L&Q's 'pioneering' £2.6bn refinancing deal rewrites HA treasury book

L&Q’s ‘pioneering’ £2.6bn refinancing included a new covenant package ‘more in line with the corporate market’ and to support its ambitions to deliver 100,000 homes.

The group married banking loans with shorter-term sales activity and longer-term debt capital markets finance with housing for rent. It also saw L&Q crystallise its mark-to-market (M2M) position on its swaps.

London and Quadrant (L&Q) has completed a ‘pioneering’ £2.6bn refinancing that ensures its treasury strategy aligns with its sales and rental activities and creates a covenant package ‘more in line with the corporate market’.

L&Q’s refinancing supports a £15bn capital expenditure programme over 10 years with an ambition to deliver 100,000 homes, split 50:50 between sale and rent, and evenly between market and sub-market.

Negotiations with seven banks were completed as part of L&Q’s merger with East Thames Group in December 2016. It saw the 90,000-home London-based association marry banking lines with shorter-term sales activity and longer-term debt capital markets finance with long-dated housing for rent.

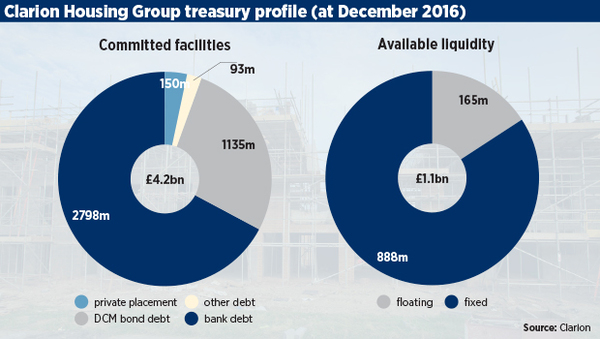

It came alongside two other major HA mergers, with Affinity Sutton and Circle Housing forming 125,000-home Clarion Group, and Sovereign and Spectrum amalgamating into a new 55,000-home association.

The L&Q deal was done with Barclays, Dexia, HSBC, Lloyds, RBC, RBS and Santander. Consents were not required from bondholders, who were kept informed throughout the process.

The revised debt profile includes 50 per cent of bilateral bank loans, 46 per cent secured debentures and 4 per cent aggregated club deals.L&Q had £2.1bn drawn debt when it reported half-year results in November 2016. East Thames had £540m at March.

We wanted to look at our entire existing banking lines..is this what we need to deliver our future objectives?

The restructure has crystallised the group’s mark-to-market (M2M) position on its swaps.

But that cost has been offset by a ‘significantly lower average cost of debt’, said group finance director Waqar Ahmed.

He said the new covenant package is ‘more in line with the corporate market’ and based on asset cover, interest cover and a leverage ratio - which companies use instead of a gearing ratio as a measure of indebtedness.

The refinancing also ensures funds can be passed through the group, including East Thames.

‘We wanted to look at our entire existing banking lines, at all our hedges, and start with a blank piece of paper. Is this what we need to deliver our future objectives? Are these the covenants, hedges and loan products we need today?

‘And the answer was, if you had a blank piece of paper, that’s not what you’d do today.

‘It means we’ve aligned our banking products with our shorter-term sales products, with longer term capital markets to support longer-term rental products.

‘This gives us the flexibility we need on interest rate management as well as the ability to deleverage should we face adverse market conditions. You may want to deleverage in a housing market downturn if you choose to do less sales and minimise cost of carry.’

He said the ‘key point’ is that sales is very different to long-term rental investment, being shorter-dated with transactions that fluctuate. As such, cashflows need more banking lines, revolvers and shorter durations to minimise cost of carry.

The work also saw the release and recharge of over 23,000 properties to a new global security trust deed, which completed ‘in an exceptionally short timeframe’, said Martin Watts, L&Q treasury director.

Mr Watts, who led on the work with Rothschild as financial advisors and A&O as legal advisors, said L&Q was ‘exceptionally well supported’ by relationship banks.

The merger will see East Thames’ care and support division become a new 6,600-home subsidiary called L&Q Living.

Another £250m is set aside for community investment and £5m for a training academy.

L&Q is also now in talks to buy strategic land company Gallagher Estates.

Banks back L&Q vision for future

Waqar Ahmed said the covenants, hedges and loan products that existed ahead of the merger with East Thames Group in December 2016 did not fully align with future objectives, including delivering 100,000 new homes, split 50:50 between sales and rent, and affordable and market.

Around 65,000 homes could be built using the combined capacity of L&Q and East Thames, and the rest delivered through partnerships.

Mr Ahmed said: ‘I think it’s a remarkable demonstration of how collaboration and shared objectives can be delivered with our key stakeholders, banks and investors. And if we can do it, of course others can.’

Restructuring swaps

Along with matching the funding strategy with its sales and rental activities and negotiating a covenant package ‘more in line with the corporate market’, the refinancing restructures the group’s freestanding and embedded swaps.

Standalone derivatives are subject to market fluctuations that can result in collateral calls and a requirement to post asset security or cash when organisations are ‘out of the money’ with their bank counterparties.

The last financial year saw 17,900-home Bedfordshire-based association BPHA pay £49.8m to break half of its standalone swaps in a bid to reduce risk and dampen its exposure to margin calls, which was welcomed by rating agency Standard & Poor’s (S&P).

Reporting half-year results to the markets in November 2016, L&Q said its fair value position of its ‘standalone’ interest rate swaps was negative £207m. East Thames reported the fair value of interest rate swaps as a £89.6m liability at March 2016. There were also significant embedded swaps.

It’s structured in a way so there is an overall minimal [net present value] impact

Mr Ahmed said while removing the swaps means there is a M2M ‘crystallisation’ on one side, it also results in a ‘significantly lower average cost of debt’.

‘It’s structured in a way so there is an overall minimal [net present value] impact, and equally beneficial to both parties,’ he added.

The refinancing leaves 60 per cent of group debt at a variable rate and 40 per cent fixed.

L&Q’s liquidity buffer has been increased under the new deal, requiring cash and undrawn facilities. As such, Mr Ahmed said they ‘look at cost of carry a lot’. The new arrangements are structured to tackle that using short and long-dated debt, revolving credit facilities (RCFs), the appropriate level of fixed and variable and a balance of bank and bond finance. There is also a split between term loans and RCFs.

Unlocking East Thames

Reworking the treasury structure also eases pressure on East Thames, which has previously incurred a cost of carry associated with higher interest rates and unutilised facilities.

Funds can now be passed through the group, including East Thames.

Improved sales activity meant East Thames’ drawn borrowings were £543m in 2015/16, down from £573m in 2012/13. The group was sitting on £177.5m of unutilised RCFs at year-end, compounded by non-utilisation fees and a low interest rate environment that offers meek returns on deposits.

It had instead drawn from its 2012 bond, issued at a 5.486 per cent coupon. It said at the time that its 5.5 per cent weighted cost of funds would have fallen to 4.4 per cent, were its available facilities fully drawn. East Thames also had higher overheads than its G15 peers pre-merger.

Moody’s said L&Q will continue to have an above average social housing lettings interest cover ratio and operating margin, while realising planned efficiency savings of £38m over two years.

But the merged entity will have lower profitability than L&Q has had historically in the medium-term, with operating margins between 30 per cent and 35 per cent, compared to L&Q’s operating margin of 39 per cent in 2016.

Aligning ambitions

The refinancing comes amid a change in how rating agencies in particular are viewing the level of risk in the HA sector.

In November 2016, S&P downgraded L&Q from AA- to A+, saying a higher dependency on sales and private rent markets for income could hamper the quality of its earnings and prevent growth in its operating margins.

In December 2016, Moody’s downgraded L&Q from A1 to A2 in light of its merger with a financially weaker association and planned increase in debt to fund ‘an ambitious development programme’. Moody’s also pointed to a continued high market sales exposure, representing over 20 per cent of revenue and with peak exposure from market sales of 60 per cent of turnover - which would be the highest in its rated portfolio.

It added that recent underperformance in L&Q’s market sales activity, which negatively impacted its current year forecast by £11m to £270m, ‘illustrates the uncertainty of market sales cash flows’.

L&Q blamed a dampening’ demand for high-end property in London’s prime markets and construction delays on key sites. High-end products make up fewer than 1,000 units of its 40,000-home pipeline.

Martin Watts, L&Q treasury director, said the increased liquidity buffer reflects a low risk appetite.

The arrangements allow L&Q to leverage or deleverage ‘without any premium or penalty’

Mr Watts said the arrangements allow L&Q to leverage or deleverage, subject to market and economic conditions and ‘without any premium or penalty’.

He said the decision to refinance rather than amend and restate existing loan agreements was taken in support of the key objectives of ‘simplicity, transparency, consistency and flexibility’.

Mr Ahmed added: ‘We allocate financial capacity to growth within prudent, board defined levels of risk tolerance.

‘This ensures that our financial strength is preserved. As one of Britain’s leading housing associations we need to play our part in tackling the housing crisis and will do as much as we can without placing our existing social housing assets at risk.’

Elements in the new package align with L&Q’s capacity model, designed to show key stakeholders that it can bear risk while retaining its strong investment grade.

It uses the financial ratios that would apply to assess an ‘AA’ credit rating, including standard credit ratios of debt to EBITDA, debt to turnover, interest cover and leverage ratios.

It then stress-tests this base using a ‘perfect storm’ of risk materialising. It calculates a peak capacity - after the risk adjustment - to maintain a minimum ‘A’ credit rating. It works back from this scenario to assess how many homes it can build.

Relationships

Mr Ahmed said strong lender relationships have been central to the negotiations.

‘Banks also see the value of additionality we’re creating, which means we’ll need their support in the coming years,’ he said.

‘On day one we met all our relationship banks and said this is what we’re doing and we want to make it work for you and for us.’

Banks also see the value of additionality we’re creating

He added the approach was about being transparent.

Overall, Mr Ahmed said the deal delivers a lower projected interest cost and a lower cost of carry that supports their business objectives.

He added: ‘We have built on existing relationships, diversifying our capital through long and short maturity profiles that match our underlying asset base. We have reduced our short-term refinancing risk and executed theentire transaction with minimal NPV opportunity cost.’

Mr Watts added: ‘We are delighted with the outcome achieved from this pioneering transaction and believe that we have ‘future proofed’ our financing arrangements in support of our business objectives.’

Richard Hughes, social housing relationship director at Lloyds Bank, said the refinancing ‘provides a sound platform for the organisation as it moves into a new phase following the completion of the merger with East Thames’.

Related Files

RELATED