'Pocket': the urban housing offer with a difference

Pocket developments have been around for a while, but are poised to make a big impact on urban housing affordability.

What is the common theme between Krispy Kreme, Costco and Rolls Royce? Success in the absence of advertising makes them all both intriguing and iconic within their respective industries. They do not want, or need, to advertise. They are ‘cult favourites’.

Cult favourites rely on consumer experiences to establish a place in hearts and minds. For these organisations, it is word of mouth publicity that raises their profile and makes them popular choices.

There is a new name on the London affordable housing scene which is already becoming a cult favourite within the housing sector.

What is ‘Pocket’?

It builds compact flats, in central locations…for outright sale to buyers who meet affordability criteria, at prices below market value.

Pocket is a private company which has, admittedly, been around for a few years but which is only now really coming to prominence and gaining proper traction with its development programme and funding partnerships.

It builds compact flats, in central locations with good public transport infrastructure, for outright sale to buyers who meet affordability criteria, at prices below market value. For Pocket, spaciousness comes second to location and, as the name suggests, the units are smaller than average.

But they are carefully designed to make the most of the space.

The company has already built and sold over 150 units and has a development pipeline of 450 more, with overwhelming demand from over 17,000 prospective customers registered on its database.

All this has been achieved without placing a single advertisement in the Evening Standard. This is the kind of cult favourite that London needs far more than doughnuts; and which has more relevance to everyday life than luxury cars will ever do.

London’s number one issue

We are still in the warm-up period before the general election campaign formally gets underway at the end of the month. And, although it is often said that housing is high on the political agenda, that is not generally reflected in public opinion polls of the issues that matter most.

There were reports this week that a new GLA survey puts housing as the number one issue facing Londoners; coming in second and third were the cost of living and population growth in London.

This highlights how important Pocket’s innovative developments are as part of solving London’s crisis in the supply of new homes. And it is a solution from which RPs could arguably learn a lot.

What we need most of all, particularly in London but also in our other major urban centres, is more homes which the ‘city makers’ in those communities can afford to live in; in locations which enable them to sustain jobs at all levels of the cities’ economies.

Whilst the politicians are throwing out huge headline numbers which are, almost certainly, unattainable, and the media focuses on the need for dozens more Letchworths on swathes of the South East, practical delivery on the ground needs to be about making the best and most intensive use of urban land in a form which is accessible to as many people as possible.

We have seen this kind of product delivered successfully by an RP in the past, well away from London, but it is not a model which is often repeated within the sector despite its obvious appeal and financial viability. So that is the secret of Pocket’s success so far, and what can RPs learn from it?

How ‘Pocket’ development works

The model works on the basis of purchasers buying 100 per cent of their 38 sq m one-bedroom flat, with no rent to pay over and above their mortgage repayments and normal service charge.

JLL is currently working with Pocket, providing independent valuation advice to their funding partners, Lloyds and the GLA, as their development programme takes shape.

Through our work, we see how Pocket appeals to some prospective, first-time buyers because the product on offer is simple and affordable.

The model works on the basis of purchasers buying 100 per cent of their 38 sq m one-bedroom flat, with no rent to pay over and above their mortgage repayments and normal service charge; and no deferred need to staircase.

In value terms, a Pocket unit will be at a discount to Market Value of at least 20 per cent, and capped at a maximum of four times the Mayor’s income threshold for first-time buyer eligibility – £66,000.

While the maximum is £264,000 some are priced below that, making the product affordable to many; and the homes will remain affordable to eligible, present and future ‘intermediate’ purchasers for whom they are intended.

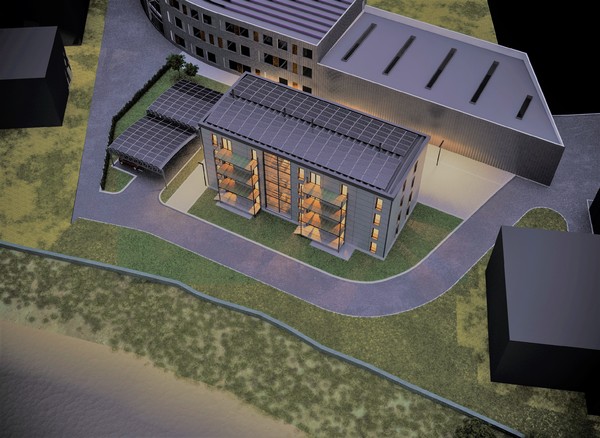

Pocket schemes typically tend to be in the order of 20 to 50 units (albeit, some future schemes are anticipated to be bigger) with communal outside space provided either in the form of gardens or roof terraces.

Most importantly, the schemes are located in highly accessible parts of London (mainly in Zones 2-5) where the first time buyers actually want to live.

At JLL, we have done a lot of independent research in this market which shows that:

● there is genuine housing need in London, even at the relatively high income levels approaching the Mayor’s thresholds;

● those people still aspire to ownership rather than private renting or shared ownership; and

● location is their paramount consideration, over and above the size of the property.

Direction of travel

We all know that many private developers would prefer to see s106 obligations to provide affordable housing met somewhere else entirely, offsite. But, where this isn’t possible, ‘Pocket-type’ units are arguably becoming the Holy Grail of s106 on-site affordable housing whilst still meeting legitimate housing need.

However, small one-bedroom flats are clearly not going to meet every level of housing need.

There is a still a need for family-sized units and for other forms of tenure – those homes still have to be provided, but there are plenty of examples of developers, Local Planning Authorities and RPs recognising that densely developed, inner-urban sites are not the best place for family housing, and do not make the most efficient use of our limited resources in major cities.

So far, surprisingly, we don’t see an abundance of ‘Pocket-type’ units delivered by anyone other than Pocket. This could be because:

● the design needs are not widely understood;

● developers are not willing to give an absolute commitment that units will remain affordable to the Londoners who need them; and/or

● others lack the acceptance by local authorities that Pocket has earned over years of collaborative discussions.

Local authorities

However it is engagement with local authorities that has really made a difference.

Pocket is recognised and increasingly accepted by local authorities as a ‘non-RP’ provider of an alternative form of intermediate affordable housing, and therefore as a suitable partner on s106 agreements. Such recognition and acceptance are tough to achieve, and shouldn’t be underestimated.

Affordability in perpetuity is ensured through a clearly defined requirement in each Pocket lease, which effectively ties the buyer perpetually into the restrictions of the particular s106 agreement under which the homes have been built.

This is helpful background for a local authority to have in mind when a site is being considered through the planning process. There is also a strategic benefit to Pocket’s standardised approach to ensuring the units remain affordable, namely that local authorities are more inclined to unlock land within their ownership to enable Pocket to develop new affordable homes for Londoners, because the land value is higher and the receipt greater.

And, as JLL knows very well, unlocking land is key.

Future growth

With the benefit of GLA funding in the form of a £21.7m interest-free loan, and a £30m revolving debt facility from Lloyds Banking Group, Pocket is targeting the delivery of 4,000 new homes in London over the next decade. These will include some larger, two-bedroom flats in response to feedback from sharers, couples and those who need some additional space to grow.

This is exactly the kind of innovative delivery that London needs to sustain employment and growth. Word of mouth is spreading the news of this new cult favourite fast, and not as a result of an advert in last night’s Standard.

Alix Green is director of residential at JLL

RELATED