Regulator of Social Housing: concerns remain over lease-based model

The English social housing regulator says lease-based specialised supported housing providers are not responding sufficiently. Sarah Williams reports

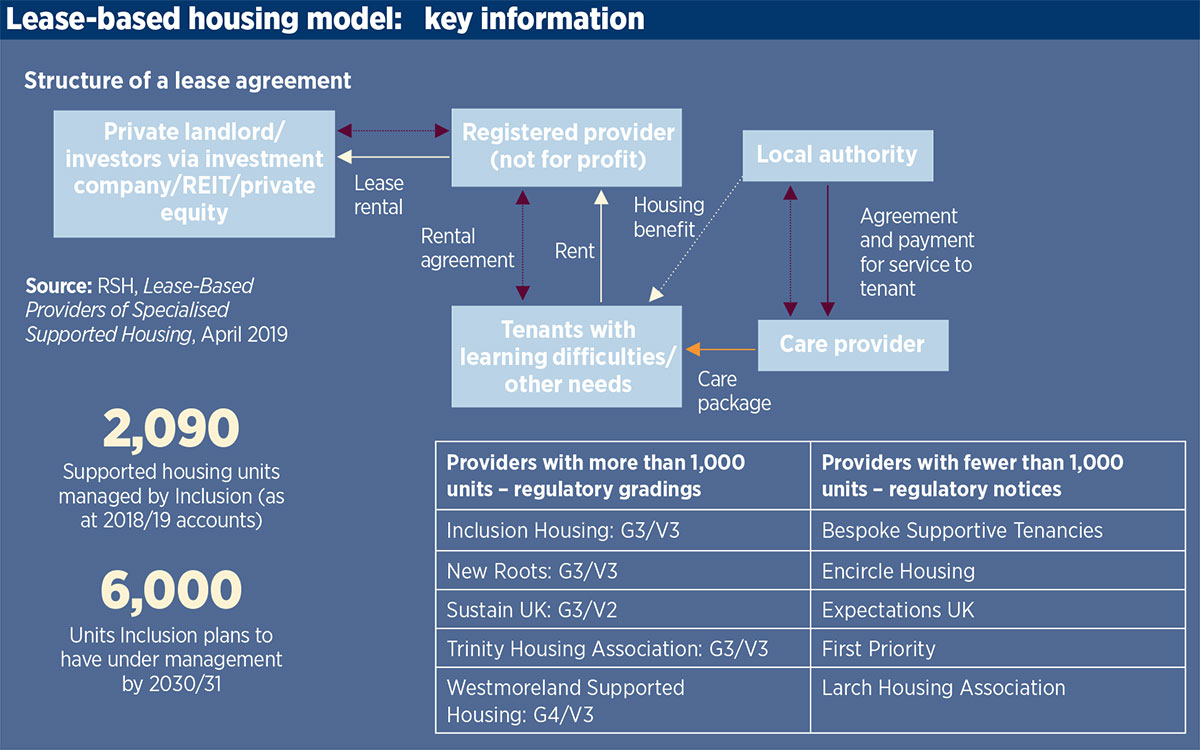

The Regulator of Social Housing (RSH) has said that concerns it set out last year over the viability of the model operated by a number of lease-based providers of specialised supported housing are not being addressed fast enough.

Jonathan Walters, deputy chief executive of the RSH, told Social Housing that the regulator would take steps to emphasise its ongoing concerns, a year on from the special addendum to its Sector Risk Profile, which it released in April 2019.

This could take the form of a follow-up to the earlier publication, which focused on insights from its engagement with lease-based providers – several of which have been found non-compliant in a string of regulatory notices and judgements.

Mr Walters said: “I think the concerns we expressed in the Sector Risk Profile addendum are often not being addressed fast enough by organisations and the fundamental one about the viability of the way the model is being operated is not being addressed sufficiently, we don’t think.”

He added: “There are concerns about the way this model is operated and the threat to the long-term viability of organisations that house vulnerable people, which often comes from inappropriate risk management and failings of governance and commercial awareness. We would want to reinforce all of that.”

Mr Walters was speaking to Social Housing in the wake of the High Court decision on an unprecedented legal challenge against the regulator concerning its engagement with one provider of specialised supported housing.

Claimant Inclusion Housing Community Interest Company had sought to overturn its non-compliant G3/V3 regulatory judgement dating from February 2019 through a judicial review, with evidence heard in the Administrative Court of the Queen’s Bench Division on 15 and 16 January 2020.

While the RSH, in its previous iterations, has faced legal challenge over statutory intervention in the past, the claim made by Inclusion is believed to be the first case in which its published opinion – in this case a regulatory judgement – has been contested in court.

However, handing his decision down on Monday 24 February, judge Martin Chamberlain dismissed all five core grounds of challenge mounted by the provider, including “irrationality” and “inadequacy” of reasons.

In his decision statement, Mr Chamberlain wrote: “Against the background of engagement between the regulator and Inclusion over the course of the [in-depth assessment], the reasons given were in my judgement intelligible and adequate. They enabled Inclusion to understand why the conclusion expressed in the [regulatory judgement] had been reached.”

Welcoming the judgement, Mr Walters said: “We’re pleased that it’s comprehensive, [the judge] dismissed all grounds that [Inclusion] brought and was clear in his reasons why. So I think it’s a solid endorsement of our approach.”

The regulator’s engagement with providers in the sector has seen a steady flow of non-compliant regulatory notices and judgements in recent years, starting with First Priority Housing Association in February 2018.

In September 2019, the regulator made statutory appointments to the board of another provider, Westmoreland Supported Housing, and subsequently downgraded it from its existing non-compliant governance grade of G3 to G4, the lowest grade.

Commenting on the regulator’s plans to reinforce its message on lease-based providers, Mr Walters said: “As we said in the Sector Risk Profile addendum, there is still far too much balance in favour of the freeholders and not enough capacity in the registered providers.”

He added: “I think the indexation [of the rent increases] can be an issue, the concentration risk can be an issue, the lack of break clauses so that you can’t get out of these leases is a significant issue. The practical impact of the leases themselves seems to be that providers are left with little money, and there’s little flex in their business plans to cope with downside risk.”

The regulator is particularly concerned about limited flexibility in lease agreements in light of housing associations’ challenges of funding investment in their existing stock.

“The sector is concerned about carbon neutral and a possible Decent Homes two, and there is no reason to expect these won’t apply to lease-based providers. Of course many of these organisations have little capacity for additional capital costs, they’ve already got thin margins and not significant access to cash and would need to find ways to undertake such works.

“We already know there’s cost pressure that’s going to come to these organisations that doesn’t appear to be in their business plans”

“So we already know there’s cost pressure that’s going to come to these organisations that doesn’t appear to be in their business plans. It’s that lack of flexibility that we don’t see elsewhere, and some very foreseeable risks that could crystallise in the next five years.”

Asked about examples referred to during the recent court hearing of providers that have been able to incorporate leases into a business model deemed compliant by the regulator, Mr Walters said that these tend to include a “diversified range of income streams”.

“The main thing is the mix of financing – so most of them will have a mix of either short-term and long-term leases or leases and freehold properties, or they do a lot of managing agreements, providing the management services rather than actually providing the property services,” he said.

Hear from the social housing regulator at the Social Housing Finance Conference in London on 7 May 2020. Click here for details

Sign up for Social Housing’s weekly news bulletin

Social Housing’s weekly news bulletin delivers the latest news and insight across finance and funding, regulation and governance, policy and strategy, straight to your inbox. Meanwhile, news alerts bring you the biggest stories as they land.

Already have an account? Click here to manage your newsletters.

RELATED