Places for People returns to retail bond market with 4.25% offer

Places for People has launched a new seven-year retail bond with an offer price of 4.25 per cent.

Prospective investors have until the 12 December 2016 to buy the bonds, at which point the offer period closes. The bonds have a minimum initial subscription amount of £2,000 and are available in multiples of £100 thereafter.

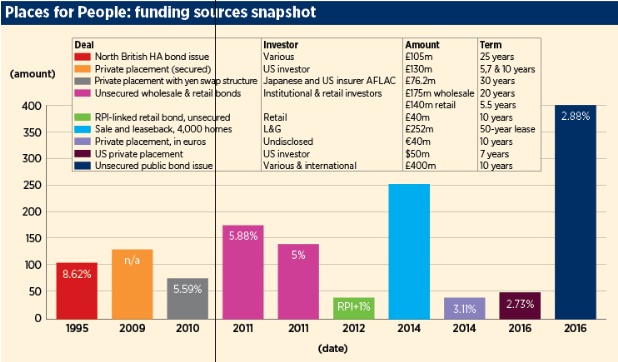

The issue marks the third retail bond for PfP, after it entered the market in 2011. A2Dominion followed PfP into that market in 2013 and 2014.

Investors in housing association retail bonds have included wholesale institutional investors and retail investors, such as wealth managers running discretionary funds and trusts, along with family offices.

The new sterling denominated 4.25% bonds mature in December 2023 and will support commercial activities, including across property management, leisure management, development and construction sectors via the PfP Operations group.

It marks the latest financing after PfP, which owns or manages 152,783 homes, issued the sector’s biggest ever bond in August 2016 through Places for People Treasury, a vehicle created to raise funding for its registered providers. That deal priced at 225 basis points over the reference gilt and a coupon of 2.875 per cent, with a 10-year maturity. The issuance attracted interest form 160 investors.

Some of those funds were used to repay its 2016 £140m retail bond, issued five years ago at a coupon of 5 per cent. PfP also has a 10-year retail bond that it issued in 2012, maturing in 2022.

A2Dominion also issued £250m unsecured wholesale bonds last month at 3.5 per cent.

PfP’s new bonds will pay a fixed rate of interest of 4.25 per cent per annum, payable twice yearly on 15 June and 15 December of each year with the first coupon payment being made on 15 June 2017.

The latest structure sees the bonds ‘irrevocably and unconditionally guaranteed’ by its commercial entities, including PFPL, Places for People Ventures Operations, Residential Management Group Limited (RMG) and Touchstone Corporate Property Services, and Zero C, together with PfP Operations.

PfP Operations and its subsidiaries make up a sub-group which carries out various commercial activities in the property management, leisure management, development and construction sectors. The issuer is a special purpose company and a wholly-owned subsidiary of group.

An interest cover covenant is included at a ratio of adjusted EBITDA to interest costs of 1.5:1.

David Cowans, chief executive of Places for People, said: ‘We are delighted to announce the launch of this Retail Bond.

‘The funds raised will enable us to further our work in the property management, leisure management, development and construction sectors via our operations group, as well as to diversify its sources of funding.

‘This will support us in bolstering our award-winning leisure management business, continuing to grow our property management businesses, helping to deliver the new homes that the UK desperately needs and creating more high quality, safe and sustainable communities.’

PfP saw its credit rating downgraded in relation to the diversification of its business and refinancing risk in summer 2016.

RELATED