Sustainability-linked loans build momentum with £0.5bn social housing foothold

Sustainability-linked loans (SLLs) are set to exceed the £0.5bn mark in social housing this year as more lenders adopt the model.

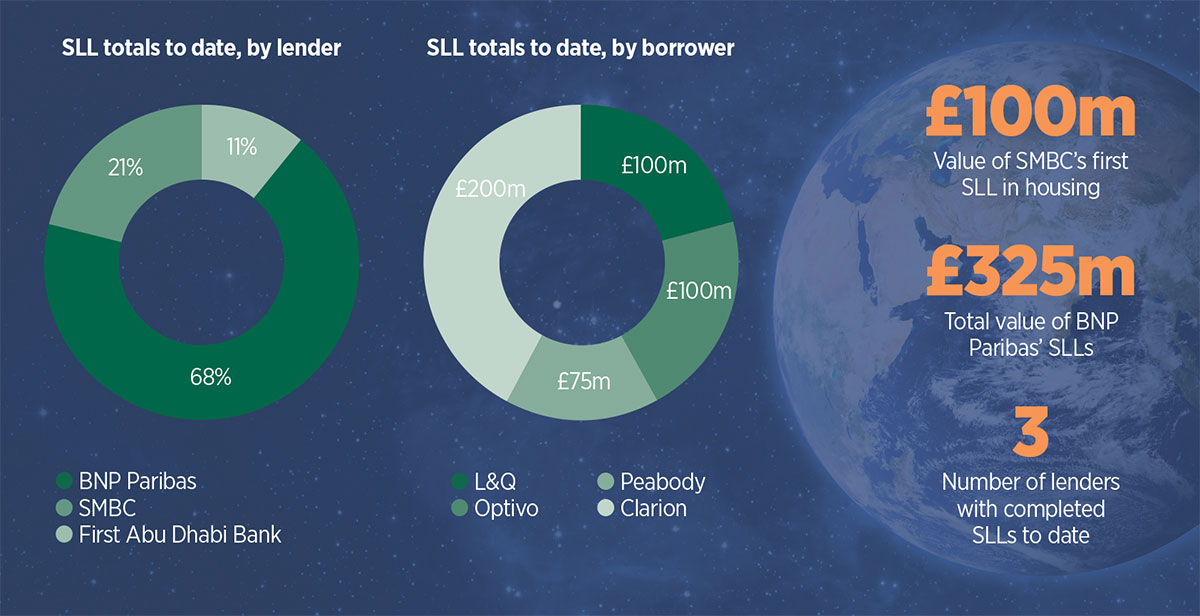

So far, £475m of deals have been completed with three banks, while a fourth – an established lender to the sector – has confirmed to Social Housing that it has three SLL deals in its current pipeline.

Sumitomo Mitsui Banking Corporation (SMBC) recently became the latest bank to link interest rate to social impact key performance indicators (KPIs) when it signed its first ever SLL with a housing association (HA), as first reported by Social Housing.

The Japanese bank, which entered the sector in 2018, agreed a £100m revolving credit facility (RCF) with Clarion Housing Group in late December. Through the deal, Clarion will pay a lower interest rate on the loan if it delivers on targets to support an agreed number of people into work each year through its training and support programmes.

At the same time, BNP Paribas – a veteran in the field, having agreed £325m of SLLs since signing the sector’s first such deal in 2018 – also agreed a £100m loan with Clarion tied to employment KPIs, in the form of a new five-year RCF.

“[We’re] looking to go beyond a loan offering, be it by leading the first ever sustainability bond from the housing sector to IT-based solutions to support board directors with their decision-making”

Both lenders were new to Clarion. Gareth Francis, director of treasury and corporate finance, said that the HA is “committed to sustainability in all that [it does]”, including the selection of its banking group.

Elsewhere, new entrant to the sector First Abu Dhabi Bank signed a three-year, £50m RCF with fellow G15 HA Optivo in August, marking its first loan to the sector.

News of Clarion’s recent deals with BNP Paribas and SMBC came shortly after its landmark £350m bond issue on 15 January, which marked UK social housing’s very first sustainable bond and achieved the lowest coupon and joint-lowest spread for an HA primary issue, at 1.875 per cent, and 98 basis points over gilts respectively.

Lloyds and NatWest, which were bookrunners on the deal along with Barclays, revealed to Social Housing in September that they intended to deliver SLLs within UK housing.

Stuart Heslop, managing director of real estate finance at NatWest, has now confirmed that the bank is “in legals” on three large SLLs to HAs.

He said that, from a starting position last year where NatWest was approaching its clients with ideas on “how [to] add some sustainability-linked covenants and ultimate benefits through pricing through the facilities”, there is now an increasing focus on environmental, social and governance (ESG) factors in inbound enquiries.

Asked how the interest rate metric would work, in terms of whether HAs would pay a higher margin if they did not meet targets, as well as receiving a lower margin if they did, Mr Heslop said: “We are much more ‘carrot’ than ‘carrot and stick’.”

He added that while the bank is continuing to agree deals that do not have a sustainability element, these tend to be shorter-term RCFs, and he said the bank would “be on the front foot” in suggesting that sustainability is considered.

David Cleary, head of housing at Lloyds Commercial Banking, said that the bank has wrapped the sustainability agenda into a broader, group-wide initiative underpinning its ‘Helping Britain Prosper’ plan, which mirrors the sustainability agenda of clients across a number of sectors.

“[We’re] looking to go beyond a loan offering, be it by leading the first ever sustainability bond from the housing sector to IT-based solutions to support board directors with their decision-making,” he said.

David Reynolds, senior banker at BNP Paribas, which signed its first £100m SLL in the social housing sector with L&Q in June 2018, has said previously that the bank would “always look to structure… loans as SLLs where it makes sense to do so”.

The bank last year signed a £50m loan to Optivo linked to employment metrics, a £75m loan to Peabody linked to childcare qualifications, and now its latest deal with Clarion.

“In the case of Clarion, the indicator that has been chosen is based on helping an agreed number of people into employment,” Mr Reynolds said. “If the target is met in the time frame agreed, Clarion will benefit from a lower interest rate on the loan.”

He said social purpose is “deeply rooted in [HAs’] DNA”, but the challenge is to find a way to integrate this into their financing strategy. “Nearly all housing associations work to support their residents across a range of initiatives. However not all organisations have the systems in place to report on this. As the sector continues to grow and look for new sources of funding, we see that this is starting to change.”

Patrick Hawkins, a director at Savills Financial Consultants, said that housing assocations need to provide clear information on their ESG credentials in view of funders’ growing focus on these aspects. "Unless housing providers can make a clear offer... there is a risk they will face a diminishing pool of investors in years to come.”

A sector partnership was formed in November with more than a dozen participating organisations to build consensus on an approach to reporting ESG metrics within social housing, as demand from investors mounts.

RELATED