UK social housing takes the global stage

Housing associations are attracting a new wave of banks from overseas. Luke Cross finds out what appeals to these investors

Banking is big business in the social housing sector – and a flurry of new lenders from across the globe have taken note.

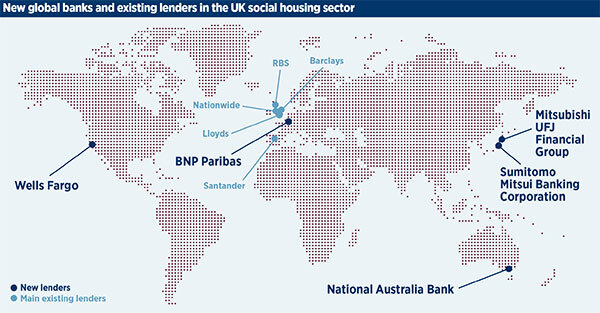

Lenders from the US, Australia, Japan and France, to name a few, have arrived in the sector looking for a piece of the £60bn bank market.

Recent entrants include National Australia Bank (NAB), BNP Paribas and Japanese bank Sumitomo Mitsui Banking Corporation (SMBC) – the second Japanese bank to enter the sector after Mitsubishi UFJ Financial Group (MUFG).

US giant Wells Fargo is on the lookout for its first deal, while lenders from other continents are also planning their entry point.

The banks join the main big lenders to the sector – Lloyds, RBS, Barclays, Santander and Nationwide – which all have multibillion-pound loan books dating back several decades.

Along with banking relationships, many will have one eye on arranging transactions in the public bond and private placement markets, with big-name investment banks such as JP Morgan and Goldman Sachs acting as bookrunners in recent times.

It also comes as Social Housing revealed last month that housing association (HA) borrowing has shot up by an estimated two-thirds in the early part of 2019 as providers seek additional liquidity and headroom in the run-up to the UK’s planned departure from the EU.

Wells Fargo

The biggest commercial real estate lender in the US entered the UK property market with a multibillion-pound deal five years ago – and is now primed to expand into UK social housing.

One of America’s top four banks, it set out its stall in 2013 with the acquisition of Commerzbank’s Hypothekenbank Frankfurt (formerly Eurohypo) UK commercial real estate portfolio, taking on £4bn of commercial real estate loans “comprised of high-quality institutional assets throughout the UK with a focus in London”. Wells Fargo set up a new headquarters in the City last year, marking its first international real estate purchase outside the US.

Frank Pizzo, regional president for EMEA, described it as a “significant milestone” for the bank in demonstrating its commitment to the UK.

“As a lender we’re always keen to strengthen our business and balance sheet, and where possible, complement our service offering with what we do in the States,” says Stacey Flor, managing director of UK commercial real estate at Wells Fargo.

Ms Flor says that the move into social housing is a “natural progression”, and that the bank already has a substantial presence in UK commercial real estate, in recent years lending to student housing and the private rented sector and build-to-rent, such as being part of Quintain’s £800m lender line-up for its Wembley regeneration.

Ms Flor says they have spent “a lot of time establishing relationships with some of the larger housing associations”.

“We have a meaningful presence in other sectors and we expect that if the appropriate opportunities arise, [social housing] will become a meaningful part of our book.”

She says that the bank brings a strong balance sheet and one of the strongest credit ratings in the real estate sector, potentially unlocking “quite a bit of capacity that the sector is in need of right now”.

It also intends to have a long-term commitment in commercial real estate, lending through the cycle with a “considered approach [which] means we won’t be coming in and going when we don’t get pricing”.

“We’re not here to change the market, we’re here to enhance the market” – Stacey Flor, Wells Fargo

But the bank will take a “very disciplined” approach and plans to supplement rather than change the market, albeit it can offer investment and development finance.

Asked about policy volatility and political risk in recent years in the UK, Ms Flor says the lack of legacy book means Wells Fargo can look at the sector and its risk profile “with a fresh pair of eyes rather than saying ‘this is more preferable’”.

She said political risk has always been an “integral part of the sector”, adding that uncertainty in the UK represents “new events rather than new risks” and that the team has done a lot of work on the sector.

They have also assessed development risks as a growing part of the HA profile, particularly with the amount of pressure providers are under to build more and fund themselves.

Lending platforms include secured finance on a non-recourse project basis and a corporate platform through which it has provided lines to listed companies and real estate investment trusts (REITs). It can offer corporate-style revolving credit facilities (RCFs) and development finance. It has provided unsecured loans to UK REITs.

However, Ms Flor adds: “We’re not here to change the market, we’re here to enhance the market in line with our regional capabilities.

“What we do know is that there are quite a lot of established sets of covenants, pricing and mechanisms across all [existing] lenders and we need to be conscious that we have to be of the market and complement the needs of market participants.

“We are not looking to change the rules of the game… and we need to make sure it fits with our strategic and risk appetite.”

Across UK commercial real estate, Wells Fargo’s loans are typically greater than £20m, with a range of products including development finance, corporate facilities, floating and fixed-rate loans and services across debt capital markets, and derivatives.

The bank will also look to arrange bonds and private placements (PPs) for HAs. It is one of the biggest PP providers globally.

National Australia Bank

Australia’s biggest business bank launched into the UK social housing market with more than £250m of bank deals, including facilities for two London G15 members.

NAB has branches in the US, the UK and Asia. Its infrastructure investments include schools, hospitals and roads.

Australia’s largest business bank signed its first £75m revolving credit facility in the sector with Sovereign at the end of 2018, and has now provided facilities to L&Q, A2Dominion and CHP.

The arrangements with the G15 associations include a £100m facility with L&Q and a £75m, five-year revolving credit facility with A2Dominion.

Michael Carr, director at NAB, tells Social Housing: “We would like to say how pleased we are to have commenced our activity in the sector with such a strong list of counterparties. Working with new entrants into a sector always requires a collaborative approach to transactions.

“Our new clients helped us in this process and enabled us to make what we hope will be viewed as a positive entrance into the sector and allow us to continue to grow along with our clients.”

He adds: “The NAB UK social housing team is committed to building relationships with housing associations to help reduce the housing shortage. Providing finance to this sector isn’t just about assets and financial transactions – it’s about projects that make a difference to people’s lives.”

Sumitomo Mitsui Banking Corporation

Japan’s second-largest bank by assets, SMBC, has lent to six housing associations, providing almost £500m to date.

It is the second Japanese bank to come into the sector in recent years.

According to Luca Gatto, executive director and head of infrastructure in global structured finance for EMEA, and Pietro Crescini, director in the international and structured finance department at SMBC – both speaking from a personal perspective – lending to the social housing sector aligns with the bank’s strategic emphasis on sustainability and development.

The bank likes the regulated nature of the social housing sector, established communication with the regulator in a constructive way and the fact that there is no history of lenders’ losses to the sector since the deployment of private financing.

Mr Gatto says: “We expect to continue lending cautiously to this sector, reviewing sector fundamentals regularly with our management and examining each proposed credit on a case-by-case basis. There are no pre-set targets.”

“We are a long-term investor focusing on establishing long-lasting relationships with customers” – Luca Gatto, SMBC

Mr Gatto says the bank would not provide specifics on the types of facilities it offers, such as whether it is lending unsecured.

He says SMBC “brings a wealth of infrastructure financing experience developed over decades and in different sectors and via different products, which adds sophistication and depth in the interaction with housing associations”.

“By our own values, in addition, we are a long-term investor focusing on establishing long-lasting relationships with customers.”

Asked about the direction of travel for the sector, he adds: “It will be interesting to assess how Brexit, if it materialises, will affect the housing market in general, understand whether new players (eg private equity investors) will make a serious attempt to enter the market and how the usage of US private placement will evolve as an additional financing source.”

SMBC has already acted on a PP, with its New York arm arranging a £200m, unsecured deal for Sanctuary Group with North American investors, across a number of maturities from 10 to 30 years.

Its first loan was a five-year RCF to One Housing in autumn 2018, with standard loan documentation. It quickly followed that with a £75m RCF for Sovereign.

MUFG

Japan’s biggest bank entered the UK social housing market more than three years ago and is now offering a range of facilities to HAs, including unsecured lending.

While making it a relative newcomer, it has built up relationships with 20 HAs. It grew a book of £850m within two years, but decided not to say what its loan book is at today.

Sanjay Narbheram, director of housing finance at MUFG, says: “[The bank] has long-standing expertise within project finance, and is particularly strong within the infrastructure sector, which proved beneficial towards our move into the social housing space.

“We at MUFG also pride ourselves on building and maintaining long-term relationships with our clients, which is pertinent within the social housing sector.”

He adds that MUFG is one of the lenders helping to meet the government’s 300,000-home challenge “by providing innovative and competitive funding solutions”.

Its 20 HAs operate across the country, ranging from 5,000 units to the very largest providers.

“The sector is prudent, thanks to strong governance and regulatory oversight, and this provides a great deal of comfort to all stakeholders” – Sanjay Narbheram, MUFG

“We are firmly committed to the social housing space, and will continue to work with housing associations to help them deliver on their commitments in the long term,” he adds.

Asked about the types of facilities MUFG offers, he says: “It’s imperative that we structure transactions in a way that works for our clients. This could be anything from an RCF and term loan with a standardised covenant suite which are competitively priced, or arranging long-term funding through the traditional sterling markets or through US private placements, as we have recently done with Home Group and Network Homes respectively.

“Structures that have been effective for clients include the bridge-to-bond and forward-start sterling private placement, which we can tailor to meet their needs. We have also structured and arranged finance on an unsecured basis.”

On the main challenges facing the sector, Mr Narbheram says: “The cross-subsidy model of developing homes on the open market is here to stay. However, given the cyclical nature of house prices and the wider economic influences, development is a key risk.

“Despite this, the sector is prudent, thanks to strong governance and regulatory oversight, and this provides a great deal of comfort to all stakeholders.”

MUFG’s RCFs range from £35m to £75m, with maturities of between two and 10 years. Its deals have included a £50m facility for Network Homes, which blends long-term and short-term funding.

It also provided a blended private placement and bank facility deal to Sanctuary. Its first deal in the sector was £75m to Anchor as part of a £265m syndicated loan facility.

RELATED