Special report: pre-tax surplus drops for second year running

Analysis by Social Housing shows that housing associations’ surplus for the year before tax decreased by five per cent to £3.76bn, driven by a 6.6 per cent drop in England. Chloe Stothart and Robyn Wilson report

Pre-tax surplus at Britain’s largest housing associations (HAs) has dropped for the second year in a row, according to their 2018/19 financial accounts. Analysis by Social Housing shows that surplus for the year before tax decreased by five per cent to £3.76bn. Although smaller than the 10.8 per cent drop in 2017/18, it is still a noteworthy decline.

This year the pre-tax surplus decrease was driven by England, where it dropped 6.6 per cent to £3.46bn. Scotland and Wales both saw increases on last year of 18.7 per cent and 11.8 per cent respectively.

The figures have been compiled from the regulating agencies in England, Scotland and Wales. England is represented by HAs with 1,000 units or more (representing more than 95 per cent of the sector’s stock). Wales is represented by the 34 largest HAs.

Despite the drop, in its analysis England’s Regulator of Social Housing (RSH) described providers’ surpluses as “healthy”, while attributing the decline to a decrease in profitability in both rental and sales activities.

England, Scotland and Wales housing association global accounts 2018/19 summary

| Total GB | Change on year | England | Change on year | Scotland | Change on year | Wales | Change on year | |

|---|---|---|---|---|---|---|---|---|

Social housing (number of units, ’000s) | 3,194 | +0.8% | 2,733 | +0.8% | 296 | +1.0% | 165 | +1.1% |

Comprehensive income | £m |

| £m |

| £m |

| £m |

|

Turnover | 23,570 | +2.3% | 20,860 | +2.0% | 1,704 | +5.5% | 1,006 | +5.5% |

Operating costs | (15,351) | +4.6% | (13,162) | -4.4% | (1,372) | +5.8% | (817) | +6.9% |

of which depreciation | (2,674) | +1.6% | (2,200) | +0.0% | (341) | +10.8% | (133) | +7.3% |

Operating surplus | 5,704 | -7.3% | 5,216 | -7.6% | 299 | +6.6% | 189 | -0.5% |

Surplus on sales of assets | 898 | -6.1% | 872 | -6.4% | (1) | -111.7% | 25 | +66.7% |

Interest payable and similar charges | (3,540) | -11.7% | (3,238) | +2.0% | (175) | +3.8% | (127) | -8.6% |

Surplus for the year before tax | 3,760 | -5.0% | 3,457 | -6.6% | 218 | +18.7% | 85 | +11.8% |

|

|

|

|

|

|

|

|

|

Financial position |

|

|

|

|

|

|

|

|

Net book value | 170,274 | +4.2% | 150,770 | +4.0% | 12,718 | +6.3% | 6,786 | +6.1% |

Long-term loans | 81,493 | +6.1% | 74,500 | +6.1% | 4,200 | +7.0% | (2,793) | +5.2% |

Capital grant | 45,332 | +4.2% | 36,600 | +2.5% | (5,482) | +5.0% | 3,250 | +7.4% |

Total finance and capital reserves | 56,360 | +4.7% | 51,900 | +4.8% | 3,291 | +3.9% | 1,169 | +1.2% |

Notes: 1) Some items of income and expenditure are not identified separately in the above table. These include exceptional items, Gift Aid, interest receivable, cost of sales, pensions, movements in fair value of financial instruments and ‘other’ items. However these items are included in the calculation of the surpluses. 2) England represented by registered providers with more than 1,000 units; Wales represented by 33 largest housing associations.

Source: Global accounts 2018/19, published by regulatory agencies in England, Scotland and Wales

The number of social housing units increased across all three countries. This was different from last year when unit levels dropped across the UK and England, albeit in England this was due to a change in the RSH’s methodology that excluded social leasehold units and included units owned or managed rather than just those in management.

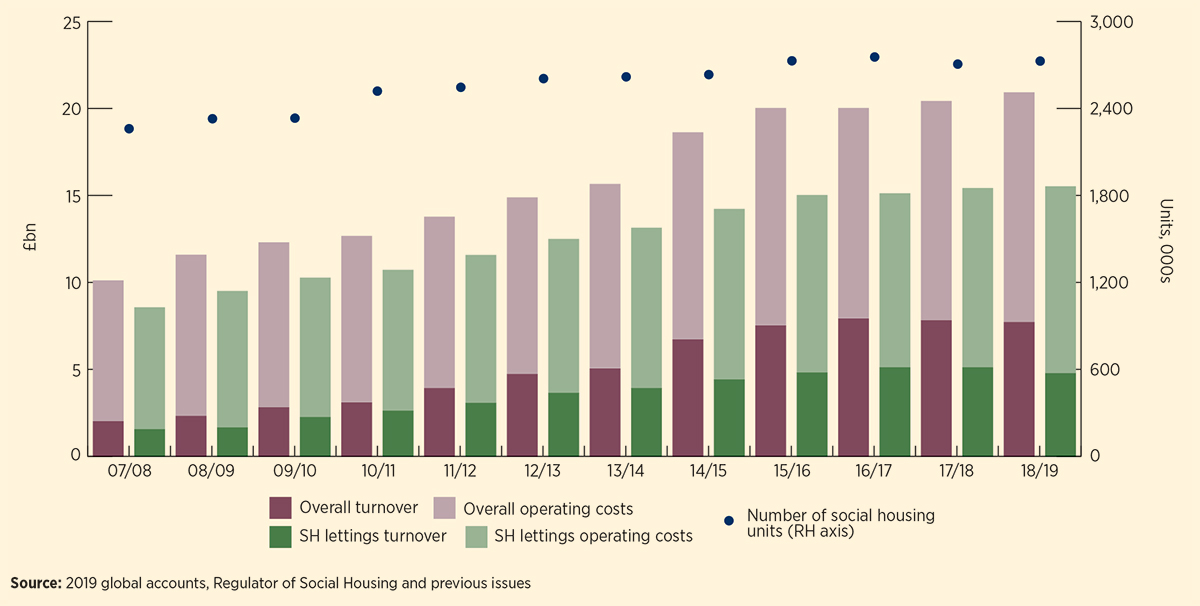

As units rose this year, turnover also increased, with both Scotland and Wales seeing the largest year-on-year increases of 5.5 per cent. England saw a more modest increase of two per cent.

England

March 2019 marked the third year of the imposed one per cent rent reductions on general needs social housing properties and the second year of rent reductions on most supported housing properties, something the RSH said had been responsible for England’s comparably smaller (in contrast to Scotland and Wales) increase in turnover to £20.86bn.

An increase of 4.4 per cent in operating costs to £13.16bn was made up largely of maintenance expenditure – broken up into ‘major repairs’ and ‘maintenance’, the latter of which had increased by nearly 15 per cent to £3.1bn.

Management cost per unit was up to £1,045 from £1,016. Maintenance cost per unit increased to £1,104, from £1,028.

Operating surplus and surplus on sales of assets were down 7.6 per cent and 6.4 per cent respectively. Operating margin stood at 25 per cent, which was also down 10.7 per cent.

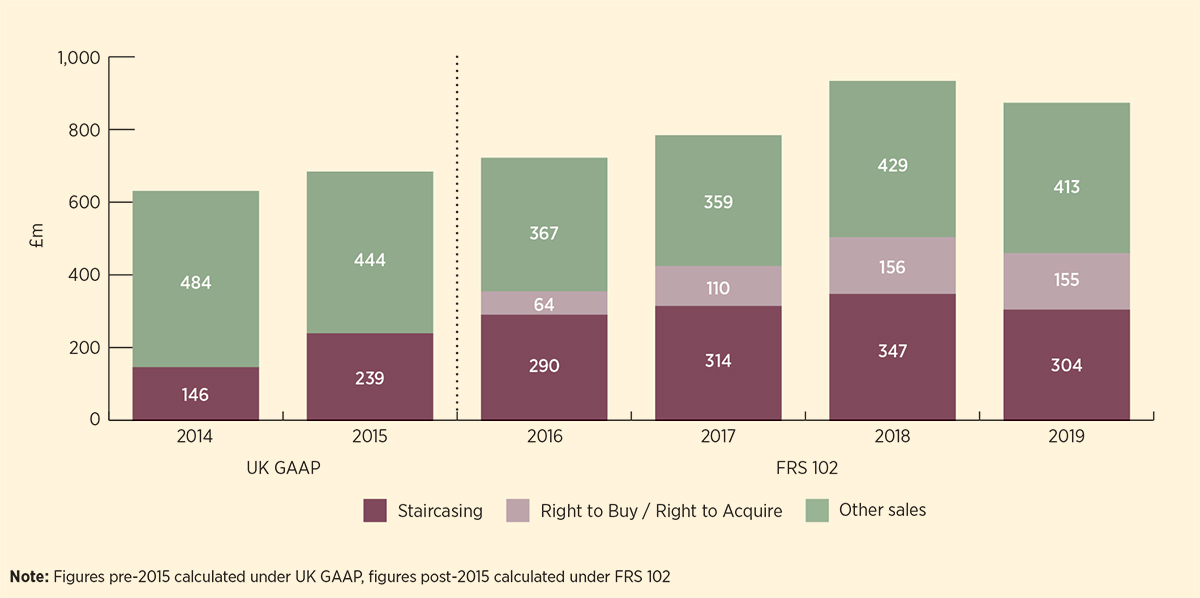

This had an effect on the UK-wide figure – Social Housing found that fixed asset sales surplus across the UK was down across shared ownership, Right to Buy/Right to Acquire and other sales.

The RSH said reductions in operating margins across rental and sales activities caused a 12 per cent reduction in interest cover to 153 per cent, although it said interest cover “remained comfortable and strong performance is widespread”.

It added that of the 217 provider groups included in the global accounts, 187 have interest cover on a social housing lettings basis of greater than 100 per cent.

England global accounts 2018/19: nine-year summary

| Total 18/19 | Change on year | Total 17/18 | Total 16/17 | Total 15/16 | Total 14/15 | Total 13/14 | Total 12/13 | Total 11/12 | Total 10/11 |

Social housing units (’000s) | 2,733 | +0.8% | 2,712 | 2,761 | 2,734 | 2,640 | 2,624 | 2,613 | 2,551 | 2,527 |

Comprehensive income | £m |

| £m | £m | £m | £m | £m | £m | £m |

|

Turnover | 20,860 | +2.0% | 20,459 | 20,000 | 20,000 | 18,600 | 15,634 | 14,860 | 13,751 | 12,647 |

Operating costs | (13,162) | +4.4% | (12,610) | (12,100) | (12,500) | (11,900) | (10,606) | (10,147) | (9,846) | (9,569) |

of which*: |

|

|

|

|

|

|

|

|

|

|

depreciation* | (2,200) | +0.0% | (2,200) | (2,100) | (2,000) | (1,900) | (1,452) | (1,347) | (1,235) | (652) |

impairment* | (0) | +0.0% | (0) | (0) | (100) | (0) | (34) | (50) | (16) | (1) |

management costs* | (2,900) | +3.6% | (2,800) | (2,600) | (2,800) | (2,700) | (2,612) | (2,488) | (2,317) | (2,206) |

service costs | (1,700) | +6.3% | (1,600) | (1,500) | (1,500) | (1,400) | (1,365) | (1,302) | (1,175) |

|

maintenance* | (3,100) | +14.8% | (2,700) | (2,700) | (2,700) | (2,700) | (2,678) | (2,593) | (2,497) | (2,551) |

major repairs* | (500) | +0.0% | (500) | (500) | (500) | (600) | (576) | (572) | (593) | (1,011) |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales | (2,481) | +12.5% | (2,205) | (1,900) | (1,900) | (1,600) | (848) | (852) | (672) | (491) |

Operating surplus | 5,216 | -7.6% | 5,644 | 5,900 | 5,500 | 5,100 | 4,139 | 3,849 | 3,220 | 2,704 |

Surplus on sales of assets | 872 | -6.4% | 932 | 783 | 700 | 600 | 630 | 466 | 516 | 321 |

Interest receivable | 123 | +18.3% | 104 | 100 | 100 | 100 | 217 | 182 | 171 | 135 |

Interest payable | (3,175) | -9.3% | (3,500) | (3,000) | (3,000) | (2,638) | (2,522) | (2,355) | (2,094) | (2,094) |

Movement in fair value of financial instruments | (3,238) | +2.0% | (3,175) | (3,500) | (3,000) | (3,000) | (2,638) | (2,522) | (2,355) | n/a |

Movement in valuation of housing properties | 1 | +106.7% | (15) | 300 | (100) | (500) | n/a | n/a | n/a | n/a |

Surplus before tax | 3,457 | -6.6% | 3,700 | 4,100 | 3,400 | 2,600 | 2,362 | 1,946 | 1,775 | 1,117 |

Unrealised surplus/deficit on revaluation of housing properties | 92 | n/a | 0 | 0 | (400) | 100 | n/a | n/a | n/a | n/a |

Actuarial loss/gain on pension schemes | (379) | -217.3% | 323 | (500) | 400 | (600) | n/a | n/a | n/a | n/a |

Change in fair value of hedged instruments | (54) | -114.4% | 374 | 100 | 0 | (900) | n/a | n/a | n/a | n/a |

Comprehensive income for the period | 2,673 | -39.4% | 4,411 | 3,700 | 3,400 | 1,100 | n/a | n/a | n/a | n/a |

|

|

|

|

|

|

|

|

|

|

|

Financial position |

|

|

|

|

|

|

|

|

|

|

Housing at cost | 148,737 | +4.5% | 142,356 | 137,475 | 101,800 | n/a | 106,851 | 105,090 | 98,075 | 84,750 |

Housing at valuation | 2,033 | -23.7% | 2,666 | 2,047 | 2,500 | n/a | 24,105 | 20,886 | 20,488 | 24,672 |

Housing at deemed cost | n/a | n/a | n/a | n/a | 40,900 | n/a | n/a | n/a | n/a | n/a |

Gross book value | 171,500 | +4.5% | 164,100 | 156,600 | 148,600 | n/a | 130,956 | 125,976 | 118,563 | 109,423 |

|

|

|

|

|

|

|

|

|

|

|

Social Housing Grant | n/a | n/a | n/a | n/a | n/a | n/a | (41,984) | (43,059) | (41,616) | (41,118) |

Other capital grants | n/a | n/a | n/a | n/a | n/a | n/a | (2,367) | (2,348) | (2,214) | (2,072) |

Depreciation and impairment** | (20,800) | +8.9% | (19,100) | (17,300) | (15,600) | * | (8,427) | (7,781) | (6,783) | (3,549) |

Net book value | 150,770 | +4.0% | 145,022 | 133,000 | 134,800 | 131,100 | 78,179 | 72,788 | 67,950 | 62,684 |

Total fixed assets | 162,000 | +4.2% | 155,400 | 148,000 | 143,200 | 139,000 | 81,958 | 76,357 | 71,150 | 65,404 |

|

|

|

|

|

|

|

|

|

|

|

Current assets | 18,000 | +10.4% | 16,300 | 15,597 | 14,300 | 13,200 | 11,063 | 10,184.0 | 9,119.0 | 8,913.0 |

Current liabilities | (8,000) | +5.3% | (7,600) | 6,900 | (6,800) | (5,900) | (5,037) | (6,488) | (6,388) | (6,291) |

– deferred capital grant | 400 | +0.0% | 400 | 400 | (300) | (300) | n/a | n/a | n/a | n/a |

Pension liability | 5 | -93.2% | 73 | n/a | n/a | n/a | (724) | (963) | (688) | (438) |

Total assets less current liabilities | 171,900 | +4.8% | 164,100 | (157,500) | 150,700 | 146,300 | 87,261 | 79,090 | 73,193 | 67,587 |

Long-term loans | 74,500 | +6.1% | 70,200 | 67,600 | 64,400 | 63,300 | 50,707 | 51,215 | 47,869 | 44,373 |

Group undertakings | 0 | +0.0% | 0 | 0 | 0 | 0 | 6,119 | – | – | – |

Finance lease obligations | 600 | +0.0% | 600 | 400 | 400 | 300 | 130 | – | – | – |

Deferred capital grant | 36,600 | +2.5% | 35,700 | 34,900 | 35,100 | 35,300 | n/a | n/a | n/a | n/a |

Other creditors and provisions | 8,300 | +1.2% | 8,200 | 9,300 | 8,900 | 9,000 | 2,867 | 4,556 | 4,665 | 4,857 |

– of which pension provision | 3,100 | +63.2% | 1,900 | 2,200 | 1,900 | 2,200 | n/a | n/a | n/a | n/a |

Reserves | 51,900 | +4.8% | 49,500 | 45,200 | 41,800 | 38,500 | 27,436 | 23,319 | 20,658 | 18,358 |

|

|

|

|

|

|

|

|

|

|

|

Growth and debt-servicing ratios |

|

|

|

|

|

|

|

|

|

|

Growth in turnover | 2% |

| 2.0% | 0.0% | +7.5% | n/a | +5.2% | +8.1% | +8.7% | +3.0% |

Operating margin | 25% | -10.7% | 28.0% | 30.0% | 27.6% | 27.4% | 26.5% | 25.9% | 23.4% | 21.4% |

Net margin | 17% | -7.9% | 18.0% | 20.0% | 16.7% | 13.8% | 15.1% | 13.1% | 12.9% | 8.8% |

Debt servicing ability |

|

|

|

|

|

|

|

|

|

|

Debt per unit | £28,138 | +5.2% | £26,738 | £25,871 | £24,397 | £23,951 | £22,474 | £21,313 | £20,400 | £17,828 |

Effective interest rate | 4.7% |

| 4.8% | 5.0% | 4.9% | 5.0% | 4.7% | 4.8% | 4.8% | 5.0% |

EBITDA MRI interest cover | 153.0% |

| 174.0% | 170.0% | 174.0% | 153.0% | 153.7% | 138.0% | 115.7% | 106.4% |

Gearing | 51.0% |

| 50.0% | 50.0% | 50.0% | 49.2% | 96.2% | 92.9% | 92.2% | 86.1% |

Operating ratios |

|

|

|

|

|

|

|

|

|

|

Management cost per unit | £1,045 |

| £1,016 | £940 | £1,080 | £1,010 | £996 | £952 | £908 | £873 |

Maintenance cost per unit | £1,104 |

| £1,028 | £990 | £1,010 | £1,030 | £1,021 | £992 | £979 | £1,009 |

Note: Global accounts represent housing association RPs larger than 1,000 units. Figures before 2014/15 calculated under FRS 102, figures from 2014/15 onwards under UK GAAP. Some FRS 102 and UK GAAP (including gearing) are not comparable. n/a = not applicable under relevant accounting standard, n/s = not stated. * = no FRS 102 figure available. ** = depreciation only up to and including 2014. Source: RSH, 2012-19 global accounts of housing providers; TSA, 2011 global accounts of housing associations; Housing Corporation global accounts

On the letting and sales environment in England, the regulator said the core lettings business was stable in the year.

However, housing markets in some regions presented a more challenging environment in respect of housing sales than in recent years.

In terms of risk, it pointed out that only a small number of providers develop properties for outright sale, with 80 per cent of turnover from outright sale reported by 20 organisations.

Residential transactions for the year decreased by two per cent, with the market weakening particularly in London and the South East.

March 2019 was also the first time the Social Housing Pension Scheme pension liability was identified, shown separately in individual registered providers’ accounts.

On this, the RSH said: “The initial measurement of this liability, as well as an overall actuarial loss in respect of all pension schemes, do not form part of the calculation of the surplus for the period but are disclosed in accounts as other comprehensive income.

“These charges were £0.8bn in total and they substantially explain the difference between the surplus for the year of £3.5bn and total comprehensive income of £2.7bn.”

Scotland global accounts 2018/19: nine-year summary

| Total 18/19 | Change on year | Total 17/18 | Total 16/17 | Total 15/16 | Total 14/15 | Total 13/14 | Total 12/13 | Total 11/12 | Total 10/11 |

Total units | 296,021 | +0.8% | 293,777 | 289,638 | 289,620 | 287,038 | 285,181 | 282,966 | 282,514 | 278,811 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income | £m |

| £m | £m | £m | £m | £m | £m |

|

|

Turnover | 1,704 | +5.5% | 1,616 | 1,560 | 1,585.9 | 1,537 | 1,318.2 | 1,275.6 | 1,241.6 | 1,221.7 |

Operating costs | (1,372) | +5.8% | (1,296) | (1,262) | (1,282.7) | (1,235) | (1,103.2) | (1,053.4) | (1,026.3) | (1,022.4) |

Operating surplus | 299 | +6.6% | 320 | 409 | 298 | 304 | 203.8 | 213.9 | 215.2 | 199.3 |

Surplus on sales of assets | (1) | -111.7% | 10 | 14 | 12 | 10 | 13.6 | 5.9 | (14.6) | (35.7) |

Interest receivable and other income | 6 | -7.9% | 7 | 9 | 10 | 16 | 9.6 | 9.5 | 45.0 | 57.2 |

Interest payable | (175) | +3.8% | (169) | (167) | (157) | (160) | (131.1) | (125.4) | (112.9) | (93.3) |

Movement in fair value of financial instruments | (4) | -163.0% | 7 | 3 | 10.2 | (21) | n/a | n/a | n/a | n/a |

Movement in valuation of housing properties | (8) | -36.2% | (6) | (12) | 4.1 | 3.7 | n/a | n/a | n/a | n/a |

Pre-tax surplus | 218 | +18.7% | 184 | 251 | 171 | 153 | 96.4 | 103.9 | 132.7 | 127.5 |

Unrealised surplus/deficit on |

|

| 73 | 16 | (9) | (2) | n/a | n/a | n/a | n/a |

Actuarial loss/gain in respect of pension schemes | -90 | -270.2% | 53.0 | (42) | 52 | 41 | n/a | n/a | n/a | n/a |

Change in fair value of hedged | -0.14 | -105.2% | 2.7 | (0.3) | (0.1) | (6) | n/a | n/a | n/a | n/a |

Total comprehensive income for the year | 120 | -61.7% | 312 | 224 | 214 | 187 | n/a | n/a | n/a | n/a |

|

|

|

|

|

|

|

|

|

|

|

Statement of financial position |

|

|

|

|

|

|

|

|

|

|

HAG |

|

| n/a | na | na | na | (7,257) | (7,104) | (6,919) | (6,661) |

Other capital grants |

|

| n/a | na | na | na | (286) | (261) | (236) | (284) |

Depreciation | (2,985) | +6.7% | (2,797) | (2,465) | (2,301) | (2,187) | (929) | (838) | (736) | (314) |

Net book value | 12,718 | +6.3% | 11,970 | 11,321 | 10,826 | 10,504 | 4,858 | 4,404 | 4,023 | 3,509 |

Total fixed assets | 13,044 | +5.8% | 12,331 | 11,656 | 11,147 | 10,805 | 5,132 | 4,623 | 4,569 | 4,152 |

|

| |||||||||

Cash in hand | 733 | +11.1% | 660 | 648 | 624.0 | 557.5 | 607 | 539 | 524 | 393 |

Other current assets | 252 | +6.0% | 238 | 249 | 221 | 235 | 402 | 519 | 272 | 263 |

Scottish housing grants under a year | (185) | +17.8% | (148) | (126) | (185) | (268) | n/a | n/a | n/a | n/a |

Current liabilities | (798) | +6.6% | (748) | (621) | (646.5) | (759.0) | (444) | (498) | (429) | (425) |

Assets less current liabilities | 14,827 | +18.8% | 12,481 | 11,931 | 11,345 | 10,838 | 5,698 | 5,184 | 4,936 | 4,382 |

|

|

|

|

|

|

|

|

|

|

|

Long-term loans | 4,200 | +7.0% | 3,926 | 3,815 | 2,731 | 2,678 | 3,378 | 3,154 | 2,992 | 2,634 |

Reserves | 3,291 | +3.9% | 3,166 | 2,851 | 2,612 | 2,397 | 1,950 | 1,619 | 1,469 | 1,176 |

|

| |||||||||

Growth ratios |

| |||||||||

Growth in turnover | +5.5% |

| +3.6% | -1.6% | +3.2% | n/a | +3.3% | +2.7% | +1.6% | +1.4% |

Profitability ratios |

| |||||||||

Operating margin | 17.5% |

| 19.8% | 26.2% | 18.8% | 19.8% | 15.5% | 16.8% | 17.3% | 16.3% |

Net margin | 12.8% |

| 11.4% | 16.1% | 10.8% | 10.0% | 7.3% | 8.1% | 10.7% | 10.4% |

Debt servicing ability * |

| |||||||||

Debt per unit | £14,960 |

| £14,059 | £13,638 | £12,814 | £12,530 | £12,184 | £11,697 | £10,908 | £9,613 |

Interest cover | 291 |

| 305 | 274 | 291.92 | 92.0% | 101.2% | 227.2% | 226.6% | 246.7% |

Gearing | 112 |

| 110 | 116 | 118.23 | 126.3% | 31.9% | 20.2% | 19.9% | 19.0% |

Note: Figures from 2014/15 calculated under FRS 102, figures before 2014/15 under UK GAAP. Some FRS 102 and UK GAAP (including gearing) are not all directly comparable. n/a = not applicable under relevant accounting standard. Source: Scottish Housing Regulator; *=ratios before 2014/15 do not include intra-group finance

Scotland

In Scotland, total units were up marginally by 0.8 per cent to 296,021. Increases in turnover of 5.5 per cent and operating costs of 5.8 per cent resulted in a £299m operating surplus, which was also up 6.6 per cent. Sales of assets saw a £1m deficit, compared with a surplus of £10m the year before, with interest payable at £175m.

Pre-tax surplus for 2018/19 stood at £218m, a more positive trend than last year, when surplus before tax dropped nearly 27 per cent to £184m.

Operating margin continued to edge down – a trend that began across all three countries last year with Scotland dropping from 26.2 per cent in 2016/17 to 19.8 per cent in 2017/18. This year operating margin stood at 17.5 per cent.

Long-term loans were up seven per cent to £4.2bn, compared with £3.93bn the year before and £3.82bn in 2016/17.

Wales global accounts 2018/19: eight-year summary

| Traditional 18/19 | LSVT 18/19 | Total 18/19 | Change on year | Total 17/18 | Total 16/17 | Total 15/16 | Total | Total | Total | Total |

Number of units owned and managed |

|

|

|

|

|

|

|

|

|

| |

General needs | 73,309 | 66,670 | 139,979 | +1.4% | 138,001 | 137,349 | 134,539 | 133,730 | 131,141 | 130,638 | 129,719 |

Supported | 5,926 | 1,574 | 7,500 | +2.0% | 7,353 | 6,967 | 6,545 | 6,293 | 7,925 | 8,893 | 8,743 |

Student accommodation | 3,970 |

| 3,970 | -1.6% | 4,035 | 4,102 | 4,061 | 4,061 | 4,235 | 4,112 | 4,103 |

Other | 3,613 | 202 | 3,815 | -7.4% | 4,119 | 3,115 | 3,153 | 3,131 | 13,318 | 9,458 | 12,587 |

Shared ownership | 2,794 | 157 | 2,951 | +1.5% | 2,907 | 2,610 | 2,632 | 2,076 | n/a | n/a | n/a |

Leasehold | 2,442 | 4,164 | 6,606 | +0.6% | 6,568 | 6,493 | 6,678 | 6,580 | n/a | n/a | n/a |

Total units | 92,054 | 72,767 | 164,821 | +1.1% | 162,983 | 160,636 | 157,608 | 155,871 | 156,619 | 153,101 | 155,152 |

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income statement | £m | £m | £m |

| £m | £m |

| £m | £m | £m | £m |

Turnover | 638 | 368 | 1,006 | +5.5% | 954 | 908 | 905 | 855 | 784 | 736 | 675 |

Operating costs | (507) | (310) | (817) | +6.9% | (764) | (715) | (734) | (698) | (634) | (582) | (528) |

Operating surplus | 131 | 58 | 189 | -0.5% | 190 | 193 | 171 | 166 | 150 | 154 | 147 |

|

|

|

|

|

|

|

|

|

|

|

|

Surplus on sales of assets | 4 | 21 | 25 | +66.7% | 15 | 9 | 12 | 10 | 11 | 6 | 8 |

Interest receivable | 8 | 1 | 9 | +28.6% | 7 | 8 | 7 | 8 | 10 | 9 | 9 |

Interest payable | (89) | (38) | (127) | -8.6% | (139) | (120) | (112) | (105) | (97) | (85) | (76) |

Pension scheme net financing gain/loss | n/a | n/a | n/a | n/a | (0) | (5) | (5) | (9) | n/a | n/a | n/a |

Fair value movements increase/decrease | (1) | (0) | 1 | -66.7% | 3 | 5 | 2 | 0 | n/a | n/a | n/a |

Actuarial gain/loss on pension schemes** | (57) | (9) | (66) | -540.0% | 15 | (32) | 4 | (34) | n/a | n/a | n/a |

Surplus for the year before tax | 49 | 36 | 85 | +11.8% | 76 | 90 | 79 | 36 | 74 | 85 | 88 |

|

|

|

|

|

|

|

|

|

|

|

|

Statement of financial position |

|

|

|

|

|

|

|

|

|

|

|

Capital grants | n/a | n/a | n/a |

| n/a | n/a | n/a | n/a | (2,888) | 2,768 | (2,640) |

Depreciation | (757) | (352) | (1,109) | +11.7% | (993) | (882) | (760) | (664) | (357) | (301) | (252) |

Net book value | 5,484 | 1,302 | 6,786 | +6.1% | 6,393 | 6,078 | 5,703 | 5,370 | 2,658 | 2,360 | 2,096 |

| |||||||||||

Total fixed assets | 5,803 | 1,351 | 7,154 | +5.9% | 6,756 | 6,425 | 6,014 | 5,676 | 2,773 | 2,515 | 2,226 |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets | 639 | 700 | 1,339 | +4.0% | 1,287 | 1,259 | 1,282 | 1,321 | (443) | 367 | 301 |

| |||||||||||

Short-term loans | (83) | (86) | (169) | +4.3% | (162) | (110) | (121) | (102) | n/s | n/s | n/s |

Short-term capital grant | (59) | (15) | (74) | -34.5% | (113) | (73) | (68) | (38) | n/a | n/a | n/a |

Other current liabilities | (173) | (105) | (279) | +5.7% | (264) | (249) | (269) | (417) | (251) | (240) | (216) |

Total assets less current liabilities | 6,127 | 1,845 | 7,972 | +6.2% | 7,504 | 7,252 | 6,838 | 6,580 | 2,965 | 2,641 | 2,311 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term loans | (2,267) | (526) | (2,793) | +5.2% | (2,656) | (2,594) | (2,377) | (2,225) | 2,112 | 1,883 | 1,642 |

Long-term capital grant | (2,899) | (276) | (3,176) | +9.1% | (2,912) | (2,787) | (2,626) | (2,521) | n/a | n/a | n/a |

Pension liability | (134) | (123) | (257) | +63.7% | (157) | (166) | (128) | (120) | (26) | (50) | n/s |

Total long-term creditors and provisions | (5,367) | (1,437) | (6,804) | +10.0% | (6,185) | (6,185) | (5,834) | (5,656) | (2,159) | (1,951) | (1,691) |

Net assets | 761 | 408 | 1,169 | +1.2% | 1,155 | 1,067 | 1,004 | 924 | 807 | 690 | 620 |

Reserves | 761 | 408 | 1,169 | +1.2% | 1,155 | 1,067 | 1,003 | 924 | 2,965 | 2,641 | 2,311 |

|

|

|

|

|

|

|

|

|

|

|

|

Growth ratios |

|

|

|

|

|

|

|

|

|

|

|

Growth in turnover |

|

| +5.4% | +10.2% | +4.9% | +0.3% | +4.9% | +9.1% | +6.5% | +8.9% | +12.5% |

Growth in operating costs |

|

| +6.9% | +11.3% | +6.2% | -2.6% | +5.3% | +8.6% | +8.9% | +10.0% | +9.9% |

Growth in operation surplus |

|

| +0.0% | +0.0% | +0.0% | +12.7% | +3.0% | +10.6% | -2.6% | +5.1% | +22.9% |

Profitability ratios |

|

|

|

|

|

|

|

|

|

|

|

Operating margin** | 20.5% | 15.8% | 18.8% | -5.7% | 19.9% | 21.3% | 18.9% | 19.4% | 19.1% | 20.9% | 21.7% |

Net margin** | 7.7% | 9.8% | 8.4% | +6.1% | 8.0% | 9.9% | 8.7% | 4.2% | 9.4% | 11.5% | 13.0% |

Debt servicing ability |

|

|

|

|

|

|

|

|

|

|

|

Long-term loans per unit** | £24,600 | £7,200 | £16,900 | +3.7% | £16,300 | £16,100 | £15,100 | £14,300 | £13,500 | £12,300 | £10,600 |

Gross interest cover*** |

|

| 159.0% | -3.6% | 165.0% | 172.0% | 166.0% | 158.0% | 154.0% | 189.6% | 213.1% |

Operating ratios |

|

|

|

|

|

|

|

|

|

|

|

Management cost per unit |

|

| 1,284 | +5.2% | £1,221 | £1,181 | £1,221 | £1,307 | £1,293 | £1,110 | £1,023 |

Routine maintenance per unit |

|

| 1,144 | +3.2% | £1,108 | £1,091 | £1,087 | £977 | £1,369 | £1,319 | £1,199 |

Notes: Compiled from the financial statements of the 34 largest housing associations measured by number of units owned and managed. n/a = not applicable under relevant accounting standard, n/s = not stated. *‘Other’ units include market rent, shared ownership, extra care. **Net margin, operating margin, and long-term loans per unit calculated by Social Housing. ***Interest cover 2019 to 2014 operating surplus/interest paid; 2013 to 2011 is SBIT/gross interest paid. Figures from 2014/15 calculated under FRS 102, figures before 2014/15 under UK GAAP. Source: ‘Financial Statements of Welsh Housing Associations’ 2012 to 2019, published by Community Housing Cymru

Wales

Total units were up in Wales to 164,821, 55.8 per cent of which were made up of traditional providers, and the bulk of these were general needs stock. Turnover was up 5.5 per cent to £1bn, from £954m the year before. The regulator said this was forecast to rise by four per cent a year to £1.2bn by 2024.

Similarly to the rest of the UK, operating costs had also risen. In Wales, this was by 6.9 per cent, totalling £817m. This resulted in an operating surplus of £189m, which was down 0.5 per cent.

The regulator said the reported operating surplus reduced to a surplus before tax of £85m primarily because of interest payable of £127m and an actuarial loss of £66m in respect of pension schemes.

It added that another key movement on the total comprehensive income included a surplus on disposal of fixed assets of £25m compared to £15m in 2018. The majority of this was made by the large-scale voluntary transfer (LSVT) providers at £21m. Pre-tax surplus was up 11.8 per cent to £85m. This was split £49m from traditional providers and £36m from LSVTs.

Operating margin slipped to 18.8 per cent, from a high of 21.3 per cent in 2016/17. Gross interest cover was down 3.6 per cent to 159 per cent, with long-term loans per unit rising 3.7 per cent to £16,900.

The regulator described the sector’s financial performance as “encouraging”, adding that “housing associations in Wales are well placed to continue investing in existing stock and deliver new supply and are also considering, in depth, the growing decarbonisation agenda and its integration into operations.”

Social Housing special reports

Each month Social Housing focuses on a specific aspect of housing finance and collates and scrutinises the data for hundreds of housing organisations.

The reports below contain unparalleled commentary and analysis along with detailed sortable and searchable data tables.

Unit costs 2019 Our analysis of data from the English regulator has found that unit costs have risen among all types of housing association, with overall maintenance costs seeing the highest weighted average increase of nearly seven per cent

Impairment 2019 Housing associations’ impairments rise almost 40% in a year, driven by fire safety costs, contractor insolvencies and reduced land values

Global accounts 2018/19 Housing associations’ surplus for the year before tax decreased by five per cent to £3.76bn, driven by a 6.6 per cent drop in England

Affordable rent profile 2018/19 The level of affordable lettings dropped for the third year in a row

Staff pay Data from audited accounts of 206 housing associations shows that average staff pay in 2018/19 was £31,787 – a rise of 3.2 per cent over a 12-month period

Professionals’ league Our exclusive professionals’ league finds that activity continued apace in 2019, when housing associations increasingly looked to private placements

Sales proceeds Despite a 10 per cent rise in housing associations’ income from development sales in the last financial year, sales revenue is likely to remain flat over the coming years as a result of the property market downturn

Capital commitments The total capital commitments of 200 housing associations rose by 15 per cent in the past year, analysis by Social Housing has found

Reliance on sales surplus Social Housing finds that the total sales surplus of 150 English registered providers has dropped by nearly 10 per cent, as a result of lower market sales surplus

Stock dispersal How many council areas does your housing association operate in? How concentrated is its stock?

Accounts digest 2018/19 How does your housing association’s finances compare to others?

Housing Revenue Account part two How do councils compare in their 2018/19 Housing Revenue Account positions? Steve Partridge of Savills takes an in-depth look

Diversification of income We look at how housing associations are diversifying their income, and finds that they made 10.3 per cent more revenue from shared ownership and non-social housing activity

Impairment 2017/18 Social Housing takes a close look at the accounts of the 130 largest housing associations, and finds that impairments rose by nearly a third to £78.4m in 2018

Global accounts Social Housing’s analysis of the sector’s global accounts finds that housing associations’ pre-tax surplus fell last year – driven by drops in England, Scotland and Wales (August 2019)

Affordable rent profile We find that the number of affordable rent lettings recorded last year by housing associations in England has dropped for the second year in a row, suggesting that the sector is shifting away from the tenure

Capital commitments We scrutinise the capital commitments of the 208 largest housing associations in the UK (June 2019)

Housing Revenue Account part one Steve Partridge of Savills takes a look at the financial factors councils should consider in their Housing Revenue Account business planning (May 2019)

Reliance on sales surplus Our analysis reveals that profits form 42 per cent of 150 English housing associations’ total surplus (April 2019)

Sales proceeds We look at housing associations’ build-for-sale income and find a two per cent increase in 2017/18 (March 2019)

Shared ownership sales England, excluding London, has seen a four per cent rise in shared ownership sales – much lower than last year’s 16 per cent increase (February 2019)

Stock dispersal We show that housing associations’ general needs stock is becoming more concentrated within their local authority areas (January 2019)

RELATED