Housing associations assured over EIB loans

Housing associations in line for more than £1bn of European Investment Bank (EIB) loans have been reassured that they will receive the funding.

However, concerns that the EU’s non-profit bank has gone cold on new applications were exacerbated after plans for a £200m Welsh funding aggregator were halted amid reports of increasingly onerous EIB demands.

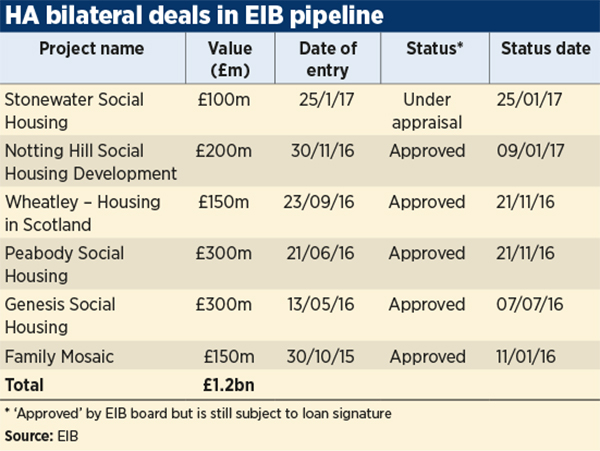

The bank – which has invested more than £4bn in UK social housing and urban renewal schemes in the past decade – has moved to reassure borrowers in its £1.2bn UK housing pipeline, which includes Genesis, Notting Hill Housing, Peabody, Wheatley and Stonewater.

Some venture capital funds are said to have walked away from deals due to the time it was taking the bank to progress them, sparking suggestions of a ‘moratorium’ on UK deals in the period around the government triggering Article 50 and the end of any future funding.

EIB loans have taken up to two years to process in the past.

Some prospective housing association borrowers and sources close to the EIB have also been told that it is not looking for any new applications. However, the bank has been keen to state that it is progressing with deals – particularly after it received some assurances from chancellor Philip Hammond during his Mansion House speech in June. Mr Hammond said he wanted EIB funding “to continue while we are members of the EU on equal terms”, adding that he was “engaged with the EIB and will provide the assurances it needs to sustain the flow of… funding”.

An EIB spokesperson told Social Housing that UK housing deals will be signed in the months ahead.

“We recognise the importance of the sector, and expect to sign deals in the UK later this year,” he said.

The uncertainty comes amid reports of an unproductive first round of Brexit talks.

The EIB is owned by the 28 member states of the EU, with the UK a 16 per cent shareholder. The bank borrows from the international capital markets and passes on its low cost of funds, potentially saving borrowers millions in interest costs over 20-year terms, as well as advisory and arrangement fees.

Representatives from the bank are set to meet approved borrowers this month, and there have been assurances that it still expects to complete the funding for those organisations that have been through the application or credit process.

One borrower that met with the EIB over the summer was told that its loan would be progressed in September after parliament regrouped from its summer recess. The EIB indicated it had a group of borrowers that were “a priority to close as soon as possible after that”.

Four of the deals are for organisations in the middle of mergers, including £300m for Genesis and £200m to Notting Hill Housing. Peabody is in line for a £300m loan, while Family Mosaic has been waiting on £150m since January 2016. Wheatley, meanwhile, is awaiting £150m. Stonewater’s £100m loan is at an earlier stage, and remains under appraisal.

The last association deal to be signed off was £150m for Sovereign in February 2017, which was first under appraisal back in 2015.

Elizabeth Froude, resources director and deputy chief executive at Genesis, said its loan documentation “is as good as finalised, and so we do intend to continue with it”.

Stonewater’s £100m loan was delayed as the EIB awaited an undertaking from the UK government. John Bruton, executive director of finance at Stonewater, said: “We do plan to pursue the loan. We are aware things have slowed down a bit and there is a risk… but we do have a plan B in place.”

RELATED