Funding flows into UK housing despite no-deal credit warnings

Funding has continued to flow into UK social housing despite warnings of a disorderly Brexit, with more global banks coming into the sector and investors proactively chasing capital market deals.

The UAE’s biggest bank, First Abu Dhabi Bank (FAB), has struck its first deal with a UK housing association, while investment banking giant Goldman Sachs has also completed an unsecured loan.

Bank FAB’s first deal is with G15 London association Optivo, which also signed a sustainability-linked loan with BNP Paribas.

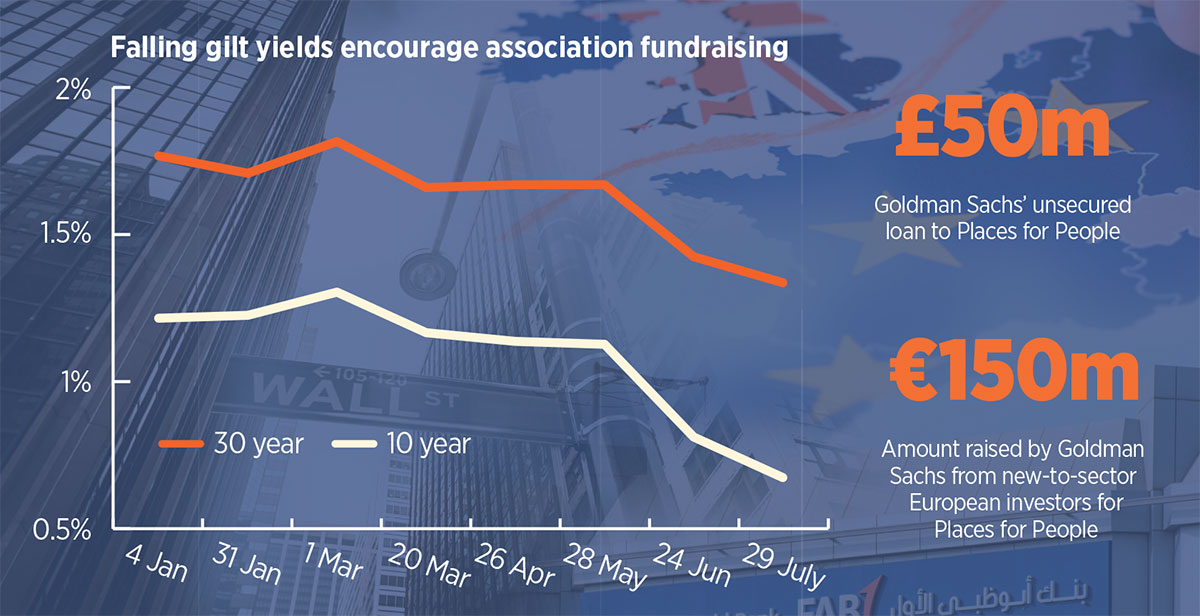

Goldman Sachs – which has acted as arranger on a handful of housing association (HA) bonds – has provided an unsecured £50m loan to Places for People, while also raising €150m from new-to-sector European investors.

Meanwhile, a number of associations have taken advantage of deferred deals with institutional investors hungry for extra yield.

The buoyant funding landscape for HAs – which follows a record £4.5bn of borrowing in the run-up to the original planned Brexit date in March – continued into the summer months in the face of uncertainty triggered by new prime minister Boris Johnson’s promise to leave the European Union by 31 October 2019 “whatever the circumstances”.

Mr Johnson’s commitment, while still subject to parliamentary agreement, has sparked renewed warnings from ratings agencies over the impact of a disorderly Brexit on the UK sovereign and related issuers, which include UK housing associations that receive an uplift on their ratings due to the likelihood of receiving extraordinary support from the UK government.

Colin Ellis, managing director for credit strategy at Moody’s, said: “Our view remains that a no-deal Brexit would have significantly negative credit effects for the UK sovereign and related issuers.”

Felix Ejgel, sector lead at S&P Global Ratings, said that recent downgrades of HAs – such as L&Q’s drop to A- stable – show how the effects of uncertainties around Brexit “are starting to crawl into the association’s financial performance which have recently reported lower earnings and higher volatility”.

S&P has reiterated that it could downgrade half of its rated HAs in a no-deal Brexit scenario.

Both ratings agencies have raised further concerns over HA exposure to sales risk, with a particular focus on the London sales market.

Jonathan Walters, deputy chief executive at the Regulator of Social Housing, said HA boards should be “revisiting the work they did in the run-up to 29 March and updating it for any changes in circumstances”.

However, funding advisors said UK social housing continues to be seen as a stable investment at home and abroad, with borrowers benefitting from Brexit-driven low gilt yields.

Grant Vaughan, partner at Newbridge Advisors, said credit ratings are “probably the biggest sensitivity investors have at the moment”, typically impacting appetite and pricing, albeit with one instance where an investor opted to pass on a 12-month deferred deal over any potential of a future downgrade.

He added: “While there is still a bit more of the Brexit jigsaw to fall into place, we are not aware that anyone is dropping out [of the market] and indeed we are seeing more people coming in.”

Mr Vaughan told Social Housing that an increasing number of investors have been proactively seeking out bilateral deals through reverse inquiries, and offering deferred options.

Recent transactions include a £100m bond tap by Notting Hill Genesis, with a six-month deferral; a £100m retained bond sale by Guinness Partnership with a 12-month deferral; and a two-tranche deferral of three and six months for £40m of funding for Link, which follows the Scottish HA’s original private placement .

He said the deferred option can set some investors apart while also providing them with an uptick on yield. HAs can pay an average premium of four to five basis points for a six-month deferral to receive the saving on the cost of carry. While US investors typically offer deferrals for up to 12 months, certain sterling investors are comfortable with three to five years.

Centrus also pointed to a wider range of options for borrowers to access the market in a more “flexible and proactive” way.

Phil Jenkins, managing director at Centrus, said that while UK deals may look “pretty thin” from the domestic perspective, with sterling cheap in relative terms and eurozone interest rates in negative territory, they may still look attractive to global lenders and investors.

“It depends on which jurisdiction you are coming from, but there is relative value in terms of returns,” he said, adding that some overseas banks, like those from the Middle East, may think of UK social housing as an extension of their “real estate focused lending”.

RELATED