Market digest April 2020: markets move to a ‘new normal’ as HAs brave issuance

Two major housing associations helped to reopen the sterling corporate bond market after an effective shutdown amid the COVID-19 crisis.

Financial markets were showing some initial signs of relative stability at the start of April, following weeks of severe turbulence triggered by the COVID-19 pandemic (click on the PDF below to see the latest tables).

Coronavirus continues to have devastating consequences on a global scale, while forcing a ‘lockdown’ across the UK that has required housing associations (HAs) to adapt how they serve their residents and operate as businesses, with safety of tenants and staff the top priority.

The sector entered the crisis in rude financial health, following months of stress-testing, fundraising and preparation for the potential consequences of a no-deal Brexit.

But the coming months are likely to see rising unemployment and continued record numbers of Universal Credit claims, pressure on public finances following the necessary raft of state interventions, and a potential era of austerity to follow.

By the first week of April, global stocks had rallied, with reports of investors beginning to see some signs of stability returning.

Included in the UK government’s multibillion-pound intervention were programmes for the Bank of England to buy up corporate bonds – with HAs making up 80 per cent of the property and finance category – and a new commercial paper initiative, both of which large HAs are hoping to benefit from.

Optivo and Sanctuary led the way in helping to reopen the sterling bond markets in late March, attracting almost £2.5bn of orders between them.

Investors welcomed the deals and reiterated their view of social housing as a low-risk sector relative to other asset classes.

They indicated that a wider credit spread will be part of the ‘new normal’ for the foreseeable future. However, there were already signs of spreads tightening just a week after the issuance.

Related Files

Market digest

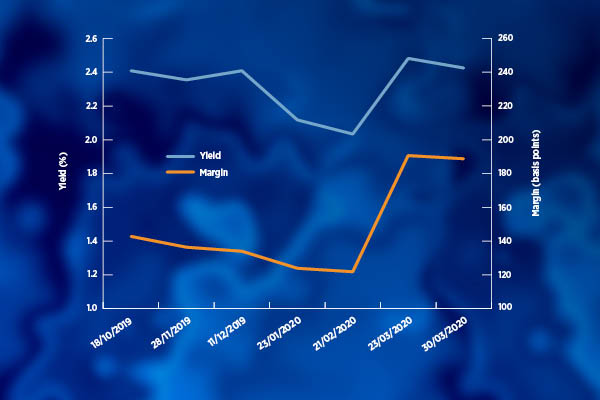

The average yield on housing association bonds jumped in March, having fallen in February as the COVID-19 crisis hit the world’s economies.

The average spread over gilts widened in that time but showed signs of tightening in the final week of March, generally a sign of investors feeling a little more confident about the sector.

Social rented housing is viewed positively as a source of predictable, steady returns by investors and credit rating agencies because of consistent levels of housing demand, government support through benefits and capital grant and the regulatory framework.

While Moody’s, for example, expects the housing market slowdown to hit sales income and rising unemployment to push up arrears, it said effects could be mitigated through reductions in spending on development and repairs.

Spreads had risen steeply since October, with the average spread 44.5 basis points higher by the end of March (see graph above).

However gilt yields were steadier in that six-month period, meaning that housing association bond yields returned to where they had started in October.

On 23 March, our market digest data showed the margins and yields on individual housing association bonds. A2Dominion’s 2028, 3.5 per cent coupon bond had the highest margin of 250 basis points on 30 March, which was up 54 points on six months earlier.

PRS Finance 1.75 per cent, 2026, which issues bonds to finance government-backed loans to private rented sector providers, had the lowest spread at 71 basis points, an increase of 11 since October.

Click on the PDF above to see the latest tables

RELATED