Sage Housing reveals £1.3bn of committed spending

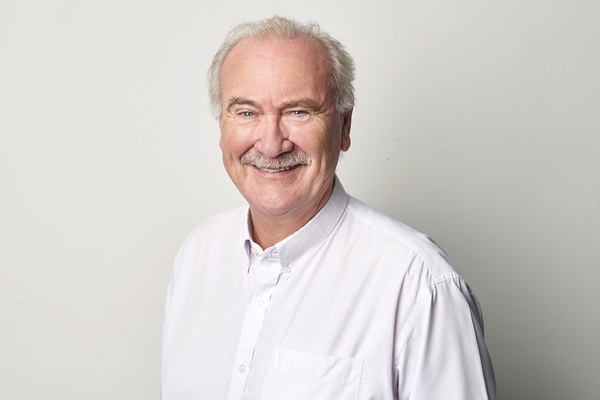

For-profit registered provider Sage Housing has a committed spend of £1.3bn to deliver 9,000 homes over 226 developments across England, chief executive Joe Cook has said.

Speaking at the Social Housing Annual Conference in London on Wednesday, Mr Cook said that within this programme, Sage was “well ahead of [its] target to deliver 20,000 homes by 2022”, with 74 full-time members of staff employed.

He also rejected suggestions that the provider, which is backed by real estate investment giants Blackstone and Regis, was outbidding non-profits in the sector.

He said: “We are currently successful in approximately one in every five bids, and this is in line with sector norms. And we are working in partnership with local authorities and registered providers across England who have the option of managing Sage homes.”

Mr Cook also emphasised that Sage is creating “new capacity in the sector” to bring genuine additionality. Extra supply would also follow from its sister organisation Sage Partnerships, which “is now involved in discussions to use private equity to provide genuine additionality in the form of partnerships with house builders, local authorities and other registered providers,” he added.

The conference also heard directly from Blackstone, marking a first for the social housing sector.

Mr Cook said Sage Housing had been formed from a desire to “make a meaningful contribution towards addressing the housing crisis” and to deliver supply to a sector in which “for affordable housing in particular, the lack of new stock being built year after year was disheartening”.

He added: “For years, different stakeholders have talked about ambitious plans to deal with this but have always fallen short of the massive levels of investment needed. It was only when I met Blackstone and Regis I realised that private equity, responsibly deployed, could be a game changer.”

Referring to Sage as a “for-dividend” provider, Mr Cook said that the company made “a modest margin primarily through the operational efficiencies generated by utilising robust scalable digital platforms”, combined with its strategy of only acquiring new-build homes.

Having “no legacy stock or systems means that we can move in a highly agile manner and focus on what’s really important to our residents”, he said.

Sage’s digital approach centres on a customer portal, which was launched in August 2018, combined with using clearly defined data touchpoints to evaluate performance and drive change.

This approach is applied “from acquisitions to delivery of properties, to the lettings market and shared ownership and after sales experience”, Mr Cook said.

He revealed that 100 per cent of residents are now registered to the portal, with 72 per cent logged in, and of these 82 per cent are regular users.

“Combining feedback gained from our residents’ portal and with [net promoter score] surveys across our customer journeys we see that we are currently achieving positive survey scores on par with sector leaders.”

He added: “As you scale, the market intelligence goalposts are constantly growing, so Sage is continually recalibrating what we think is important based on input from our residents and stakeholders.”

As comments in other sessions addressed the question of ongoing regulatory scrutiny of lease-based providers of social housing, Mr Cook emphasised that Sage is a regulated entity and not a lease-based model.

“The model is not predicated on stock disposal… Sage the regulated entity draws equity into the RP and it buys the stock and holds the stock within the RP. So the stock is protected by the regulator in exactly the same way [as most non-profit stock is protected].”

He added: “We have a dividend which is paid to our shareholders in a similar way to what I prefer to say are not for dividend, because every business makes a profit or a surplus, we provide that surplus up and our investors take a dividend in the same way as any shareholder in a normal business would take a dividend.”

RELATED