Hyde Group plans to ramp up housebuilding after swinging back into the black

Hyde Group has confirmed plans to deliver up to 2,000 a homes a year by 2027-28, after posting results that show it has swung into the black with a surplus of £94m.

The landlord’s financial results recorded a total pre-tax surplus of £94m in the year to 31 March 2022, up from a £22.6m loss the previous year, in which the group paid out £154.9m in refinancing costs.

The £94m includes the impact of interest rate swaps fair value movement, with pre-tax surplus standing at £62.1m before these are added.

The core business for the group generated an operating surplus and margin of £81.7m and 29.5 per cent in the year to 31 March, a slight drop from £85.4m and 31.3 per cent during the previous year. The not-for-profit said this was against a backdrop of significant pressures on operating costs, which will continue to affect its future margins.

Hyde Group said its financial plan for the next five years shows the group has healthy liquidity and a covenant position that means it can manage potential risks and is able to withstand the most severe Bank of England stress-test in March 2023 and March 2027.

The association said it has significant liquidity of £891m as of 31 March 2022, in the form of headroom on undrawn existing facilities and cash, which exceeds its target of £400m. The group said it provides significant financial resilience against the heightened uncertainties it faces, safeguarding its long-term viability even under the most extreme economic stress-testing scenarios.

During the year, the Regulator of Social Housing confirmed Hyde’s governance and financial viability ratings of G1/V2 while both S&P and Fitch awarded Hyde a stable credit rating of A+.

Rod Holdsworth, chief finance and resources officer at Hyde, said the group was “delighted to deliver a healthy surplus and core operating margin again this year”, but anticipates margins to be squeezed in its 2022-23 financial year.

He said: “Looking ahead, we anticipate that margins are likely to be squeezed in 2022-23, as we continue to invest in services and in improving homes, against this challenging inflationary backdrop. It’s right to invest for the future, so we can meet our long-term goals.”

Hyde Group said in 2021-22, it delivered 456 homes and started work on 859, a drop from 651 and 1,926 respectively the previous year. This was because of delays and materials and labour shortages, caused by the pandemic, impacting its development programme since 2020, the group added.

The landlord said it expects to increase the number of homes it builds over the next few years and, by 2027-28, aims to be building at least 2,000 homes a year, with a planned pipeline of more than 18,000 homes. It said it will require more funding from institutional investment, new development land in its existing operating areas and expansion into new regions.

The 50,000-home group aims to be managing between 75,000 and 100,000 homes by 2050 and will partner with others to build more than it can alone. Hyde Group said it will use a mixed-funding model, incorporating grant, debt funding, partnerships, joint ventures and third-party investors to build the homes with modern methods of construction to improve energy efficiency.

Last month, the group successfully registered a for-profit provider, Halesworth, with the Regulator of Social Housing. Social Housing revealed in June 2020 that the group planned to launch its own for-profit entity to use institutional capital to fund the new supply, as part of the group’s plans to adopt an “ownership-blind” approach to the development and management of new homes. Hyde also has a development partnership with M&G through the latter’s own for-profit registered provider, centred on shared ownership homes.

The accounts note an additional investment of £2.9m during the year, which it notes “relates to the group’s investment in the new entity, Halesworth Limited”.

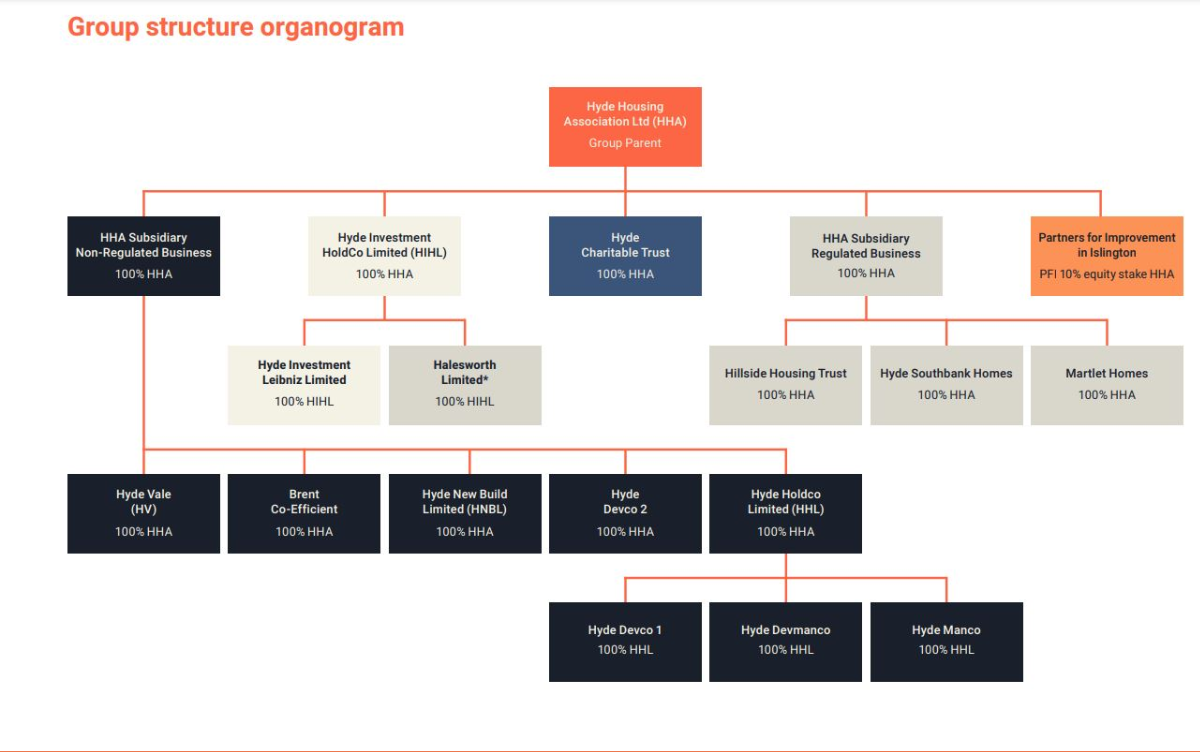

According to a group structure chart (see below), the entity sits beneath a holding company, Hyde Investment

HoldCo Limited (HIHL), which is itself a subsidiary of the group parent and non-profit registered provider, Hyde Housing Association.

Building safety

Hyde Group invested £16.2m on building safety in 2021-22, up from £12.7m the previous year and part of £80m invested since 2017. The group said it will launch its new sustainability strategy in 2022 and plans to invest £282m more, to further improve the safety and energy efficiency of its homes.

The group said its charitable status limits its discretion to pay for building safety works on behalf of leaseholders and shared owners, but has recovered £18.3m through the courts and from the government’s Building Safety Fund.

The group hopes to obtain grant funding where possible and to recover money from its developers mutually or via legal action, where it can, to offset these costs. Last month (July), the association was successful in legal action, brought via its subsidiary Martlet Homes, against developer Mulalley & Co. The latter was ordered by the High Court to pay Hyde Group for the cost of replacing combustible cladding on five tower blocks in Hampshire.

Andy Hulme, chief executive at Hyde, said: “We want our staff and customers to be proud of the homes we provide and the communities we support.

“So, alongside the £80m we’ve spent on building safety since 2017, investment in our five-year property improvement programme will continue. We also plan to invest £282m more, to further improve the safety, quality and energy efficiency of our homes.

“And, while new homebuilding continued to be impacted by COVID-19 and materials and labour shortages last year, we aim to be building at least 2,000 homes a year by 2027-28.”

Hyde Group’s gearing reduced from 48 per cent in 2020-21 to 45 per cent in 2021-22, as the landlord has simplified and cut its loan portfolio over the past five years with less dependency on debt.

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED