First Priority lender says CVA is 'least disruptive solution' for tenants

First Priority Housing Association’s (FPHA) lender has described the provider’s compulsory voluntary arrangement (CVA) as "the least disruptive solution" for vulnerable tenants.

The agreement for the small specialist housing provider follows a period of insolvency and a moratorium during which a company voluntary arrangement (CVA) was agreed, according to Companies House.

While it is the second instance of a housing association becoming insolvent, after the high-profile case of larger association Ujima in 2008, it represents a very different situation, as FPHA does not own any social housing assets or have any secured debt.

It also sees the first CVA in the sector, which came days before the commencement of a new Housing Administration regime.

The housing association’s main lender, Topland Henley Healthcare Investments, described the CVA as “the least disruptive solution”, adding that it had been holding “available significant funding to ensure the continued provision of accommodation to First Priority and its tenants”.

The CVA agrees payments to creditors over a fixed period and enables the association to continue to trade. It is understood to have a nine-month term with an option to extend.

John Higgins, who became chief executive of FPHA following a change in leadership in Autumn last year, said the CVA agreement followed work to “reorganise our finances and make our operations financially sound”.

Jonathan Walters, deputy director of strategy and performance at the Regulator of Social Housing (RSH), said: “The CVA is a helpful development in allowing FPHA to continue to trade while it looks at the best way to structure its business for the long term.

“We will continue to be actively involved with FPHA as they go through this process.”

FPHA’s troubles stemmed from financial and governance problems revealed by the RSH in February. It said the association – which manages homes primarily for adults with learning disabilities and mental health problems – was trading on the “goodwill of its creditors” and did not have sufficient working capital or financial capacity to meet its debts as they fall due.

FPHA’s audited accounts signed off in April reported a loss of £1.05m before tax and £2.9m owed to creditors in 2017 after a period of “significant growth”.

The accounts said its ability to continue as a going concern was in question, and it was working with the Topland Henley JV to recapitalise the business.

The RSH’s regulatory judgement also triggered an inspection of around 30 small associations with similar lease-based business models. One organisation, Inclusion Housing Community Interest Company, has since been placed under review by the regulator.

Three of FPHA’s landlords have parted ways with FPHA in recent months, leaving main creditor Topland Henley JV – which is a joint venture business between two property investment firms – and landlord Equitix, an established investor in infrastructure and private finance initiatives (PFIs).

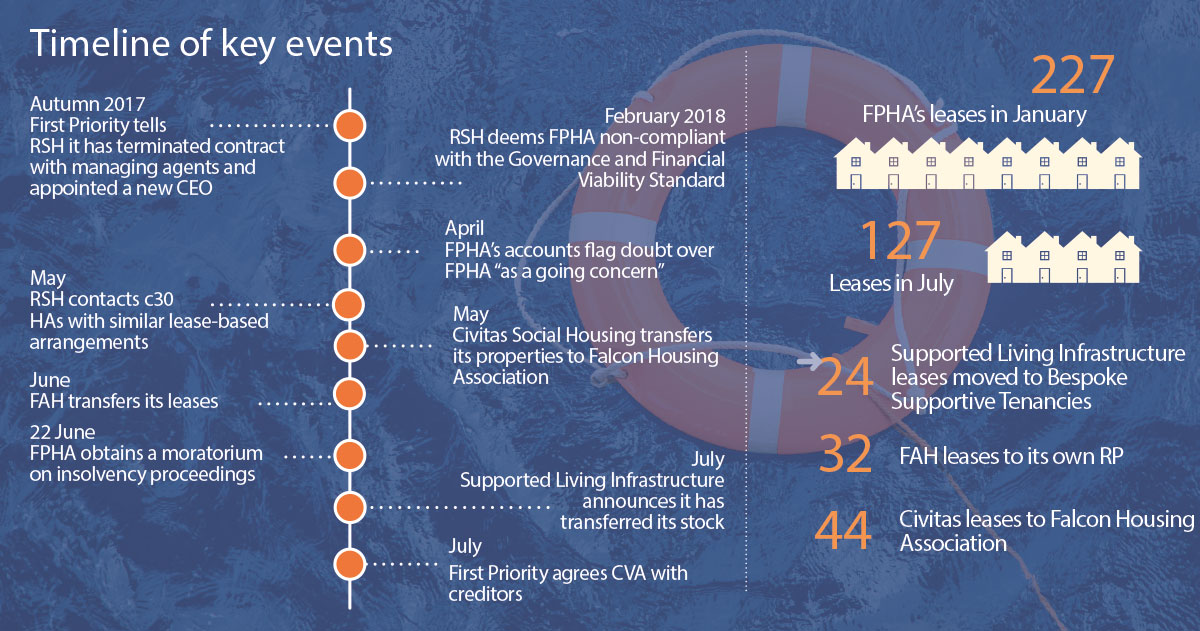

At the point of regulatory intervention, FPHA had 26 landlord counterparties across 227 properties, with 759 tenancies in place. The three other landlords, Civitas, Funding Affordable Homes and Supported Living Infrastructure, all transferred their properties elsewhere. The total number of leases transferred away from FPHA was 100 by July, leaving it with 127.

Andy Brandon, managing director of Henley Healthcare Investments, said the Topland Henley JV had agreed to subordinate secured loans to the business in order to ensure a successful CVA for FPHA.

“We understand that this has been well received by the regulator and has only been possible through prioritising other creditors and by allowing other landlords to receive FPHA funds first,” he said.

He added: “As a landlord and also as a lender, through a JV partnership, we have always remained supportive of First Priority. When the full extent of the housing association’s cash flow problems became known to us earlier this year, we kept available significant funding to ensure the continued provision of accommodation to First Priority and its tenants.”

Mr Brandon said that the priority “has always been the continued provision of accommodation to the residents who are among the most vulnerable in society”.

“We believe the CVA was the least disruptive solution for the tenants living in the properties as it ensured First Priority can continue to provide a consistent service to those people,” he added.

Equitix had 77 residential units with FPHA, according to its website, with 25-year leases and rents paid directly by local authorities.

Equitix – which also has three schemes with Inclusion and housing PFIs – was contacted for comment.

FPHA would not comment on whether creditors or landlords incurred any losses.

Mr Higgins, whose board was bolstered by treasury and care and support experts from across the sector, said: “[The CVA] means we can continue operating on a more robust financial footing, thanks to the proactive work we carried out to reorganise our finances and make our operations financially sound.

“Our tenants are our number one priority and our ongoing focus is now on providing a high-quality service to them.”

He said the group remains in regular contact with the regulator and has “worked hard to ensure that all our tenants keep their homes within our sector”.

Mr Walters said the regulator’s primary aim has been to protect tenants, adding that “we are very pleased that they have been able to stay in their homes”. He said: “This was an unusual case as there were no social housing assets owned by FPHA and therefore no creditors secured on social housing.”

The regulator will work closely with both FPHA and the other organisations that have transferred their stock “to ensure that the tenants are looked after and the providers meet our standards”, he added.

“We welcome the fact the freeholders have worked hard to maintain their stock in the social sector.”

RELATED