‘Perfect storm’ could spell auditor shortage

Shifts in the auditing sector could see housing associations that have listed debt forced to pay more for services, as the list of external auditors that specialise in public interest entities is shrinking.

Following the collapse of major companies such as Carillion, the auditing sector has had a shake-up to tighten its regulatory framework, which has added to the costs of auditing companies.

External auditing of PIEs requires additional regulatory adherence and auditing costs.

The surge in associations taking on listed debt, such as bonds, has boosted the number classed as PIEs. These are subject to a stricter external auditing process for which fewer auditing firms are able or willing to bid.

Sector experts have described a “perfect storm”, and said that while those classed as PIEs face additional challenges, there is a thin supply of external auditors serving providers more generally.

Jonathan Walters, deputy chief executive at the Regulator of Social Housing (RSH), said: “Over the past few months, it has become apparent that the market for external audits of registered providers (RPs) has become quite thin and there have been reports of only a small number of bidders when providers have tested the market.

“I don’t think the RP sector is alone in this and we are aware of similar pressures in other industries, including universities and local authorities. For some RPs, there is an additional complexity of being classed as PIEs, which adds to the cost and complexity of completing the audit.”

Housing associations require particular external auditing experience and this, combined with the issue of associations being classed as PIEs, is contributing to supply drying up. According to Lee Cartwright, partner at auditing firm Beever and Struthers, the regulation that relates to PIEs is “far more searching, rigorous and onerous” than for other types of entity.

He believes that the stringent regulatory measures imposed by the Financial Reporting Council (FRC) have created a disadvantage for housing association PIEs to be audited, as the FRC’s file reviews of PIEs are very resource-intensive for audit firms. Additionally, auditing PIEs requires specialised experience and is usually reserved for large organisations, with fees sometimes reaching hundreds of thousands of pounds for the bigger firms.

Mr Cartwright said the average housing association audit fee is usually lower than other types of PIE, such as banks and insurance companies, and if an audit firm has 20 or more PIEs on its books, it will be inspected by the FRC annually, rather than every three years, costing the firm time and money.

The combination of this, plus a shortage of auditors in the UK and the regulatory tightening-up, has created a “perfect storm”, according to Mr Cartwright, as firms no longer have the time or resources to take on housing association PIEs.

Mr Cartwright told Social Housing: “If you’re auditing a housing association with 3,000 units, you still face the same regulatory risk as you would on a much bigger audit. So it’s just not a risk that many of the big firms are willing to take. There’s a disconnect between the financial reward of the audit fee and the level of risk you’re taking on by increasing your pool of PIE audits.

“You might argue that because housing associations are in a stable, well-run and well-regulated sector, the chances of those bondholders losing their investment with a housing association are arguably very small – an investor has never lost money in a housing association, [so] there is an argument [that] having listed bonds shouldn’t bring housing association PIEs into that regulatory regime.”

As well as the ability to charge higher sums for PIE auditing of organisations traditionally larger than housing associations, professional service and auditing firms can often make greater returns on services outside of PIE auditing.

Mr Walters said: “I think many of the challenges facing RPs in securing external auditors also relate to issues in the audit industry and the increased regulation audit firms are facing, alongside a desire from RPs to achieve value for money when tendering for audits.”

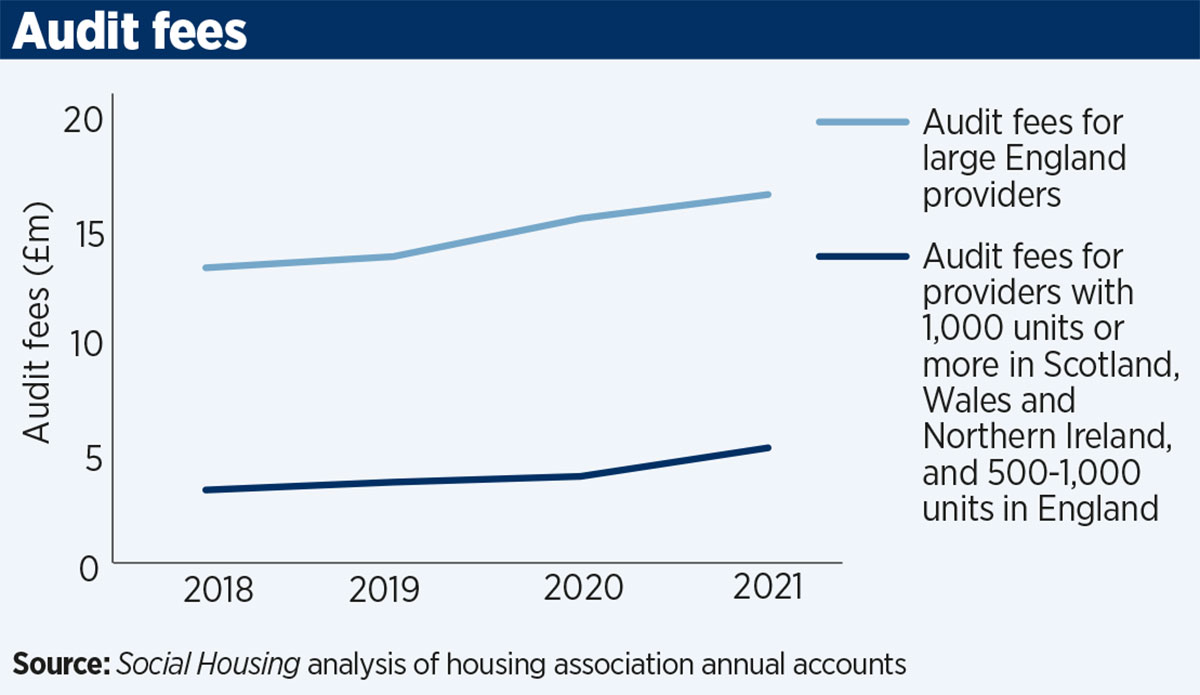

The largest housing associations in England – those with 1,000 homes or more – spent a combined total of £16.4m on external audits in 2020-21, Social Housing analysis of association annual accounts data has shown. This represented a seven per cent increase on 2020, although a smaller increase was seen in that year (13 per cent).

Meanwhile, the combined audit fees for providers with more than 1,000 units in Scotland, Wales and Northern Ireland – and 500 to 1,000 units in England – rose 33 per cent to £5.1m in 2021.

Nationally, Places for People, which is made up of more than 20 companies across the housing sector, spent the most on external auditing fees out of any provider in 2020-21, at £700,000. Worcester-based Sanctuary Housing spent the next highest amount, at £600,000.

Lee Gibson, senior director at Newbridge Advisors and former chief financial officer at Bromford, said audit contracts in comparison to other advisory services may be less profitable for audit firms due to the amount of hours required to complete an audit.

Mr Gibson said: “When an auditor is appointed, they are then tightly restricted in the other services they can provide to avoid a conflict of interests.”

Peter Hubbard, senior partner at Anthony Collins Solicitors, said he was aware of accountancy firms that had to resign bids where housing associations had become PIEs because they did not have anyone with the necessary listed company experience.

Mr Hubbard said: “You need a cohort of auditors who have got listed experience to do the public interest entities and that’s really limited when looking at those audit firms who have also got housing association audit experience.

“The top accountancy firms are doing more tax and advisory work for FTSE 250s. This means the mid-tier accountancy firms who do a lot of the social housing audit work are now being drawn into auditing the FTSE 250. This leaves less capacity for auditing housing associations.

“I know a few accountancy firms did not bid for recent housing association tenders because all their capacity was soaked up into auditing FTSE 250 companies.

“A couple of clients are delaying retendering their audit because they have tested the market and they are not sure they’re going to get sufficient bidders.

“There’s an opportunity here to undertake audit work for housing associations who have not become PIEs and this could percolate down the tiers of accountancy firms.”

Issues with attracting auditors do not appear to be limited to larger associations with listed debt.

Karen Cooper, chief executive at Penge Churches Housing Association (PCHA) and chair of the G320, a collection of small London-based housing associations, said there has been a “creeping increase” in audit fees over the past couple of years.

“However, this is life and if audit fees continue to go up then, like everything else, we will find a way to swallow this as an essential cost to the business,” she said.

“In terms of tendering external audit services, I know that a couple of G320 members have struggled more than they have done previously in terms of interest from some of the larger audit firms when tendering.

“One G320 member said that they had gone through all of the firms listed on the [National Housing Federation] website and none of them were interested in tendering. So that is slightly worrying.

“In the end that housing association has actually gone to smaller firms, or new entries to the market rather than the traditional specialists in social housing in order to get a reasonable tender list.

“It’s really important to us that we have auditors that understand the sector and understand our business and that is why we’ve often gone to a relatively small handful of firms in the sector.

“For smaller organisations, I think we are often quite reliant on the advice from our external auditors on things that happening in the sector or changes in certain accounting treatments.

“At PCHA we value the strength and value that our relationship with our current auditors brings us.

“It is vital that we have auditors that we have absolute confidence in and preferably that understand the sector. If we have to look elsewhere for that service, this would be a real shame.”

Social Housing approached the Financial Reporting Council for comment, but it did not respond before this article was published. Places for People and Sanctuary were approached for comment.

Social Housing approached the ‘big four’ professional services companies to comment on the article. Deloitte and PwC declined to comment, while KPMG and Ernst and Young did not respond in time before going to press.

Update: at 09.53am, 03.02.22

This story was updated to provide clarity on Ms Cooper’s quotes.

Update: at 09.53am, 04.02.22

The story was updated to remove a quote that had been incorrectly attributed to Lee Gibson.

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

Sign up for the Social Housing Finance Conference

The leading one-day event for senior finance and treasury professionals

Brought to you by Social Housing magazine, the Social Housing Finance Conference (11 May, etc. venues, St Paul’s, London) is recognised as the longest-standing, leading one-day event bringing together sector leaders and senior finance and treasury professionals from across the sector to discuss the strategic, operational and technical finance matters of most importance.

RELATED