HA funding comes of age

With unprecedented levels of competition in the market, borrowers are in a strong position to negotiate

In association with:

The UK housing association funding market has come of age in recent years, from the banks and aggregators pre-financial crisis, to own-name bonds post-crisis and an increasing number of bilateral private transactions in the past five years.

The growing number of bilateral transactions in the housing association market is driven by:

- Housing associations looking for long-term funding partners that understand their business and can support them for years to come

- The bespoke nature of funding, covenants and deferred drawdowns

- The ability to quickly top up funding with a single investor or a group of funders

From the investor perspective, there has been an evolution in the way they select the long-term assets they want to have exposure to.

Insurers and pension funds increasingly invest directly and select assets based on their individual liability mix, identifying points on the maturity curve they want to invest in, the credit profile, the borrower’s business model, the deferred funding profile and so on.

This increased flexibility on the part of investors – and typically insurers – is driven by the more active approach funders take in sourcing their assets on the private credit side.

Asset driven

That in turn is a function of long-term low interest rates forcing them to ‘reach for yield’ and compete for assets, along with longer liabilities (over 35 years) which are generally not available in public markets and visibility on the maturity of their existing assets, removing or at least reducing refinancing risk.

The current funding market for housing associations is favourable, enabling them to access structures previously not available in a variety of ticket sizes and at very competitive levels, compared with the more standard formats seen in the public markets.

With more investors entering the social housing funding market, the inflow of capital into the private credit space has meant increased competition.

While some investors with large existing exposures to housing associations are becoming more selective or require tighter covenants, newer players are differentiating themselves by providing longer deferral profiles, longer maturities, larger tickets, faster execution and flexibility around covenants.

For a number of years, the private debt market for housing associations was dominated by domestic institutions. More recently, non-UK investors have begun to play a much greater role in terms of deal volumes. For these overseas investors, UK housing association exposure is part of their global strategy by country/region and sector. The lack of geographic proximity and familiarity means that they typically need more hand-holding, sector teach-ins and consultations with lawyers and the regulator before investing.

Home or abroad?

From a borrower’s perspective, there are several considerations when deciding between the domestic and overseas investor bases for a private market transaction. These typically include:

- Use of credit ratings

- Deferred profile

- Maturity

- Covenant package

- Secured vs unsecured borrowing

- Cross-currency swap indemnity language

- Documentation

UK investors are typically more flexible when providing longer deferred drawdowns (up to three years) and longer tenors, sometimes beyond 35 years. They also like amortising or part-amortising structures that under insurers’ Solvency II regulation do not need external ratings and have natural appetite to fund in sterling.

Many investors seek to build a long-term relationship with the borrower, gradually increasing exposure over time. They like diversified geographical exposure and are increasingly aware of the risks associated with commercial activities and organisations with exposure to the housing market.

Overseas investor relationships tend to be more transactional in nature with periodic credit updates. Typically, US investors require or prefer issuers to be rated (a private rating letter often suffices), to be able to provide deferred drawdowns up to 12 months, to be price-competitive on medium tenors (15 to 25 years), generally require swap indemnity language and push for covenants in line with bank covenants.

Having said that, an increasing number of larger US investors have been more flexible recently on covenants; provided delayed draws up to three years; dropped swap indemnity language requirements; and started investing in larger ticket sizes bilaterally.

Many overseas investors are also more willing to provide unsecured funding than domestic investors, for whom secured lending is the widely accepted format. Being less established and wedded to a particular structure, non-UK investors sometimes assign less value to security and prefer to be paid extra spread.

On the flip side, given the regulated nature of the sector, political headwinds can change overseas investors’ long-term appetite dramatically, whereas local investors with larger exposures are typically more tolerant of sector-wide ups and downs.

Building a relationship

In terms of negotiating changes to capital structure, we always urge borrowers to try to agree covenants that give them maximum flexibility to evolve their business.

Covenant negotiations with investors, whether domestic or overseas, can be a protracted process and depend on individual institutions and their priorities at that point in time.

Needless to say, the stronger the relationship and the better the investor’s understanding of the business, the easier these negotiations can be.

However the outcome can never be guaranteed regardless of the jurisdiction of the ultimate investor, which is why a robust negotiation of covenants that are capable of standing the test of time is so important at the outset. There is further flexibility and competition to be gained by diversifying the investor base, especially for larger associations where domestic investors are getting ‘full’ on some individual credit exposures.

Smaller and medium-sized associations have to take into account all of the above considerations when choosing long-term investment partners.

Process-wise, we find that a lot of clients like to engage bilaterally with the selected investor base when choosing the right investor, rather than widely syndicating their debt in the private market. We expect this trend to continue as individual investors become more active and take control in sourcing their assets.

Many investors also like this process as it gives them enough time to get to know, understand and analyse the borrower and potentially gain a larger exposure than would be the case through a syndicated process.

The funding environment is positive for housing associations with larger availability of capital pools and flexibility of funding structures.

But borrowers should carefully consider the implications when choosing long-term funding partners – and whether they are right for their business.

Maria Goroh, director of investor coverage, Centrus

Finding a committed partner

While short-term cost savings are attractive, thinking about the long-term relationship is crucial, writes Elizabeth Cain of the Pension Insurance Corporation

The social housing sector has evolved rapidly over the past decade.

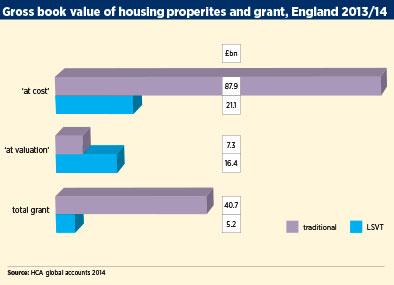

Cuts to funding mean that just 6,000 social rent homes were built in 2018, with traditional investment sources such as government funding falling from 50 per cent of the cost of building a home before the financial crisis to just 12 per cent today.

In 2018, housing associations raised a combined £4.9bn in funding via 48 bond issues — almost double the £2.6bn raised via 26 capital markets transactions in 2017.

These funds are increasingly being raised through long-term partnerships between housing associations and institutional investors.

These partnerships are a natural consequence of investors’ need for long-term secure investments, and those associations’ need for flexible funding options.

Housing associations often have incremental funding needs. By nurturing long-term funding relationships, they have quick and easy access to repeat funding which is, crucially, available in smaller tranches than if they were to go to new investors.

These payments can stretch out for more than 30 years, requiring long-term, secure investments to ensure the pensions can be paid as they fall due.

The social housing sector has proved an ideal partner, allowing the assets backing the pensions of an older generation to benefit younger and future generations.

Pricing is a key consideration for borrowers when they assess bids from funders, but they should also consider the nature of the investor.

This includes looking at their business model, geography and commitment to the sector.

Short-term savings on pricing can seem initially attractive. However, these may not play out over the long term.

Having to deal with a large number of investors on a private placement deal on an ongoing basis can be time-consuming and comes with its own challenges.

Take the example of a competitively priced overseas investor.

While they may have a winning bid when the deal closes, looking ahead a few years, these investors may not be as active in the sector as previously. Without this ongoing commitment, the barriers to agreeing new terms or changing documentation can be significant.

Housing associations’ needs may change over time, with accompanying changes to documentation – for example, for mergers, consents or covenant restructuring.

These types of processes need ongoing dialogue with funders.

Proactive engagement on the part of the funder can be highly beneficial in these circumstances, again highlighting the importance of a long-term, committed relationship between the borrower and lender.

Insurance companies with long-term liabilities work well with housing associations due to the regulated nature of the sector, their ability to manage risks well and the central role they play in the real economy, providing employment, skills and social support as well as housing.

Elizabeth Cain is senior debt origination manager at the Pension Insurance Corporation

This article was written in partnership with:

Collaborating to meet housing need

David Blackman hears how funding deals for three housing associations bolstered their growth plans

ACCORD

Homes owned and managed: 13,000

Funding with PIC: £130m

Use: General needs and social care housing

Around 45 per cent of Accord Housing Association’s turnover is accounted for by its social care business.

“We do more social care than the typical housing association and we are comfortable about that: it’s core to our purpose,” says Stuart Fisher, executive director of resources at the West Bromwich-based association.

But that posed a challenge for Accord when it embarked on a fundraising exercise recently because social care provision tends to generate lower returns than general needs homes.

While housing associations can generally expect operating margins of 35 per cent to 40 per cent for a general needs home, for social care it is generally in single digits.

Mr Fisher says: “Social care can be perceived as less attractive financially than general needs housing.

“To some investors that might have been unattractive.”

However, Mr Fisher says that the Pension Insurance Corporation (PIC) was accommodating of this key strand of the ethos at Accord, which owns and manages around 13,000 homes across Birmingham, the Black Country and north Worcestershire.

In June last year, Accord secured a £100m private placement funding deal with the defined benefit pension scheme insurer. It has since taken a further £30m with PIC.

The initial placement is being drawn down over three tranches, the first £50m of which took place in June 2018.

The second, worth £30m, was completed in June 2019 with a 12-month deferral. The £30m will be drawn down in June 2020 alongside the third and final tranche of the initial £100m deal.

Accord, which is one of Homes England’s strategic partners, will use the bulk of the funds to develop general needs housing.

But a sizeable chunk will be earmarked for social care provision, including a series of dementia centres of excellence, which it is delivering in a strategic partnership with Staffordshire County Council.

The first of these centres, which Accord says will offer a pioneering model of caring for sufferers of the condition, has already opened with a second currently being developed in Lichfield.

Accord was keen to do a deal with a UK-based entity because it wanted to carry out a sterling transaction.

Mr Fisher says: “We wouldn’t have done a deal with an organisation that didn’t have a UK base and for our first step in the private placement market we wanted a sterling transaction.”

SOHA

Homes owned and managed: 6,700

Funding with PIC: £40m

Use: Build 250 homes a year in Oxfordshire

Soha Housing is well placed to capitalise on wider growth plans in the Oxford to Cambridge arc, which has been identified as a key growth location by the government.

The association, which has its headquarters in the Oxfordshire town of Didcot, has around 6,700 properties in and around the area. It has a strategy to add around 250 homes per annum to its stock.

To help turn these ambitions into a bricks-and-mortar reality, Soha took out a private placement with PIC in November 2018 – the second deal it has concluded with the insurer. The other key driver was to capitalise on the relatively low interest rates on offer to secure long-term finance, says Nasreen Hussain, director of finance and resources.

Soha kicked off the process by holding a roadshow, together with its advisors ATFS and Santander, where it met six of the sector’s biggest funders. The £40m placement, which matures in 2051 with drawdown deferred until April 2021, will be used for new housing. Around 85 per cent of the new homes that Soha is planning to develop will be delivered via Section 106 agreements, such as garages or by the redevelopment of existing sites.

Investment in existing stock will be met from the association’s reserves.

Pointing to a recent statement from the Regulator of Social Housing on the importance of associations knowing their investors, Ms Hussain says the association was looking for an investor with a sound understanding of the housing world.

“Thirty years is a long time – even five years is a long time – and you have no idea what the economic or regulatory environment is going to be so it is really important that they understand.”

She says it also helps having a relationship with a UK-based investor, as it means that a meeting is only ever a train ride to London.

She says: “Face-to-face is really important: you can lose half the message sometimes, even with a teleconference.”

PHOENIX COMMUNITY HOUSING

Homes owned and managed: 6,500

Funding from PIC: £75m

Use: support development of 200 homes and replace legacy debt

For Phoenix Community Housing, which has its roots in a stock transfer from the London Borough of Lewisham more than a decade ago, securing greater covenant leeway was important when it was seeking to refinance. The fundraising had two key aims from the resident-led housing association’s perspective: to support its 200-home development programme over three years and replace some of its legacy debt, set up at the time of the original stock transfer.

The association, which owns and manages 6,250 association homes in Lewisham and the neighbouring borough of Bromley, secured £75m in a private placement from PIC. To help it access the debt capital markets, Phoenix appointed Barclays, which approached investors on the association’s behalf. There then followed a series of roadshows with potential investors, which culminated in a number of offers.

Of the initial £75m placement, the first £40m was drawn down in March 2018, followed by two more £10m tranches in September last year and March 2019 respectively.

When the association began looking for finance, a public bond was not on the cards due to Phoenix’s relatively small size, while banks no longer provide core long-term funding over the desired 30 to 40-year timescale.

The private placement used an EBITDA interest cover covenant, while many banks insisted on an EBITDA-MRI (earnings before interest, tax, depreciation, amortisation, major repairs included) interest cover covenant, which means Phoenix is not exposed to major works expenditure, says Chris Starke, director of finance at Phoenix. Such covenants could be problematic in the event of a new stock condition standard, which would in turn require a sudden jump in the amount of work that the association would have to carry out over a short period.

Mr Starke says: “The package may look fine today but who knows what the world will look like in 20 years’ time? We felt keeping MRI out of the 40-year covenant was very important.”

The association also wanted to free itself from the “quite restrictive” covenants in its existing loans, he says. Renegotiating these covenants freed up Phoenix from the need to secure consents when seeking additional funding.

Phoenix also wanted a UK-based investor in case it had to deal with any legal issues, Mr Starke says: “Scoring UK against US investors, UK investors would always have the advantage because you would be in the UK courts.”

In association with:

RELATED