Special report: UK associations complete £8.8bn of deals with investors

Social Housing’s exclusive professionals’ league finds that private placements are still the preferred funding route within the capital markets. Chloe Stothart and Robyn Wilson report

Housing associations (HAs) across the UK completed £8.8bn of funding deals with institutional investors in the 12 months to 31 March 2022, exclusive analysis by Social Housing has found.

A total of 69 deals were carried out over this time, with private placements still the preferred funding route within the capital markets over bond issues or loans with institutional investors, with a significant number of HAs looking at deferred funding structures to take advantage of the favourable market conditions seen during 2021-22.

The latest figures were sourced by Social Housing via advisors, arrangers, funders and lawyers operating in the sector. They cover bonds, retail bonds, retail charity bonds, private placements, taps of bonds, retained bonds, institutional investor loans and other similar deals. They do not include bank loans.

This is the first year that Social Housing has collected data on deals made through bond aggregators, although this has been analysed separately from the main data.

Overall, our findings show that the total number of deals completed between 1 April 2021 and 31 March 2022 decreased compared with our last report in 2018-19 when there were 108 deals recorded. However, our 2018-19 report covered a longer 18-month period from July 2018 to December 2019, compared with the 12-month view taken for this report.

While these reports cover different time periods and different organisations responded to the two surveys, they do give a good snapshot of emerging trends and general deal activity, with 2021-22 looking to be another busy year.

Low interest rates and high investor demand were big drivers behind the activity, with deferred funding and a drive to decarbonise stock coming out at as two key trends.

Elizabeth Cain, head of debt origination at the Pension Insurance Corporation (PIC), said: “2021-22 were good conditions for issuance, both in terms of government borrowing and credit spreads, so the amount we pay above government borrowing. They were attractive from a borrowing perspective; we certainly saw plenty of issuance and were very active during that time period.”

Major deals involving PIC over this period included one of the largest private placements made in 2021-22 – a £150m deal in partnership with Macquarie Asset Management to Havebury Housing. Savills Financial Consultants acted as financial advisor. The funding is for affordable housing development and to improve the energy efficiency of Havebury’s homes.

PIC also agreed a £130m private placement with Raven Housing Trust, £75m of which was drawn down to refinance existing facilities, with two tranches of deferred funding. Savills Financial Consultants acted as funding advisors.

Terms of the loan were not disclosed, although it took a ‘use of proceeds’ approach to ESG-linked lending, with reference to Raven’s sustainable finance framework. This included commitments to energy efficiency and renewable energy capacity, as well as affordable housing delivery.

Patrick Hawkins, a director at Savills Financial Consultants, said that a lot of the deal activity seen in 2021-22 was “forward-funding development pipelines, so there was a strong focus on cost of carry, with people trying to fund as far in advance as they felt they could without being reckless. So deferred drawdown was a big thing.”

This was particularly the case in the private placement market, he said. “Those investors find it easier to do deferred drawdowns because they’re able to manage the cost of carry on their balance sheet rather than the borrower having to manage the cost of carry of its balance sheet.”

He added that, in contrast, deferred drawdown structures are much harder in the public market. “In that market, you want to sell a bond and settle it five to seven days later. Private placements are more bespoke and there’s more flexibility.”

Our data shows that private placements were the preferred funding route within capital markets, with 33 deals completed. This compared with 29 bonds and seven loans with institutional investors.

This chimed with all the respondents that Social Housing spoke to for this report, including Joe Atkinson, associate at Savills Financial Consultants.

“We did a lot of private placements over that time period and pretty much all of them had some sort of deferral structure going out for a maximum of three years. We saw one investor [although we were not involved in the deal] go out to five years at that point.”

He said these deferred structures were to forward-fund Savills’ clients’ development plans and lower their cost of carry.

Natalie Singh, partner at Anthony Collins, said that her organisation also saw a large number of bond taps rather than new issuances during the period, which she said was in part down to favourable pricing. This included a £70m bond tap by East Midlands-based Futures Housing Group on its 2044 bond. The tap was priced at a yield of 2.31 per cent, with a spread of 95 basis points over the benchmark gilt rate.

HAs and deal size

Deal size ranged from under £20m to up to £500m. Five deals were sized between £301m and £500m, with 25 deals sized between £101m and £300m.

There were two private placements valued at £150m. These were the largest private placements agreed over the period and included Havebury Housing’s deal with PIC and Macquarie Asset Management. The other deal was between Riverside and US investor Pricoa Private Capital, a subsidiary of insurance giant Prudential’s investment arm, PGIM.

The deal was Riverside’s first private placement and is believed to be only the third investment in the UK social housing sector from Pricoa Private Capital.

Neil Waller, partner at Trowers & Hamlins, said: “US investors on the private placement side came and went over the period, but there did seem to be interest.”

Savills’ Mr Atkinson said that while it had seen “a few” North American investors, most of the company’s private placements involved UK investors with “a few Canadian investors”.

HAs’ funding advisors for bond issues/placements: April 2021 to March 2022

Total, £m | 29 | 5,900 | 33 | 2,571 | 7 | 333 | 8,804 |

| Bond issues | Private placements | Institutional loan | |||||

|---|---|---|---|---|---|---|---|

| Advisor | Number | Value, £m | Number | Value, £ | Number | Value, £m | Total value of fundings, £ |

Gresham House | 0 | 0 | 1 | 100 | 0 | 0 | 100 |

Chatham Financial | 6 | 800 | 5 | 331 | 0 | 0 | 1,131 |

Centrus | 4 | 675 | 5 | 215 | 2 | 65 | 955 |

NatWest | 0 | 0 | 1 | 140 | 0 | 0 | 140 |

Newbridge Advisors | 3 | 350 | 0 | 0 | 0 | 0 | 350 |

David Tolson Partnership | 0 | 0 | 1 | 15 | 0 | 0 | 15 |

Savills Financial Consultants | 1 | 70 | 6 | 725 | 4 | 230 | 1,025 |

Undisclosed | 15 | 4,005 | 14 | 1,045 | 1 | 38 | 5,088 |

Note: Table lists deals where firm was advisor rather than arranger

Source: Various, including housing associations and advisors

He added: “North American investors were less competitive in 2021 [since] they focus on the interest and currency environment. This has become more favourable to them this year, but of course the market has slowed down.

“[North American investors] also tend to have a slightly different tenor preference to UK investors, who tend to go for longer-dated, more comfortable, 25-35 [year terms]. Whereas North American investors have a preference for 15-20 years and, in private placements, the borrowers like longer-dated transactions, so they weren’t as competitive.

“Ironically, they have become more competitive now this year because the currencies are much more in their favour and also gilt yields are higher. But the private placement market has ground to a halt at the moment. So just as they were maybe coming back in and becoming more competitive, the market has slowed down completely. So we haven’t seen the re-entrance that maybe we would have liked to.”

The largest bonds over this period were sized at £400m. The first was issued by PA Housing for £400m, for which Chatham Financial acted as funding advisor. Paragon Treasury issued the second.

There were three bonds each with a value of £350m, all sustainability bonds. The first was issued by Paradigm, with £100m retained and the remaining £250m priced on 12 May at a spread of 88 basis points over gilts. Anchor and Peabody were the other two bond issuers.

Aggregators

There were 16 deals completed through aggregators during the 2021-22 period, totalling £471m. The bulk of these (10) were through Blend, with four completed through MORhomes and the remaining through The Housing Finance Corporation (THFC), Blend’s parent company.

The largest of these deals was GreenSquareAccord’s £75m, 40-year bond. This was issued in June 2021 at an all-in rate of 2.467 per cent and a spread of 128 basis points over gilts. It was the first deal for the group after its merger in April that year.

Range in size of deals: April 2021 to March 2022

| Total | 29 | 33 | 7 |

| Size, £m | Bonds | Placements | Institutional loans |

|---|---|---|---|

Unknown to 20 | 0 | 4 | 2 |

21 to 40 | 2 | 6 | 2 |

41 to 60 | 2 | 4 | 1 |

61 to 80 | 3 | 4 | 1 |

81 to 100 | 2 | 5 | 1 |

101 to 300 | 15 | 10 | 0 |

301 to 500 | 5 | 0 | 0 |

Note: Bond issues include retail, charity and retained bonds, bond taps

Source: Various, including housing associations and advisors

MORhomes’ deals were smaller in size, ranging between £15m and £19m. Andrew Morton, the group’s deputy chief executive and chief financial officer, said this “played to our strengths”, with the group able to go to the market for amounts as small as £10m.

He added that with interest rates on the up and uncertainty as to where they might head, organisations could increasingly look for smaller deals “to keep them going until they have a clearer view on where things are going

to land”.

Speaking on the drivers behind 2021-22 deal activity, Mr Morton said that sustainability continued to climb up the priority list for HAs, with MORhomes also launching its first sustainability bond in November 2021.

“If we look back a number of years, people would typically be borrowing to build new houses as you might expect, but there is increasingly the element now of HAs looking to do retrofit as we move towards net zero,” he said.

The two remaining aggregators – GB Social Housing and ARA Venn – were unable to or did not respond to a request for a list of deals done during the period. Newbridge and Aviva were unable to provide data and Chatham did not respond.

Funding advisors to housing associations: bonds, private placements and institutional loans, April 2021 to March 2022

Issued by | Date | Amount, £m | Housing association’s funding advisor/arranger/bookrunner | Housing association’s legal advisor | Funder’s valuation | Funder’s legal |

Accent Capital (Retained) (b) | Oct 2021 | 125 | /Lloyds Bank Corporate Markets/ |

|

|

|

Adra (Tai) Cyfyngedig (pp) | Jan 2022 | 30 | Chatham Financial// | Trowers & Hamlins | Savills | Addleshaw Goddard |

Anchor (b) | Jul 2021 | 350 | //Santander, Barclays, NAB and MUFG |

| JLL |

|

Apex Housing (pp) | Dec 2021 | 100 | Gresham House// | Devonshires |

| Addleshaw Goddard |

Aspire Housing (pp) | Oct 2021 | 145 | Savills Financial Consultants/NatWest/ | Anthony Collins/Capsticks | Savills | Addleshaw Goddard |

Barcud (pp)1 | Sep 2021 | 50 | // |

|

|

|

Believe Housing (pp)2 | Apr 2021 | 85 | Chatham Financial// | Trowers & Hamlins |

|

|

Bernicia Group (pp)3 | Aug 2021 | 30 | // | Trowers & Hamlins |

| Addleshaw Goddard |

Beyond Housing (b) | May 2021 | 250 | Centrus/Lloyds & NatWest/Lloyds & NatWest | Devonshires | Savills | Addleshaw Goddard |

Black Country Housing Group (il)4 | Apr 2021 | 40 | Savills Financial Consultants/Savills Financial Consultants/ | Anthony Collins | JLL | Addleshaw Goddard |

Black Country Housing Group (pp)5 | Apr 2022 | 40 | Savills Financial Consultants/na/ | Anthony Collins | n/a | Addleshaw Goddard |

Broadland Housing Association (pp)6 | Aug 2021 | 20 | Centrus/na/ | Anthony Collins | n/a | Addleshaw Goddard |

Broadland Housing Association (il)7 | Jan 2022 | 15 | Centrus/na/ | Anthony Collins |

| Devonshires |

Clarion (b) | Sep 2021 | 300 | /Lloyds Bank Corporate Markets/ |

| JLL |

|

Cottsway (pp)8 | Apr 2022 | 75 | // |

| JLL |

|

Curo Places Limited (pp)9 | Nov 2021 | 65 | Centrus/Centrus/ | Devonshires | JLL | Pinsent Masons |

Eastlight (pp)10 | Aug 2021 | 120 | // | Trowers & Hamlins/ Morrison Foerster | JLL |

|

Futures Housing Group (b)11 | Jan 2022 | 70 | Savills Financial Consultants/NatWest/ | Anthony Collins | Savills | Addleshaw Goddard |

Grwp Cynefin (pp)12 | Aug 2021 | 40 | // | Devonshires |

| Addleshaw Goddard |

Havebury Housing Partnership (pp)13 | Dec 2021 | 150 | Savills Financial Consultants/Lloyds/ | Bevan Brittan | Savills | Addleshaw Goddard |

Heart of Medway (pp) | Nov 2021 | 20 | // | Trowers & Hamlins |

|

|

Housing & Care 21 (Retained) (b) | Jan 2022 | 80 | Chatham Financial/Lloyds Bank Corporate Markets/ | Devonshires | JLL | Addleshaw Goddard |

Housing 21 (b) | Dec 2021 | 130 | // | Devonshires | JLL | Addleshaw Goddard |

Islington and Shoreditch (il)14 | Dec 2021 | 20 | Savills Financial Consultants/Savills Financial Consultants/ | Devonshires |

| Bevan Brittan |

Local Space (pp)15 | May 2021 | 61 | Chatham Financial/Lloyds/ | Devonshires | Savills | Morgan, Lewis and Bockius UK |

L&Q (b) | Jan 2022 | 250 | /Barclays, BNPP, HSBC, NAB/Barclays, BNPP, HSBC, NAB | Devonshires | CBRE | Allen & Overy |

Longhurst (il)16 | Aug 2021 | 100 | Savills Financial Consultants/Newbridge/ | Winkworth Sherwood | JLL | Clifford Chance |

Magna Housing (pp) | Nov 2021 | 140 | NatWest /NatWest/ | Devonshires | Savills, JLL | Addleshaw Goddard |

Medway HA (pp)17 | Dec 2021 | 20 | // |

| JLL |

|

Melin Homes (il)18 | May 2021 | 50 | Centrus/Centrus/ | Devonshires/Clarke Willmott |

| Addleshaw Goddard |

Metropolitan (b)19 | Jul 2021 | 250 | /Barclays, BNPP, NatWest/Barclays, BNPP, NatWest | Devonshires, Penningtons, Trowers & Hamlins plus other firms | JLL | Addleshaw Goddard |

Mosscare St Vincent’s (pp)20 | Feb 2022 | 140 | Savills Financial Consultants/Barclays/ | Trowers & Hamlins | Savills | Addleshaw Goddard |

Metropolitan Thames Valley (b) | Jul 2021 | 250 | // |

| JLL |

|

Muir Group (pp)21 | Apr 2022 | 50 | // |

| JLL |

|

Notting Hill Genesis (b) | May 2021 | 250 | /Lloyds Bank Corporate Markets/ |

| JLL |

|

Notting Hill Genesis (b) | Jun 2021 | 250 | /Barclays, Lloyds, NatWest/Barclays, Lloyds, NatWest | Devonshires | JLL | Addleshaw Goddard |

Onward Homes (b) | Feb 2022 | 50 | Centrus// | Devonshires |

| Addleshaw Goddard |

Optivo Finance (b) | Aug 2021 | 100 | Newbridge Advisors//Barclays | Devonshires |

| Addleshaw Goddard |

Optivo Finance (b) | Mar 2022 | 150 | Newbridge Advisors// | Devonshires | Savills, JLL | Addleshaw Goddard |

Optivo Finance (b) | Mar 2022 | 100 | Newbridge Advisors// | Devonshires | Savills, JLL | Addleshaw Goddard |

Origin Housing (pp)22 | Jun 2021 | 120 | /NatWest Capital Markets/ |

| JLL | Greenberg Traurig |

PA Housing (b) | May 2021 | 400 | Chatham Financial/Barclays, Lloyds/Barclays, Lloyds | Devonshires | Savills | Addleshaw Goddard |

Paradigm (b) | May 2021 | 350 | /Lloyds Bank Corporate Markets/Barclays, Lloyds, NAB | Trowers & Hamlins | JLL |

|

Paragon Treasury (b) | Apr 2021 | 400 | /Lloyds Bank Corporate Markets/ |

|

|

|

Peabody (b) | Feb 2022 | 350 | /Lloyds Bank Corporate Markets/NatWest, Lloyds, Barclays, SMBC | Trowers & Hamlins | JLL | Addleshaw Goddard |

Penarian Housing Finance (part of ClwydAlyn Housing) (b)23 | Feb 2022 | 40 | Chatham Financial/na/ | Anthony Collins | n/a | Addleshaw Goddard |

Phoenix Community Housing (pp)24 | Dec 2021 | 100 | // | Trowers & Hamlins |

|

|

Platform HG Financing (b) | Sep 2021 | 250 | /Lloyds Bank Corporate Markets/ |

|

|

|

Platform HG Financing (b) | Sep 2021 | 250 | /Lloyds, MUFG, NAB, NatWest/Lloyds, MUFG, NAB, NatWest | Devonshires | Savills | Addleshaw Goddard |

Progress Housing (pp)25 | Sep 2021 | 100 | Chatham Financial/Chatham Financial/ | Devonshires | JLL | Greenberg Traurig |

Progress Housing (pp) | Sep 2021 | 85 | // |

| JLL |

|

Raven Housing Trust (pp)26 | Feb 2022 | 130 | Savills Financial Consultants/Barclays Bank/ | Anthony Collins | JLL | Addleshaw Goddard |

Riverside (pp)27 | Mar 2021 | 150 | // |

| JLL |

|

Sanctuary (pp)28 | Oct 2021 | 75 | // |

| JLL |

|

Shepherds Bush (pp)29 | Oct 2021 | 110 | // |

| JLL |

|

South Lakes Housing (pp)30 | Mar 2022 | 15 | David Tolson Partnership/M&G/ | Trowers & Hamlins |

| Addleshaw Goddard |

Southern Housing Group (b) | Oct 2021 | 300 | Centrus/HSBC, MUFG, NatWest/HSBC, MUFG, NatWest | Devonshires | JLL | Pinsent Masons |

Southway Housing Trust (pp)31 | Jun 2021 | 120 | Savills Financial Consultants/NatWest/ | Anthony Collins | JLL | Devonshires |

Stonewater Funding PLC (b) | Sep 2021 | 250 | /Barclays, Lloyds, NatWest/Barclays, Lloyds, NatWest | Devonshires | JLL | Addleshaw Goddard |

The Community Housing Group (il)32 | Aug 2021 | 70 | Savills Financial Consultants// | Trowers & Hamlins |

| Pinsent Masons |

The Wrekin Housing Group (b)33 | Nov 2022 | 25 | Chatham Financial/Allia C&C/ | Devonshires |

| Addleshaw Goddard |

Thrive Homes Finance (b)34 | Feb 2022 | 75 | Centrus/Centrus/ | Devonshires | Savills | Addleshaw Goddard |

Vale of Aylesbury Housing Trust (now Fairview Homes) (pp)35 | Oct 2021 | 55 | Chatham Financial/Santander/ | Devonshires |

| Akin Gump Strauss Hauer & Feld |

Wales and West Housing (il)36 | Apr 2021 | 37.5 | // |

|

|

|

Yorkshire Housing Finance (b) | Oct 2021 | 200 | Chatham Financial// | Devonshires | Savills | Addleshaw Goddard |

Yorkshire Housing Finance (b) | Jan 2022 | 55 | Chatham Financial/NatWest/ | Devonshires |

| Addleshaw Goddard |

Your Housing Group (pp)37 | May 2021 | 60 | Centrus/Centrus/ | Devonshires | Savills | Addleshaw Goddard |

Your Housing Group (pp)38 | May 2021 | 30 | Centrus/Centrus/ | Devonshires | Savills | Addleshaw Goddard |

Your Housing Group (pp)39 | May 2021 | 40 | Centrus/Centrus/ | Devonshires | Savills | Addleshaw Goddard |

Notes: (b) bond, (il) institutional loan, (pp) private placement

Investors (if named): 1 Phoenix Group, 2 LGIM Real Assets, 3 Legal & General Assurance Society, 4 Undisclosed, 5 Confidential, 6 Confidential, 7 Confidential, 8 Barings, 9 Massachusetts Mutual Life Insurance Company, 10 Various, 11 Bond, 12 Rothesay Life, 13 PIC/Macquarie, 14 M&G, 15 MetLife, 16 Undisclosed, 17 PIC, 18 Macquarie Group, 19 Various – Law Debenture Trust Corporation as note trustee and security trustee, 20 Undisclosed, 21 Rothesay, 22 Six US & Canadian institutional investors including Cigna Investments, Inc and Aegon USA Investment Management, 23 Confidential, 24 LGIM and PIC, 25 SunLife/Rothesay Life, 26 PIC, 27 Pricoa, 28 Rothesay, 29 Various, 30 M&G/Prudential Funds, 31 Undisclosed, 32 Scottish Widows, 33 Pershing Securities, 34 Phoenix Life and PIC, 35 Massachusetts Mutual Life Insurance Company, 36 PIC, 37 Macquarie Group, 38 PIC, 39 Aberdeen Standard Investments

Source: Social Housing, funding advisors, law firms

Advisors, lawyers and valuers

Chatham Financial and Savills Financial Consultants both advised on 11 deals. The majority of Savills’ deals (six) were private placements, while the bulk of Chatham Financial’s (six) were bonds. Centrus followed with 11 deals, half of which were private placements. There were 30 deals where the financial advisor had not been disclosed.

Out of the 69 deals, Addleshaw Goddard acted as the funder’s legal advisor on more than half of the deals (36). Pinsent Masons acted on three deals, while Greenberg Traurig and Devonshires both acted on two. There were, however, 21 deals where the funder’s legal advisor had not been disclosed.

On the HA side, Devonshires acted on the most deals (28), as well as appearing as joint legal advisor on one deal with Clarke Willmott and another with Penningtons.

Trowers & Hamlins acted on 10 deals, plus one more with Morrison Foerster, while Anthony Collins acted across nine, which included one where it was joint legal advisor with Capsticks.

Future deal flow

The market turmoil currently driving up interest rates is having a big impact on deal flow, with borrowers likely moving towards shorter-term funding amid the volatility, experts said.

Mr Waller said activity in the bond markets is “just not happening at the moment”, while Mr Morton said that MORhomes has “already seen a very significant slowdown in deal activity”, with “very few” deals done in recent months.

Ms Singh said that the uncertainty means more HAs are looking to the banks rather than the capital markets for any current funding requirements.

She added: “There’s just too much uncertainty out there at the moment. So, it’s a case of ‘wait and see’ what happens to the gilt rates.

“I don’t think people will hold out, I think they’re just waiting to see how things settle because the danger of going to the capital markets at the moment is there’s absolutely no certainty about what pricing is going to look like.”

Mr Waller said that borrowers could increasingly move towards shorter-term funding amid the pricing volatility.

He said: “There undoubtedly will be a move towards shorter-term funding. Whether that’s as a sort of bridge-type structure, where you’re looking forward to a time where hopefully you can make those investment decisions, or whether it’s just an acceptance that for a little while associations can’t take out longer-term products because the rates required for those don’t stack up. So, I think undoubtedly there will be more churn and shorter-term arrangements at least for a little while.”

Highest-paying housing associations: audit and other fees above £100,000, 2020-21

Housing association | Auditor | Total fees, £’000 | Change on year, % | Audit, £’000 | Change on year, % | Other services, £’000 | Change on year, % |

Places for People | KPMG | 808 | 2.41 | 700 | 0.00 | 108 | 21.35 |

Sanctuary | KPMG | 800 | 0.00 | 600 | 0.00 | 200 | 0.00 |

L&Q | KPMG | 785 | 7.53 | 575 | 0.00 | 210 | 35.48 |

Clarion | KPMG | 600 | 0.00 | 500 | 0.00 | 100 | 0.00 |

Peabody | KPMG | 501 | -1.57 | 460 | 0.22 | 41 | -18.00 |

Your Housing Group | KPMG | 344 | 35.97 | 313 | 71.98 | 31 | -56.34 |

Southern Housing Group | PwC | 340 | 28.30 | 340 | 28.30 | 0 |

|

Notting Hill Genesis | BDO | 335.1 | 27.61 | 335.1 | 27.61 | 0 |

|

Hyde | BDO | 297 | -35.43 | 297 | -27.38 | 0 | -100.00 |

Thirteen | PwC | 290 | 31.22 | 178 | 42.40 | 112 | 16.67 |

Aster | KPMG | 281 | 48.68 | 216 | 18.03 | 65 | 983.33 |

Home Group | Deloitte | 264 | 16.81 | 219 | 21.67 | 45 | -2.17 |

Riverside | KPMG | 253 | 36.02 | 250 | 40.45 | 3 | -62.50 |

Swan | Grant Thornton | 233 | 21.99 | 189 | 18.13 | 44 | 41.94 |

Optivo | BDO | 228 | 10.14 | 228 | 10.14 | 0 |

|

Catalyst | BDO | 226 | -2.59 | 190 | -15.56 | 36 | 414.29 |

Network Homes | BDO | 208 | 33.33 | 208 | 33.33 | 0 |

|

A2Dominion | BDO | 200 | 0.00 | 200 | 0.00 | 0 |

|

Orbit | KPMG | 200 | 100.00 | 100 | 0.00 | 100 |

|

The Guinness Partnership | BDO | 200 | -33.33 | 100 | -50.00 | 100 | 0.00 |

Platform | KPMG | 200 | 102.02 | 144 | 105.71 | 56 | 93.10 |

Sovereign | KPMG | 195 | -25.00 | 188 | -1.05 | 7 | -90.00 |

The Wrekin Housing Group | Grant Thornton | 185 | -37.07 | 185 | -13.95 | 0 | -100.00 |

Yorkshire Housing | Grant Thornton | 184 | 48.39 | 180 | 50.00 | 4 | 0.00 |

Anchor | BDO | 178 | 8.54 | 154 | -2.53 | 24 | 300.00 |

Abri | BDO | 173 | -29.10 | 173 | 9.49 | 0 | -100.00 |

Bromford | Beever and Struthers | 172 | -27.12 | 132 | -31.61 | 40 | -6.98 |

Onward | BDO | 171 | 81.91 | 140 | 48.94 | 31 |

|

Together | BDO | 170 | 31.78 | 116 | 2.65 | 54 | 237.50 |

Housing Plus | KPMG | 168 | 46.09 | 120 | 11.11 | 48 | 585.71 |

Accent | Grant Thornton | 160 | -0.62 | 160 | 16.79 | 0 | -100.00 |

ExtraCare Charitable Trust | RSM | 147 | 5.00 | 60 | 22.45 | 87 | -4.40 |

One Housing Group | BDO | 144 | 19.01 | 144 | 19.01 | 0 |

|

Jigsaw | BDO | 144 | 19.01 | 120 | 25.00 | 24 | -4.00 |

Incommunities | BDO | 141 | 5.22 | 138 | 2.99 | 3 |

|

Regenda | BDO | 139 | -5.44 | 93 | 4.49 | 46 | -20.69 |

LiveWest | KPMG | 138 | 33.98 | 128 | 37.63 | 10 | 0.00 |

Gentoo | Grant Thornton | 132 | 24.53 | 89 | 85.42 | 43 | -25.86 |

Midland Heart | KPMG | 130 | 4.84 | 96 | 9.09 | 34 | -5.56 |

Vivid | BDO | 127 | 27.00 | 91 | 12.35 | 36 | 89.47 |

WDH* | Grant Thornton | 126 | -2.33 | 104 | -5.45 | 22 | 15.79 |

Housing 21 | BDO | 126 | 29.90 | 111 | 21.98 | 15 | 150.00 |

Longhurst | BDO | 126 | -21.74 | 126 | -21.74 | 0 |

|

Great Places | BDO | 122 | 10.91 | 105 | 59.09 | 17 | -61.36 |

Abbeyfield | Crowe | 122 | -13.48 | 95 | -20.17 | 27 | 22.73 |

EMH Group | KPMG | 120 | 4.35 | 98 | 6.52 | 22 | -4.35 |

GreenSquareAccord | BDO | 120 | 31.87 | 64 | 8.47 | 56 | 75.00 |

Torus | BDO | 119 | 16.67 | 102 | 8.51 | 17 | 112.50 |

Connexus | KPMG | 117 | 5.41 | 117 | 5.41 | 0 |

|

Futures | BDO | 107 | -40.88 | 104 | 13.04 | 3 | -96.63 |

Metropolitan Thames Valley | BDO | 106 | -58.91 | 100 | -55.16 | 6 | -82.86 |

Bernicia** | KPMG | 105 | 32.91 | 74 | 76.19 | 31 | -16.22 |

Wandle | BDO | 105 | 12.90 | 76 | 20.63 | 29 | -3.33 |

Total |

| 12,112.1 | 4.77 | 10,125.1 | 6.08 | 1,987 | -1.44 |

Source: Housing associations’ audited accounts, 2020-21

Notes: *WDH spent £86,000 with its internal auditor PwC in 2021; **Bernicia spent £59,000 with its internal auditor RSM

Other factors that could impact deal flow (that both investors and borrowers are watching) include proposals to introduce a new cap on the amount social housing providers can increase rent for the financial year 2023-24, which at the time of writing is under consultation.

On this, Ms Singh said: “[Providers] are probably holding tight for the outputs of the consultation and ascertaining – if there’s a cap of five per cent or even three per cent – what the impact is and where savings need to be made. I suspect savings will immediately come in the form of cutting development programmes.

“Certainly, what we’re hearing from a lot of investors is that they would rather see that [providers] are not cutting spend on existing stock, so there needs to be a mind to that for providers as well because that can affect their credit quality.

“If they keep going with their development programmes at the expense of existing stock, that’s not going to make them very attractive to investors.”

Auditors fees over £100,000, 2020-21

| Auditor | Number of HA clients (fees over £100k): 2020-21 | Number of HA clients (fees over £100k): 2019-20 | Total fees, £ | Change on year, % | Audit, £ | Change on year, % | Other services, £ | Change on year, % |

KPMG | 17 | 17 | 5,745 | 9.16 | 4,679 | 8.01 | 1,066 | 14.50 |

PwC | 2 | 3 | 630 | -33.40 | 518 | -35.17 | 112 | -23.81 |

BDO | 24 | 25 | 4,012 | 1.30 | 3,515 | 4.29 | 497 | -15.76 |

Deloitte | 1 | 0 | 264 | n/a | 219 | n/a | 45 | n/a |

Grant Thornton | 6 | 6 | 1,020 | -11.46 | 907 | -1.84 | 113 | -50.44 |

Beever and Struthers | 1 | 1 | 172 | 73.74 | 132 | 88.57 | 40 | 37.93 |

RSM | 1 | 1 | 147 | 5.00 | 60 | 22.45 | 87 | -4.40 |

Crowe | 1 | 0 | 122 | n/a | 95 | n/a | 27 | n/a |

PIC’s Ms Cain said that UK investors will likely be watching credit ratings across the sector in the months ahead. “The sector needs to remain investment-grade to be fundable is our view. And we are seeing downward pressure on credit ratings [such as] Swan Housing, which is obviously having financial difficulty. That will be a real test of regulatory support for the sector… That is probably the key thing that a lot of the UK investors, like ourselves, will be keeping a close eye on.”

Sanctuary is in merger talks with Swan at the time of writing, after Orbit pulled out of discussions in September. So whether Sanctuary’s rescue of Swan succeeds will be a key test of the regulatory regime.

Despite the volatility, however, Ms Cain said there are reasons to be hopeful. “Ultimately this is a core UK sector [with] core assets, with strong long-term demand. We will always need social housing so in that respect, it remains a key sector for us.”

Auditors

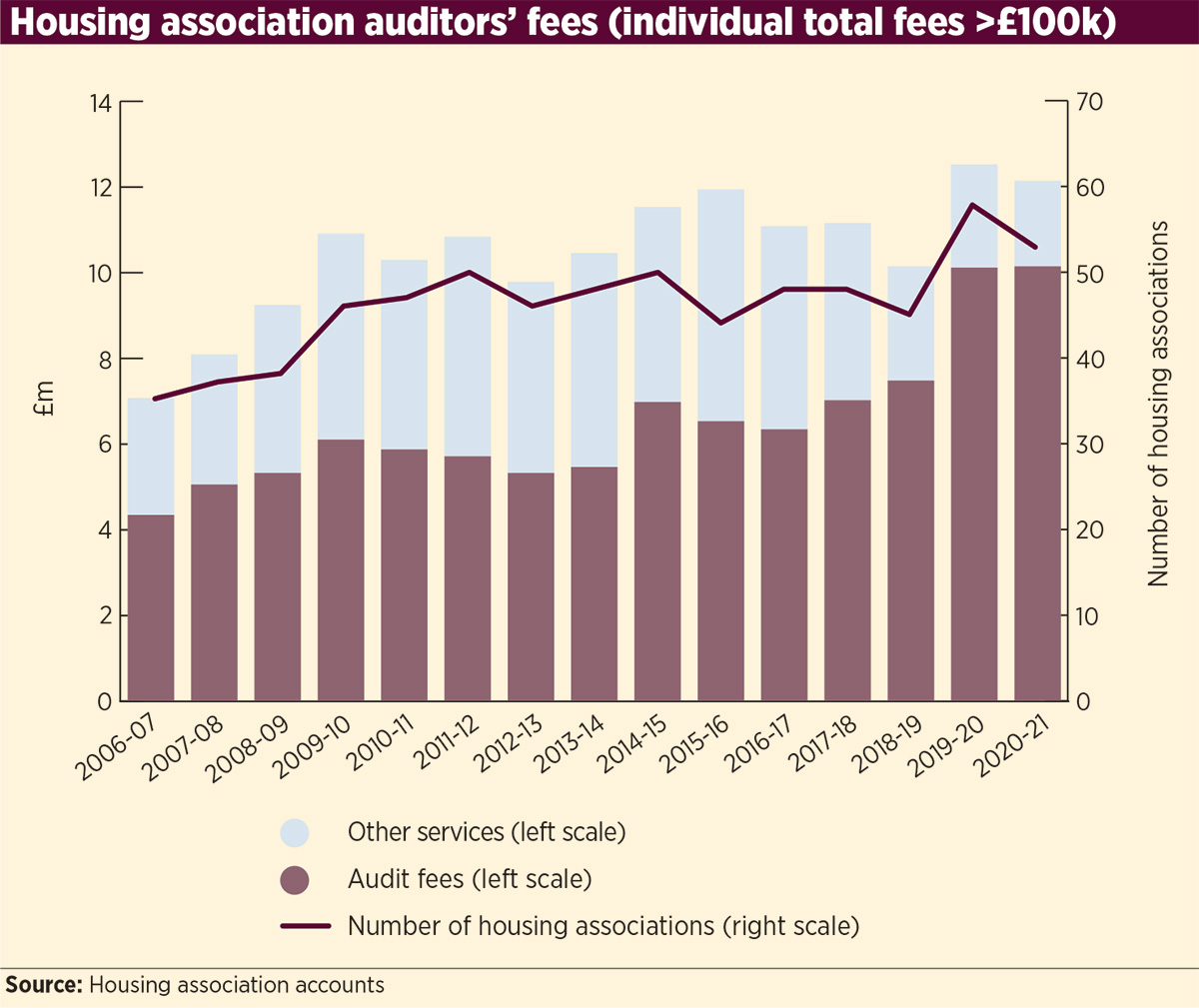

As part of this report, Social Housing has analysed HAs’ 2020-21 financial accounts to find the total amount paid to auditors by associations with a bill of £100,000 or more.

A total of £12m was paid in fees by HAs over the period, which was up nearly five per cent on the 2019-20 period. This was made up of £10m in audit fees (up six per cent on the previous year) and £2m in other services (down 1.4 per cent on the previous period).

BDO had the highest number of clients (24), with a total of £4m in fees. KPMG followed with a total of 17 clients, although its fees totalled more at £5.7m. Grant Thornton, with six, came third, with fees totalling £1m.

PwC had the biggest decrease in its total fees. They reduced by 33 per cent to £630,000, with its clients going from three in 2019-20 to two in 2020-21.

RELATED