Equity funds to deploy billions into housing

Blackstone’s investment in for-profit provider Sage Housing looks set to run into billions of pounds, as several other big names in investment are setting out their intentions to deploy capital in affordable housing.

The new provider has made waves with what its chief executive Joe Cook has called a “sea change” for UK social housing finance, with an equity-backed model purely focused on Section 106 acquisitions of social and affordable homes.

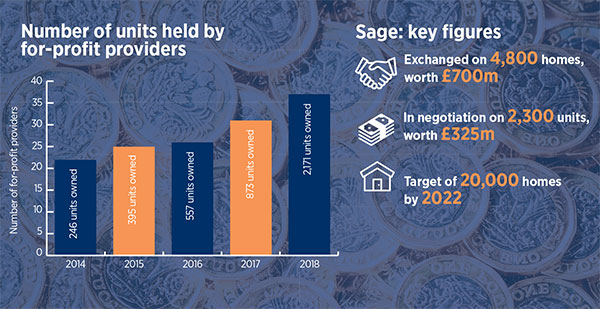

It has exchanged on 4,800 properties and has another 2,300 in negotiation. That portfolio of 7,000 homes is worth £1bn and has been funded by equity investment from Blackstone.

With a business plan to deliver 20,000 homes, and equity for the acquisitions committed by Blackstone, the investment is set to run into billions of pounds.

Mr Cook told Social Housing the group had no intention of taking government grant funding, and said “it’s not a situation where the pension fund purchases the properties”.

“We draw equity into Sage in equity drawdowns and use that cash to purchase. Our business model is to deliver 20,000 units between now and December 2022, and we have committed funding to enable us to do that,” said Mr Cook.

The news comes as other big names in investment have set out their intentions to deploy capital in affordable housing. CBRE Global Investors announced its intention to launch a £250m affordable housing equity fund, with plans to buy up properties and lease them to registered providers.

And the social impact fund launched by hedge fund Cheyne Capital in 2014 revealed to Social Housing that it has deployed almost £1bn into housing and now expects to launch a second iteration of the fund.

Last month, Bloomberg reported that the world’s largest publicly listed hedge fund, Man Group, was planning to create a new affordable housing fund. Man Group declined to comment.

In the case of Sage, funding is being sourced via a global base of long-term institutional LP investors, whose money comes from pensions and endowment via Blackstone Real Estate Partners Europe V, a closed private equity fund. It is then channelled into Sage’s immediate parent, Sage Investments Sàrl.

Mr Cook would only say that the investors require a “single-digit return” paid through dividends, although Social Housing reported last year that the fund typically seeks an eight per cent return.

In December, Blackstone told the Social Housing Annual Conference that it is “a long-term owner and a long-term investor in this space”.

Legal & General said last year that it is vying to become the UK’s leading private affordable housing provider as part of a plan to establish institutional investors as landlords. Its for profit provider, Legal & General Affordable Homes, plans to use equity funding from L&G Capital to deliver 3,000 homes per year.

RELATED