L&Q paid £439m in break costs on swaps as part of £2.6bn refinancing

L&Q has reported a £417m post-tax deficit for the nine months to December 2016 after booking £625m of exceptional costs, predominantly relating to its £2.6bn refinancing.

The costs included £439m paid to banks during the refinancing following the merger with East Thames Group, which completed on 6 December 2016.

But the 96,000-home London-based group said it expects to reverse the deficit by year-end after it adjusts for East Thames’ assets, liabilities and reserves.

Outside of the exceptionals, the group operating surplus is set to drop by 2 per cent to £261m, against a 13 per cent rise in turnover. While its lettings margins were up, L&Q had reported in November 2016 that its full-year surplus would be affected by ‘dampening’ demand for high-end property in London’s prime markets and construction delays on key sites.

Its £2.6bn L&Q refinancing deal was done with Barclays, Dexia, HSBC, Lloyds, RBC, RBS and Santander. It came with a new covenant package ‘more in line with the corporate market’ and to support its ambitions to deliver 100,000 homes as part of an £15bn investment plan.

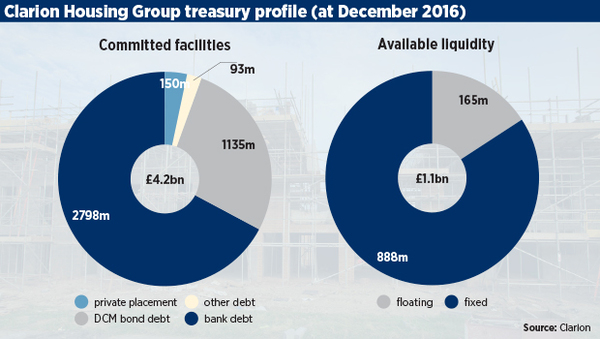

Available liquidity - which equates to cash and cash equivalents plus fully secured and committed undrawn loans - stands at £890m, compared with £370m at the March 2016 year-end.

L&Q had declined to reveal the costs when announcing the refinancing in December 2016. Group finance director Waqar Ahmed told Social Housing at the time that while the restructure has crystallised the group’s mark-to-market (M2M) position on its swaps, that cost is offset by a ‘significantly lower average cost of debt’.

Reporting unaudited results to the markets today, L&Q said the financial restructuring ‘moved a material amount of debt from [East Thames] to L&Q, terminated all outstanding interest rate swaps and terminated a material proportion of fixed rate debt’.

In the statement to the markets today, Mr Ahmed said: ‘During the trading period L&Q has completed the transaction to add [East Thames] as a subsidiary that materially increases the value of assets and conducted a £2.6bn refinancing exercise that adds flexibility to the capital structure; delivers a stronger liquidity coverage ratio; and lowers future financing costs to support our corporate objectives.’

Exceptional refinance costs included £4m of previously capitalised costs, a £182m reclassification from cash flow hedge reserve to the Statement of Consolidated Income (SOCI), and the fair value termination costs of £439m.

Standalone derivatives are subject to market fluctuations that can result in collateral calls and a requirement to post asset security or cash when organisations are ‘out of the money’ with their bank counterparties. The last financial year saw 17,900-home Bedfordshire-based association BPHA pay £49.8m to break half of its standalone swaps in a bid to reduce risk and dampen its exposure to margin calls, which was welcomed by rating agency Standard & Poor’s (S&P).

During the refinancing, L&Q married banking loans with shorter-term sales activity and longer-term debt capital markets finance with housing for rent. It also saw L&Q crystallise its mark-to-market (M2M) position on its swaps. The refinancing leaves 60 per cent of group debt at a variable rate and 40 per cent fixed.

For the full-year to 31 March 2017, L&Q said there will be an exceptional adjustment through the statement of consolidated income (or balance sheet) to reflect the fair value of East Thames Group’s assets, liabilities and reserves.

It added: ‘These values are subject to an on-going independent external valuation and audit and will be disclosed in the audited financial statements for the FY ending 31 March 2017. L&Q expects this to materially reverse the existing deficit for the year after tax.’

Performance

L&Q said its homes in management stand at 95,657 (2015: 78,353). Turnover is up 13 per cent from £570m to £646m, while operating surplus is down 2 per cent from £261m to £257m, ‘reflecting a lower surplus on disposal of fixed assets and investments’.

Group operating margin fell from 46 per cent to 40 per cent. Operating margin on lettings is up from 47 per cent to 52 per cent. But operating costs and cost of sales up 22 per cent.

It said on a pre-exceptional basis, surplus for the period at £208m has remained in line with the prior year.

Mr Ahmed added today that operating margins on lettings activities are above the medium-term target of 50 per cent.

As previously reported, he said ‘construction delays on key sites and a dampening of demand for ‘high end’ outright sales units located within London’s prime markets and constructed within joint ventures, has resulted in slower than expected sales rates’.

He added: ‘Sales margins achieved on a year-on-year basis remain stable at 20 per cent; are above L&Q’s hurdle rates; and during the quarter L&Q has outperformed its expectations on shared ownership first tranche sales and staircasings.

‘Our low end guidance on surplus for the FY ending 31 March 2017 remains at £270m on a pre-exceptional basis.’

The consolidated unaudited results only include the trading activities of East Thames Ltd from the date of becoming in early December 2016 to 31 December 2016.

The statement explains that a 23 per cent increase in total assets less current liabilities ‘reflects core growth and the addition of [East Thames] as a subsidiary’.

Total assets move from £8bn in the full-year to March 2016 to almost £9.9bn at December, as loans rose from £2.1bn to £3.9bn. Net debt per unit rises from £26.5k to £39.5k.

The net debt figure excluding derivative liabilities for the nine-month period has increased to £3.78bn, up from £2.109bn at March, reflecting ‘an increase in investment capital expenditure and the refinancing exercise’.

On 21 December 2016, Moody’s downgraded L&Q’s rating to A2 from A1 and assigned a negative outlook, citing East Thames’ ‘weaker credit profile, the expectation of lower margins and the increase in net debt to support the corporate strategy’.

Development pipeline

L&Q’s development pipeline has risen to 41,040 units. Outside of what is reported in the trading update, it has also recently acquired Gallagher, which has around 42,000 plots.

L&Q has delivered 1,540 housing completions in the period, including joint ventures, which is down from 1,729 in the period a year earlier. It said 813 housing completions were for sub-market tenures, including social housing and shared ownership, which is down form 1,039. It said 727 were for market tenures of outright sale and market rent, up from 690.

L&Q is expected to hand-over 2,300 units for the full-year ending 31 March 2017 and to have commenced 2,900 units.

It is operating from 100 active sites, including jvs and has approved an additional 2,800 units, bringing total units in the development pipeline to 41,040, which is up from 39,800 in March 2016. Of these, 10,200 units are on site. The projected development pipeline cost is estimated at £3.4bn, of which £1.2bn is currently committed.

RELATED