UK housing associations see fall in surpluses

London G15 housing associations and Homes for the North were among those to see falls in pre-tax surpluses in 2018, according to exclusive research by Social Housing

Picture: Getty

Analysis of audited accounts shows that the pre-tax profit margins of 188 UK associations fell on average in 2018 after several years of growth.

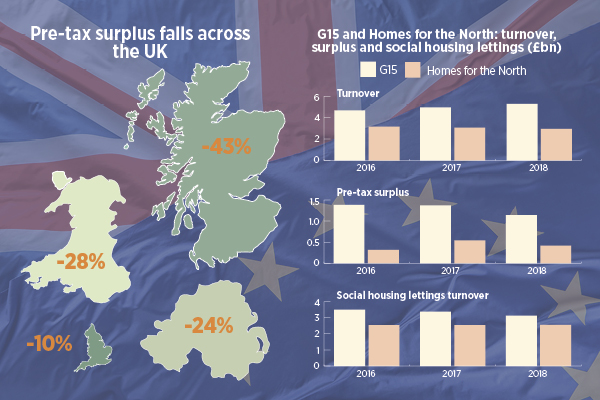

Overall pre-tax surpluses fell by 27.7 per cent in Wales, 43 per cent in Scotland, 24 per cent in Northern Ireland and just under 10 per cent in England.

Ten of the 12 members of the London G15 and 12 of the 18 organisations making up Homes for the North saw a fall in their pre-tax surplus in 2018 (see graph, above). Net surpluses across the G15 fell by 17 per cent to £1.1bn, while figures recorded by Homes for the North’s members dropped 21 per cent to £423m.

The 12 months to March 2018 marked the second year of the four-year social and affordable housing rent reduction. Social housing lettings surpluses and income were down for Homes for the North (by nearly six per cent) and by just under one per cent across England. But the G15 saw a 1.9 per cent rise on social lettings surpluses in 2018.

A number of housing associations have booked refinancing costs, including from mergers. Some reported higher capitalised repairs and exceptional items for remedial works to tower blocks following the Grenfell Tower tragedy in June 2017.

The financial figures come amid news that English associations plan to deliver twice as many low-cost homeownership (LCHO) and market sale properties, despite a big jump in the stock of properties unsold for six months. Many are also looking to the potential impacts of Brexit and a no-deal scenario.

No-deal Brexit

Standard & Poor’s ran a sector sensitivity analysis of a no-deal Brexit this month, saying it would result in a fall in its housing association credit ratings by one notch for the majority of cases, and by two notches for a few others. The more vulnerable associations are those that derive a larger proportion of their earnings from sales revenues, it said.

It added: “We anticipate that the ratings will remain highly concentrated in the ‘A’ category in this scenario.”

Jonathan Walters, deputy director of strategy and performance at the Regulator of Social Housing, said the regulator has been stress-testing housing associations’ business plans against Bank of England metrics.

Mr Walters said there is a lot of cash on associations’ balance sheets, adding: “Provided the sector behaves rationally and sensibly, and responds to any slowdown in the market, then they are quite well-placed going into a Brexit downturn, if that’s where we end up.”

Clarion Housing Group said it has identified “imported cost inflation” if sterling drops in value, with a shortage of construction labour, and potential issues around “sourcing of mechanical and electrical components for maintenance”.

Gareth Francis, Clarion’s treasury and corporate finance director, said the group’s “strong financial position means that we are well-placed to manage under any Brexit scenario”.

Paul Gray, chief financial officer of 18,500-home BPHA, said Brexit was a factor in the timing of the organisation’s recent £150m bond tap.

Piers Williamson, chief executive of The Housing Finance Corporation, said: “The sector is very liquid, so housing associations are well positioned to ride out the short term.”

Sue Harvey, a partner at Campbell Tickell, said liquidity levels are being affected by housing market risk, with “people wanting to have enough funds to build out the development programme or to mothball parts of the development programme” and that this “could be exacerbated by Brexit”. But she said the sector will be less affected than others.

Treasury advisors said associations have been securing larger committed facilities earlier than usual.

Richard Conway, associate director at JCRA, said the consultancy has seen a general trend of widening spreads, but that strong US demand for private placements meant pricing has been remarkably stable.

Phil Jenkins, managing director at Centrus, added: “Yes, spreads have widened, but there’s a range of factors – I don’t think it’s necessarily Brexit-specific, it’s more to do with wider market dynamics generally, and some association-specific characteristics.”

For Pete Gladwell at Legal & General Investment Management - Real Assets, housing remains an attractive sector for investment, whatever the Brexit outcome, because "people across the UK will still require warm, secure, affordable homes - and the millions of pensioners whose savings L&G stewards will still require long term, secure income streams".

He continued: "There’s a danger we lose sight of our social roles amongst a flurry of gilt rates, bond yields, and swaps - a distraction that’s reinforced by the sector’s dramatic over-dependence on banks and traded credit markets - but this is a time for us to refocus on the fundamentals, and create long term partnerships that enable both RP’s and investors to deliver on our social roles.”

RELATED