.1% |

2015/16 | 47,173 | 3.30 | 17,216 | 147,971 | 195,144 | 24.2% |

2016/17 | 44,645 | -5.36 | 12,754 | 122,344 | 166,989 | 26.7% |

2017/18 | 42,338 | -5.17 | 9,648 | 129,308 | 171,646 | 24.7% |

2018/19 | 41,709 | -1.49 | 4,673 | 127,131 | 168,840 | 24.7% |

Source: Regulator of Social Housing, Statistical Data Return 2012 to 2019

Affordable rents in the four most expensive regions – London, the South East, the East of England and the South West – fell in 2018/19.

The 2019 SDR said higher general needs rents in the South reflected higher formula rents in these areas, which in turn follow higher property values and county-level earnings. The difference in affordable rent is mainly down to variations in private rent levels around the country. These regional figures compared with an average national gross rent of £126.94 per week for affordable rent homes as published in the SDR.

Richard Petty, lead director – Living Advisory at JLL, said his colleagues were seeing more London Living Rent properties coming though rather than affordable rent in the capital. He said some associations in London were reducing affordable rent levels or reverting to social rent instead. “We understand the average affordable rent was about 65 per cent of market rent across London, even in the early days of affordable rent, and our understanding is people are pulling back from that and coming in lower,” he added.

He also cited a planning decision in November 2019 in which a London authority chose to have fewer affordable units in order to get a marginally lower rent.

Some developers of build-to-rent schemes were including some London Living Rent units to meet their affordable housing quota without having to bring in a registered provider to own the affordable units, he said.

Summary of affordable rents compared with general needs rents, 2018/19

| Average £ per week | |||

|---|---|---|---|

| Region | General needs | Affordable rent | Affordable rent margin on general needs |

| East Midlands | 87.39 | 103.88 | 18.9% |

| East of England | 98.85 | 131.19 | 32.7% |

| Greater London | 120.60 | 184.40 | 52.9% |

| North East | 77.88 | 95.93 | 23.2% |

| North West | 82.14 | 102.73 | 25.1% |

| South East | 107.53 | 150.99 | 40.4% |

| South West | 92.13 | 121.23 | 31.6% |

| West Midlands | 88.58 | 108.18 | 22.1% |

| Yorkshire and the Humber | 81.57 | 98.63 | 20.9% |

Note: All rents for owned, self-contained stock. Affordable rent and general needs exclude higher-income social housing tenant rents

Source: Regulator of Social Housing, Statistical Data Return 2019

Affordable rent lettings: 50 highest RPs as at 31 March 2019

The top 10 housing associations with the highest number of affordable rent lettings made in 2019 brought up similar names to last year, with Home Group, Clarion, Jigsaw (before the merger with New Charter), Riverside, Orbit, Together and Guinness all appearing in Social Housing’s previous report.

That said, 50 per cent of the top 10 had reduced their number of affordable rent lettings, with the biggest drop coming from Clarion (-43 per cent) to 1,229 lettings. This reduction topped last year when its affordable rent lettings dropped by 35 per cent. On this, a spokesperson for the group said: “Clarion operates in over 170 local authorities and manages 125,000 homes, the vast majority of which are let at social rents.

“Homes for affordable rent form a small part of our overall portfolio and while we saw a reduction overall in new lettings in 2018/19, this simply reflects the fact that fewer households living in this tenure chose to move from their Clarion home.”

Platform was a new addition to the top 10, with 1,013 affordable rent lettings, although the housing association was formed from a merger between Fortis Living and Waterloo Housing in 2018, the latter of which was in the top 10 last year.

Riverside, Orbit and Guinness all reduced their affordable rent lettings, albeit Guinness’ reduction was smaller (at three per cent), compared with Riverside’s near-20 per cent reduction and Orbit’s drop of 14 per cent.

Home Group topped the list this year, compared with last year when it came second. The housing association had a total of 1,323 affordable rent lettings, which was down nearly 17 per cent on 2017/18 figures.

On this, Joe Cook, the group’s executive director of development, said there were a number of factors that have a bearing on the figures, including the phasing and timing of when properties are completed and let, as well as associations’ development programmes.

“For Home Group, we are driven by providing our customers with the right homes in the right places at the right costs – whether that’s for social rent, affordable rent, outright sale or shared ownership. These numbers and percentages are not major factors for us as they can move around significantly year to year.”

Highlighting the importance in regional differences in affordable rent lettings (a point which comes out in the data later on this report), he added: “What the data fails to do is take into account the hugely varying costs of affordable rent depending on which region they are in. A large proportion of our properties are in the North, where there’s minimal difference between social and affordable rent costs. For example, in Sunderland our average social rent is £320 per month, while our affordable rent is £352 per month. That compares to a market rate average in Sunderland of over £500 per month.

“It’s quite a different story in the South where the gaps are much wider. Therefore, it wouldn’t be unusual to see less focus on affordable rent and more on social rent in the South. A large proportion of housing associations in the dataset with a higher percentage of properties for affordable rent in 2018/19 were from the North or were developing in the North.”

Affordable rent lettings: 50 highest RPs as at 31/03/2019

| Affordable rent lettings in 2018/19 | ||||||

|---|---|---|---|---|---|---|

| Registered provider | Affordable rent lettings | Change on year | Conversions to affordable rent | Other general needs lettings, 2018/19 | Total general needs lettings (including affordable rent) in 2018/19 | Affordable rent as a % of total general needs lettings |

Home | 1,323 | -16.64 | 245 | 2,513 | 3,836 | 34.49 |

Clarion | 1,229 | -42.97 | 63 | 4,373 | 5,602 | 21.94 |

Jigsaw | 1,101 | n/a | 326 | 1,405 | 2,506 | 43.93 |

Riverside | 1,095 | -19.66 | 0 | 2,295 | 3,390 | 32.30 |

Platform | 1,013 | n/a | 15 | 2,058 | 3,071 | 32.99 |

Together | 924 | 15.50 | 375 | 2,475 | 3,399 | 27.18 |

Sovereign | 888 | 24.72 | 41 | 2,269 | 3,157 | 28.13 |

Orbit | 887 | -14.22 | 96 | 1,480 | 2,367 | 37.47 |

Plymouth Community | 870 | 21.68 | 528 | 154 | 1,024 | 84.96 |

Guinness | 866 | -3.02 | 5 | 2,784 | 3,650 | 23.73 |

Sanctuary | 741 | -8.52 | 0 | 2,561 | 3,302 | 22.44 |

Vivid | 739 | -1.86 | 41 | 1,309 | 2,048 | 36.08 |

Hyde | 713 | 22.72 | 21 | 1,517 | 2,230 | 31.97 |

London & Quadrant | 713 | 35.55 | 66 | 2,497 | 3,210 | 22.21 |

Housing 21* | 678 | -1.02 | 62 | * | 4 | * |

Walsall | 677 | 14.17 | 0 | 2,588 | 3,265 | 20.74 |

Aster | 671 | 63.26 | 2 | 1,600 | 2,271 | 29.55 |

Bromford | 664 | 91.35 | 24 | 2,086 | 2,750 | 24.15 |

Thirteen | 612 | 6.62 | 33 | 2,319 | 2,931 | 20.88 |

Saffron** | 607 | 56.44 | 117 | -78 | 529 | 114.74 |

Great Places | 601 | -11.49 | 231 | 428 | 1,029 | 58.41 |

Notting Hill Genesis | 592 | n/a | 260 | 857 | 1,449 | 40.86 |

Stonewater | 546 | -24.38 | 0 | 1,595 | 2,141 | 25.50 |

Radian | 489 | -19.57 | 3 | 1,157 | 1,646 | 29.71 |

Peabody Trust | 429 | n/a | 134 | 399 | 828 | 51.81 |

BPHA | 424 | 65.63 | 3 | 620 | 1,044 | 40.61 |

LiveWest | 403 | 10.71 | 2 | 1,949 | 2,352 | 17.13 |

Optivo | 393 | 23.97 | 0 | 5,319 | 5,712 | 6.88 |

Accord | 391 | 34.36 | 122 | 453 | 844 | 46.33 |

WM | 391 | 61.57 | 0 | 1,862 | 2,253 | 17.35 |

Midland Heart | 390 | 11.75 | 0 | 1,608 | 1,998 | 19.52 |

Network | 365 | -17.23 | 28 | 719 | 1,084 | 33.67 |

Paragon Asra | 365 | -3.69 | 17 | 663 | 1,028 | 35.51 |

Hightown | 358 | -17.32 | 2 | 208 | 566 | 63.25 |

Incommunities | 358 | pz | 252 | 1,968 | 2,326 | 15.39 |

Karbon | 345 | 13.86 | 4 | 1,914 | 2,259 | 15.27 |

Yorkshire | 336 | -19.04 | 0 | 1,159 | 1,495 | 22.47 |

East Midlands | 335 | -22.09 | 190 | 624 | 959 | 34.93 |

Places for People | 322 | -21.08 | 33 | 4,314 | 4,636 | 6.95 |

Sage | 303 | 7,475.00 | 0 | n/s | 0 | n/s |

Plus Dane | 302 | 46.60 | 1 | 795 | 1,097 | 27.53 |

Torus62 | 296 | n/a | 1 | 1,924 | 2,220 | 13.33 |

Coastline | 295 | 31.11 | 59 | 95 | 390 | 75.64 |

Rooftop | 291 | -0.34 | 1 | 353 | 644 | 45.19 |

Wakefield and District | 289 | 9.89 | 18 | 1,937 | 2,226 | 12.98 |

Havebury | 284 | -12.88 | 1 | 226 | 510 | 55.69 |

Calico | 271 | 247.44 | 23 | 102 | 373 | 72.65 |

Paradigm | 263 | -26.54 | 3 | 425 | 688 | 38.23 |

Grand Union | 262 | n/a | 0 | 549 | 811 | 32.31 |

Bolton at Home | 262 | -38.64 | 7 | 922 | 1,184 | 22.13 |

Note: n/a – merged or restructured so no prior year data; pz – prior year figure was zero; * Housing 21’s stock is housing for older people; n/s – no general needs lettings; ** Affordable rent lettings can be higher than general needs lettings if they include housing for older people

Source: Regulator of Social Housing, Statistical Data Return 2018 and 2019

Elsewhere in this table, affordable rent lettings represented more than 50 per cent of total general needs lettings for eight associations. This included Plymouth Community Homes (PCH) at 85 per cent, Coastline at 76 per cent, and Calico at 73 per cent. PCH also had the highest conversion rate with 528 for the year. Overall, it had 870 affordable rent lettings, which was up 22 per cent on the prior year.

Nick Jackson, director of business services and development at PCH, said the organisation had converted 3,033 homes to affordable rent since 2016 in order to fund the regeneration of the North Prospect area, which was one of its stock transfer promises to residents. “[This was] in line with government policy and the only viable route for delivering on our promise to residents following changes to development funding, the ending of rent convergence and the one per cent rent cut,” he said.

However, the final phase of the £127m scheme is beginning shortly so PCH has begun reducing the affordable rents that funded it to bring them in line with other housing association rents in the city, he added. “Our affordable rents remain below Local Housing Allowance rates and our social rents continue to be some of the lowest in the country,” he said.

Affordable rents in the 40 local authority areas with most affordable rent units

The North West had the largest number of authorities in the top 40 by affordable rent stock, with a total of 12 local authority areas holding 30,935 units. To put that into context, the region had the largest share of England’s affordable rent units at nearly 20 per cent.

Greater London had the second-largest group of local authorities in the top 40, with six local authority areas holding 10,162 affordable rent units. It has the third-largest share of the country’s affordable rent stock at nearly 14 per cent, behind the South East in second place with nearly 17 per cent.

The gap between the number of London and North West authorities in the top 40 could be down to the market value difference highlighted earlier in this report by Home Group’s Mr Cook. Additionally the introduction of more affordable tenure products in the capital, such as London Living Rent as an alternative to affordable rent, could reduce the number of affordable rent homes in the capital.

Of the North West local authority areas, Liverpool held the most affordable rent stock with 5,582. This was up on last year when the local authority area had 5,399 units.

The East Midlands had just one local authority – East Lindsey – in the top 40 with 1,399 units. This was up slightly on last year when the same council area had 1,325 units.

Croydon in London had the highest percentage difference between its lowest and highest weighted affordable rents at nearly 157 per cent. Halton in the North West had the smallest difference at just over 20 per cent.

Average affordable rents charged by RP, in local authority areas, 2018/19

| Self-contained general needs | Affordable rent | ||||||

|---|---|---|---|---|---|---|---|

| HIGHEST 25 | Local authority | Number of units owned | Average weekly rent, £ | Number of units owned | Average weekly rent, £ | Margin on general needs rent | |

Agudas Israel | Hackney | 0 | n/a | 90 | 307.31 | n/a | |

One | Lambeth | 0 | n/a | 59 | 265.69 | n/a | |

Network | Westminster | 950 | 131.94 | 156 | 263.98 | 100.1% | |

Spitalfields | Tower Hamlets | 0 | n/a | 60 | 261.43 | n/a | |

One | Haringey | 85 | 125.48 | 126 | 241.62 | 92.6% | |

Newlon | Tower Hamlets | 567 | 123.94 | 58 | 241.57 | 94.9% | |

Origin | Camden | 1,490 | 124.26 | 59 | 237.35 | 91.0% | |

Southern | Hackney | 1,746 | 113.35 | 53 | 232.63 | 105.2% | |

Octavia | Hammersmith and Fulham | 338 | 121.05 | 111 | 232.11 | 91.7% | |

Notting Hill Genesis | Bexley | 0 | n/a | 63 | 230.24 | n/a | |

Clarion | Southwark | 641 | 133.05 | 56 | 230.23 | 73.0% | |

Notting Hill Genesis | Hackney | 776 | 112.72 | 51 | 226.90 | 101.3% | |

Notting Hill Genesis | Croydon | 462 | 124.50 | 126 | 226.21 | 81.7% | |

Notting Hill Genesis | Hounslow | 849 | 129.29 | 154 | 225.75 | 74.6% | |

Hyde | Brent | 1,041 | 126.80 | 89 | 224.91 | 77.4% | |

Catalyst | Brent | 1,609 | 125.45 | 152 | 224.58 | 79.0% | |

Catalyst | Barnet | 217 | 132.01 | 82 | 222.84 | 68.8% | |

Network | Harrow | 184 | 120.81 | 95 | 222.39 | 84.1% | |

One | Camden | 2,163 | 132.52 | 142 | 221.75 | 67.3% | |

Notting Hill Genesis | Barking and Dagenham | 266 | 113.07 | 145 | 221.05 | 95.5% | |

Notting Hill Genesis | Tower Hamlets | 1,271 | 139.40 | 149 | 219.75 | 57.6% | |

Clarion | Hackney | 1,150 | 132.43 | 114 | 218.43 | 64.9% | |

Notting Hill Genesis | Westminster | 2,069 | 136.87 | 74 | 218.34 | 59.5% | |

Network | Barnet | 244 | 131.37 | 107 | 217.34 | 65.4% | |

Notting Hill Genesis | Newham | 514 | 123.35 | 275 | 216.60 | 75.6% | |

| Self-contained general needs | Affordable rent | ||||||

|---|---|---|---|---|---|---|---|

| LOWEST 25 | Local authority | Number of units owned | Average weekly rent, £ | Number of units owned | Average weekly rent, £ | Margin on general needs rent | |

Home Group | Northumberland | 472 | 73.85 | 103 | 90.52 | 22.6% | |

Together | Kirklees | 495 | 80.90 | 83 | 90.51 | 11.9% | |

Riverside | St. Helens | 714 | 85.15 | 181 | 90.40 | 6.2% | |

Yorkshire Housing | Craven | 996 | 83.76 | 516 | 90.36 | 7.9% | |

Together | Pendle | 2,894 | 72.21 | 345 | 90.00 | 24.6% | |

Sanctuary | Plymouth | 447 | 71.91 | 110 | 89.89 | 25.0% | |

Bromford | Walsall | 207 | 99.33 | 55 | 89.88 | -9.5% | |

Home Group | County Durham | 2,034 | 74.78 | 691 | 89.53 | 19.7% | |

Stoke-on-Trent | Stoke-on-Trent | 0 | n/a | 94 | 89.52 | n/a | |

Metropolitan Thames Valley | Derby | 1,826 | 86.80 | 87 | 89.34 | 2.9% | |

North Star | County Durham | 51 | 84.36 | 270 | 89.26 | 5.8% | |

First Choice Oldham | Oldham | 10,669 | 73.63 | 769 | 89.22 | 21.2% | |

Sanctuary | Wirral | 261 | 89.04 | 66 | 88.73 | -0.4% | |

Salvation Army | Leeds | 0 | n/a | 82 | 88.60 | n/a | |

Riverside | Carlisle | 5,190 | 80.08 | 1,215 | 88.39 | 10.4% | |

Sanctuary | Kingston upon Hull | 1,156 | 78.49 | 98 | 87.96 | 12.1% | |

Yorkshire Housing | Sheffield | 441 | 77.45 | 63 | 86.81 | 12.1% | |

Derby Homes | Derby | 0 | n/a | 59 | 86.43 | n/a | |

Yorkshire Housing | Calderdale | 359 | 78.66 | 129 | 86.35 | 9.8% | |

Together | Rossendale | 3,214 | 72.12 | 364 | 85.90 | 19.1% | |

Rochdale Boroughwide Housing | Rochdale | 10,931 | 71.02 | 967 | 85.11 | 19.8% | |

Riverside | Kingston upon Hull | 1,021 | 72.89 | 174 | 84.66 | 16.1% | |

EPIC | Stoke-on-Trent | 954 | 64.40 | 140 | 84.21 | 30.8% | |

Livin | County Durham | 7,167 | 75.58 | 1,152 | 83.75 | 10.8% | |

Sanctuary | Sheffield | 2,504 | 79.05 | 262 | 81.94 | 3.7% | |

Notes: n/a = not applicable because there are no general needs units

Source: Regulator of Social Housing, Statistical Data Return 2019

Average affordable rent charged by RPs in local authority areas for 2018/19

This report has broken down the average weighted affordable rent rates charged by housing associations in local authority areas, ordered by the highest and lowest 25 rents by organisations and council area. It looks only at associations with more than 50 units in a local authority.

For the highest average affordable rents, one association, Notting Hill, appeared eight times, while Network and One Housing appeared three times each. Unsurprisingly, every council area in the top 25 was in London.

Agudas Israel had the highest average affordable rent in a council area for 90 homes in Hackney, London. It does not have any general needs properties in the borough. Last year it was 12th in the top 25 again for its 90 properties in Hackney, but this year the average weighted rent for the homes is £1.20 a week lower at £307.31.

Notting Hill Genesis had the largest number of units in the top 25 at 1,037 across eight authorities. It also had the largest number in the top 25 in a single council area with 275 in Newham, on an average weighted rent of £216.60 per week.

Last year’s top 25 contained a large number of Clarion entries but drops in its affordable rents in 2019 meant it appeared only twice this year.

The 25 with the lowest average affordable rents in a local authority was dominated by authorities in the North and the Midlands. Only Sanctuary’s 110 units in Plymouth were outside those areas. Two associations had affordable rents that were slightly below general needs levels in an authority: Bromford in Walsall and Sanctuary in Wirral.

The gap between general needs and affordable rents was considerably smaller in the bottom 25 than the top 25, reflecting Mr Cook from Home Group’s point about affordable and general needs rents being quite close together in some areas of the North and the Midlands.

The average percentage difference for the lowest 25 was nearly 13 per cent, whereas it was 81 per cent for the top 25.

The highest affordable rent in the bottom 25 was for Home Group’s 103 properties in Northumberland at £90.52, while the lowest was for Sanctuary’s 262 homes in Sheffield at £81.94.

Sanctuary also appeared most frequently in the bottom 25 in four councils, while Riverside had the most units in the bottom 25 at 1,570.

Seven organisations had affordable rent units but no general needs units in a local authority area.

Average affordable rents in the 40 local authority areas with the most AR stock, 2018/19

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| East Midlands | Affordable rent number of units | Lowest | Median | Highest |

| East Lindsey | 1,399 | 80.00 | 96.34 | 90.47 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| East of England | Affordable rent number of units | Lowest | Median | Highest |

| South Norfolk | 1,675 | 101.63 | 132.67 | 109.18 |

| East Hertfordshire | 1,673 | 120.25 | 180.00 | 166.13 |

| Peterborough | 1,496 | 93.64 | 118.36 | 104.74 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| Greater London | Affordable rent number of units | Lowest | Median | Highest |

Tower Hamlets | 2,341 | 132.82 | 261.43 | 198.73 |

Croydon | 1,811 | 88.17 | 226.21 | 174.33 |

Bromley | 1,743 | 94.80 | 216.33 | 166.46 |

Brent | 1,483 | 116.89 | 225.79 | 200.41 |

Bexley | 1,418 | 125.34 | 230.24 | 161.03 |

Lewisham | 1,366 | 118.52 | 258.33 | 184.41 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| North East | Affordable rent number of units | Lowest | Median | Highest |

County Durham | 3,511 | 83.75 | 126.98 | 96.39 |

Sunderland | 1,931 | 84.04 | 117.62 | 92.59 |

Stockton-on-Tees | 1,710 | 94.61 | 126.94 | 98.40 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| North West | Affordable rent number of units | Lowest | Median | Highest |

Liverpool | 5,582 | 75.47 | 112.73 | 95.68 |

Cheshire East | 3,622 | 77.92 | 131.53 | 111.76 |

Bolton | 3,199 | 84.37 | 101.39 | 94.19 |

Manchester | 2,907 | 90.36 | 166.16 | 103.87 |

Tameside | 2,368 | 86.77 | 118.94 | 102.85 |

Cheshire West and Chester | 2,112 | 92.56 | 152.08 | 109.79 |

Salford | 2,100 | 93.04 | 187.42 | 111.74 |

Wirral | 2,012 | 86.81 | 140.00 | 102.62 |

Halton | 2,003 | 84.37 | 101.40 | 97.29 |

Trafford | 1,846 | 92.49 | 127.36 | 107.76 |

Rochdale | 1,801 | 85.11 | 109.84 | 98.27 |

Oldham | 1,383 | 89.22 | 111.79 | 103.17 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| South East | Affordable rent number of units | Lowest | Median | Highest |

Aylesbury Vale | 1,685 | 103.68 | 171.41 | 149.01 |

Cherwell | 1,433 | 138.00 | 287.07 | 155.05 |

Maidstone | 1,425 | 102.72 | 165.79 | 146.39 |

Vale of White Horse | 1,422 | 118.59 | 202.93 | 162.85 |

Eastleigh | 1,400 | 132.27 | 198.71 | 145.44 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| South West | Affordable rent number of units | Lowest | Median | Highest |

Plymouth | 3,662 | 86.86 | 120.35 | 106.17 |

Cornwall | 2,979 | 93.40 | 132.57 | 117.53 |

Wiltshire | 2,747 | 98.84 | 149.74 | 123.99 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| West Midlands | Affordable rent number of units | Lowest | Median | Highest |

Walsall | 2,124 | 82.25 | 113.45 | 104.85 |

Coventry | 2,068 | 100.50 | 146.09 | 108.33 |

Shropshire | 1,660 | 91.20 | 109.94 | 104.25 |

Birmingham | 1,604 | 92.59 | 137.63 | 113.02 |

| Average weekly affordable rent*, £ | ||||

|---|---|---|---|---|

| Yorkshire and the Humber | Affordable rent number of units | Lowest | Median | Highest |

Bradford | 2,894 | 68.30 | 106.91 | 91.25 |

Wakefield | 2,212 | 93.57 | 130.33 | 99.30 |

Sheffield | 2,022 | 65.41 | 124.64 | 95.26 |

Notes: Table compiled by aggregating the number of registered providers’ affordable rent units in each local authority area, then selecting the resulting 40 largest local authorities; * ‘Average weekly affordable rent’ represents figures for individual registered providers within a given local authority area, eg ‘lowest’ represents a single figure for the registered provider with the lowest average affordable rent in a given local authority area

Source: Regulator of Social Housing, Statistical Data Return 2019

Future

The government announced a £12.2bn extension to the Affordable Homes Programme, which was due to end in 2021. The new five-year programme begins in 2021/22 but the government has not said how the funding will be split by tenure.

The shutdown of building sites and the supply chain as a result of the COVID-19 lockdown is likely to lead to a major fall in the number of homes completed in 2021 and possibly also 2022, Mr Petty said. “If fewer homes are started it will reduce Section 106 opportunities. The hope would be that registered providers can come into the market and take up land and develop directly to fill the vacuum left by builders but there are bound to be fewer social homes started and completed.

“We are talking about 80,000 homes being started this year and that is below the previous low of 2008 which was about 100,000 in the worst part of the financial crisis. That will really have a knock-on effect on completions.”

Methodology

Figures are aggregated from subsidiary to group level. Average rents are the median of the average rents recorded in the Regulator of Social Housing’s Statistical Data Return for the members of each housing group in a local authority. Other general needs lettings is the total general needs lettings made during the year to 31 March 2019 minus the number of affordable rent lettings. Some organisations have a higher number of affordable rent lettings than general needs because they have supported housing or housing for older people let at affordable rents.

Social Housing special reports

Each month Social Housing focuses on a specific aspect of housing finance and collates and scrutinises the data for hundreds of housing organisations.

The reports below contain unparalleled commentary and analysis along with detailed sortable and searchable data tables.

Unit costs 2019 Our analysis of data from the English regulator has found that unit costs have risen among all types of housing association, with overall maintenance costs seeing the highest weighted average increase of nearly seven per cent

Impairment 2019 Housing associations’ impairments rise almost 40% in a year, driven by fire safety costs, contractor insolvencies and reduced land values

Global accounts 2018/19 Housing associations’ surplus for the year before tax decreased by five per cent to £3.76bn, driven by a 6.6 per cent drop in England

Affordable rent profile 2018/19 The level of affordable lettings dropped for the third year in a row

Staff pay Data from audited accounts of 206 housing associations shows that average staff pay in 2018/19 was £31,787 – a rise of 3.2 per cent over a 12-month period

Professionals’ league Our exclusive professionals’ league finds that activity continued apace in 2019, when housing associations increasingly looked to private placements

Sales proceeds Despite a 10 per cent rise in housing associations’ income from development sales in the last financial year, sales revenue is likely to remain flat over the coming years as a result of the property market downturn

Capital commitments The total capital commitments of 200 housing associations rose by 15 per cent in the past year, analysis by Social Housing has found

Reliance on sales surplus Social Housing finds that the total sales surplus of 150 English registered providers has dropped by nearly 10 per cent, as a result of lower market sales surplus

Stock dispersal How many council areas does your housing association operate in? How concentrated is its stock?

Accounts digest 2018/19 How does your housing association’s finances compare to others?

Housing Revenue Account part two How do councils compare in their 2018/19 Housing Revenue Account positions? Steve Partridge of Savills takes an in-depth look

Diversification of income We look at how housing associations are diversifying their income, and finds that they made 10.3 per cent more revenue from shared ownership and non-social housing activity

Impairment 2017/18 Social Housing takes a close look at the accounts of the 130 largest housing associations, and finds that impairments rose by nearly a third to £78.4m in 2018

Global accounts Social Housing’s analysis of the sector’s global accounts finds that housing associations’ pre-tax surplus fell last year – driven by drops in England, Scotland and Wales (August 2019)

Affordable rent profile We find that the number of affordable rent lettings recorded last year by housing associations in England has dropped for the second year in a row, suggesting that the sector is shifting away from the tenure

Capital commitments We scrutinise the capital commitments of the 208 largest housing associations in the UK (June 2019)

Housing Revenue Account part one Steve Partridge of Savills takes a look at the financial factors councils should consider in their Housing Revenue Account business planning (May 2019)

Reliance on sales surplus Our analysis reveals that profits form 42 per cent of 150 English housing associations’ total surplus (April 2019)

Sales proceeds We look at housing associations’ build-for-sale income and find a two per cent increase in 2017/18 (March 2019)

Shared ownership sales England, excluding London, has seen a four per cent rise in shared ownership sales – much lower than last year’s 16 per cent increase (February 2019)

Stock dispersal We show that housing associations’ general needs stock is becoming more concentrated within their local authority areas (January 2019)

RELATED