Special report: sector closes £9.9bn of capital markets deals in 18 months

Social Housing’s exclusive professionals’ league finds that activity continued apace in 2019, when housing associations increasingly looked to private placements. Chloe Stothart and Robyn Wilson report

Housing associations (HAs) across the UK completed nearly £10bn of funding deals with institutional investors in the 18 months to the end of 2019, exclusive analysis by Social Housing reveals.

Deal activity in the social housing sector continued apace during 2018/19, with HAs increasingly looking to the private placements market for funding.

The number of deals in the sector more than doubled to 108 over the period of July 2018 to December 2019, compared with 51 the year before, although this report covers 18 months instead of 13.

The latest figures were sourced by Social Housing via advisors, arrangers, funders and lawyers operating in the sector. They cover bonds, retail and retail charity bonds, private placements, taps of bonds, retained bonds, institutional investor loans and other similar deals. They do not include bank loans or deals made through bond aggregators.

The data and the trends covered in this report cover the period before the COVID-19 pandemic rocked the financial and funding markets.

Along with the increase in deal numbers, deal value shot up by nearly 40 per cent to £9.9bn, compared with £7.3bn the year before. This was less than the 70 per cent increase seen in last year’s report, although clearly it is still a significant rise.

It should be noted that although a year-on-year comparison has been drawn between the 2017/18 and 2018/19 datasets, they cover different time periods and different organisations responded to the two surveys.

That aside, the report gives a good snapshot of general deal activity and any trends that emerged in social housing financing over 2018/19.

Particularly interesting was the rise seen in private placement deals over this period, with a notable 63 completed, totalling £4.2bn (accounting for 43 per cent of total deals).

This represented a 135 per cent increase on last year, when there were only 24 private placement deals carried out.

This trend chimes with the view of Richard Sedlacek, managing director at debt advisory Rothschild & Co, who says during 2018/19 his company saw more HAs turn to the private placement market for their longer-term debt needs. More generally, he adds that over the period “new bank lenders continued to enter the sector, providing further liquidity for development and replacing legacy funders”.

David Cassidy, head of social housing at Barclays, said that social housing issuance is now “a consistent and strong component of both the sterling public market and the [US private placements] space”.

He added: “We’re seeing a healthy spread of repeat issuers and new entrants giving investors a good choice, whether it’s the geography of the issuer, including the devolved government areas, size of issuer or business mix.

“In addition, we have seen a number of issuers execute at differing tenor – the emergence of sub-15-year issues – and in the [US private placement] space, the availability of deferred drawdown options.

“Encouragingly, market volumes are trending upwards as overall requirement for new sector debt increases, fuelled by larger development pipelines and the drive to deliver more affordable home supply as quickly as feasible.”

On overseas investor interest, Gary Grigor, partner at Devonshires, said there has been “a lot of appetite in the US”, with a number of issuers deciding to do US roadshows to engage those entrants, some of which are new to the sector.

As to why, Mr Grigor added: “[HAs are] not only to trying to obtain new money, they are trying to obtain slightly different types of money as well, so some are trying to obtain money on an unsecured basis, which is harder to achieve in the UK.

“They’ve taken the strategic decision to actually target some of those institutional investors in America, where they might be more receptive to long-term unsecured funding, so they don’t necessarily need to put their assets to work in the conventional way they have done in the past.”

This can be seen within Social Housing’s data, which shows a number of US private placement deals over this time, including a £100m deal with Bromford and five US investors, two of which were new entrants to the sector.

Network Homes finalised a £175m private placement deal with six US and Canadian investors, which included £150m of secured borrowing, as well as £25m of unsecured borrowing. At the same time, US banking giant and one of the biggest private placement providers globally, Wells Fargo, revealed plans to move into the UK social housing sector.

Stacey Flor, the group’s managing director of UK commercial real estate, told Social Housing at the time that the team had spent “a lot of time establishing relationships with some of the larger housing associations” and was looking to arrange bonds and private placements for HAs.

HAs and deal size

Average deal size for the period reduced to £91.4m from £143.3m the year before. That said, there were still a number of deals worth over £100m – the majority of which were bonds (16 out of 23).

They included four bonds with a value of more than £300m. The highest of these was a £375m bond issued by Sovereign in October 2019. At the time of the deal, Tracey Barnes, the group’s chief financial officer, said there was “overwhelming appetite from investors” for the deal.

The other three bonds all totalled £350m each and were issued by Accent Housing, Home Group and Peabody.

There were then 12 bonds with a value between £101m and £300m, with nine private placements also in this category. There were no loans in this size band.

The largest private placement was made by Vivid for £210m in 2019, followed by a £190m private placement with Shepherds Bush in 2018, the latter of which was combined institutional and bank debt. That included £40m from Allied Irish Bank, and £150m from Macquarie Infrastructure Debt Investment Solutions and MUFG.

Advisors, lawyers and valuers

Out of the 108 deals, 60 had named housing association advisors. Seven firms dominated: Chatham Financial (formerly JCRA), Centrus, Savills Financial Consultants, TradeRisks, Rothschild & Co, Aquila Treasury & Finance Solutions and Newbridge Advisors.

Of these, Chatham Financial and Centrus had been advising the most HAs at the time of the deals, with 21 and 17 respectively. Both were split fairly evenly across bonds and private placements, according to our research.

Savills followed with six deals split between bonds, private placement and loans. TradeRisks advised on five deals, the majority of which were bonds.

In terms of valuers, JLL and Savills dominated. JLL acted on some sizeable bonds and private placements, including a £350m bond for Peabody in 2018. Savills acted on a bond of equal size for Accent in 2019.

Bruton Knowles and Castle Surveyors appeared once each within the dataset, with Bruton acting on the overall largest deal – the £380m L&Q bond.

Devonshires and Trowers & Hamlins were the most frequently used HA legal advisors, with Addleshaw Goddard advising more regularly for the funders. Pinsent Mason, Winckworth Sherwood, Allen & Overy and Clifford Chance all appeared on multiple deals.

HAs’ funding advisors for bond issues/placements: Jul 2018–Dec 2019

Total, £m | 41 | 5,451.63 | 63 | 4,234.30 | 4 | 194.35 | 9,880.28 |

| Bond issues | Private placements | Institutional loan | |||||

|---|---|---|---|---|---|---|---|

| Advisor | Number | Value, £m | Number | Value, £ | Number | Value, £m | Total value of fundings, £ |

| Aquila Treasury & Finance Solutions | 0 | 0 | 2 | 115 | 0 | 0 | 115 |

Centrus | 5 | 1,050 | 12 | 844 | 0 | 0 | 1,894 |

Chatham Financial | 10 | 1,656 | 11 | 1,117 | 0 | 0 | 2,773 |

IDCM | 0 | 0 | 1 | 68.5 | 0 | 0 | 68.5 |

Link Asset Services | 0 | 0 | 0 | 0 | 1 | 40 | 40 |

Lloyds | 1 | 250 | 0 | 0 | 0 | 0 | 250 |

M&G | 0 | 0 | 1 | 16 | 0 | 0 | 16 |

Newbridge Advisors | 1 | 75 | 1 | 40 | 0 | 0 | 115 |

Rothschild & Co | 2 | 550 | 0 | 0 | 0 | 0 | 550 |

Santander Global Corporate Banking | 0 | 0 | 1 | 50 | 0 | 0 | 50 |

Savills | 2 | 300 | 3 | 200 | 1 | 75 | 575 |

TradeRisks | 4 | 203 | 1 | 40 | 0 | 0 | 243 |

Undisclosed | 16 | 1,367 | 30 | 1,743.80 | 2 | 79.35 | 3,190.68 |

Note: Table lists deals where firm was advisor rather than arranger

Source: Various, including housing associations and advisors

COVID-19 and future deal flow

Asked about the impact that the coronavirus pandemic may have on deal activity for 2019/20 and beyond, both Mr Grigor and Mr Cassidy pointed to deals completed during the virus outbreak as a sign that deal flow may continue.

Mr Cassidy said: “Despite the challenges of COVID-19, social housing issuers are active in the market and proving attractive to investors, and several successful transactions have completed across late March/early April. This emphasises the underlying credit quality and resilience of the sector.”

Mr Grigor added that Devonshires also completed a deal in April, “so deals are still being done”. He noted: “A trend we saw during Brexit – there were certain discreet periods where HAs were holding back and thinking, ‘Should we go before Brexit or not and will that have an effect on pricing?’

“So there were some momentary pauses on the path of that 12 to 18-month period but ultimately the deals got done – maybe that will be the same for COVID: as we went into lockdown, people just took a step back to reassess [the markets].”

Mr Grigor added: “It will be interesting to see, when we look back, if other associations took a moment to get the funding through before returning to their day job once the government lockdown was lifted.”

One source working at an advisory noted: “There’s still the same amount of money available and I’d like to think that a highly regulated, zero-loss, asset-backed sterling sector is a pretty damn safe sector to invest your cash in.

“There is a lot of investor nervousness but if you’re flexible about when you need to execute, then you just sit tight and ride that volatility.”

However, the same source warned of the risks attached to HAs rushing deals through: “People shouldn’t be panicking and putting in place facilities that they don’t need, which are structured or priced wrong. It’s not just about doing something quickly, it’s about doing something right.”

Range in size of deals: July 2018 to December 2019

| Total | 41 | 63 | 4 |

| Size, £m | Bonds | Placements | Institutional loans |

|---|---|---|---|

| 500 to 301 | 4 | 0 | 0 |

| 300 to 101 | 12 | 9 | 0 |

| 100 to 81 | 6 | 9 | 0 |

| 80 to 61 | 5 | 12 | 2 |

| 60 to 41 | 4 | 9 | 0 |

| 40 to 21 | 6 | 14 | 1 |

| 20 to unknown | 4 | 10 | 1 |

Note: bond issues include retail, charity and retained bonds, bond taps

Auditors

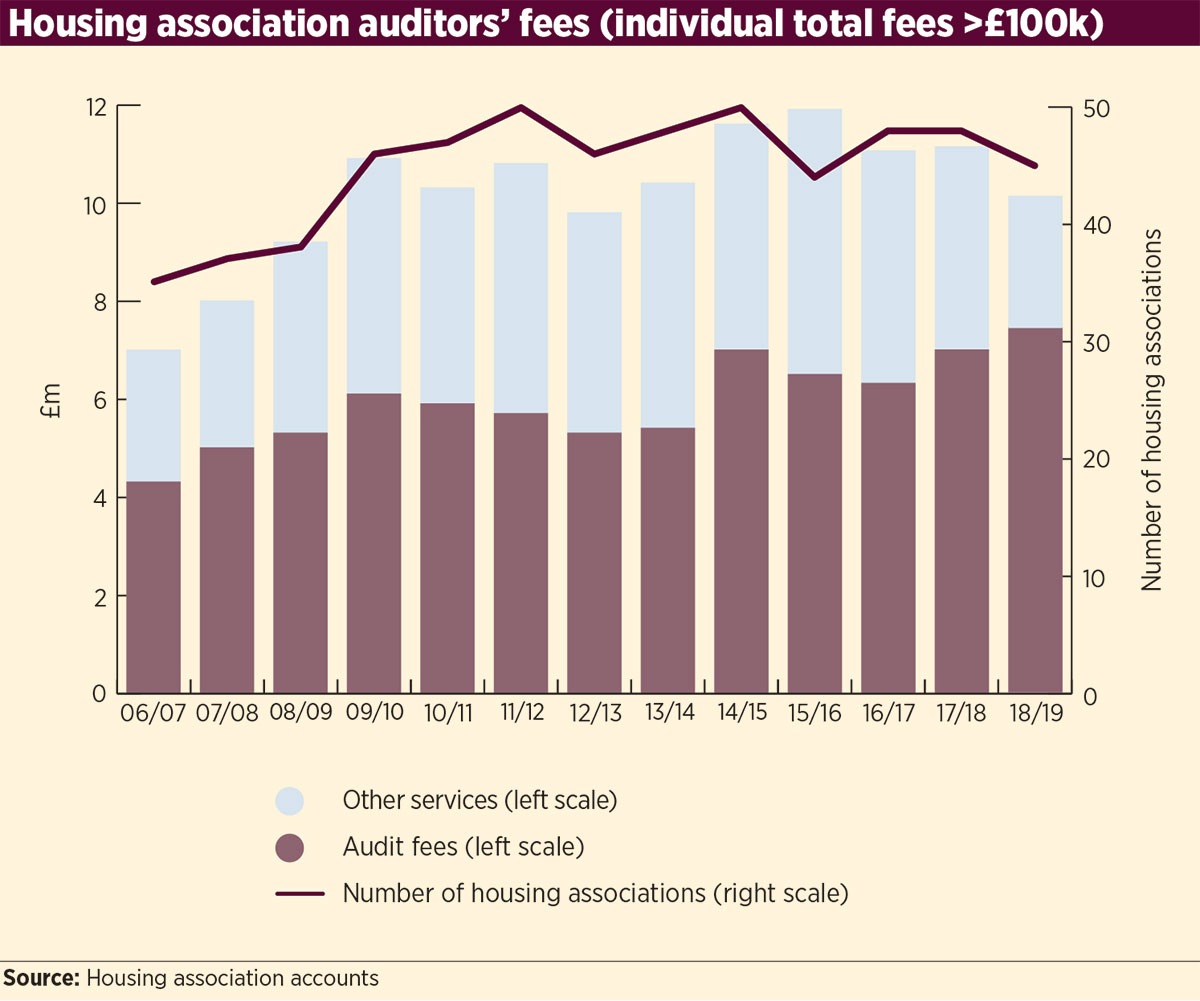

As with last year’s report, Social Housing has analysed HAs’ 2018/19 financial accounts to find the total amount paid to auditors by associations with a bill of £100,000 or more.

This year shows a three per cent decrease in total fees paid over the period, to £10.1m. This was made up of £7.5m in audit fees and £2.7m in other services – the latter of which had dropped by nearly a third. This drop in fees was driven by notable decreases in fees paid by The Guinness Partnership, Optivo and Network Homes – all of which saw a 100 per cent decrease in other service fees as well as various drops in audit fees (apart from Network Homes, which saw a marginal 0.72 per cent increase).

In terms of the highest-paying HAs, this year’s top five were made up of Sanctuary (£800,000), Places for People (£600,000), L&Q (£562,000), Peabody (£517,000) and Clarion (£500,000).

The only change to the top five in this year’s report was the addition of L&Q, with Together leaving the top five.

KPMG once again topped the list for being the highest-paid auditor, with 19 HA clients that paid more than £100,000. Its fees totalled £5.3m, which had dropped by three per cent on last year.

It was followed by BDO, which had 14 clients with fees totalling £2.6m. Again, this was down three per cent on last year.

The remaining six auditors – Grant Thornton, PwC, RSM, Beever and Struthers, Mazars, and Nexia Smith & Williamson – had less than five HA clients paying £100,000 or more.

Grant Thornton saw nearly a 70 per cent increase in total fees to £673,000. Its new clients in 2018/19 included Torus, which helped to boost its fees for the year.

Funding advisors to housing associations: bonds, private placements and institutional loans, July 2018 to December 2019

| Issued by | Date | Amount, £m | Housing association’s funding advisor/arranger/bookrunner | Housing association’s legal advisor | Funder’s valuation | Funder’s legal advisor |

|---|---|---|---|---|---|---|

Yorkshire Housing (br) | 23/12/2019 | 60 | Chatham Financial (formerly JCRA)// | Devonshires | Savills | Winckworth Sherwood |

Bromford (ppi) | 18/12/2019 | 40 | Newbridge Advisors// | Trowers & Hamlins | n/a | Pinsent Masons |

A2Dominion (bi) | 12/12/2019 | 160 | undisclosed//Lloyds Bank Corporate Markets | Devonshires | n/a | Allen & Overy |

Port of Leith (ili)1 | 02/12/2019 | 40 | Link// | Harper Macleod | JLL | Addleshaw Goddard |

Adra (ppi) | 01/12/2019 | 155 | Chatham Financial (formerly JCRA)/NatWest Bank/ | Trowers & Hamlins | Savills | Addleshaw Goddard |

Metropolitan Thames Valley Housing (ppi) | 01/12/2019 | 75 | undisclosed// | Pinsent Masons, Trowers & Hamlins | n/a | Greenberg Traurig |

Honeycomb (Staffs Housing) (ppi) | 01/12/2019 | 8 | Chatham Financial (formerly JCRA)/M&G/ | Trowers & Hamlins | n/a | Winckworth Sherwood |

Dumfries & Galloway (ppi) | 01/12/2019 | 114 | Chatham Financial (formerly JCRA)// | n/a | n/a | n/a |

Cross Keys Homes (bt) | 29/11/2019 | 100 | Centrus// | Devonshires | Savills | Addleshaw Goddard |

Sanctuary Group (bi) | 28/11/2019 | 75 | /RBC Capital Markets/RBC Capital Markets | Gowling, Addleshaw Goddard | JLL | Gowling, Addleshaw Goddard |

Cottsway Housing (ppi)5 | 25/11/2019 | 75 | Centrus// | Trowers & Hamlins, Morrison & Foerster | n/a | Pinsent Masons |

Vivid (ppi) | 25/11/2019 | 210 | Chatham Financial (formerly JCRA)/Centrus// | n/a | n/a | n/a |

Howard Cottage (ppt) | 21/11/2019 | 15 | Chatham Financial (formerly JCRA)// | Anthony Collins Solicitors | n/a | Winckworth Sherwood |

Thirteen (ppi) | 19/11/2019 | 100 | undisclosed/Chatham Financial (formerly JCRA)/ | Anthony Collins Solicitors, Morrison & Foerster | Savills | Greenberg Traurig |

Curo Group (ppi) | 15/11/2019 | 75 | Centrus/Centrus/ | Devonshires, Morrison & Foerster | JLL | Pinsent Masons |

Moat (bt) | 08/11/2019 | 150 | Centrus// | Devonshires | Savills | Addleshaw Goddard |

One Housing Group (ppi)11 | 06/11/2019 | 150 | Centrus/MUFG Securities and NatWest Markets/ | Devonshires, Morrison & Foerster | JLL | Greenberg Traurig, Winckworth Sherwood, Addleshaw Goddard |

Sovereign (bi) | 04/11/2019 | 375 | Chatham Financial (formerly JCRA)/Lloyds, NatWest, National Australia Bank, SMBC Nikko Capital Markets/Lloyds/NatWest | Trowers & Hamlins, Winckworth Sherwood | JLL | Pinsent Masons |

Radius (ppi) | 01/11/2019 | 105 | Chatham Financial (formerly JCRA)// | Wilson Nesbitt | n/a | Greenberg Traurig, Pinsent Masons |

MORhomes (br) | 01/11/2019 | 12.5 | Chatham Financial (formerly JCRA)// | n/a | n/a | n/a |

The Wrekin Housing Group (bt) | 23/10/2019 | 250 | Chatham Financial (formerly JCRA)//NatWest, Lloyds and Santander | Devonshires, Anthony Collins Solicitors | Savills | Addleshaw Goddard |

L&Q (bt) | 21/10/2019 | 84.8 | undisclosed//Lloyds Bank Corporate Markets | Devonshires | Savills | Addleshaw Goddard |

LiveWest (bi) | 18/10/2019 | 250 | Lloyds/Lloyds/Lloyds, Santander and MUFG | Trowers & Hamlins | Savills | Addleshaw Goddard |

MORhomes (br) | 01/10/2019 | 38.6 | Chatham Financial (formerly JCRA)// | Devonshires | n/a | Addleshaw Goddard |

One Manchester (ili)2 | 01/10/2019 | 75 | Savills Financial Consultants/NatWest Markets/ | Devonshires | Savills | Addleshaw Goddard |

Citizen (bt) | 01/10/2019 | 100 | Savills Financial Consultants/Barclays/Barclays/RBS | Anthony Collins Solicitors | Savills | Addleshaw Goddard |

North Wales Housing Association (ppi)1 | 25/09/2019 | 39 | Centrus// | Devonshires | Savills | Pinsent Masons |

The Guinness Partnership (br) | 24/09/2019 | 100 | undisclosed/Newbridge Advisors/ | Trowers & Hamlins | n/a | Addleshaw Goddard |

Soha Housing (ppi)3 | 19/09/2019 | 40 | undisclosed// | Devonshires | Savills | Pinsent Masons |

Stonewater (br) | 16/09/2019 | 28 | TradeRisks// | Devonshires | n/a | Addleshaw Goddard |

Stonewater (br) | 04/09/2019 | 25 | TradeRisks// | n/a | n/a | n/a |

Broadland Housing Association (ppt) | 02/09/2019 | 15 | undisclosed// | Anthony Collins Solicitors | n/a | Addleshaw Goddard |

Optivo (br) | 02/09/2019 | 75 | undisclosed// | Trowers & Hamlins | n/a | n/a |

RHP (br) | 01/09/2019 | 35 | undisclosed/Chatham Financial (formerly JCRA)/ | Devonshires | Savills | Addleshaw Goddard |

Catalyst Housing (br) | 01/09/2019 | 50 | undisclosed// | Trowers & Hamlins | n/a | n/a |

Peabody (ppi) | 15/08/2019 | 100 | Centrus// | Trowers & Hamlins | n/a | Akin Gump |

Bromford (ppi) | 12/08/2019 | 50 | undisclosed/Newbridge Advisors/ | Trowers & Hamlins | n/a | Pinsent Masons |

Newport City Homes (ppi)2 | 02/08/2019 | 95 | Centrus/NatWest Markets/ | Trowers & Hamlins | Savills | Pinsent Masons |

Accord (ppi)3 | 01/08/2019 | 30 | Centrus// | Devonshires, Pinsent Masons | n/a | Pinsent Masons, Devonshires, Brodies |

Walsall Housing Group (br) | 31/07/2019 | 25 | undisclosed// | Anthony Collins | n/a | Clifford Chance |

Wheatley Group (ppi)4 | 12/07/2019 | 100 | undisclosed/BlackRock Real Assets/ | Devonshires, Pinsent Masons | n/a | Addleshaw Goddard |

MHS Homes (ppi) | 10/07/2019 | 10 | undisclosed// | Trowers & Hamlins | n/a | Addleshaw Goddard |

Eildon HA (ppi)3 | 10/07/2019 | 40 | undisclosed/Santander/ | Harper Macleod | JLL | Devonshires, Brodies |

EMH Group (ppi)3 | 09/07/2019 | 100 | Savills Financial Consultants/-/- | Trowers & Hamlins | Savills | Addleshaw Goddard |

Accent (bi) | 01/07/2019 | 350 | Centrus//Barclays, Lloyds, NatWest Markets | Trowers & Hamlins, Wright Hassall | Savills | Allen & Overy |

Shepherds Bush (ppi) | 01/07/2019 | 50 | Chatham Financial (formerly JCRA)// | n/a | n/a | n/a |

Catalyst Housing (br) | 01/07/2019 | 50 | undisclosed// | Trowers & Hamlins | n/a | n/a |

Link Group (ppi)8 | 27/06/2019 | 50 | undisclosed/Newbridge Advisors/ | Harper Macleod | JLL | Pinsent Masons |

Accord (ppi) | 21/06/2019 | 75 | Centrus// | Devonshires, Anthony Collins Solicitors | JLL | Pinsent Masons |

Halton Housing Trust (ppi) | 07/06/2019 | 20 | undisclosed// | n/a | Savills | Addleshaw Goddard |

Aster (br) | 01/05/2019 | 20 | Chatham Financial (formerly JCRA)// | Trowers & Hamlins | n/a | n/a |

GreenSquare (ppt) | 30/04/2019 | 30 | undisclosed// | Anthony Collins Solicitors | n/a | Devonshires |

Optivo (br) | 25/04/2019 | 25 | undisclosed// | Trowers & Hamlins | n/a | n/a |

Linc (ppi) | 16/04/2019 & 16/12/2019 | 40 | undisclosed/Newbridge Advisors/ | Devonshires | n/a | Addleshaw Goddard |

ForViva (ppi)5 | 04/04/2019 | 50 | Savills /Savills/ | Trowers & Hamlins | Savills | Addleshaw Goddard |

GB Social Housing (bt) | 29/03/2019 & 29/07/2019 & 17/10/2019 | 17.725 | undisclosed/Barclays/ | Trowers & Hamlins | n/a | Addleshaw Goddard |

Greatwell Homes (formerly Wellingborough) (ppi)3 | 29/03/2019 | 40 | TradeRisks/TradeRisks/ | Trowers & Hamlins | Savills | Addleshaw Goddard |

Home Group (bi) | 27/03/2019 | 350 | Centrus/HSBC, NatWest and Mitsubishi UFJ Financial Group (MUFG)/HSBC, MUFG and NatWest Markets | Devonshires, Addleshaw Goddard | Savills | Addleshaw Goddard |

Livin (ppi)3 | 22/03/2019 | 65 | Centrus// | Trowers & Hamlins | Savills | Addleshaw Goddard |

Metropolitan Thames Valley Housing (br) | 07/03/2019 | 100 | undisclosed//Lloyds Bank Corporate Markets and HSBC | Devonshires | JLL | Clifford Chance |

Broadland Housing Association (ppt) | 01/03/2019 | 15 | undisclosed// | Anthony Collins Solicitors | n/a | Addleshaw Goddard |

Incommunities (bt) | 01/03/2019 | 250 | Chatham Financial (formerly JCRA)//Barclays and NatWest | Devonshires, Trowers & Hamlins | Savills | Allen & Overy |

Stonewater (br) | 01/03/2019 | 75 | TradeRisks// | n/a | n/a | n/a |

ACIS (ppi) | 18/02/2019 | 16 | M&G/M&G/ | Forbes | n/a | Winckworth Sherwood |

Cambridge Housing Society (ppi) | 14/02/2019 | 60 | undisclosed/Barings/ | Devonshires, Morrison & Foerster | Savills | Addleshaw Goddard |

Grŵp Cynefin (ppi)6 | 12/02/2019 | 50 | Centrus/M&G/ | Devonshires, Clarke Willmott | Savills | Winckworth Sherwood |

A2Dominion (ppi)13 | 11/02/2019 | 50 | Centrus// | Devonshires | n/a | Pinsent Masons |

Futures Housing Group (bi) | 01/02/2019 | 200 | Savills Financial Consultants//Santander and NatWest Markets | Anthony Collins Solicitors | Savills | Addleshaw Goddard |

Bromford (ppi) | 01/02/2019 | 100 | Chatham Financial (formerly JCRA)/NatWest Markets (acted as sole agent)/ | Trowers & Hamlins, Morrison & Foerster | savills | Greenberg Traurig |

Mid Wales (ppi)6 | 01/02/2019 | 30 | undisclosed/BAE/ | Anthony Collins Solicitors | Savills | Winckworth Sherwood |

MORhomes (bt) | 01/02/2019 | 250 | Chatham Financial (formerly JCRA)//Morgan Stanley, JP Morgan and Barclays | Addleshaw Goddard | n/a | n/a |

Cunninghame Housing Association (ppi)8 | 30/01/2019 | 30 | undisclosed/NatWest Markets/ | Harper Macleod | JLL | Devonshires |

Hillcrest (ppi)7 | 29/01/2019 | 70 | undisclosed/NatWest Markets/ | Harper Macleod | JLL | Devonshires |

Notting Hill Genesis (bi) | 25/01/2019 | 250 | undisclosed//Barclays, HSBC and Santander | Devonshires | JLL | Allen & Overy |

Clarion (bi) | 17/01/2019 | 250 | undisclosed//Barclays, HSBC and RBC Capital Markets | Allen & Overy, Winckworth Sherwood | JLL and Savills | Clifford Chance |

A2Dominion (bi) | 16/01/2019 | 75 | Newbridge Advisors// | Devonshires | n/a | Allen & Overy |

Network Homes (ppi) | 15/01/2019 | 175 | undisclosed/MUFG/ | Trowers & Hamlins, Winckworth Sherwood | JLL | Greenberg Traurig, Addleshaw Goddard |

Queens Cross Housing Association (ppi)4 | 11/01/2019 | 40 | Centrus/NatWest Markets/ | Harper Macleod | JLL | Devonshires |

One Vision Housing (ppi)4 | 21/12/2018 | 30 | undisclosed// | Weightmans | Savills | Devonshires |

Wheatley Group (ili)1 | 13/12/2018 | 76.5 | undisclosed// | Addleshaw Goddard | Savills | Brodies |

Octavia Housing (ppi) | 10/12/2018 | 150 | Chatham Financial (formerly JCRA)/Santander/ | Devonshires | JLL | Pinsent Masons |

Nottingham Community Housing Association (ppi) | 06/12/2018 | 85 | undisclosed// | Anthony Collins Solicitors, Trowers & Hamlins | n/a | Addleshaw Goddard |

Port of Leith (ppi)8 | 03/12/2018 | 10 | undisclosed// | Harper Macleod | n/a | Pinsent Masons |

Hastoe (bi) | 01/12/2018 | 75 | TradeRisks/TradeRisks/ | Trowers & Hamlins | JLL | Allen & Overy |

Soha Housing (ppi)3 | 30/11/2018 | 40 | Aquila Treasury & Finance Services/Santander/ | Devonshires | n/a | Pinsent Masons |

Linc Cymru (ppi) | 16/11/2018 | 75 | Chatham Financial (formerly JCRA)/NatWest Markets/ | Devonshires, Morrison & Foerster | Savills | Addleshaw Goddard |

Stonewater (br) | 14/11/2018 | 50 | undisclosed/Lloyds Bank Corporate Markets/ | Devonshires | n/a | Bryan Cave Leighton Paisner |

Places for People Treasury (ppi)12 | 05/11/2018 | 75 | undisclosed// | Allen & Overy | n/a | Pinsent Masons |

BPHA (bt) | 01/11/2018 | 150 | Chatham Financial (formerly JCRA)//Barclays Bank and Lloyds Bank Corporate Markets | n/a | JLL | Addleshaw Goddard |

Karbon Homes (bt) | 01/11/2018 | 250 | Chatham Financial (formerly JCRA)//NatWest Markets and Lloyds Bank Corporate Markets | Trowers & Hamlins | Savills | Addleshaw Goddard |

Stonewater (ppi) | 01/11/2018 | 15.3 | undisclosed/PGIM/ | Devonshires, Morrison & Foerster | n/a | Morgan, Lewis & Bockius |

Howard Cottage (ppi) | 01/11/2018 | 40 | undisclosed/Chatham Financial (formerly JCRA)/ | Anthony Collins Solicitors | JLL | Winckworth Sherwood |

Aster (br) | 01/11/2018 | 20 | undisclosed/Chatham Financial (formerly JCRA)/ | Trowers & Hamlins | n/a | n/a |

Raven Housing Trust (ppi)2 | 22/10/2018 | 50 | Savills Financial Consultants/Savills Financial Consultants/ | Anthony Collins Solicitors, Trowers & Hamlins | JLL | Addleshaw Goddard |

Southern Housing Group (bi) | 15/10/2018 | 200 | Rothschild & Co and Newbridge Advisors//HSBC, Natwest Markets and Lloyds | Devonshires | JLL | Addleshaw Goddard |

Newlon Housing Trust (ppi) | 12/10/2018 | 135 | Chatham Financial (formerly JCRA)/Barclays/ | Devonshires, Trowers, Morrison & Foerster, McMillan | JLL | Greenberg Traurig, Addleshaw Goddard |

East End Homes (ppi) | 28/09/2018 | 20 | undisclosed/M&G/ | Trowers & Hamlins | n/a | Winckworth Sherwood |

Peabody (bi) | 12/09/2018 | 350 | Rothschild & Co//Barclays, HSBC and Santander | n/a | JLL | n/a |

A2Dominion (ppi) | 31/08/2018 | 80 | undisclosed// | Devonshires, Morrison & Foerster | n/a | Morgan, Lewis & Bockius |

More Homes Waltham Forest (ppi)6 | 21/08/2018 | 88.5 | undisclosed// | Trowers & Hamlins, Acuity Legal, Eversheds | Castle Surveyors Limited | Devonshires |

Riverside (br) | 17/08/2018 | 100 | Centrus/Barclays/ | Devonshires | JLL | Allen & Overy |

Phoenix (ppi)3 | 09/08/2018 | 75 | Aquila Treasury & Finance Solutions// | Trowers & Hamlins, Morrison & Foerster | JLL | Greenberg Traurig |

GreenSquare (ppi)9 | 30/07/2018 | 75 | undisclosed/TradeRisks/ | Anthony Collins Solicitors | Savills | Devonshires |

Norland Estates* (ppi) | 20/07/2018 | 68.5 | IDCM// | Gowling | JLL | Devonshires |

Kingdom Housing Association (ppi) | 20/07/2018 | 85 | undisclosed/NatWest Markets/ | Harper Macleod | JLL | Devonshires, Brodies |

Cairn Housing Association (ppi) | 17/07/2018 | 50 | Santander Global Corporate Banking// | Harper Macleod | n/a | n/a |

Homes for Good* (ilr)15 | 17/07/2018 | 2.85 | undisclosed// | n/a | n/a | n/a |

Shepherds Bush (ppr)14 | 01/07/2018 | 190 | undisclosed// | n/a | n/a | n/a |

Notes: (ili) institutional loan issue, (ppi) private placement issue, (br) bond retained, (bt) bond tap, (ppt) private placement tap, (bi) bond issue, (ppr) private placement retained, (ilr) institutional loan retained

Investors (if named): (1) Scottish Widows, (2) LGIM, (3) Pension Insurance Corporation, (4) M&G, (5) Massachusetts Mutual Life Insurance Company, (6) BAE, (7) SunLife and anonymous US Investor, (8) Canada Life, (9) Blackrock Real Assets, (10) The Prudential Assurance Company, (11) Pacific Life Insurance, (12) South Korean investors including DB Life Insurance, (13) Phoenix Group, (14) Macquarie Infrastructure Debt Investment Solutions, MUFG Bank and Allied Irish Bank, (15) Social and Sustainable Capital

* non-registered provider issuer

Source: Social Housing, funding advisors, law firms

Highest-paying housing associations: audit and other fees above £100,000, 2018/19

Total |

| 10,132 | -3.30 | 7,463 | 11.37 | 2,668.6 | -29.34 |

| Housing association | Auditor 2018/19 | Total fees, £’000 | Change on year, % | Audit, £’000 | Change on year, % | Other services, £’000 | Change on year, % |

|---|---|---|---|---|---|---|---|

Sanctuary | KPMG | 800 | 0.00 | 600 | 20.00 | 200 | -33.33 |

Places for People | KPMG | 600 | -6.98 | 600 | 0.00 | 0 | -100.00 |

L&Q | KPMG | 562 | -9.79 | 410 | 5.13 | 152 | -34.76 |

Peabody | KPMG | 517 | 26.72 | 384 | 10.66 | 133 | 118.03 |

Clarion | KPMG | 500 | 0.00 | 400 | 0.00 | 100 | 0.00 |

Onward | KPMG | 422 | -16.10 | 161 | 22.90 | 261 | -29.84 |

Hyde | PwC | 419 | 28.92 | 301 | 54.36 | 118 | -9.23 |

Metropolitan Thames Valley | BDO | 387 | 3.75 | 265 | 9.96 | 122 | -7.58 |

Anchor Hanover | BDO | 357 | 53.88 | 203 | 89.72 | 154 | 23.20 |

Notting Hill Genesis | BDO | 277 | -51.00 | 247 | -20.32 | 30 | -88.37 |

Torus | Grant Thornton | 245 | 122.73 | 98 | 164.86 | 147 | 101.37 |

Southern | PwC | 240 | 40.35 | 192 | 12.28 | 48 | 0.00 |

Thirteen | PwC | 235 | 16.92 | 105 | 45.83 | 130 | 0.78 |

Riverside | KPMG | 216 | -13.25 | 190 | 16.56 | 26 | -69.77 |

Bromford | KPMG | 210 | 69.35 | 147 | 133.33 | 63 | 3.28 |

Aster | KPMG | 204 | 65.85 | 147 | 22.50 | 57 | 1800.00 |

A2Dominion | BDO | 200 | 0.00 | 200 | 0.00 | 0 | 0.00 |

Orbit | KPMG | 200 | 100.00 | 100 | 0.00 | 100 | 0.00 |

The Guinness Partnership | Nexia Smith & Williamson | 200 | -83.33 | 200 | 0.00 | 0 | -100.00 |

Sovereign | KPMG | 183 | -8.04 | 178 | 7.88 | 5 | -85.29 |

Your | Grant Thornton | 176 | 13.55 | 124 | 20.39 | 52 | 0.00 |

Optivo | BDO | 169 | -13.33 | 169 | 5.63 | 0 | -100.00 |

Abbeyfield | BDO | 164 | 19.71 | 122 | 6.09 | 42 | 90.91 |

Plus Dane | KPMG | 155 | 33.62 | 59 | 28.26 | 96 | 37.14 |

Together | BDO | 148 | 38.32 | 133 | 24.30 | 15 | 0.00 |

Longhurst | Beever & Struthers | 141 | 28.18 | 93 | 9.41 | 48 | 92.00 |

Network Homes | BDO | 139 | 0.72 | 139 | 1.46 | 0 | -100.00 |

Swan | Grant Thornton | 134 | -1.47 | 104 | 0.00 | 30 | -6.25 |

Trafford | BDO | 131 | 57.83 | 61 | 45.24 | 70 | 70.73 |

Home Group | KPMG | 130 | 5.69 | 108 | 16.13 | 22 | -26.67 |

Regenda | BDO | 130 | 49.43 | 83 | 27.69 | 47 | 113.64 |

Midland Heart | KPMG | 123 | -2.38 | 85 | -32.54 | 38 | 0.00 |

Jigsaw | BDO | 122 | -8.96 | 101 | -12.93 | 21 | 16.67 |

Stonewater | BDO | 119 | -6.30 | 106 | 15.22 | 13 | -62.86 |

Wythenshawe | Grant Thornton | 118 | 13.46 | 50 | 25 | 68 | 6.25 |

One | BDO | 115 | -3.36 | 115 | -3.36 | 0 | 0.00 |

Radian | BDO | 113 | 7.62 | 107 | 8.08 | 6 | 0.00 |

Irwell Valley | RSM | 110 | 161.90 | 40 | 33.33 | 70 | 483.33 |

Gentoo | KPMG | 105 | -9.48 | 58 | -9.38 | 47 | -9.62 |

Incommunities | RSM | 102 | 29.11 | 76 | 38.18 | 26 | 8.33 |

Connexus | KPMG | 101 | -0.98 | 101 | -0.98 | 0 | 0.00 |

Grand Union | Mazars | 100 | -12.28 | 63 | 8.62 | 37 | -33.93 |

Stonewater | BDO | 105 | 20.69 | 79 | 5.33 | 26 | 116.67 |

Knightstone | Mazars | 104 | 0.00 | 44 | 2.33 | 60 | -1.64 |

Radian | BDO | 103 | -25.90 | 97 | -11.82 | 6 | -79.31 |

LiveWest | KPMG | 107 | 11.46 | 97 | 7.78 | 10 | 66.67 |

East Midlands | KPMG | 104 | -9.57 | 80 | -6.98 | 24 | -17.24 |

BPHA | KPMG | 102 | 67.21 | 61 | 10.91 | 41 | 583.33 |

Grand Union | Mazars | 100 | -12.28 | 63 | 8.62 | 37 | -33.93 |

Source: Housing associations’ audited accounts, 2018/19

RELATED