SHPS and SHAPS: how has the pandemic affected the schemes?

Contrary to what employers might expect, accounting positions for the sector’s pension schemes have largely improved, writes Andy O’Regan, employer relationships director at TPT Retirement Solutions.

With recent market volatility, employers participating in the Social Housing Pension Scheme (SHPS) and the Scottish Housing Associations’ Pension Scheme (SHAPS) might have anticipated that the accounting position would have worsened at 31 March 2020, but in most cases it actually improved. So why was this, what has happened since, and what might it tell us about what to expect for scheme funding in 2020?

Determining the current liabilities for any pension scheme involves two key elements. The first is projecting expected benefit payments into the future for all scheme members.

One of the key drivers here is the market’s view of future price inflation. The higher the future price inflation assumed in the calculation, the higher the projection of expected benefit payments and vice versa.

The market view of future price inflation was lower at 31 March 2020 than it was at 31 March 2019, meaning the projection of expected benefit payments was also lower. In isolation this reduces the current value placed in the liabilities.

The second element in determining current liabilities is discounting those projected payments back to the calculation date to place a current value on the liabilities. The discount rate can be thought of as a credit for future investment returns. The higher the future investment returns assumed in the calculation, the lower the current value placed on the liabilities, ie we need less money now to meet expected benefit payments in the future.

For accounting purposes, the discount rate is prescribed and reflects the yield available on high quality (AA-rated) corporate bonds at the calculation date. For scheme funding purposes (to drive the contribution levels every three years), the discount rate is basedon government bond yields.

Widening credit spreads (the difference between corporate bond yields and government bond yields) had a positive impact on 31 March 2020 accounting results.

The market value of the scheme assets is determined at the calculation date. These values are dependent on investment returns plus cash flow in and out of the scheme in the form of contributions and benefit payments.

There has been much volatility in markets as a result of the COVID-19 pandemic, however, TPT’s growth assets portfolio (GAP) is highly diversified which helps provide some protection against market volatility.

Although the GAP value has fallen recently, the experience has been lower than those across equity markets in general.

Additionally, TPT has a policy of protecting the scheme funding level against changes in interest rates that affect the scheme funding liabilities through a liability driven investment (LDI) portfolio. Falling government bond yields have resulted in an increase in the value of scheme assets as they have risen in line with increases in expected scheme funding liabilities.

In combination, the identification of values for the assets and liabilities determine the overall surplus or deficit in the scheme – this is the net balance sheet position in the financial statements.

Since 31 March 2020 credit spreads have reverted towards the level observed at the end of 2019. This means a lower discount rate is being used for accounting purposes, placing a higher current value on future benefit payments and leading to an increase in accounting deficits.

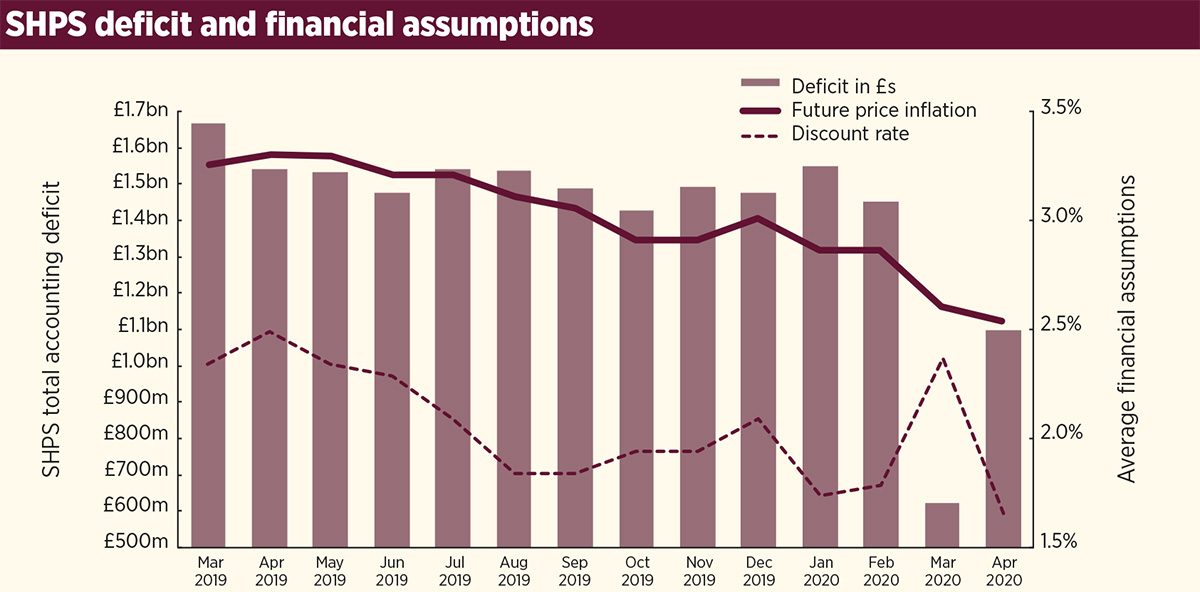

The graph (right axis) demonstrates this recent volatility in key assumptions for an average employer in SHPS for each month up to 30 April, with the trend for SHAPS following the same curve. This volatility will have impacted the current value placed on liabilities at each month-end for employers to varying degrees depending on the profile and maturity of their scheme membership.

The movement in the deficit across all employers in SHPS is also shown below (left axis). As you can see, the accounting deficit position was very positive at the 31 March year-end, but has since worsened primarily due to the reduction in credit spreads as noted above.

To help monitor the position during this period of high volatility, SHPS and SHAPS employers are able to use TPT’s online defined benefit (DB) accounting tool to prepare their DB pension scheme FRS 102 accounting disclosure during the year, using the latest available monthly assumptions, as well as view sensitivity statistics

and five-year financial projections.

The accounting funding position isn’t a clear guide for scheme funding, which is likely to look very different. This is primarily because the discount rate used in the calculation of the scheme funding liabilities is based on government bond yields, rather than corporate bond yields, which have been falling. As noted above, a lower discount rate means a higher current value placed on the liabilities.

The next valuation for SHPS is on 30 September 2020 and the next valuation for SHAPS is on 30 September 2021. The valuation will assess the scheme funding position and determine any deficit contributions payable by employers, as well as future service contribution rates for any new defined benefits being accrued. The improved accounting position at 31 March 2020 can’t be taken as an indication to the results of the valuation because of the different components of the calculation basis.

TPT provides SHPS and SHAPS employers with a quarterly update regarding the schemes – the next is due in September 2020. SHPS employers will hear more about the timetable for the 30 September 2020 valuation later this year.

Andy O’Regan, employer relationships director, TPT Retirement Solutions

RELATED