Special report: latest council HRAs show sector is ripe for investment

How do councils compare in their 2018/19 Housing Revenue Account positions? Steve Partridge of Savills takes an in-depth look

Back in the May edition of Social Housing, we presented our first detailed look at the Housing Revenue Account (HRA), analysing the financing of 163 local authorities that run council housing. Following the abolition of the restriction of HRA borrowing (the so-called debt cap) in October 2018, many authorities are looking ahead to a positive future in which they will develop more housing.

Do the numbers support the ambition?

In our first article we compared the position on the HRA nationally, and for individual authorities, with housing associations in 2017/18. We identified that if we transpose conventional measures around fundability and viability to the HRA from the experience of housing associations, measures such as interest cover ratio and loan to value, there is likely to be substantial funding capacity for extensive and long-term investment in new council housing.

Now that the March 2019 accounts are all but fully closed, we have updated and supplemented the analysis to include the 2018/19 financial year. This allows us to update our view on the capacity available for investment, but also to compare year on year for the first time.

At the same time, here at Savills we have been working with many authorities locally to develop funding and investment frameworks to set the basis for future decisions around new supply and regeneration on a coherent and longer-term basis. This has highlighted the opportunity to analyse additional measures that can work for local authorities.

This analysis therefore focuses on the position of the national HRA for 2018/19, highlights how different authorities compare, and shows how things have moved on from last year. We have again excluded Oldham and Salford where the HRA comprises private finance initiative stock only following the transfer of the remainder of the HRA stock.

The year 2020 is likely to prove a pivotal one – the current financial year is the last year of the one per cent rent cut policy and 2020 the first year of a return to inflation plus rent increases.

And 2020/21 promises to be the year that authorities put meaningful shape on their ambitions to build as next year is the first year following the abolition of the debt cap that authorities will have had a full budgeting and business planning lead-in to set out their plans.

For example, research by Social Housing’s sister publication, Inside Housing, found that councils had ambitions to build 78,651 homes by 2024/25.

There are inevitably some headwinds, given political uncertainties, rising prices in the construction industry and pressures on existing stock driven by higher building standards and the need to make existing homes more environmentally sustainable.

The hike in Public Works Loan Board (PWLB) rates will also affect new borrowing, although the impact is likely to be initially marginal as most historical debt is at fixed rates and in any case PWLB rates remain lower than the actual average interest rates in business plans – a consolidated national average of 3.9 per cent in 2018/19.

The national position – and how it has moved on

The national position continues to offer opportunities for investment.

Turnover was £8.13bn with operating costs £6.15bn, delivering a healthy £1.98bn of operating surpluses. Operating margins for 2018/19 were therefore 24.4 per cent – which takes into account expenditure on major repairs and stock improvements through major repairs reserves.

As would be expected, while healthy, operating margins tightened in 2018/19, reducing from 27 per cent in 2017/18. Unit turnover reduced from £5,211 per unit in 2017/18 to £5,151 per unit – driven by the one per cent rent cut. Unit operating costs rose 3.7 per cent from £3,769 per unit in 2017/18 to £3,896 per unit – driven by inflationary pressures but undoubtedly also influenced by reducing stock numbers.

Stock reduced a net 0.52 per cent between the years, largely through ongoing Right to Buy sales.

It will be interesting to see whether the new developments being planned and delivered by authorities reverse the long-term decline in stock numbers, giving authorities the opportunity to lower future unit costs through growth.

The overall debt position was largely stable, rising from £26bn to £26.2bn, just 0.53 per cent. This reverses a position of net debt reduction across the national HRA where debt had reduced marginally year on year from 2015 as authorities became more cautious – caution driven by the rent cut and the previously planned policies towards high-value asset sales.

That authorities increased debt in 2018/19 may demonstrate that plans are already being put in place to deliver investment programmes at scale. Debt per unit remains relatively low (certainly compared to the housing association sector) at £16,567 per unit.

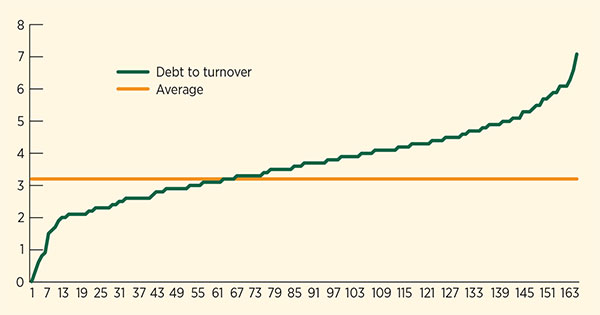

Debt levels compared to turnover is a widely accepted measure of sustainability – for HRAs in 2018/19, closing debt was 3.2x annual turnover. This is lower than for housing associations (circa 4.0 from 2018’s global accounts). It is also only marginally increased on 2017/18 (3.1), suggesting that the first year post-debt cap has been characterised by continued initial caution while plans are put in place.

Interest cover

The interest cover ratio (ICR) – measured as turnover less operating costs divided by interest costs – is fast becoming an accepted measure of capacity for HRAs. While PWLB borrowing is not dependent on achieving a minimum ICR as operates in private bank funding, this metric does offer a straightforward way of ensuring that members understand the sustainability of their debt and interest costs.

Operating surpluses of £1.98bn compared to interest costs of £1.03bn – an ICR of 1.93 for 2018/19, a decrease from the 2.23 recorded in 2017/18. This is as expected given reductions in rents, increases in operating costs and with a similar interest cost base. On the one hand, this might suggest that capacity for investment has tightened. On the other, this level of cover remains very comfortable, and well above any level that might cause authorities in general to review their plans.

Even at increased PWLB rates, 50-year loans remain at just over three per cent (at 24 October 2019), suggesting scope for additional borrowing of up to £10bn assuming a minimum ICR of 1.50, or up to £18bn if setting a minimum of 1.25. At the lower level, and with grant funding, there remains the scope for investment in new homes up to around £15bn within the national HRA.

Local authorities with HRAs (as at March 2018)

| Total | 1,578,448 | 94,588,252 | 26,150,643 | 16,567 | 650 | 8,130,311 | 6,149,843 | 1,980,468 | 24.36% | 1.93 | 3.2 | |

| Local authority | Region | No of units | Total assets (£000) | Debt (£000) | Debt per unit (£000) | Interest per unit (£) | Turnover (£) | Operating cost (£000) | Operating surplus (£000) | Operating margin | Interest cover ratio | Debt to turnover |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Oadby & Wigston | EM | 1,207 | 62,839 | 20,027 | 16,592 | 457 | 5,031 | 4,100 | 931 | 18.51% | 1.69 | 4.0 |

Richmondshire | YH | 1,507 | 67,795 | 19,247 | 12,772 | 307 | 6,433 | 4,864 | 1,569 | 24.39% | 3.39 | 3.0 |

Castle Point | East | 1,511 | 125,337 | 36,418 | 24,102 | 719 | 7,676 | 5,439 | 2,237 | 29.14% | 2.06 | 4.7 |

Melton | EM | 1,811 | 96,438 | 31,484 | 17,385 | 645 | 8,013 | 5,184 | 2,829 | 35.31% | 2.42 | 3.9 |

City of London | Lon | 1,926 | 271,400 | 0 | 0 | 0 | 16,200 | 17,800 | -1,600 | -9.88% | 0.00 | 0.0 |

Fareham | SE | 2,394 | 126,987 | 51,141 | 21,362 | 750 | 12,629 | 8,943 | 3,686 | 29.19% | 2.05 | 4.0 |

Brentwood | East | 2,475 | 263,623 | 59,166 | 23,905 | 779 | 13,150 | 8,053 | 5,097 | 38.76% | 2.64 | 4.5 |

Adur | SE | 2,552 | 194,011 | 60,103 | 23,551 | 879 | 13,285 | 10,143 | 3,142 | 23.65% | 1.40 | 4.5 |

Barrow-in-Furness | NW | 2,587 | 74,614 | 18,838 | 7,282 | 355 | 11,577 | 8,582 | 2,995 | 25.87% | 3.26 | 1.6 |

Tandridge | SE | 2,606 | 344,501 | 64,525 | 24,760 | 617 | 14,939 | 12,855 | 2,084 | 13.95% | 1.30 | 4.3 |

Wokingham | SE | 2,644 | 205,344 | 90,322 | 34,161 | 1,045 | 15,191 | 10,232 | 4,959 | 32.64% | 1.80 | 5.9 |

North Warwickshire | WM | 2,658 | 150,355 | 49,889 | 18,769 | 590 | 12,214 | 7,820 | 4,394 | 35.98% | 2.80 | 4.1 |

Uttlesford | East | 2,808 | 338,475 | 86,622 | 30,848 | 939 | 15,322 | 10,980 | 4,342 | 28.34% | 1.65 | 5.7 |

Runnymede | SE | 2,876 | 303,593 | 101,956 | 35,451 | 1,156 | 17,329 | 8,801 | 8,528 | 49.21% | 2.57 | 5.9 |

Wealden | SE | 2,940 | 214,996 | 69,613 | 23,678 | 638 | 15,102 | 11,011 | 4,091 | 27.09% | 2.18 | 4.6 |

South Derbyshire | EM | 2,971 | 126,252 | 61,584 | 20,728 | 536 | 13,559 | 9,081 | 4,478 | 33.03% | 2.81 | 4.5 |

Mid Devon | SW | 3,003 | 157,446 | 41,637 | 13,865 | 388 | 13,195 | 8,289 | 4,906 | 37.18% | 4.21 | 3.2 |

Medway | SE | 3,005 | 171,174 | 41,328 | 13,753 | 687 | 14,362 | 11,077 | 3,285 | 22.87% | 1.59 | 2.9 |

Thanet | SE | 3,033 | 157,753 | 20,787 | 6,854 | 267 | 13,833 | 11,113 | 2,720 | 19.66% | 3.36 | 1.5 |

Selby | YH | 3,036 | 157,697 | 53,559 | 17,641 | 795 | 12,347 | 6,622 | 5,725 | 46.37% | 2.37 | 4.3 |

Gosport | SE | 3,117 | 147,289 | 61,903 | 19,860 | 611 | 14,794 | 12,389 | 2,405 | 16.26% | 1.26 | 4.2 |

Tendring | East | 3,136 | 125,828 | 43,434 | 13,850 | 460 | 13,760 | 9,630 | 4,130 | 30.01% | 2.87 | 3.2 |

Lewes | SE | 3,179 | 244,843 | 64,180 | 20,189 | 587 | 16,458 | 13,393 | 3,065 | 18.62% | 1.64 | 3.9 |

Mid Suffolk | East | 3,248 | 232,089 | 87,370 | 26,900 | 829 | 15,132 | 10,817 | 4,315 | 28.52% | 1.60 | 5.8 |

Hinckley & Bosworth | EM | 3,290 | 177,196 | 71,915 | 21,859 | 635 | 13,628 | 9,631 | 3,997 | 29.33% | 1.91 | 5.3 |

Woking | SE | 3,336 | 300,626 | 132,786 | 39,804 | 1,452 | 18,625 | 13,963 | 4,662 | 25.03% | 0.96 | 7.1 |

Arun | SE | 3,359 | 221,710 | 55,400 | 16,493 | 475 | 16,651 | 10,121 | 6,530 | 39.22% | 4.09 | 3.3 |

Shepway | SE | 3,381 | 172,259 | 47,417 | 14,025 | 472 | 15,985 | 9,831 | 6,154 | 38.50% | 3.85 | 3.0 |

Eastbourne | SE | 3,405 | 198,451 | 42,649 | 12,525 | 563 | 16,226 | 13,626 | 2,600 | 16.02% | 1.36 | 2.6 |

Babergh | East | 3,420 | 225,647 | 85,753 | 25,074 | 828 | 16,658 | 10,506 | 6,152 | 36.93% | 2.17 | 5.1 |

Kettering | EM | 3,651 | 185,601 | 63,754 | 17,462 | 514 | 15,148 | 10,602 | 4,546 | 30.01% | 2.42 | 4.2 |

Lancaster | NW | 3,702 | 131,529 | 40,394 | 10,911 | 507 | 15,310 | 11,694 | 3,616 | 23.62% | 1.93 | 2.6 |

South Holland | EM | 3,778 | 152,567 | 68,609 | 18,160 | 621 | 16,149 | 10,131 | 6,018 | 37.27% | 2.56 | 4.2 |

Rugby | WM | 3,786 | 193,118 | 61,632 | 16,279 | 347 | 17,507 | 12,565 | 4,942 | 28.23% | 3.76 | 3.5 |

North Kesteven | EM | 3,830 | 161,576 | 67,724 | 17,683 | 536 | 15,402 | 9,077 | 6,325 | 41.07% | 3.08 | 4.4 |

Harrogate | YH | 3,869 | 246,900 | 60,756 | 15,703 | 425 | 17,392 | 11,065 | 6,327 | 36.38% | 3.85 | 3.5 |

High Peak | EM | 3,943 | 174,296 | 55,859 | 14,167 | 496 | 15,066 | 10,023 | 5,043 | 33.47% | 2.58 | 3.7 |

Sedgemoor | SW | 4,039 | 143,900 | 56,478 | 13,983 | 383 | 18,043 | 13,910 | 4,133 | 22.91% | 2.67 | 3.1 |

Shropshire | WM | 4,071 | 198,795 | 84,595 | 20,780 | 735 | 18,322 | 13,300 | 5,022 | 27.41% | 1.68 | 4.6 |

East Devon | SW | 4,190 | 240,111 | 80,601 | 19,237 | 601 | 18,400 | 11,803 | 6,597 | 35.85% | 2.62 | 4.4 |

North West Leicestershire | EM | 4,218 | 232,112 | 73,993 | 17,542 | 538 | 17,809 | 10,493 | 7,316 | 41.08% | 3.22 | 4.2 |

Tamworth | WM | 4,224 | 189,311 | 68,041 | 16,108 | 641 | 20,699 | 15,703 | 4,996 | 24.14% | 1.84 | 3.3 |

Dartford | SE | 4,234 | 310,903 | 60,294 | 14,240 | 340 | 21,497 | 11,367 | 10,130 | 47.12% | 7.04 | 2.8 |

Dover | SE | 4,298 | 201,101 | 71,911 | 16,731 | 613 | 19,585 | 9,539 | 10,046 | 51.29% | 3.81 | 3.7 |

Broxtowe | EM | 4,422 | 178,620 | 81,330 | 18,392 | 548 | 16,180 | 12,263 | 3,917 | 24.21% | 1.62 | 5.0 |

Waveney | East | 4,446 | 219,608 | 77,377 | 17,404 | 517 | 20,732 | 12,974 | 7,758 | 37.42% | 3.37 | 3.7 |

Redbridge | Lon | 4,457 | 288,071 | 67,658 | 15,180 | 582 | 28,612 | 18,944 | 9,668 | 33.79% | 3.73 | 2.4 |

Cheltenham | SW | 4,478 | 224,126 | 44,777 | 9,999 | 379 | 20,333 | 16,300 | 4,033 | 19.83% | 2.38 | 2.2 |

Poole | SW | 4,508 | 284,414 | 86,455 | 19,178 | 685 | 21,470 | 14,590 | 6,880 | 32.04% | 2.23 | 4.0 |

Kingston upon Thames | Lon | 4,602 | 389,589 | 131,411 | 28,555 | 1,002 | 35,264 | 26,001 | 9,263 | 26.27% | 2.01 | 3.7 |

Corby | EM | 4,686 | 249,086 | 78,587 | 16,771 | 522 | 19,391 | 15,602 | 3,789 | 19.54% | 1.55 | 4.1 |

Harrow | Lon | 4,762 | 431,712 | 150,652 | 31,636 | 1,706 | 31,595 | 25,792 | 5,803 | 18.37% | 0.71 | 4.8 |

Blackpool | NW | 4,801 | 117,887 | 4,849 | 1,010 | 83 | 18,769 | 14,694 | 4,075 | 21.71% | 10.24 | 0.3 |

Waverley | SE | 4,830 | 429,557 | 188,700 | 39,068 | 1,189 | 30,184 | 18,861 | 11,323 | 37.51% | 1.97 | 6.3 |

Exeter | SW | 4,891 | 267,806 | 57,882 | 11,834 | 376 | 20,260 | 14,809 | 5,451 | 26.91% | 2.96 | 2.9 |

St Albans | East | 4,898 | 564,536 | 173,416 | 35,405 | 1,013 | 28,318 | 14,413 | 13,905 | 49.10% | 2.80 | 6.1 |

Ashford | SE | 5,007 | 285,800 | 118,473 | 23,661 | 747 | 25,294 | 18,592 | 6,702 | 26.50% | 1.79 | 4.7 |

Stroud | SW | 5,015 | 268,166 | 95,742 | 19,091 | 682 | 23,072 | 17,946 | 5,126 | 22.22% | 1.50 | 4.1 |

New Forest | SE | 5,054 | 372,052 | 142,039 | 28,104 | 873 | 27,817 | 18,760 | 9,057 | 32.56% | 2.05 | 5.1 |

Bournemouth | SW | 5,086 | 330,964 | 57,033 | 11,214 | 488 | 24,020 | 19,617 | 4,403 | 18.33% | 1.77 | 2.4 |

Canterbury | SE | 5,093 | 324,898 | 79,732 | 15,655 | 438 | 25,342 | 16,951 | 8,391 | 33.11% | 3.76 | 3.1 |

Winchester | SE | 5,100 | 422,064 | 164,022 | 32,161 | 1,013 | 28,806 | 21,701 | 7,105 | 24.67% | 1.37 | 5.7 |

Bolsover | EM | 5,104 | 198,405 | 107,482 | 21,058 | 741 | 22,032 | 16,938 | 5,094 | 23.12% | 1.35 | 4.9 |

Cannock Chase | WM | 5,146 | 190,706 | 81,039 | 15,748 | 628 | 20,009 | 13,021 | 6,988 | 34.92% | 2.16 | 4.1 |

Guildford | SE | 5,207 | 519,633 | 197,024 | 37,838 | 991 | 32,447 | 17,282 | 15,165 | 46.74% | 2.94 | 6.1 |

South Cambridgeshire | East | 5,245 | 486,269 | 204,429 | 38,976 | 1,371 | 31,014 | 17,267 | 13,747 | 44.33% | 1.91 | 6.6 |

Central Bedfordshire | East | 5,266 | 456,308 | 164,895 | 31,313 | 779 | 30,207 | 21,325 | 8,882 | 29.40% | 2.17 | 5.5 |

Wiltshire | SW | 5,309 | 304,831 | 123,297 | 23,224 | 692 | 26,422 | 21,917 | 4,505 | 17.05% | 1.23 | 4.7 |

Darlington | NE | 5,313 | 153,022 | 69,596 | 13,099 | 476 | 24,555 | 12,542 | 12,013 | 48.92% | 4.75 | 2.8 |

Newark & Sherwood | EM | 5,447 | 289,577 | 99,445 | 18,257 | 700 | 23,151 | 15,185 | 7,966 | 34.41% | 2.09 | 4.3 |

Cheshire West and Chester | NW | 5,469 | 193,807 | 99,455 | 18,185 | 439 | 22,154 | 13,142 | 9,012 | 40.68% | 3.75 | 4.5 |

Warwick | WM | 5,483 | 396,128 | 135,787 | 24,765 | 869 | 27,747 | 19,285 | 8,462 | 30.50% | 1.78 | 4.9 |

Charnwood | EM | 5,571 | 277,271 | 81,552 | 14,639 | 492 | 22,216 | 15,010 | 7,206 | 32.44% | 2.63 | 3.7 |

Gravesham | SE | 5,685 | 326,527 | 88,665 | 15,596 | 432 | 28,355 | 20,999 | 7,356 | 25.94% | 3.00 | 3.1 |

Redditch | WM | 5,716 | 285,180 | 122,158 | 21,371 | 730 | 24,497 | 21,042 | 3,455 | 14.10% | 0.83 | 5.0 |

Nuneaton & Bedworth | WM | 5,717 | 216,304 | 77,518 | 13,559 | 368 | 25,412 | 21,476 | 3,936 | 15.49% | 1.87 | 3.1 |

Taunton Deane | SW | 5,725 | 297,378 | 103,029 | 17,996 | 468 | 26,773 | 24,508 | 2,265 | 8.46% | 0.84 | 3.8 |

Great Yarmouth | East | 5,783 | 239,126 | 82,778 | 14,314 | 474 | 23,184 | 17,256 | 5,928 | 25.57% | 2.16 | 3.6 |

Colchester | East | 5,900 | 371,392 | 127,933 | 21,684 | 955 | 30,047 | 18,632 | 11,415 | 37.99% | 2.03 | 4.3 |

Sutton | Lon | 5,915 | 416,087 | 185,057 | 31,286 | 1,060 | 36,347 | 23,624 | 12,723 | 35.00% | 2.03 | 5.1 |

West Lancashire | NW | 5,928 | 173,525 | 81,901 | 13,816 | 516 | 25,577 | 16,064 | 9,513 | 37.19% | 3.11 | 3.2 |

Southend-on-Sea | East | 6,009 | 376,876 | 98,740 | 16,432 | 581 | 28,532 | 19,402 | 9,130 | 32.00% | 2.62 | 3.5 |

South Kesteven | EM | 6,017 | 236,025 | 106,070 | 17,628 | 468 | 26,017 | 17,544 | 8,473 | 32.57% | 3.01 | 4.1 |

Slough | SE | 6,084 | 574,432 | 158,077 | 25,982 | 902 | 36,027 | 27,431 | 8,596 | 23.86% | 1.57 | 4.4 |

Epping Forest | East | 6,376 | 708,563 | 146,749 | 23,016 | 874 | 33,995 | 26,514 | 7,481 | 22.01% | 1.34 | 4.3 |

Mansfield | EM | 6,501 | 216,964 | 81,437 | 12,527 | 430 | 28,430 | 20,164 | 8,266 | 29.07% | 2.96 | 2.9 |

Kensington & Chelsea | Lon | 6,701 | 821,417 | 210,617 | 31,431 | 1,406 | 54,335 | 51,779 | 2,556 | 4.70% | 0.27 | 3.9 |

Bassetlaw | EM | 6,708 | 331,898 | 92,357 | 13,768 | 542 | 28,015 | 18,041 | 9,974 | 35.60% | 2.74 | 3.3 |

Reading | SE | 6,710 | 474,695 | 189,341 | 28,218 | 1,565 | 39,024 | 32,558 | 6,466 | 16.57% | 0.62 | 4.9 |

Ashfield | EM | 6,712 | 233,095 | 80,081 | 11,931 | 528 | 24,166 | 15,684 | 8,482 | 35.10% | 2.39 | 3.3 |

Cambridge | East | 7,146 | 667,470 | 214,321 | 29,992 | 1,049 | 43,483 | 28,233 | 15,250 | 35.07% | 2.03 | 4.9 |

York | YH | 7,598 | 477,458 | 139,034 | 18,299 | 595 | 33,753 | 23,560 | 10,193 | 30.20% | 2.26 | 4.1 |

Oxford | SE | 7,696 | 704,981 | 202,708 | 26,339 | 1,001 | 45,004 | 29,406 | 15,598 | 34.66% | 2.02 | 4.5 |

Luton | East | 7,714 | 488,413 | 132,133 | 17,129 | 714 | 39,617 | 32,419 | 7,198 | 18.17% | 1.31 | 3.3 |

Brent | Lon | 7,751 | 617,200 | 159,874 | 20,626 | 839 | 55,000 | 36,700 | 18,300 | 33.27% | 2.82 | 2.9 |

Lincoln | EM | 7,783 | 271,144 | 58,503 | 7,517 | 302 | 28,483 | 22,326 | 6,157 | 21.62% | 2.62 | 2.1 |

North East Derbyshire | EM | 7,793 | 352,440 | 174,409 | 22,380 | 675 | 32,127 | 21,005 | 11,122 | 34.62% | 2.11 | 5.4 |

Ipswich | East | 7,871 | 446,961 | 118,855 | 15,100 | 467 | 35,795 | 21,267 | 14,528 | 40.59% | 3.96 | 3.3 |

Bury | NW | 7,939 | 236,228 | 118,784 | 14,962 | 564 | 30,459 | 23,635 | 6,824 | 22.40% | 1.52 | 3.9 |

Crawley | SE | 7,956 | 613,244 | 260,325 | 32,721 | 1,044 | 47,117 | 25,576 | 21,541 | 45.72% | 2.59 | 5.5 |

Stevenage | East | 7,965 | 622,817 | 207,817 | 26,091 | 869 | 43,452 | 31,926 | 11,526 | 26.53% | 1.67 | 4.8 |

Northumberland | YH | 8,512 | 319,190 | 105,145 | 12,353 | 460 | 32,012 | 25,006 | 7,006 | 21.89% | 1.79 | 3.3 |

Welwyn Hatfield | East | 8,952 | 1,017,242 | 257,002 | 28,709 | 678 | 51,719 | 36,682 | 15,037 | 29.07% | 2.48 | 5.0 |

Chesterfield | EM | 9,089 | 353,399 | 132,344 | 14,561 | 535 | 37,326 | 24,239 | 13,087 | 35.06% | 2.69 | 3.5 |

Harlow | East | 9,180 | 741,549 | 187,370 | 20,411 | 729 | 49,568 | 32,182 | 17,386 | 35.08% | 2.60 | 3.8 |

Havering | Lon | 9,267 | 580,931 | 174,669 | 18,848 | 632 | 56,412 | 39,431 | 16,981 | 30.10% | 2.90 | 3.1 |

Barnet | Lon | 9,780 | 832,059 | 201,614 | 20,615 | 760 | 59,058 | 54,921 | 4,137 | 7.00% | 0.56 | 3.4 |

Thurrock | East | 9,855 | 763,566 | 187,260 | 19,002 | 574 | 54,763 | 47,442 | 7,321 | 13.37% | 1.29 | 3.4 |

Solihull | WM | 9,902 | 445,267 | 174,737 | 17,647 | 738 | 44,154 | 32,089 | 12,065 | 27.32% | 1.65 | 4.0 |

Hillingdon | Lon | 10,078 | 761,155 | 181,514 | 18,011 | 713 | 61,138 | 38,235 | 22,903 | 37.46% | 3.19 | 3.0 |

Waltham Forest | Lon | 10,080 | 874,359 | 200,631 | 19,904 | 957 | 62,491 | 46,632 | 15,859 | 25.38% | 1.64 | 3.2 |

Dacorum | East | 10,128 | 1,025,657 | 344,104 | 33,976 | 1,145 | 56,336 | 38,481 | 17,855 | 31.69% | 1.54 | 6.1 |

Enfield | Lon | 10,160 | 738,800 | 178,805 | 17,599 | 807 | 70,700 | 44,600 | 26,100 | 36.92% | 3.18 | 2.5 |

Cornwall | SW | 10,243 | 520,047 | 110,457 | 10,784 | 303 | 39,973 | 33,030 | 6,943 | 17.37% | 2.24 | 2.8 |

Swindon | SW | 10,300 | 475,567 | 114,016 | 11,070 | 367 | 49,568 | 35,027 | 14,541 | 29.34% | 3.84 | 2.3 |

Basildon | East | 10,804 | 823,147 | 205,028 | 18,977 | 723 | 52,411 | 40,963 | 11,448 | 21.84% | 1.47 | 3.9 |

Stockport | NW | 11,193 | 456,775 | 138,512 | 12,375 | 534 | 54,218 | 46,629 | 7,589 | 14.00% | 1.27 | 2.6 |

East Riding of Yorkshire | YH | 11,314 | 453,181 | 229,511 | 20,286 | 684 | 49,283 | 29,366 | 19,917 | 40.41% | 2.58 | 4.7 |

Tower Hamlets | Lon | 11,476 | 1,134,908 | 85,352 | 7,437 | 313 | 93,096 | 79,489 | 13,607 | 14.62% | 3.79 | 0.9 |

Northampton | EM | 11,488 | 586,286 | 189,698 | 16,513 | 536 | 53,010 | 43,774 | 9,236 | 17.42% | 1.50 | 3.6 |

Brighton & Hove | SE | 11,551 | 873,227 | 124,589 | 10,786 | 879 | 60,579 | 40,594 | 19,985 | 32.99% | 1.97 | 2.1 |

Ealing | Lon | 11,743 | 891,049 | 163,584 | 13,930 | 583 | 66,590 | 55,792 | 10,798 | 16.22% | 1.58 | 2.5 |

Westminster | Lon | 11,840 | 1,468,136 | 261,283 | 22,068 | 930 | 112,971 | 97,818 | 15,153 | 13.41% | 1.38 | 2.3 |

Milton Keynes | SE | 12,108 | 653,341 | 229,571 | 18,960 | 664 | 55,721 | 35,725 | 19,996 | 35.89% | 2.49 | 4.1 |

Hammersmith & Fulham | Lon | 12,218 | 1,323,670 | 214,361 | 17,545 | 272 | 93,640 | 77,424 | 16,216 | 17.32% | 4.88 | 2.3 |

Derby | EM | 12,809 | 519,749 | 231,373 | 18,063 | 859 | 58,788 | 47,618 | 11,170 | 19.00% | 1.02 | 3.9 |

Hounslow | Lon | 12,873 | 1,005,900 | 230,956 | 17,941 | 800 | 87,800 | 65,300 | 22,500 | 25.63% | 2.18 | 2.6 |

Croydon | Lon | 13,475 | 970,034 | 322,497 | 23,933 | 897 | 91,265 | 70,744 | 20,521 | 22.49% | 1.70 | 3.5 |

Lewisham | Lon | 13,957 | 1,329,594 | 57,543 | 4,123 | 442 | 98,141 | 86,377 | 11,764 | 11.99% | 1.91 | 0.6 |

Portsmouth | SE | 14,591 | 681,744 | 171,580 | 11,759 | 409 | 83,083 | 78,760 | 4,323 | 5.20% | 0.72 | 2.1 |

North Tyneside | NE | 14,656 | 663,155 | 339,341 | 23,154 | 1,036 | 63,473 | 39,429 | 24,044 | 37.88% | 1.58 | 5.3 |

Norwich | East | 14,729 | 809,006 | 205,717 | 13,967 | 566 | 67,965 | 47,932 | 20,033 | 29.48% | 2.40 | 3.0 |

Haringey | Lon | 15,104 | 1,341,699 | 227,444 | 15,059 | 700 | 111,801 | 84,513 | 27,288 | 24.41% | 2.58 | 2.0 |

Manchester | NW | 15,845 | 612,670 | 269,245 | 16,992 | 743 | 86,432 | 59,332 | 27,100 | 31.35% | 2.30 | 3.1 |

Newham | Lon | 15,970 | 1,397,349 | 197,953 | 12,395 | 1,037 | 103,238 | 83,522 | 19,716 | 19.10% | 1.19 | 1.9 |

Southampton | SE | 16,018 | 688,296 | 168,237 | 10,503 | 333 | 78,849 | 63,916 | 14,933 | 18.94% | 2.80 | 2.1 |

South Tyneside | NE | 16,664 | 588,316 | 287,503 | 17,253 | 674 | 66,741 | 55,791 | 10,950 | 16.41% | 0.97 | 4.3 |

Wandsworth | Lon | 17,119 | 1,477,427 | 319,950 | 18,690 | 262 | 149,670 | 102,784 | 46,886 | 31.33% | 10.44 | 2.1 |

Barking & Dagenham | Lon | 17,622 | 1,101,446 | 279,072 | 15,837 | 550 | 107,398 | 79,427 | 27,971 | 26.04% | 2.89 | 2.6 |

Stoke-on-Trent | WM | 17,944 | 534,588 | 156,641 | 8,729 | 360 | 66,962 | 58,268 | 8,694 | 12.98% | 1.34 | 2.3 |

Barnsley | YH | 18,400 | 590,426 | 271,734 | 14,768 | 552 | 72,033 | 48,953 | 23,080 | 32.04% | 2.27 | 3.8 |

Gateshead | NE | 19,078 | 710,663 | 345,505 | 18,110 | 729 | 79,194 | 57,758 | 21,436 | 27.07% | 1.54 | 4.4 |

Doncaster | YH | 20,125 | 663,147 | 267,069 | 13,271 | 588 | 75,297 | 52,623 | 22,674 | 30.11% | 1.92 | 3.5 |

Rotherham | YH | 20,296 | 685,213 | 304,125 | 14,984 | 658 | 83,270 | 62,155 | 21,115 | 25.36% | 1.58 | 3.7 |

Leicester | EM | 20,366 | 973,714 | 214,052 | 10,510 | 434 | 82,832 | 67,140 | 15,692 | 18.94% | 1.78 | 2.6 |

Greenwich | Lon | 21,278 | 1,560,636 | 334,630 | 15,727 | 711 | 116,973 | 102,689 | 14,284 | 12.21% | 0.94 | 2.9 |

Dudley | WM | 21,734 | 921,791 | 470,300 | 21,639 | 807 | 87,913 | 70,738 | 17,175 | 19.54% | 0.98 | 5.3 |

Wigan | NW | 21,736 | 589,570 | 308,030 | 14,171 | 649 | 87,972 | 72,309 | 15,663 | 17.80% | 1.11 | 3.5 |

Hackney | Lon | 21,806 | 2,552,090 | 110,219 | 5,055 | 88 | 141,839 | 139,790 | 2,049 | 1.44% | 1.06 | 0.8 |

Wolverhampton | WM | 22,009 | 763,300 | 273,156 | 12,411 | 468 | 95,500 | 64,100 | 31,400 | 32.88% | 3.05 | 2.9 |

Kirklees | YH | 22,395 | 632,752 | 237,740 | 10,616 | 390 | 82,709 | 68,086 | 14,623 | 17.68% | 1.68 | 2.9 |

Camden | Lon | 23,446 | 2,556,851 | 471,556 | 20,112 | 671 | 180,347 | 162,905 | 17,442 | 9.67% | 1.11 | 2.6 |

Kingston upon Hull | YH | 23,890 | 474,275 | 242,441 | 10,148 | 447 | 94,698 | 72,338 | 22,360 | 23.61% | 2.09 | 2.6 |

Lambeth | Lon | 23,955 | 2,342,093 | 396,695 | 16,560 | 1,091 | 179,616 | 148,040 | 31,576 | 17.58% | 1.21 | 2.2 |

Newcastle upon Tyne | NE | 25,263 | 874,868 | 369,205 | 14,614 | 657 | 110,787 | 91,170 | 19,617 | 17.71% | 1.18 | 3.3 |

Islington | Lon | 25,274 | 3,117,604 | 445,275 | 17,618 | 990 | 215,682 | 169,201 | 46,481 | 21.55% | 1.86 | 2.1 |

Nottingham | EM | 25,535 | 1,048,166 | 294,703 | 11,541 | 532 | 107,946 | 79,186 | 28,760 | 26.64% | 2.12 | 2.7 |

Bristol | SW | 26,937 | 1,730,307 | 244,568 | 9,079 | 425 | 120,499 | 93,250 | 27,249 | 22.61% | 2.38 | 2.0 |

Sandwell | WM | 28,607 | 1,123,971 | 441,637 | 15,438 | 701 | 121,399 | 79,410 | 41,989 | 34.59% | 2.09 | 3.6 |

Southwark | Lon | 37,312 | 3,388,106 | 429,166 | 11,502 | 614 | 260,094 | 224,100 | 35,994 | 13.84% | 1.57 | 1.7 |

Sheffield | YH | 39,260 | 1,418,888 | 345,969 | 8,812 | 334 | 152,262 | 116,156 | 36,106 | 23.71% | 2.75 | 2.3 |

Leeds | YH | 55,924 | 2,203,299 | 816,405 | 14,598 | 695 | 221,637 | 167,899 | 53,738 | 24.25% | 1.38 | 3.7 |

Birmingham | WM | 60,836 | 2,501,900 | 1,091,153 | 17,936 | 828 | 285,400 | 193,900 | 91,500 | 32.06% | 1.82 | 3.8 |

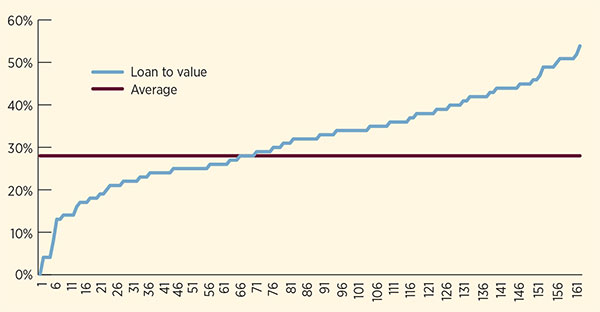

Loan to value

An interesting area for analysis is the loan to value (LTV) ratio.

Dwelling assets in the HRA are valued at EUV-SH. Loans at 31 March 2019 were just 28 per cent of the total stock value of £94.6bn (an average of £60,000 per unit).

Ratios at this level are much lower than equivalents in the housing association sector. Banking covenants for associations can be up to 65 to 70 per cent. This might suggest considerably more scope for increased leverage.

However, HRA borrowing is not secured against stock and to an extent the LTV is of academic consideration. This is also emphasised when looking at the basis for EUV-SH in the HRA: it is not a cash flow net present value-based valuation as for housing associations, but is based on a discount to open market value, using discounts set by Ministry of Housing, Communities and Local Government officials that apply at a regional level, periodically updated en masse by government.

This unusual approach leads to an EUV-SH that is above a sustainable level that might be implied by the net cash flows generated by the assets. Put another way, if LTV were to be a meaningful measure against which to test borrowing capacity, we would need to set the maximum level a lot lower than might be seen in an average banking covenant.

One question arising from the abolition of the debt cap might therefore be: should government consider adopting a more accurate methodology for valuing council dwellings?

The regional position

A look at the regional variation in these metrics highlights some contrasts.

As expected, London HRAs tend to offer a dominant contrast to the other regions, with only 29 authorities out of 163 and less than 25 per cent of the stock, but more than 34 per cent of the turnover and 38 per cent of the asset valuations.

Operating margins are, however, considerably lower in London than in the rest of the country – 18.8 per cent compared with a high of more than 30 per cent in the East of England, and 28 per cent in both the South East and the West Midlands. Margins across the South West and the five regions in the North and the Midlands are very closely banded.

As far as ICR is concerned, the outlier appears to be the North East, with a combined ICR of less than 1.5. LTVs are also the highest in this region.

Notwithstanding that operating margins are just about in line with the national average,

while there are only five HRA authorities in the entire North East region, this may suggest that these authorities may find some routes to investment more constrained than authorities across the rest of the country.

In contrast, 13 authorities in the South West share an average ICR of 2.29, implying plenty of capacity to invest in new council housing.

Regional totals for local authorities with HRAs (as at March 2018)

Regions | Number of local authorities | Number of units | Operating margin | Interest cover ratio | Loan to value | Total assets (£000) | Asset value per unit (£) | Debt (£000) | Debt per unit (£) | Interest per unit (£) |

London | 29 | 391,947 | 18.83% | 1.89 | 18% | 35,981,372 | 91,802 | 6,390,038 | 16,303 | 708 |

East of England | 24 | 154,865 | 30.16% | 2.05 | 29% | 12,139,505 | 78,388 | 3,534,687 | 22,824 | 764 |

South East | 31 | 169,049 | 28.29% | 2.04 | 31% | 11,460,032 | 67,791 | 3,519,398 | 20,819 | 738 |

South West | 13 | 93,724 | 22.99% | 2.29 | 23% | 5,245,063 | 55,963 | 1,215,972 | 12,974 | 453 |

East Midlands | 25 | 174,730 | 27.38% | 2.08 | 34% | 7,684,716 | 43,981 | 2,618,372 | 14,985 | 549 |

West Midlands | 14 | 197,833 | 28.24% | 1.82 | 41% | 8,110,714 | 40,998 | 3,288,283 | 16,622 | 682 |

Yorkshire and the Humber | 13 | 236,126 | 26.20% | 1.92 | 37% | 8,390,221 | 35,533 | 3,092,735 | 13,098 | 540 |

North West | 9 | 79,200 | 24.51% | 1.92 | 42% | 2,586,605 | 32,659 | 1,080,008 | 13,636 | 568 |

North East | 5 | 80,974 | 25.54% | 1.48 | 47% | 2,990,024 | 36,926 | 1,411,150 | 17,427 | 734 |

How do authorities vary?

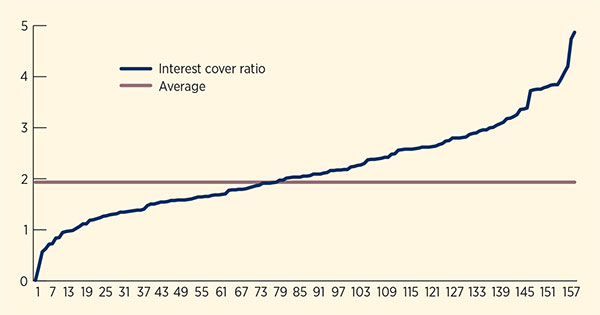

The three charts show the distribution of all HRA authorities around the average for the three key metrics.

The ICR chart excludes three outlier authorities with very high cover (of more than 7.0). Fewer authorities are below the average than above – and of those below, a small minority (19) are below what would be a covenant-minimum 1.25. It should be emphasised that a low level of ICR in the HRA context is not a reason to be concerned over whether an authority can invest or otherwise – it is a measure, not a covenant, and provides a guide for decision-makers around future sustainability.

The LTV chart demonstrates a similar pattern, as does the debt to turnover ratio chart. There are a number of authorities with a very high debt to turnover ratio (six HRAs are above 6x). In many cases these levels of debt are a legacy from the self-financing settlement, which was based on

net present value of future net rents in 2012.

These authorities will have had relatively high debt levels given higher rents relative to costs, rather than as a result of high borrowing in the past few years.

All six of these authorities are in the wider East/South East area and are characterised by higher-value stock with fewer flats. However, only one of these (Woking) has a relatively tight ICR. This highlights that we should take a rounded view of all the ratios and measures that are adopted when considering opportunities for investment and setting objectives.

Summary

The picture remains informed by multiple historic factors that have led up to 2018/19.

Levels of rents, stock size and complexity, stock condition and type, the 2012 self-financing settlement, and behaviour since 2012 – all these factors and many more go to make up the varied pattern across the country.

We might expect margins and ICRs to tighten in 2019/20 from the figures that form the basis of this analysis, given one further year of rent cuts. Yet authorities are already looking ahead to invest within the current year and in particular from 2020.

Our analysis supports the case for investment – and we might expect that capacity will grow from 2020 as margins increase and investment generates new stock and new sources of income.

Social Housing special reports

Each month Social Housing focuses on a specific aspect of housing finance and collates and scrutinises the data for hundreds of housing organisations.

The reports below contain unparalleled commentary and analysis along with detailed sortable and searchable data tables.

Unit costs 2019 Our analysis of data from the English regulator has found that unit costs have risen among all types of housing association, with overall maintenance costs seeing the highest weighted average increase of nearly seven per cent

Impairment 2019 Housing associations’ impairments rise almost 40% in a year, driven by fire safety costs, contractor insolvencies and reduced land values

Global accounts 2018/19 Housing associations’ surplus for the year before tax decreased by five per cent to £3.76bn, driven by a 6.6 per cent drop in England

Affordable rent profile 2018/19 The level of affordable lettings dropped for the third year in a row

Staff pay Data from audited accounts of 206 housing associations shows that average staff pay in 2018/19 was £31,787 – a rise of 3.2 per cent over a 12-month period

Professionals’ league Our exclusive professionals’ league finds that activity continued apace in 2019, when housing associations increasingly looked to private placements

Sales proceeds Despite a 10 per cent rise in housing associations’ income from development sales in the last financial year, sales revenue is likely to remain flat over the coming years as a result of the property market downturn

Capital commitments The total capital commitments of 200 housing associations rose by 15 per cent in the past year, analysis by Social Housing has found

Reliance on sales surplus Social Housing finds that the total sales surplus of 150 English registered providers has dropped by nearly 10 per cent, as a result of lower market sales surplus

Stock dispersal How many council areas does your housing association operate in? How concentrated is its stock?

Accounts digest 2018/19 How does your housing association’s finances compare to others?

Housing Revenue Account part two How do councils compare in their 2018/19 Housing Revenue Account positions? Steve Partridge of Savills takes an in-depth look

Diversification of income We look at how housing associations are diversifying their income, and finds that they made 10.3 per cent more revenue from shared ownership and non-social housing activity

Impairment 2017/18 Social Housing takes a close look at the accounts of the 130 largest housing associations, and finds that impairments rose by nearly a third to £78.4m in 2018

Global accounts Social Housing’s analysis of the sector’s global accounts finds that housing associations’ pre-tax surplus fell last year – driven by drops in England, Scotland and Wales (August 2019)

Affordable rent profile We find that the number of affordable rent lettings recorded last year by housing associations in England has dropped for the second year in a row, suggesting that the sector is shifting away from the tenure

Capital commitments We scrutinise the capital commitments of the 208 largest housing associations in the UK (June 2019)

Housing Revenue Account part one Steve Partridge of Savills takes a look at the financial factors councils should consider in their Housing Revenue Account business planning (May 2019)

Reliance on sales surplus Our analysis reveals that profits form 42 per cent of 150 English housing associations’ total surplus (April 2019)

Sales proceeds We look at housing associations’ build-for-sale income and find a two per cent increase in 2017/18 (March 2019)

Shared ownership sales England, excluding London, has seen a four per cent rise in shared ownership sales – much lower than last year’s 16 per cent increase (February 2019)

Stock dispersal We show that housing associations’ general needs stock is becoming more concentrated within their local authority areas (January 2019)

RELATED