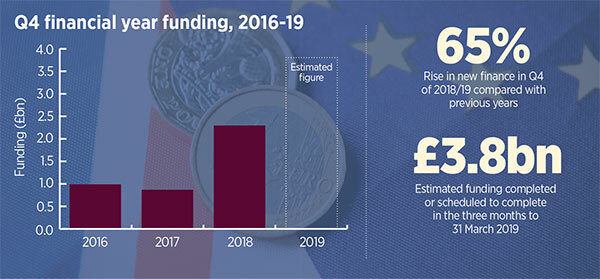

Funding rush sees deals approach £4bn

Housing association borrowing has shot up by an estimated two-thirds in the early part of 2019 in the run-up to the UK’s planned departure from the European Union, according to figures collected by Social Housing.

Deals completed or scheduled to complete before the end of March could exceed £3.8bn, according to globalised estimates provided by law firms Trowers & Hamlins, Devonshires, Anthony Collins and Winckworth Sherwood.

The circa £3.8bn in estimated fundraising would mark a 65 per cent jump on the £2.3bn in new finance recorded for the same period last year (Q4 2017/18) in the Regulator of Social Housing’s (RSH) quarterly survey, and the £877m in Q4 2016/17, and £1bn in Q4 2015/16.

Eleanor James, partner at Trowers & Hamlins, said that the increased activity is particularly weighted in favour of revolving credit facilities.

She put this down to housing associations “perhaps pulling forward their funding requirements a bit further than they might usually do to deal with market uncertainty”, as well as providers that have scaled up their development programmes seeking to comply “with the regulatory expectation [that] they will have 18 months of committed funding available”.

Stuart Heslop, regional managing director of real estate finance at RBS, said it had been a “stronger six months than for a good while”, including a “real pick up in activity on the capital markets, with a number of issuers and a strong pipeline”.

He said that the entry of new overseas investors into private placements are a sign of social housing being seen as “potentially less impacted than maybe other parts of the economy would be”.

Jon Coane, partner at Anthony Collins, noted that private placements may be seen by borrowers and their advisors as “a bit quicker and more relaxed about Brexit than going the bond market”.

He observed that some borrowing was delayed from closing before Christmas as participants awaited the result of the parliamentary vote on the UK’s withdrawal agreement.

Like Ms James, he recognised very strong demand for revolving credit facilities, but combined with borrowers seeking longer term options as part of ongoing refinancing efforts.

Lloyds, which has committed to delivering £5.5bn of debt funding to social housing in the three years to 2020, has also seen funding demand rise.

David Cleary, regional director for housing, said that activity had continued in January and February following “considerable demand” from housing associations last year for both revolving credit and term debt facilities to complement capital market issuances.

Julian Barker, partner at Devonshires, said that some of the “rush” in funding includes borrowers agreeing funds to be drawn down at a later date “to cut down the transaction risk and interest rate risk”.

David Cassidy, head of social housing at Barclays Corporate Banking, said that the three months to 31 March are typically “the busiest quarter for deal flow”, but that 2019 has seen a “strong demand and more activity than at this time in 2018”. But he said that a bigger driver than Brexit is the ambition of providers “to accelerate growth plans in a helpful policy environment with some good buying opportunities”.

Jonathan Walters, deputy director of strategy and performance at the RSH, said: that the sector is “very liquid at the moment”, having raised a lot of cash over the past 12 to 18 months to fund development.

“Individual organisations will have different funding needs so some will be going out to the markets now, and I think it’s really important that people have got that 18 months to two years’ worth of cash,” he said.

At RBS, Mr Heslop said that, based on current work in progress, his team was likely to remain busy into April and May, and that it was on track to write “in excess of £1.5bn to £1.75bn of debt this year in the market”. This could include growing its balance sheet to further support UK housing, he said.

RELATED