Nine in 10 HAs seek funding for new development

Two-thirds of HAs plan to raise money this year, and most will look to the banks – but many question their number of lenders.

This article was written in partnership with:

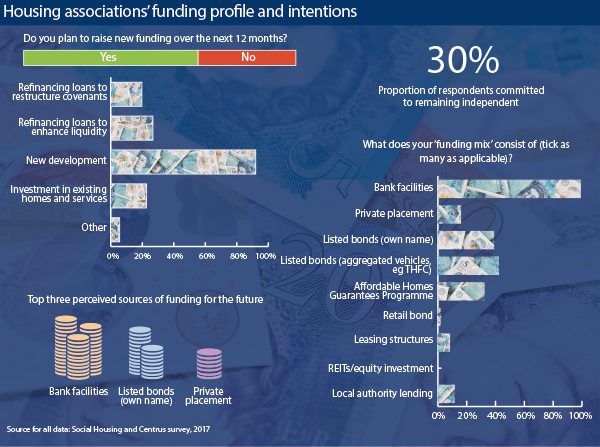

More than nine in 10 housing associations have identified new development as a driver for seeking further funding, according to an exclusive survey.

And nearly two-thirds – or 64.4 per cent – of the 113 senior housing finance professionals surveyed said they plan to raise finance over the next 12 months.

The poll was carried out by Social Housing and Centrus in November 2017.

It covered a full range of association sizes, with a quarter of respondents from an organisation that has between 1,000 and 5,000 properties under management; a quarter with between 10,000 and 25,000 homes; as well as representation from groups that have more than 50,000 homes and below 1,000.

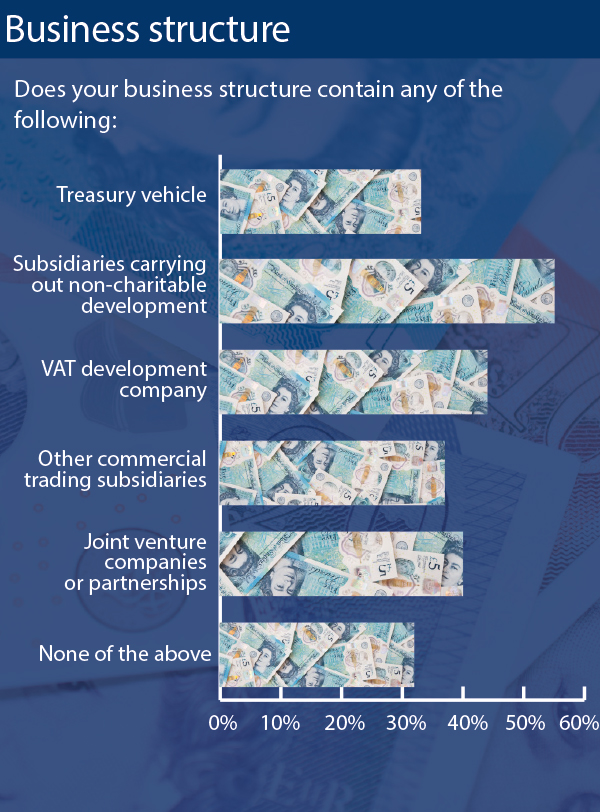

The results also offer some insight into their structures, with more than half saying they have subsidiaries carrying out non-charitable development, 40 per cent reporting they have VAT development companies and 37 per cent with joint venture companies or partnerships.

Less than a third of respondents questioned about a potential merger said they are committed to remaining independent.

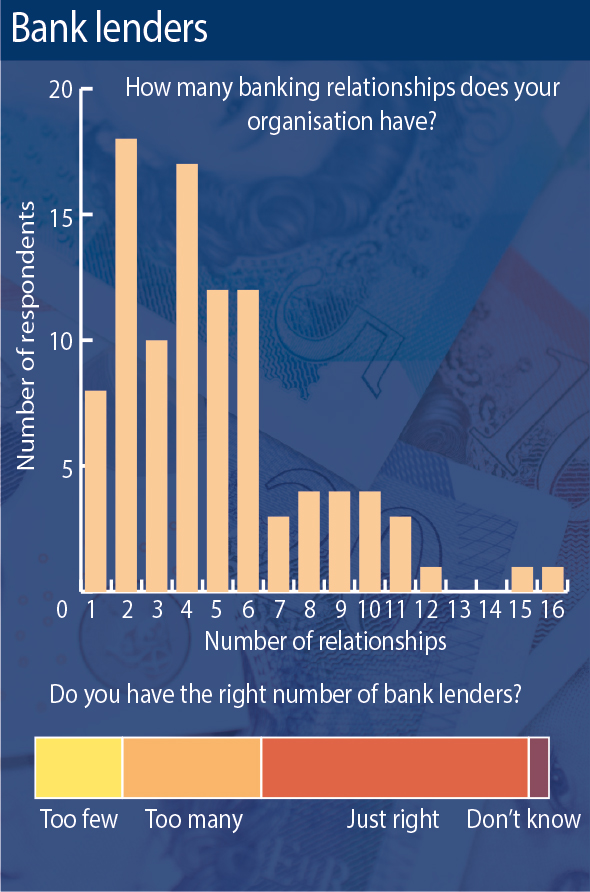

And while the funding focus remains on bank finance, more than a quarter of respondents feel they have too many bank relationships.

Funding to develop

After new development, the most popular driver for seeking funding was a desire for enhanced liquidity by refinancing existing lending, which was cited by just over a quarter of respondents.

Restructuring covenants and investment in existing homes and services were named as motivations by 20.3 per cent and 23.4 per cent of respondents respectively.

Phil Jenkins, managing director of Centrus, says that this level of planned fundraising is higher than expected, but reflects what he describes as a “buoyant mood” in the market, particularly surrounding development.

“You had a period of rent cuts, then the Brexit referendum and lots of uncertainty around the market. Now it feels like a period of stability and a renewed focus on policy and social objectives, namely the supply of new housing,” he says.

The increased focus on development is also changing funding types, as sales activity generates greater liquidity across the sector.

The most popular source of new debt continues to be banks, which easily outstrip both listed debt and private placements.

More than two-thirds (68.8 per cent) of associations said they are likely to arrange new banking facilities over the next 12 months. Nearly a third (32.8 per cent) said they would do so in the next six months.

A greater exposure to private sales and shared ownership has meant a number of housing associations’ lending profiles are taking on some of the characteristics of the volume house builders – namely, a greater reliance on liquidity via revolving credit facilities.

“More shared ownership or sales shifts you towards revolving credit facilities as opposed to long-term fixed-rate debt, which is suited more to long-term renting,” says Mr Jenkins.

“We are seeing that in the amount of bank debt that is being raised for liquidity purposes, with an interesting trend towards holding increased amounts of what we would call ‘opportunistic liquidity’ – a level well in excess of what is suggested by the treasury management policy so organisations can take advantage of rescue situations, portfolio acquisitions or land purchases.”

More than a third (35.9 per cent) of associations said they are likely to issue a private placement during the next 12 months, while 46.9 per cent said it was not on their short-term agenda.

Meanwhile, 29.7 per cent of registered providers indicated an appetite for listed debt.

Almost two-thirds said they are unlikely to raise non-recourse funding, which associations seek when they enter into direct borrowing for non-regulated activities, such as for private sale schemes and when embarking on joint ventures.

But a quarter said they are likely to pursue this commercial funding route over the next 12 months.

Mr Jenkins says: “It is part of a move we are seeing to a greater separation between regulated and non-regulated activities.

“As housing associations move into more and more commercial activity, the ability to do what [they] have traditionally done, which is to on-lend from regulated to non-regulated business, becomes more difficult, constrained by a combination of risk appetite, lender restrictions and perception of ratings agencies and the Homes and Communities Agency.”

In the longer term, the funding picture is slightly different.

Banks remain the number one choice for 54 per cent of respondents. But listed bonds are becoming more prominent – with more than 44 per cent of associations putting them as their top source of funding, and 33 per cent saying they will be their number two source.

Aggregated bonds are the most popular second source, at more than 42 per cent, with banks taking 34.5 per cent of the share.

Existing positions

The survey shows that bank lending is by far and away the biggest source of finance at present.

Nearly all (98.9 per cent) of the associations surveyed reported that they made use of bank facilities, far outstripping any other sources of borrowing.

The next most significant source of lending (42.4 per cent) was listed aggregated bonds, like those issued by aggregated vehicles such as The Housing Finance Corporation (THFC) and legacy loans from the likes of Orchardbrook. Almost a third had debt from Affordable Housing Finance, the delivery partner to the UK government’s Affordable Homes Guarantees Programme.

A bigger proportion of associations (39.1 per cent) had issued own name bonds rather than take out private placements (16.3 per cent).

The surprise for Centrus’ Mr Jenkins was the relative popularity of local authority lending. Around one in eight (12 per cent) of respondents said they had borrowed from a council.

By contrast, 2.2 per cent and 8.7 per cent had recourse to retail bonds and leasing structures respectively, while no one said they had accessed real estate investment trust (REIT) funding, despite the high profile that such instruments have made in recent months.

Much of the focus over the past year has been on local authorities acquiring commercial property. However, several are clearly also lending to housing associations, such as Portsmouth and Warrington councils.

More than three-quarters (77.5 per cent) of the associations surveyed said that their funding arrangements possess sufficient flexibility and capacity to deliver their organisations’ corporate and social objectives.

This does not necessarily match general feedback from Centrus clients, many of whom are either in the process of or considering material restructuring of existing financing arrangements in order to provide greater flexibility.

Almost a third of respondents have a treasury vehicle, nearly 40 per cent possess joint venture companies or partnerships, more than half have subsidiaries carrying out non-charitable development and over 40 per cent have VAT development companies.

Just 30 per cent of associations are committed to remaining independent, which reflects appetite for tie-ups in the market.

Nearly half (48.3 per cent) said while not actively seeking mergers, they are open to opportunities. Nearly one in 10 are actively looking for merger and acquisition opportunities, while 11.2 per cent reported that they are currently engaged in an M&A process.

Such activity will have treasury management implications, says Mr Jenkins. “We expect that to drive further activity on the treasury side, because every time there is a merger there is usually a shake-out of the existing banking arrangements.”

He adds that, particularly with legacy lending arrangements, associations use mergers as an opportunity to review and possibly remove lenders from their portfolios.

Lender relationships

Lenders may take note from the survey’s finding that a number of associations feel they have too many funding relationships. While more than half (52.5 per cent) felt the number was ‘just right’, just over a quarter (26.7 per cent) thought they had too many lending relationships, while 16.8 per cent said they have too few.

Mr Jenkins says he suspects that the issue is more likely to be whether their existing relationships are fit for purpose, as opposed to feeling they have too many lenders.

“We are seeing a lot of clients who want to ensure they are working with consistent and supportive lenders which can provide balance sheet going forward and a range of funding products. I don’t see many who feel they have too many lenders: more often they feel they have lenders which are not supportive or consistent, or may be in run-down mode.”

Almost 60 per cent of respondents said they do not have standalone swaps. Of those that do, the biggest proportion have fixed instruments. Just over a third have standalones swapped to fixed rates, and 15.6 per cent have cancellable swaps.

Posting a mix of cash and property is the most common form of collateral, followed by 100 per cent property and then cash.

Forward view

Respondents also gave a variety of answers to what they see as the main risks in the next two years, including availability of competitive finance, security headroom, market shocks that could impact covenant compliance and the unknowns around Brexit.

The majority of associations expect borrowing costs to rise.

Just over three-quarters (76.1 per cent) expect borrowing costs to rise marginally, with another 4.3 per cent anticipating a significant increase in rates. Only 1.1 per cent expect that costs will fall, while 18.5 per cent forecast no change.

But Mr Jenkins believes most housing associations will be largely safeguarded against a rise in borrowing costs, at least for the short-to-medium term. “A lot of clients are heavily hedged in terms of interest rate exposure, so the impact is likely to be minimal,” he adds.

RELATED