Interview: Metropolitan Thames Valley

Metropolitan Thames Valley’s CFO Ian Johnson talks Sarah Williams through the recent merger, dealing with lenders and what might be next for Fizzy Living

Picture: Metropolitan Thames Valley Housing

The start of October saw the formal creation of Metropolitan Thames Valley Housing (MTVH) as one of the UK’s largest housing associations, with approximately 57,000 homes spread across London, the South East, the East Midlands and the East of England.

A new entity formed by bringing together Metropolitan Housing and Thames Valley Housing, MTVH emerged from a careful process of negotiation with stakeholders over several months. Since the plan was announced in January, the “critical part” has been the lender negotiation, according to Ian Johnson, chief financial officer at MTVH.

“As with all transactions of this type, that tends to be the bit that takes longest, and certainly, as with all housing associations, we’ve got some long-standing banking relationships with some long-dated debt,” he says.

While there was a degree of “chivvying along” to meet the October deadline, the end result was that “all of our banks got on board”, Mr Johnson says.

“We’ve got the same list of banking partnerships after [the process] as before, if you added the two organisations together, so nobody has left us through the process, and everybody has been supportive in giving us what we’ve asked for.”

By arranging a number of early repayments and shifted margins, and reducing maturities on some longer-dated debt, MTVH was able to draw up a new set of covenants that provide “more capacity to do more in the future”.

“That was really one of the objectives that we set ourselves,” Mr Johnson says. “The key to that was moving from the net worth covenant into a historic cost covenant – and that switch in itself is something that has been happening across the sector.”

Thames Valley, which had come close to a merger with Genesis Housing Association until the two organisations called it off, citing “differences in style and approach” in August 2016, had something of a head start on the process of renegotiating with lenders.

“Thames Valley was already part way along, [it had] negotiated some changes to its covenant suites,” Mr Johnson says.

Did that experience impact processes this time around?

“I think the more substantive issue was: ‘How did each board go into this?’, and I think it’s really important to reiterate that both boards were very much more comfortable after the very first meeting about the relative openness and the alignment,” he says. “I think we very quickly got comfortable that this was a group of people and a company and a culture that we wanted to do business with.”

The structure actually saw the larger Metropolitan parent become a subsidiary of the smaller Thames Valley.

Before the merger, Metropolitan Housing Trust (MHT) – the registered provider and stock-owning parent – had three non-registered entities: Metropolitan Living, EM Property Services and Metropolitan Funding. Thames Valley Housing Association (TVHA) was the parent to registered provider Thames Valley Charitable Housing Association (TVCHA), as well as TVHA Fizzy Holdings, Opal (a joint venture with Galliford Try) and Evolution – which became a wholly owned subsidiary of TVHA in June 2018.

In creating MTVH – the new trading name of the fused organisations – TVCHA has transferred its engagements to MHT, which in turn has become a subsidiary of ultimate parent TVHA.

Negotiating change

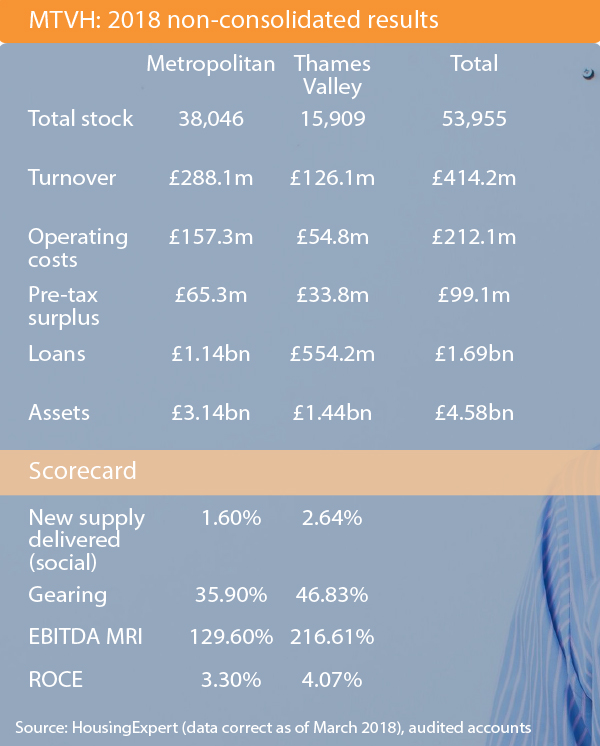

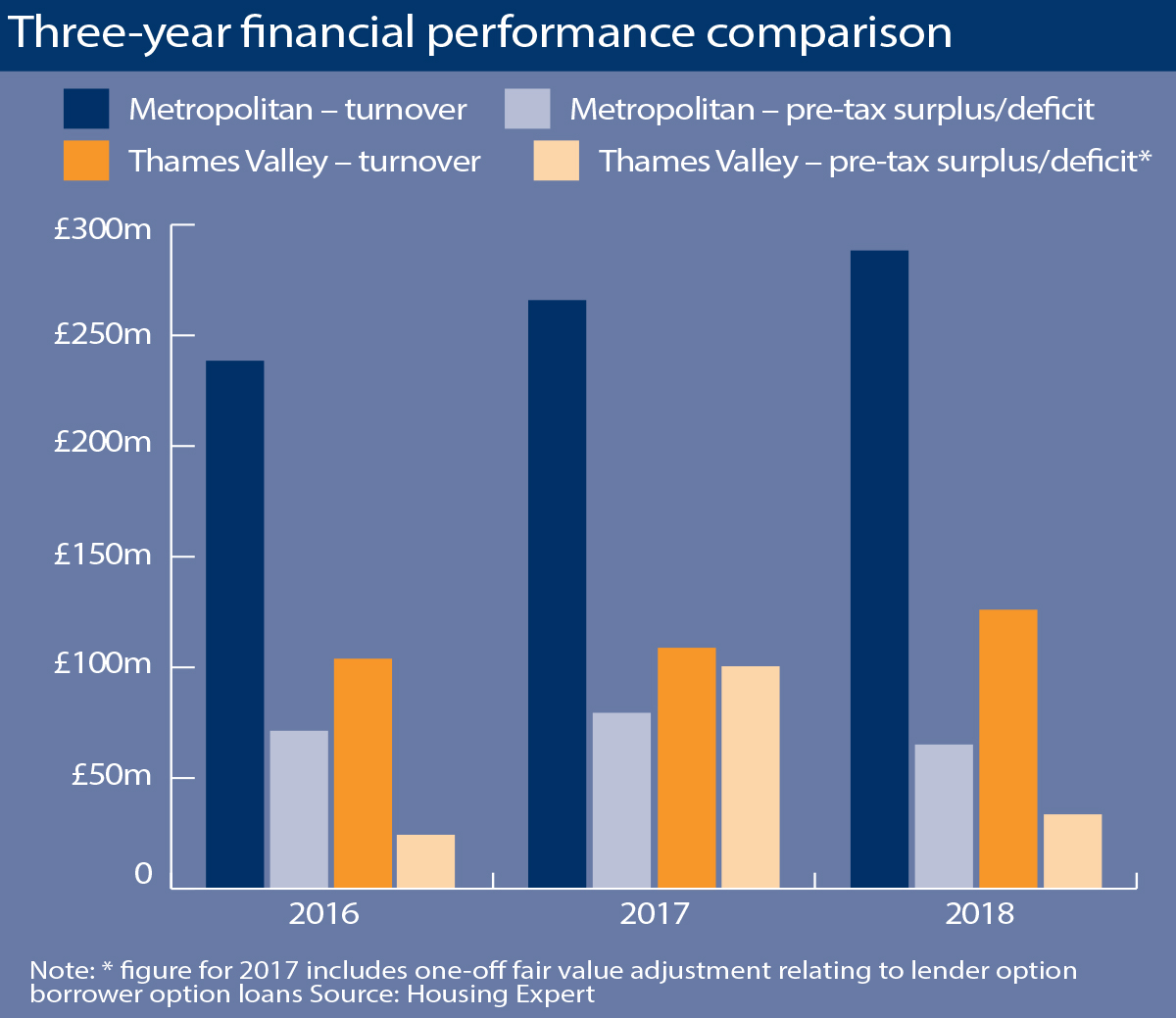

According to its annual results to 31 March 2018, drawn debt for Metropolitan was £1.138bn. It had £189m of derivative contracts as part of its fixed-rate hedging. Thames Valley had drawn loans amounting to £562m.

Although the derivatives position was maintained during the merger, Mr Johnson says there was a “little bit” of tidying up to do.

“We will be charging a little bit in break costs through that, because there is some early repayment,” he says. “And obviously we’d have some break costs associated with reducing the maturity of some of that debt, so both of those elements will result in some break costs – but not significant in the scheme of things.”

While he will not be drawn on the exact figure, it was not in the vicinity of the likes of L&Q and East Thames, which booked close to £500m in exceptional costs to transform the new organisation’s treasury structure to support its ambitions to deliver 100,000 homes over 10 years.

Mr Johnson says: “We haven’t been through a radical process like some of the other housing associations – it’s been a working at the margins of our existing agreements rather than something very radical.”

It was also “not anything like as much as we had budgeted”, he adds, and was “not in the hundreds of millions”.

Where Metropolitan’s 2011 private placement was concerned, investors were required to approve changes to the rules governing the placement as a precursor to the partnership.

Mr Johnson adds: “It’s fair to say we worked well with them, but we definitely had to work a little bit harder to get them to see the opportunity that perhaps the lending banks have seen, and perhaps [there is] more to be done there in terms of those relationships.”

Releasing capacity

New covenants and additional capacity support ambitious plans for MTVH, led by a chief executive who brings detailed knowledge of both legacy organisations. Geeta Nanda joined Metropolitan in October 2017 after nine years at Thames Valley.

MTVH now intends to deliver up to 2,000 homes a year, of which around 80 per cent will be affordable. That builds upon the 623 new homes delivered by Metropolitan in the year to 31 March 2018, of which 169 were for rent (105 affordable rent and 64 social rent), 351 were for shared ownership and 103 were for private sale. Thames Valley delivered 317 new shared ownership and rented homes during the year and acquired a further 663 for its pipeline.

Thames Valley also launched So Resi during the year, as a rebrand of its shared ownership portfolio. The addition of this brand to the combined group is a win for MTVH, Mr Johnson believes, in bringing a strong “customer journey solution” to combine with Metropolitan’s existing experience within shared ownership.

“Both legacy organisations here have got very strong presence in the shared ownership space, we’re one of the biggest, if not the biggest, operator of shared ownership in the sector, and I think that will continue to be very much part of what we’re about.

“I think in So Resi we’ve got an outstanding offer to customers – as a social shared ownership solution.”

Fizzy’s future

So Resi may be rooted in the group’s future, but another Thames Valley brand, private rented sector subsidiary Fizzy Living, may not be.

News emerged in June that British Land was in discussions to buy Thames Valley’s remaining stake in the Twickenham-based private rental company, with the housing association’s joint venture partner Abu Dhabi Investment Authority, which had invested £400m, to retain its majority share in the deal.

In a statement released at the time, TVHA said it “always had an exit strategy for our investment in Fizzy, and we continue to keep that option under review”.

Mr Johnson explains that the decision by Thames Valley to look at divesting the subsidiary was made independently from the process of partnering with Metropolitan.

“Certainly it wasn’t a prerequisite or anything like that of what the combined board wanted to do,” he says. “It was something that came about as part of Thames Valley and that team’s own assessment of what they wanted to do, for lots of reasons.”

Mr Johnson says that while Thames Valley is still “very attached to the Fizzy brand” as a successful part of its business, “it was felt that there was a good opportunity for them to hand it on to somebody who could take it to the next level”.

“I would be surprised if we retained an interest in it. It’s not off the table, but I would be quite surprised if we did,” he says.

At the time of writing, Fizzy and its several limited liability partnerships remain within the MTVH group structure, according to the company’s website.

Clapham Park

Another major element in the mix is the Clapham Park masterplan, which was previously at the centre of a financial restructuring at Metropolitan.

Mr Johnson says: “There’s a lot about Clapham to talk about – what a great opportunity it is for us as an organisation, 2,500 units over the next 15 years or so; it’s really fantastic. It’s going to be transformational for that part of London.”

Originally contained in registered subsidiary Clapham Park Homes (CPH), the scheme saw Metropolitan’s regulatory governance rating downgraded in December 2012 amid concerns over viability and the group’s financial planning. A £61m investment and £177m refinance for the subsidiary through a syndicate of Lloyds and Barclays followed in March 2013, but the regulator’s next judgement in December 2014 highlighted exposures relating to the delivery of the scheme, and the fact that the group’s capacity to mitigate these exposures fully was limited by restrictions over on-lending. The group transferred CPH’s engagements to Metropolitan, receiving a V1 rating for viability in March 2017.

Placing CPH’s engagements in Metropolitan “enabled us to look at the funding and make that funding solution much more fit for purpose”, Mr Johnson says. “And since then we’ve got the planning permission, and are now able to look forward to building out the next phase.”

He adds: “We’re totally in control of the speed of that development, so it doesn’t represent a huge development risk for us.”

Another area that presents an opportunity for the merged group is the NHS estate, says Mr Johnson. Thames Valley has knowledge of NHS key worker housing, while Metropolitan has “very good relationships with the NHS” through its experience providing housing with care and support.

“That’s an opportunity to come back to the NHS with a single offering about perhaps utilising NHS land to build space to bring people out of hospital and into supported housing, as well as providing more key worker homes to NHS trusts,” adds the chief financial officer.

Overall, Mr Johnson sees the MTVH partnership as creating “financially, much stronger, more resilient organisations, with strong balance sheets, more resources, more capacity”.

At the heart of this will be a focus on community building, something that ties the two legacy organisations together.

With a similar heritage, both have a future vision “focused around the customer and providing the best deal for our customers [both] future and current”, Mr Johnson says.

“Yes, putting homes on the ground is important, but in the context of making sure that our customers are treated as well as they can be.

“[It means people can] live well, which is about community building, but also offering people support through their lives in order to live well and help them to make choices.”

RELATED